Windstorm Ciarán (Emir) industry loss lifted 3% to €1.94bn by PERILS

The insurance and reinsurance industry loss estimate from November 2023’s European extratropical windstorm Ciarán has been raised by around 3% to almost €1.94 billion by PERILS.

It remains the highest insurance industry loss from a European windstorm event, rather than a cluster, since Kyrill in 2007.

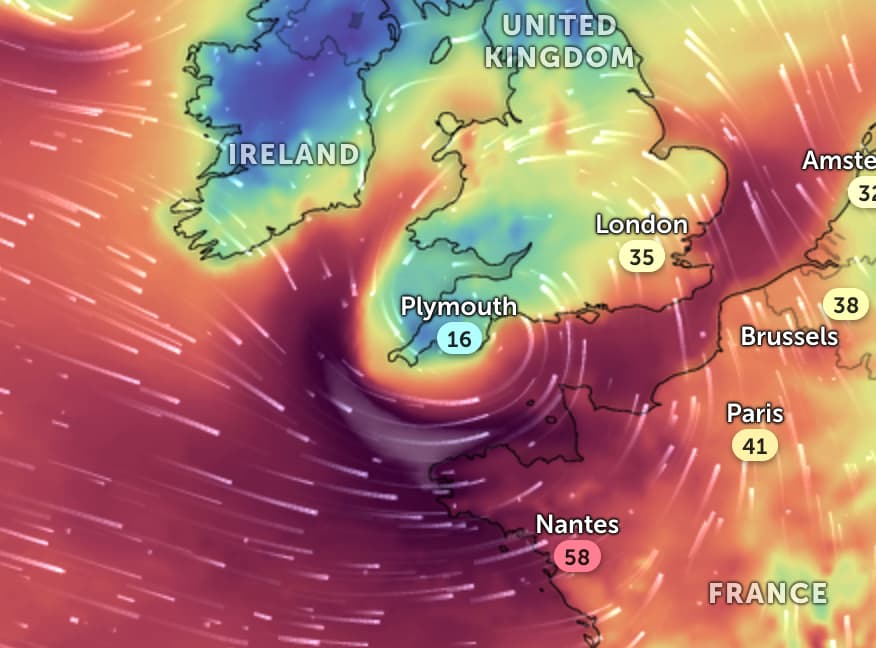

Windstorm Ciarán (Emir) affected France, Belgium, the United Kingdom, and the Netherlands between November 1st and 2nd 2023 and saw some of the strongest wind gusts experienced in Europe for years.

Losses experienced by the insurance industry are said to have been typical for a European windstorm, with a large number of smaller claims, mostly from non-structural property damage, adding up to a significant total, PERILS explained.

Initially, PERILS estimated the insurance market loss from the windstorm at just under €1.89 billion.

Now, at the second estimate PERILS has increased the total by nearly 3% to just under €1.94 billion.

France bore the brunt of the insured losses, with PERILS having initially estimated that around €1.593 billion of the total were attributed to the country, followed by the UK and Belgium.

In France, insurance industry losses from windstorm Ciarán reached a level not seen from a windstorm since Klaus in 2009, PERILS explained.

The loss estimate only covers the property line of insurance business.

PERILS estimate for Ciarán remains considerably higher than the initial estimates from risk modellers, as Verisk had pegged the storm at between €800 million and €1.3 billion and Moody’s RMS had put it at between €900 million and €1.5 billion.

PERILS also said today that it will not report on losses from windstorm Zoltan (aka Pia), which affected the United Kingdom, Norway, Denmark, the Netherlands, Germany, and Austria on 21st to 23rd December 2023, as storm Zoltan not drive an industry loss exceeding the reporting threshold of EUR 300m for anyone country and EUR 500m Europe-wide.