Workers comp insurance for small businesses in the US

Workers comp insurance for small businesses in the US | Insurance Business America

Guides

Workers comp insurance for small businesses in the US

The financial impact of workplace accidents highlights the importance of workers comp insurance for small businesses. Find out if this coverage suits you

As a business owner, you cannot predict what’s going to happen in your day-to-day operations – and sometimes, even if you have exercised due diligence and taken all the necessary precautions, workplace accidents can still occur. This is where workers’ compensation insurance plays a crucial role, especially for small businesses weaving their way to profitability.

In this article, Insurance Business discusses the importance of workers comp insurance for small businesses. We will explain how this type of coverage works and how you can get the policy that suits your coverage needs. For industry professionals, we will touch on the attributes that insurance brokers are looking for when searching for a suitable carrier for their clients as uncovered by our special reports team through hundreds of interviews. Read on and learn more about the benefits workers’ compensation insurance brings to small businesses.

Workers’ compensation insurance is a legal requirement in almost all states for businesses with employees, regardless of their size. This type of coverage pays out for the following:

Medical expenses: These include the cost of treatment for the injured or sick employee, including hospital and doctor’s visits, prescription medication, and surgery. Some policies also pay out for medical expenses incurred due to COVID-19 infection, but this depends on the industry.

Lost income: Workers comp insurance for small businesses also covers a portion of the worker’s salary if they need to take time off from work because of illness or injury. This ensures that your employees have a source of income while they are recovering.

Disability benefits: If someone from your staff becomes disabled due to a work-related accident, they are eligible for full or partial disability benefits. This can help cover medical expenses and some lost income. However, they can also take out a standalone disability insurance policy, which provides wider coverage.

Ongoing care costs: Employees that require extended medical care because of a workplace injury or illness are covered for the expenses they incur, including physical therapy and other rehabilitation costs.

Death benefits: If a workplace accident results in the death of your employee, workers comp insurance can pay for their funeral and burial expenses and just like how life insurance policies work, offers financial benefits to their loved ones.

This means that by taking out workers comp insurance, your business is also protected from the financial liability of having to cover these costs out of pocket, which can be a great help given that small businesses and startups typically operate on limited financial resources.

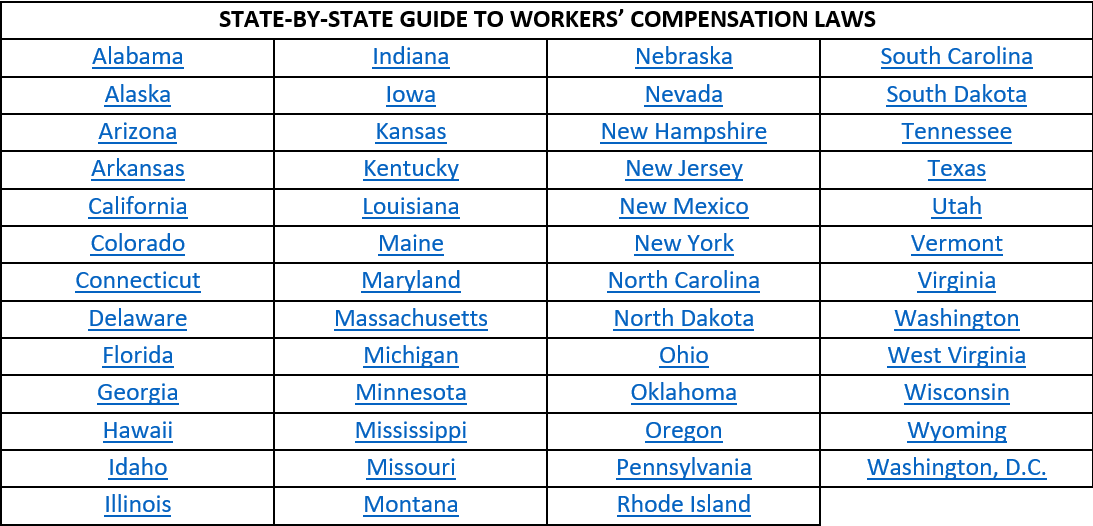

But each state implements different rules on workers’ compensation. You can click on the links in the table below to find out how workers comp laws work in your state.

In addition, the state decides who handles and sells workers’ compensation insurance policies. These may be the following:

Workers’ compensation insurance policies have two main parts, according to the Insurance Information Institute (Triple-I). These are:

Part One: Workers’ Compensation

This is where the insurer agrees to pay any state-required amount of compensation. One important thing to remember is that, unlike other types of insurance, workers comp policies do not have a capped policy amount. This means the insurance company is required to pay whatever amount the business is obligated to because of a workplace accident.

Part Two: Employers’ Liability

This covers a business against lawsuits filed by an employee for a job-related illness or injury that is not subject to state statutory benefits. Unlike Part One of the policy, this comes with a monetary limit.

Workers’ compensation insurance, however, does not cover every illness or injury that happens in the workplace. Among the incidents that are excluded from coverage are:

Accidents occurring while your staff is on the way or going home from work

Food poisoning that happens while the employee is on lunch break as breaks are not considered work-related

Injuries suffered from recreational activities even if they occur in the workplace

Injuries sustained while the employee is intoxicated or under the influence of prohibited substances

Intentional or self-inflicted injuries

Workers comp insurance claims, however, can be rejected for a slew of other reasons, most of which are avoidable. Find out the most common reasons why workers comp claims are denied and what small businesses can do to prevent them in this comprehensive guide.

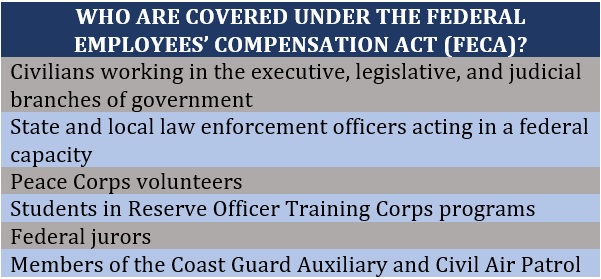

Workers’ compensation insurance also does not cover federal government employees as they already have coverage under the Federal Employees’ Compensation Act (FECA). The table below lists the group of workers covered by this legislation.

Annual premiums for workers comp insurance for small businesses can go for between hundreds to a few thousand dollars, depending on a range of factors. A business with a total payroll of around $100,000, for example, may pay around $700 to $3,000 in workers’ compensation costs each year.

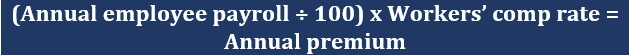

You can also get an estimated cost of how much you need to pay in annual coverage by using this formula:

One important thing to remember is that workers’ compensation rates are set by your state’s rating agency using four main factors. These are:

Class codes or job classification codes, which reflect the riskiness of the work a business does

Location, meaning where your workers do their jobs and not necessarily where your business is based

Total payroll

Experience modifiers, which reveal your previous workers’ comp insurance claims

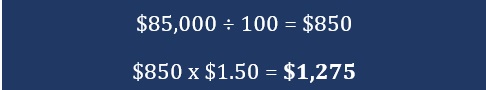

So, if your small business has a yearly payroll of $85,000 and your workers’ comp rate is at $1.50, your annual premiums will be calculated like this:

Your estimated annual premiums for workers’ compensation insurance cost $1,275.

Are there businesses that qualify for workers’ compensation insurance exemption?

Although most states require businesses with employees to take out workers comp insurance, not all businesses fit this category. According to Triple-I, there are certain types of businesses that may be exempted from getting workers’ compensation coverage. These include:

Sole proprietors*

Partnerships*

Businesses with employees paid solely on commission

For businesses with only a few employees, the threshold is between three and five depending on the state

Business owners’ immediate family members who work for their firm

*These types of businesses are given the option to self-insure unless they have employees who are not part of the ownership.

Independent contractors are often legally not considered employees. But Triple-I explains that under workers’ compensation rules in most states, contractors, subcontractors, and their employees are treated as your employees, meaning you may be held liable if they get sick or injured while working for you. To avoid liability, some businesses require independent contractors to carry workers’ comp insurance before agreeing to work with them.

Can an employee sue my business for a workplace accident?

Generally, no. The workers’ compensation system operates a no-fault model, meaning that if one of your employees gets sick or injured while working, they do not have to go the traditional tort route of proving negligence to make a claim. However, this also means that they cannot file charges against your business for the injuries or illnesses they sustain.

The Insurance Business research team conducted several one-on-one interviews with industry specialists and polled hundreds more to get their take on the most important attributes they are looking for when searching for workers’ compensation coverage that fits their clients’ needs.

The survey results, which reflect what insurance brokers prioritize the most, can also serve as a guide for small businesses trying to decide which workers comp insurance providers offer the best protection.

Here are the top factors insurance brokers are considering when searching for a provider ranked in order of importance:

Customer service: Provides efficient and quality care to a business’s most valuable asset – its employees

Claims handling: Ensures that claims are handled in a consistent, fair, and timely manner

Communication: Communicates relevant details of a workers comp insurance policy clearly and on time

Underwriting expertise: Provides flexible and tailored coverages designed to meet the unique needs of a business

Coverage: Offers robust coverage options that comply with the varying requirements in each jurisdiction

Competitive rates: Not necessarily offering the lowest rates but provides businesses with the best value for their money

Risk mitigation: Enables businesses to identify potential threats and helps them minimize the impact of these on their operations

Range of products: Boasts a wide array of solutions catering to different industries

Online access: Has user-friendly digital channels that allow businesses to easily access various features of their policies, no matter where they are

You can check out the complete survey results, along with the full roster of this year’s batch of Insurance Business’ five-star awardees for the Top Workers’ Compensation Insurance Companies in the USA here.

Triple-I shared several tips on how small businesses can save on workers comp insurance premiums. Here are some of them:

Manage your business’ risks: Most small businesses do not have the financial means to hire a risk manager, but this does not mean they can ignore workplace safety. If possible, you can assign a person who can take charge of keeping workers safe. Having a written workplace injury and illness prevention program that you can refer to in order to address unsafe working conditions is also advisable.

Take advantage of state-sponsored savings: Small businesses that pay $5,000 or less in annual premiums may be eligible for a 5% to 15% discount if they haven’t made a lost-time-work claim during a certain period. Some states offer discounts to businesses with alcohol- and drug-free workplace programs, as well as safety programs.

Ensure your premiums are correctly calculated: This includes getting the right class codes and making sure that the workers’ comp insurer’s payroll computations are correct.

Avoid being placed in the assigned risk pool: Some states have an assigned risk pool for higher-risk businesses or those with multiple work comp claims. Having a sound workplace safety program can help prevent workplace accidents and the need to file claims because of these.

You can visit, and bookmark, our Workers Comp section for more of the latest news and industry developments in the workers’ compensation insurance space.

What do you think are the advantages of workers comp insurance for small businesses? Have you experienced filing a claim? Feel free to share your story in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!