Zambia can meet growing food demand: how to fix what’s standing in its way

Lorries blocked at the border between DRC and Zambia. Poor roads are a major stumbling block to trade. Lucien Kahozi/AFP via Getty Images)

African countries face great challenges in adapting to climate change to meet growing demand for food. The current drought in East Africa is the latest manifestation of changing weather patterns.

But countries such as Zambia, where there is good land and water, have major opportunities to meet food demand by growing agriculture exports and processing their produce. Zambian farmers can earn substantial returns from increased production. Their production can also alleviate the pressures in countries such as Kenya.

To realise these opportunities, Zambian products have to reach export markets at good prices. For this, Zambia needs competitive cross-border markets and efficient transport and logistics services. However, regional grain and oilseeds trade is not working for producers in Zambia or for buyers in East Africa, with huge variances in agricultural commodity prices in Kenya and in Zambia.

Our reality check on the workings of cross-border markets points to regional integration being the key to unlocking massive potential for Zambia to anchor sustainable agricultural growth in Africa. But effective regional integration remains a dream, undermining Zambia’s potential.

How are markets really working for Zambia?

Zambian agriculture has been a growth story with expanding net exports in important products such as soybeans. However, this performance is very short of where it should be. Zambia should be the grain basket for the whole region. Malawi has shown what is possible in soybeans. It almost doubled production in 2019/2020, to 421,000 tonnes, more than Zambia in that year.

A major issue is how cross-border markets are working, or not working. Zambian suppliers report having substantial volumes of soybeans which can meet the huge regional demand.

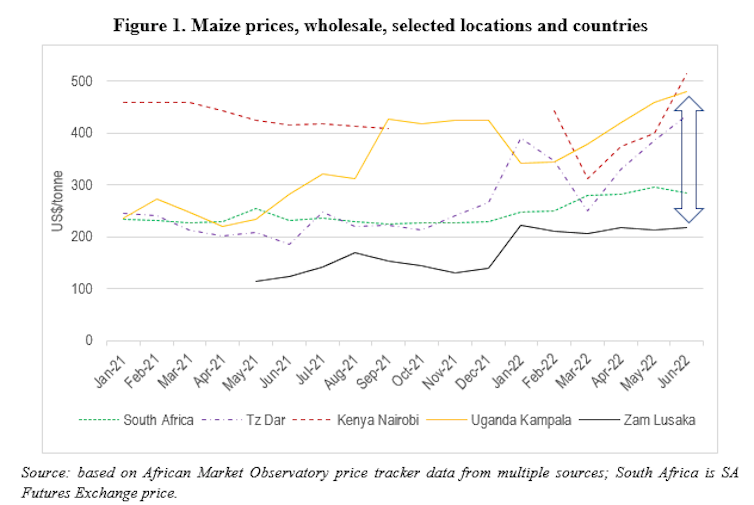

Market prices for maize in Nairobi climbed to over US$500/Mt in June 2022, reaching similar levels in Kampala, Uganda (Figure 1). In early July, prices were reported to have climbed well above US$750/Mt in Kenya. Meanwhile prices in Zambia were around US$220/Mt or 3,700 kwacha/Mt.

Though lower than Kenya’s, Zambian maize prices are still substantially higher than last year’s. This is in line with global trends. With higher input costs, farmers need higher output prices to incentivise production.

The gap between prices in Zambia and those in Nairobi and Kampala is close to US$300/Mt. This is double what would be explained by the efficient cost of transporting maize from Zambia to these countries. Efficient transport costs take account of reasonable trucking, logistics and border costs.

Even with the higher fuel costs, grain should cost around US$150/Mt to be transported from Lusaka to Kampala and Nairobi. Of course, quoted transport rates may be much higher, but this reflects the many problems in cross-border transport which need to be addressed.

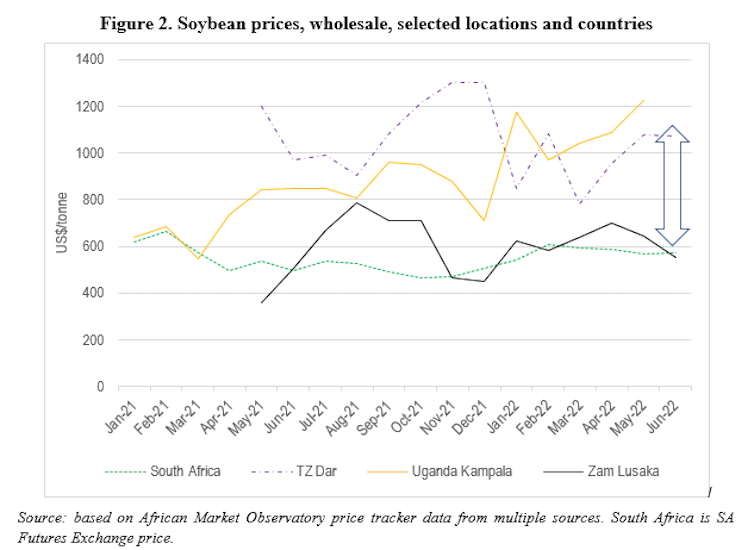

The situation is even more extreme in soybeans, which are a much higher value commodity. Zambia’s bumper soybean harvest in 2022 was being sold at prices around US$550/Mt in June, with prices even being quoted as low as US$439/Mt at the end of the month. Prices in East Africa were well over US$1,000/Mt, some US$500-700/Mt above those in Zambia. This is three to four times the transport costs.

In other words, producers in Zambia should be getting more for their crops and buyers in East Africa should be paying less, alleviating the food price spikes there.

How can this be and what is to be done?

A combination of factors is undermining the growth of Zambia.

First, reliable market information is required to link buyers and suppliers, and to enable markets to work. In the absence of information, it’s risky to export. This lack of information affects small and medium sized farmers and businesses. Large-scale traders who have operations across the region have an advantage over smaller businesses and farmers because they have private information.

Second, the market players require clear trade policy signals to take advantage of export opportunities. Any hesitation or mixed signals tend to undermine the ability to make deals with confidence. It is therefore important for Zambia’s new government not to impose ad hoc trade restrictions, for example, as the previous government did in August 2021 to restrict maize exports. Such restrictions, imposed and lifted from month to month, mean deals cannot be made with the confidence that they can be fulfilled.

Third, the market opportunities in East Africa require urgent regional co-operation to improve transport corridors on the ground rather than in rhetoric.

Malawian soybean suppliers have shown the value. Small suppliers have already been using the African Market Observatory data on East African prices in 2022 to negotiate better prices for their exports. This increased realised prices by around $200/Mt more than they would otherwise have accepted.

Zambian farmers could reap similar benefits too. This would support a big push in production, enabling Zambian farmers to invest in improved agricultural systems. This is even more essential as next year is likely to be another La Niña weather pattern which sees good rains in Zambia and poor rains in parts of East Africa and the Horn of Africa.

The ongoing effects of climate change mean more investment is required to make agriculture resilient. This involves investments in water management, irrigation, storage facilities, advice and information systems.

The vulnerability of the whole of Southern and East Africa as a climate “hotspot” means urgent and coordinated regional action is required.

But Zambia doesn’t have to wait for this action.

It can lead in championing sustainable agricultural growth in the knowledge that this is essential for resilient food supplies across the region. This requires good policies with a longer-term vision. The country needs, without any reservations, to fully back regional integration and competitive regional markets. Excessive margins cannot be captured by connected so-called “middlemen”.

Greater certainty for businesses needs to be accompanied by enforcement of clear rules for company power. Regional competition enforcement by the Competition and Consumer Protection Commission of Zambia together with the COMESA Competition Commission is a key part of fair and competitive markets which work for all.

Investment is required in critical infrastructure such as storage for smaller market participants to use on fair terms. Finance can be mobilised, such as that being made available by the African Development Bank.

It is essential to support regional research networks, such as those led by the Indaba Agricultural Policy Institute and the African Market Observatory of the Centre for Competition, Regulation and Economic Development and partners.

![]()

The Centre for Competition, Regulation and Economic Development at the University of Johannesburg has received funding for related work from the COMESA Competition Commission and the South African Department of Trade, Industry and Competition.

Antony Chapoto and Ntombifuthi Tshabalala do not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and have disclosed no relevant affiliations beyond their academic appointment.