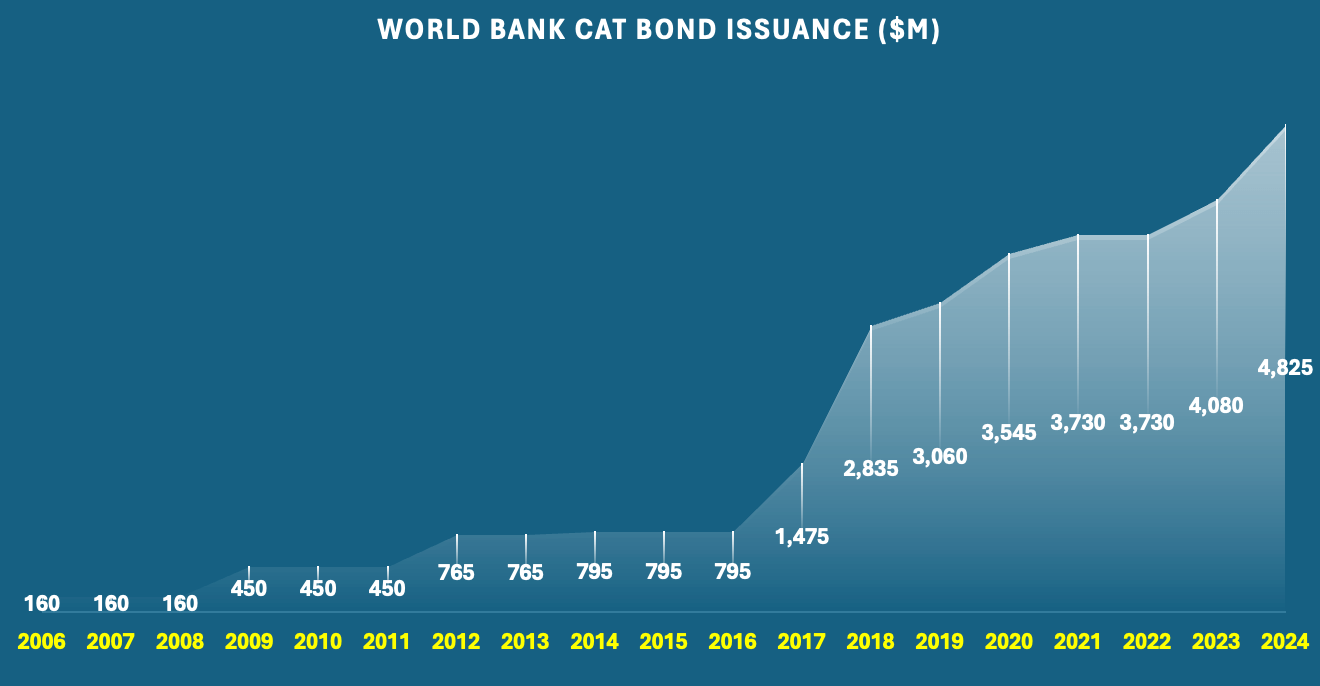

World Bank has now facilitated over US $4.8bn in catastrophe bonds

The World Bank has now facilitated and issued over US $4.8 billion in catastrophe bonds across 17 transactions we have covered over the years, with $745 million issued over the course of just a few weeks in 2024 to support Mexico and Jamaica’s disaster risk transfer and financing needs.

The most recent catastrophe bonds from the World Bank have all been issued through the International Bank for Reconstruction and Development (IBRD) Global Debt Issuance Facility’s Capital-at-Risk notes program, which is now the preferred securitization vehicle through which World Bank cat bonds are brought to market.

It’s notable that this year the World Bank managed to price $745 million of cat bond notes, across five tranches that were offered to investors, all within the space of just one month.

Which is no mean feat during what was already a particularly busy period for the cat bond market and at a time of quite rapid spread developments in the market.

It is also a strong signal of the appetite catastrophe bond fund managers and investors have for the diversifying peril opportunities the World Bank cat bonds provide.

As well as a testament to investor’s attraction to support responsive risk transfer transactions that contribute to the resilience of countries that are exposed to major disasters.

Furthermore, it also reflects investor’s continued strong appetite for insurance and natural catastrophe risk structured with parametric triggers, as all of the World Bank cat bonds have been.

The World Bank has been active in the catastrophe bond market for almost two decades, leveraging the cat bond structure as a way to access private institutional capital to support and augment with efficient and responsive funding, its member country’s disaster insurance needs.

The Bank has been facilitating and supporting the insurance needs of countries for longer, but the cat bond program has become a significant contributor to its broader disaster risk and resilience work, with now US $4.825 billion in cat bonds facilitated and/or directly issued.

We’ve tracked every single one of the World Bank’s catastrophe bonds over the years, since its first in 2006 for Mexico (CAT-Mex Ltd.), where it played a facilitation role but was not the issuer.

You can see how the over $4.8 billion of World Bank cat bond issuance has grown over time in the chart below, while details of every World Bank cat bond can be viewed further down this article.

The World Bank has not just been a significant facilitator and now issuer of catastrophe bonds to benefit countries around the world, it has also done this market a significant service through its willingness to engage and educate constituents around the world.

Representatives of the World Bank Treasury have kindly spoken at many of Artemis’s insurance-linked securities (ILS) market conferences. We’re delighted to have Michael Bennett speaking again for us in Singapore on July 11th at our ILS Asia 2024 event.

You can also watch a video of Jorge Familiar, Vice President and Treasurer of the World Bank Group, speaking at our Artemis London 2023 conference here.

Staff of the World Bank and the World Bank Treasury have become important proponents of the catastrophe bond structure and its use in disaster risk financing arrangements for sovereign sponsors, while also educating the institutional investor community as to cat bonds and ILS as investment opportunities as well.

In addition, the World Bank has been forward-thinking in how it enables the use of collateral backing catastrophe bonds it has issued, thanks to its balance-sheet strength giving it the ability to act as a guarantor.

In its transactions, for now a number of years, the World Bank has put the proceeds to use in funding sustainable development projects for its member countries, demonstrating a path towards greater ESG-compatibility for ILS investments and aligning with the needs of many large institutions.

The World Bank has also become a proponent for expanding the range of use-cases for catastrophe bonds, issuing the first pandemic cat bond, and importantly discussing the disaster risk financing needs of countries afflicted by famine, drought and other perils or crises, while explaining how catastrophe bonds with parametric triggers could be applicable here as well.

You can see all of the World Bank facilitated and issued catastrophe bonds included in the Artemis Deal Directory below:

It’s important to stress that the catastrophe bond work of the World Bank is only a small component of the significant disaster risk and resilience financing work it undertakes.

In fact, the World Bank has also helped member countries transfer catastrophe risk to the capital markets using other structures, such as swaps. While also arranging and supporting many index-based and parametric insurance schemes as well.

So, not only has the World Bank innovated in the insurance-linked securities (ILS) space over the last almost two decades, it has also provided product design and innovation inspiration for the broader insurance industry around the globe, while delivering tangible benefits to the populations of its member countries.

At this time the World Bank is the only multi-lateral issuer of catastrophe bonds, but other multi-lateral development banks and similar organisations are increasingly exploring the sector, to identify whether cat bonds can be an efficient option for their members and client countries.

We expect the role of multi-lateral development banks (MDB’s) in the catastrophe bond market will increase over time, bringing additional options for investors to support broader insurance coverage across the globe and offering new diversification opportunities for their portfolios.

You can find details of every World Bank issued or facilitated catastrophe bond, including any newer than the list above, in our extensive Artemis Deal Directory.