Zurich opts to non-renew its cat aggregate reinsurance for 2023

European headquartered re/insurer Zurich opted not to renew its global aggregate catastrophe treaty for 2023 at the recent renewals, but did add a $200 million U.S. earthquake swap, and a new $300 million top cat layer to its programme for the year ahead.

The global insurance and reinsurance giant warned last year that it might not renew its cat aggregate treaty if the price was too high amid the hardening reinsurance landscape.

At this time, CFO George Quinn said that the preference was to keep the reinsurance tower the same in 2023 as in 2022, in order to keep things predictable.

However, reinsurance rates increased significantly at the January 1st 2023 renewals, most notably for catastrophe business, with reinsurers less willing to participate in aggregate treaties on the back of consecutive heavy loss years.

It seems that this has had an impact on Zurich’s reinsurance protections for 2023, as the carrier chose not to renew its global aggregate catastrophe treaty.

For 2022, the global aggregate cat treaty, after a $900 million retention, provided Zurich with $250 million of reinsurance protection, with the combined global cat treaty extending this by a further $200 million, of which both slices featured co-participation.

Ultimately, and as explained by Quinn previously, the aggregate treaty is not essential to Zurich as it can retain more volatility if needed and if it feels the costs of purchasing reinsurance are too high for this layer of coverage, which seems to have been the case at the January 1st 2023 renewals.

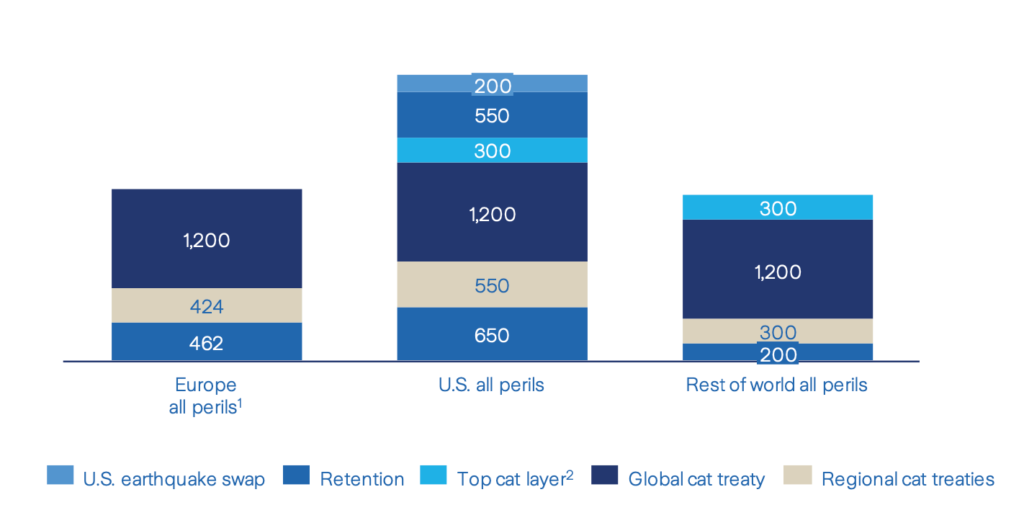

But the carrier still has a comprehensive reinsurance programme in place across three towers for 2023, which can be seen below:

Unchanged from the mid-year 2022 renewals, when Zurich expanded its global catastrophe treaty, the amount of cover provided by this arrangement stands at $1.2 billion for 2023 across Europe, the U.S., and rest of the world, covering all perils.

However, there have been some changes, including the addition of new layers, within each of the three reinsurance towers secured by Zurich at 1/1.

Starting with the Europe all perils tower, and comparing with the mid-year 2022 renewals, the retention has risen from $434 million to $462 million. Above this sits a regional cat treaty sized at $424 million for 2023 compared with $398 million, followed by the unchanged $1.2 billion global cat treaty. Last year, above the main slice of protection sat a $200 million combined global cat treaty layer, but this has been dropped for 2023.

That $200m cover could be used only once, either for aggregated losses or for an individual occurrence or event.

Within the US all perils tower, the retention is also unchanged at $650 million, as is the regional cat treaty at $550 million. Above the $1.2 billion global cat treaty, however, this tower differs for 2023 than from the June / July renewals in 2022.

Last year, Zurich’s US programme featured a $115 million US wind swap and then the $200 million combined global cat treaty.

That’s all changed this year, with Zurich instead opting for a new $300 million top cat layer to sit above the main $1.2 billion global cat treaty. Above this is a $550 million retention, and then a new $200 million U.S. earthquake swap.

For the rest of world all perils tower, the retention has remained at $200 million of qualifying losses, and the regional cat treaty is unchanged at $300 million. However, above the $1.2 billion global cat treaty, sits a $300 million top cat layer for 2023, compared to the $200 million combined global cat treaty with co-participation in 2022.

Zurich explains that the new top cat layer protection is only relevant for U.S. named windstorms, U.S. earthquake, and Canada earthquake.

So despite dropping its cat aggregate treaty for 2023 in light of market conditions, Zurich remains well protected and has added some additional coverage in the U.S. and for the rest of world, while also growing its regional cat treaty in Europe and lifting the retention.