Younger Business Owners Drive a Shift in Group & Voluntary Benefits

Published on

June 22, 2023

As life grows more complex and the benefits landscape gets even wider and also more complex, simplicity is now crucial to employees and employers. Ironically, part of that simplicity will be provided by new and additional group and voluntary benefits. Just as hospital indemnity helps to simplify the economics of an unexpected hospital stay or pet insurance serves to alleviate the stress of sick pets, up-and-coming benefits will simplify aspects of life that affect work/life balance and financial wellness.

BenefitBump is an example of a new, innovative group benefit that simplifies employee lives during the birth and adoption process, the family leave period, and the beginning of daycare. Many employers have realized that there is a great deal of complexity around these crucial timeframes in a family. Busy employees don’t naturally know how to navigate all of the ins and outs of their benefits. It can result in a high rate of those who don’t return to work.

BenefitBump educates employees at the individual level, assigning a navigator who supplies guidance, health tools, and emotional support. Their initial survey statistics are impressive, with “98% of program participants successfully returned to work.” Group insurer, Securian, now offers BenefitBump as a value-added service, paired with their hospital indemnity insurance.[i]

Talent + Shift in Ownership

Everyone has been talking about the war for talent, the new generation of employees, and the expectations that today’s digital employees bring with them into the workplace. What they haven’t looked at as closely is the makeup of today’s business owners and executives. At what point will their expectations and ideas on what is needed for their businesses and employees impact the entire group & voluntary landscape?

Well, that point has arrived. GenZ and Millennials are owning and running businesses and they are highly perceptive about what benefits packages will motivate their employee peers. This leaves insurers searching for new gaps to fill. In Majesco’s latest thought-leadership report, Bridging the Customer Expectation Gap: Group & Voluntary Benefits, we examine SMB customer opinions and how they align against both employee expectations and insurer plans to meet those expectations.

Today’s customer expectation gap

What is the customer expectation gap? The gap is the difference between what customers expect, want, and need, as compared to what insurers are delivering. This gap needs to be as small as possible for insurers to create long-term customer growth, value, and loyalty. It demands a customer-centric strategy that understands the unique generational segment differences in behaviors, lifestyles, and more, that drive insurers’ decisions about products, services, and customer experiences.

“Traditional” SMB customers – Gen X and Boomers – represent a vast portion of insurers’ revenue and profit today. Many remained loyal to their insurer for years, even if they were not always 100% satisfied. However, these “traditional” customers are changing. They are increasingly digitally adept and are looking for more value from insurers.

At the same time, we are seeing the growing dominance of SMB customers from the Gen Z and Millennial segment who appear to be more in tune with the changing needs and expectations of today’s employees – especially the younger generation – and the value of offering newer and innovative benefit options to attract and keep employees. They want new products that will align with their needs, activities, and behaviors. And they want it their way … personalized to them. With the fluid state of employment that is increasingly common for the younger generation, portability and flexibility of benefits have become imperative in the competition for talent.

The Gen Z and Millennial generation has the potential to reverse the growing protection gap for insurance.

From a high in the mid-1970s, when 72% of adults and 90% of households with two-parent owned life insurance,[ii] to a new 50-year low in 2010 when only 44% of US households had individual life insurance, based on LIMRA’s 2010 life insurance study.[iii] A February 2017 LIMRA study noted that employment-based benefits (group and voluntary) life insurance covered more people than individual life insurance as of 2016. Encouragingly, a recent analysis found 50% of North American employers that are currently not offering voluntary benefits are considering adding them. Plus, 40% who do offer them are looking to add additional benefits[iv] which would help close the protection gap.

This changing market dynamic highlights growth opportunities for insurers who can offer benefits that meet a more diverse employee base. Insurers have an opportunity to provide the right products, value-added services, and experiences to help SMBs navigate these challenges and position their businesses for growth.

Savvy, innovative companies are redefining insurance from an outside-in perspective to adapt to what customers – of any generation — want and expect, instead of following the generations-long practice of an inside-out perspective that requires customers to adapt to the way insurance works. As a result, these innovative companies are transforming insurance from a mysterious, confusing, and difficult ordeal most would rather avoid, to a more transparent, simple, and engaging experience.

To understand the customer expectation gap, Majesco used the results of our SMB, Consumer, and Insurer Strategic Priorities research to assess the differences between customers and insurers with a three-pronged gap model view that includes personalized pricing with data/product, value-added services, and distribution channels.

Talent and Benefit Offerings

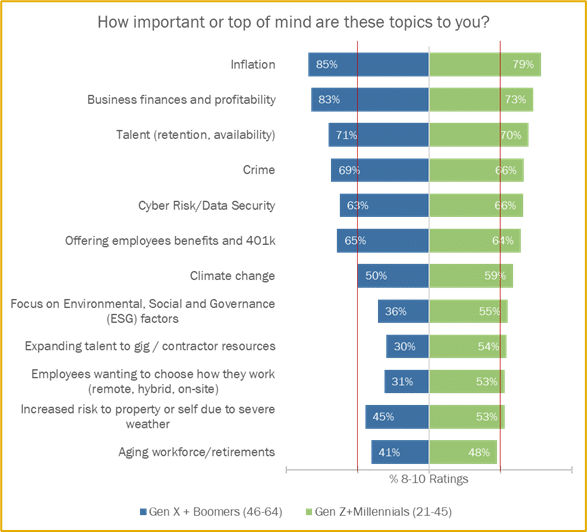

Majesco took a close look at business owners’ top-of-mind issues. Talent and benefit offerings are #3 and #6, respectively, as seen in Figure 1. In the battle for talent, a benefits plan that offers choices based on different demographics, including generational groups and lifestyle, can make the difference between attracting star performers or simply missing out, impacting the business positively or negatively. This is why employers are increasingly looking to offer a wider range of products that are relevant and stand out from the crowd, regardless of the size of the business.

Figure 1: SMBs’ top of mind issues

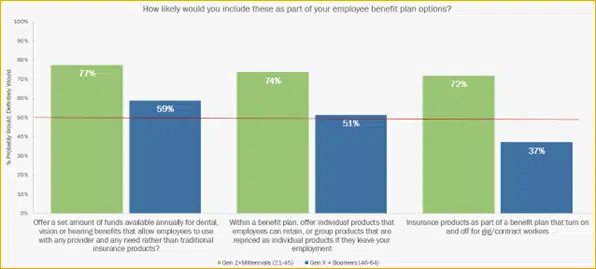

For insurers taking advantage of this opportunity, it is not without its challenges. The typical American now holds an average of 12.3 jobs between the ages of 18 and 52, with approximately half of these occurring before the age of 25.[v] Furthermore, the Gig economy now accounts for about 35% of the US workforce in some form (whether a full-time occupation or part-time) and growing, and demand for more fractional coverage linked to Gig workers’ itinerant careers presents a challenge.[vi] As such, switching employers is happening more, leaving the need for insurance a potential gap or opportunity, depending on the product and portability. The demand for these capabilities is high, as reflected in Figure 2 by both generational groups of SMB owners.

Figure 2: SMBs’ interest in offering new employee benefit plan options

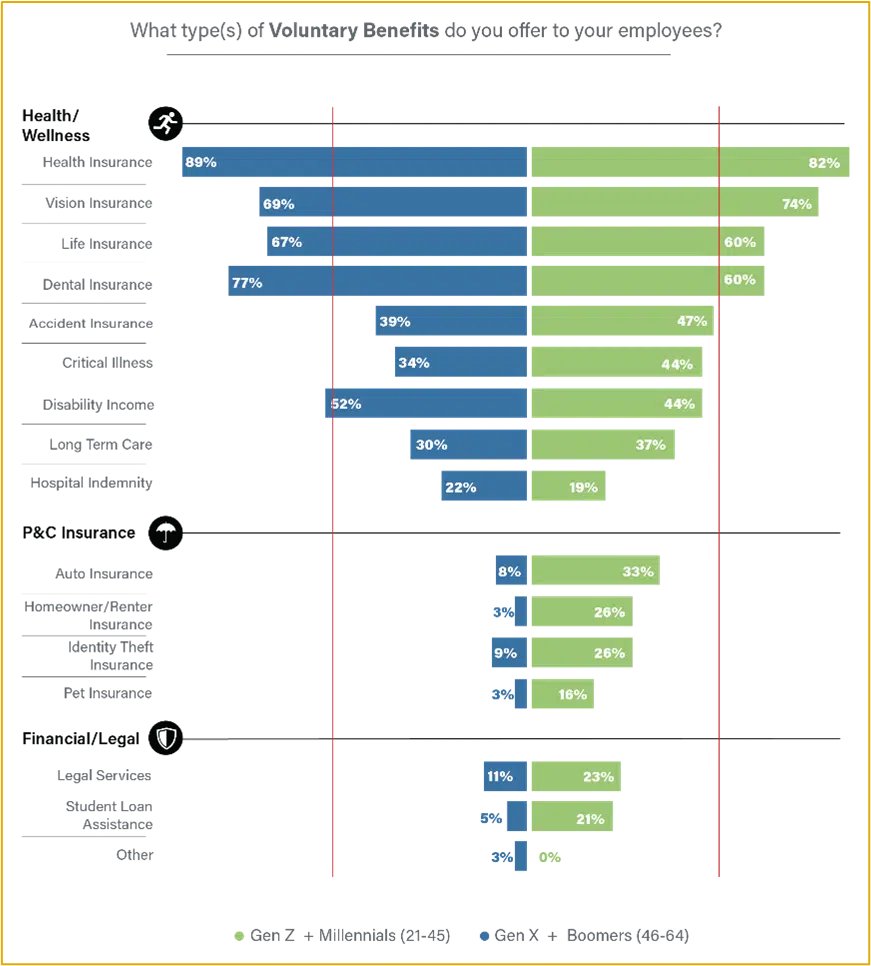

The voluntary benefits market is robust with activity as responsibility has shifted from employer to employee for many nonmedical, health-related insurance products, with strong interest reflected in growing sales.

However, today’s products still trend toward the traditional — focused on life, accident, disability, medical, dental, and A&H, lacking innovation and answers for new needs and expectations, particularly for Millennials and Gen Z.

Insurers who can offer options beyond traditional product boundaries have an opportunity to capture new customers more cost-effectively and grow the relationship as they evolve along their life journey. Developing, partnering, and offering products that meet the employee’s unique immediate needs, while enticing them to stay as a customer if they leave their employer, is a growing strategy among leading insurers. This is reflected in Figure 3 where the younger generation of SMB owners has a strong, growing interest in other products.

Figure 3: Voluntary benefits offered by SMBs

It follows that any new or innovative offerings that enhance employees’ protection and support employer fight for talent would offer growth opportunities for insurers. The challenge for traditional group and benefits insurers is understanding what new offerings and plans can position them as the provider with choice, to drive more engagement, enrollment, and buying of specific products.

This is where next-gen intelligent core and enrollment systems can help personalize and drive this growth opportunity.

Innovative Benefits and Financial Wellness Products

Today’s customers want a risk product, value-added services, and an experience that provides them with what they need to manage their lives and humanize the entire customer lifecycle. Traditional products can handicap insurers. From an increased interest in life, critical illness, and disability insurance to telematic and Gig benefits and more, customers want innovative products that assess their personal risk, lifestyle, and behaviors.

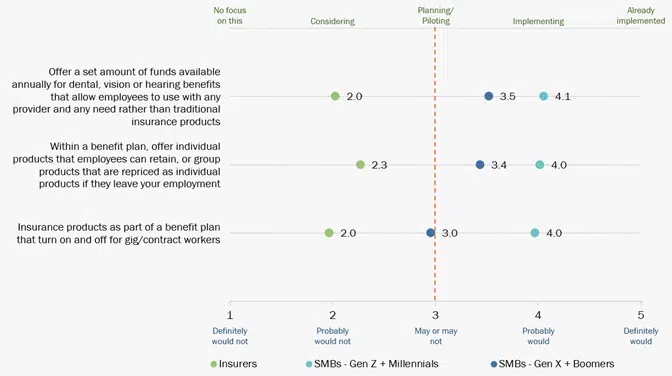

This demand for innovative products is seen in Figure 4 with both generational SMB groups having a high demand for them. Employers of all ages are becoming more adept and understanding employee needs and fitting those needs into the organization’s benefit offerings.

Unfortunately, most insurers, however, have not yet responded to this need. Offering individual products that are both portable and cost-effective, and products that can turn on and off for Gig workers is expected, but also needed, given the shift in the employee market. With more businesses turning to Gig workers and needing products more aligned with the reality of employee expectations, insurers have a huge opportunity to differentiate and drive growth as the workplace continues to rapidly change.

Figure 4: Interest gaps between SMB and Insurers in new benefit plan options

Financial wellness is about adopting new practices and solutions to lead a more healthy and financially secure life. Practicing financial wellness ranges across budgeting, protecting assets like homes and cars, saving, investing, and the use of insurance to meet short- and long-term financial goals.

Rising customer interest in financial wellness can be attributed to many factors. Certainly, the COVID pandemic played a role. The expanded use of wearable devices that track heart rate, sleep cycles, and fitness activity has motivated many individuals to live healthier lives. And a booming wellness economy demonstrates that people are willing to invest in their wellness. For SMBs, managing the financial and operational aspects that keep the business running and healthy – the SMB’s financial wellness – has been challenging due to the macroeconomic factors post-COVID.

According to a CNBC+ survey, only 57% of adults in the United States are financially literate, meaning that 43% are not using the right tools or lack the knowledge to budget or invest.[vii] Additionally, as stated in a recent LendingClub press release, 63% of Americans are living paycheck-to-paycheck and have not been able to reach a level of financial wellness.[viii] And for businesses, the rising inflation and supply chain challenges, let alone the fight for talent, are straining their short and long-term financial results. This is why it has risen as a top-of-mind issue.

Given that insurance is a major component of financial wellness, it would reflect a tremendous opportunity for insurers to offer solutions. However, as seen in Figure 5, there is a major customer expectation gap in what insurers are offering. This reflects a continuing business model and culture of product- versus customer-driven strategies within insurers that will not succeed in a customer-driven marketplace.

Figure 5: SMB-Insurer gaps in financial wellness value-added services

The Group and Voluntary opportunity x 10

Group and Voluntary insurance products and services have always been about multiplication. “How can we place large volumes of business on the books all at once?” With today’s technologies, that dynamic is changing into, “How can we place new, innovative products that resonate with the diversity of lifestyles and needs of employees while helping employers to grow loyalty and attract the best talent?” It’s still a matter of multiplication, but in today’s scenario, it’s also about retention, flexibility, and treating the employee as the center of the benefits relationship. It is a strategic shift that may result in far greater results.

As companies strive to differentiate themselves with prospective employees, they are running a race that needs help. Group and voluntary insurers need to prepare themselves to support properly by utilizing technologies and processes that can make it all happen.

Is your company ready to serve the next generation of employers? Majesco has created solutions for group and voluntary benefits that will not only bring insurers into the digital age but will also prepare to give the data and analytic feedback insurers and employers need to optimize their offerings. We are working with several insurers who are bringing innovative group and benefits products to market, along with value-added services to meet the demands of a rapidly changing employer and employee marketplace.

Find out more about Majesco’s market-leading solutions that bring what you need for the future today including L&AH Intelligent Core Suite, ClaimVantage IDAM, Global IQX Sales and Underwriting, and Enroll360 solutions[DG1] that are helping Group and Voluntary insurers meet the increasing demands of employers and their employees.

For more on this topic, be sure to read, Wanted: Group and Voluntary Products to Boost Employee Engagement & Loyalty, and download, Bridging the Customer Expectation Gap: Group & Voluntary Benefits.

[i] “Securian Financial collaborates with “BenefitBump” to enhance education among expectant parents,” Press release, Securian.com, September 29, 2022.

[ii] Dahl, Corey, “A brief history of life insurance,” ThinkAdvisor, September 9, 2013, https://www.thinkadvisor.com/2013/09/09/a-brief-history-of-life-insurance/

[iii] Ibid.

[iv] Howe, Barbara, “A Fresh Look at Voluntary Benefits,” Corporate Wellness Magazine.com, https://www.corporatewellnessmagazine.com/article/a-fresh-look-at-voluntary-benefits

[v] “Number of Jobs, Labor Market Experience, Marital Status, and Health: Results from a National Longitudinal Survey,” Bureau of Labor Statistics, August 31, 2021, https://www.bls.gov/news.release/pdf/nlsoy.pdf

[vi] Henderson, Rebecca, “How COVID-19 Has Transformed The Gig Economy,” Forbes, December 10, 2020, https://www.forbes.com/sites/rebeccahenderson/2020/12/10/how-covid-19-has-transformed-the-gig-economy/?sh=42b329d16c99

[vii] Lorsch, Emily, “This is why Americans can’t manage their money,” CNBC, April 8, 2022, https://www.cnbc.com/video/2022/04/08/financial-literacy-in-america.html

[viii] “Wages Have Failed to Match Inflation, 65% of Employed Consumers are Living Paycheck to Paycheck,” LendingClub press release, October 24, 2022, https://ir.lendingclub.com/news/news-details/2022/Wages-Have-Failed-to-Match-Inflation-65-of-Employed-Consumers-are-Living-Paycheck-to-Paycheck/default.aspx