Will you marry me? [A seriously fun Marriage Proposal]

![Will you marry me? [A seriously fun Marriage Proposal]](https://www.cheapsr22.us/wp-content/uploads/2022/02/1643934964_Will-you-marry-me-A-seriously-fun-Marriage-Proposal.png)

It is not every day that you receive a proposal, so hear us out on this one.

What is this proposal about?

We want to marry you. And take care of your Financial Discovery Journey.

Because we know that getting the right Life Insurance isn’t a top priority for many people, so we’re taking it upon ourselves to perform this civic duty.

Wouldn’t you want to get hitched with me?

We are pledging to help you enjoy the process of learning more about your financial needs, uncovering what you already have, along with what you still lack.

The Clearly Surely platform was designed with an aim to help you match up with trustworthy finance professionals, and reduce the cost of premiums.

Other than our pledge, this campaign also has a slew of other benefits waiting to be given away.

What can I get out of this campaign?

Saddle up, because you are in for one hell of a ride. Here’s a list of rewards that are up for grabs:

$30 Cash (yes, cash)

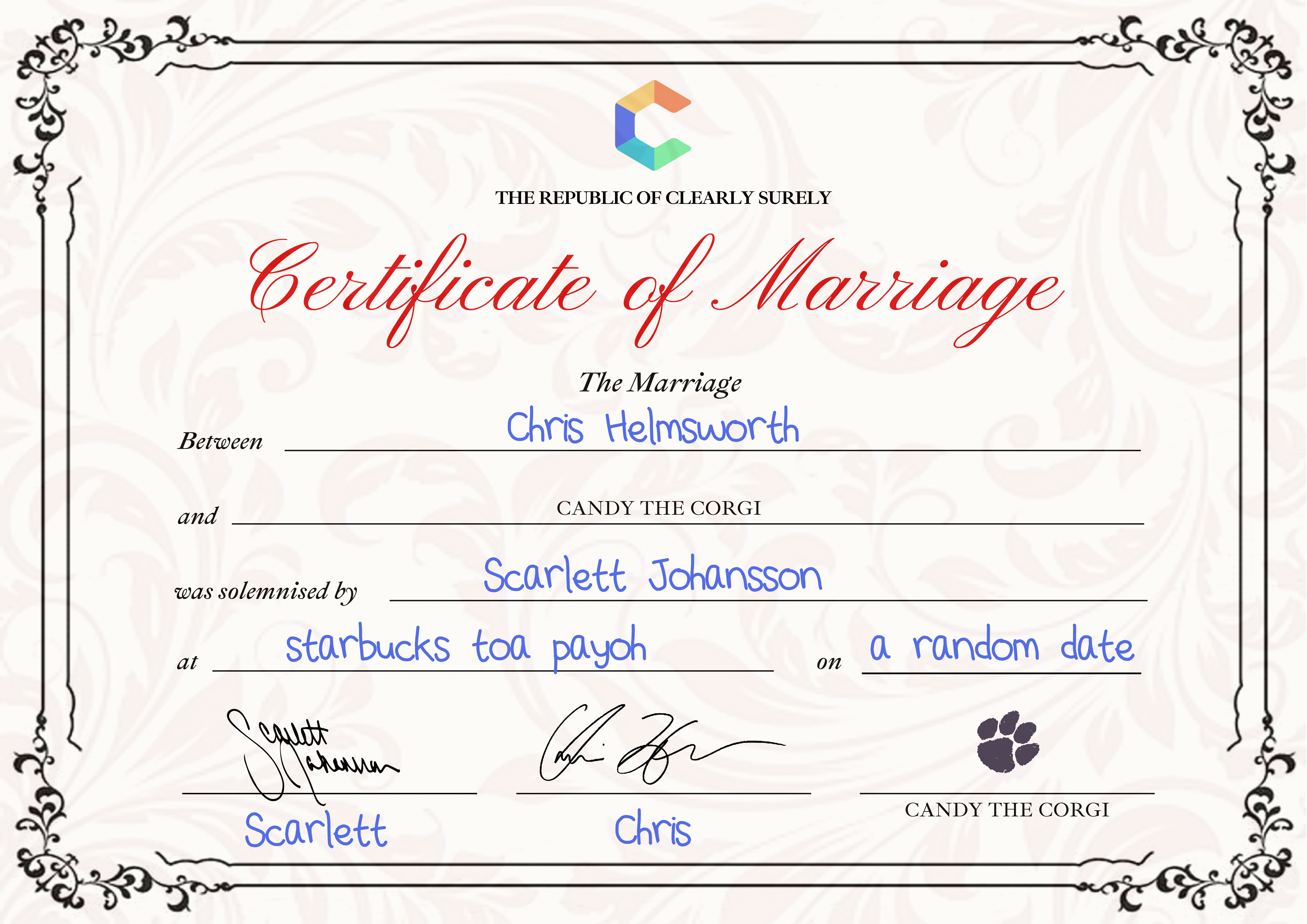

An impressive marriage cert (issued by us)

A passably impressive ring

A gift pack containing cute merch and a thank you card

The first of 5 limited edition enamel pins (Bubble Tea Candy Pin – this has it own separate reward tied to it, a $200 cash bounty. You can read about it here)

Much legit. Many wow

This looks way cuter in physical form. And it is also your ticket to collect $200 (for real, Singapore dollars)

When you use our platform, you also get gems that can then exchanged for cash when you make purchases from our appointed agent partners. (Think of it as a permanent promo code for insurance policies)

How long will this campaign last?

It starts from 16th November 2020 till 6th December 2020, but we may extend the campaign period if the situation warrants it.

Alright. What do I have to do?

As easy as 1-2-3.

1. Head over to ClearlySurely.com to create your account, and complete your Financial Discovery Journey.

When you give consent to meet up with our appointed agent partners, they will pass you:

the marriage cert

the ring

the gift pack

2. To earn the $30 cash, you only need to refer at least 3 friends to sign up on the platform as well.

Here’s the best way to convince them:

Don’t take no for an answer

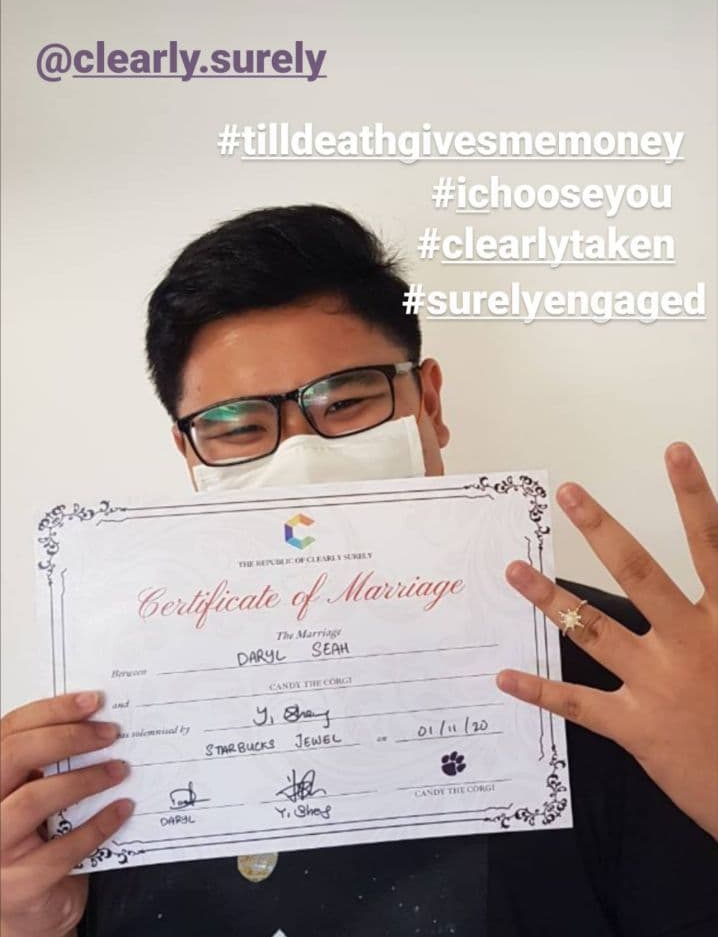

3. And to obtain the limited edition Bubble Tea Candy enamel pin, just create an IG Story / Post with a picture or video of you getting the marriage cert and the ring, with the captions:

I tied the knot!

(remember to tag us)

@clearly.surely

#clearlysurely

#clearlytaken

#surelyengaged

+ any other cool hashtags you can come up with! See example below:

He looks so happy!

Remember, all rewards are only claimable when you meet up with our appointed agent partners.

Cool, what other information do you have for me?

To get the best out of your entire experience with us, we suggest going through this series of explainer articles about what the platform entails, and how to maximize your enjoyment throughout this journey.

Part 1: Introducing our newest creation

Part 2: Platform Walkthrough

Part 3: How to maximize your experience

Part 4: Rewards

Part 5: Random Delights and Surprises

Part 6: How you can contribute

Part 7: Frequently Asked Questions

This campaign has been reviewed many times by the Mathematicians’ Association of Singapore. They still can’t work out why it is so appealing.

www.ClearlySurely.com is a refreshing new way to approach Life Insurance – with humour and fun, bound together by imagination.

Our Financial Discovery Platform provides hours of entertainment while providing an overall view of your insurance adequacy.

If you’re curious about how we can make a dry subject nearly as wholesome as Keanu Reeves, join our community today.

We have been eradicating the knowledge gap between consumers and Life Insurance since 2015, and have a vision that one day, every Man, Woman, and Child will be properly insured.