Will Rising Rates Make Life Insurance Loans More Expensive?

Podcast: Play in new window | Download

The Fed made very clear this week its intentions to begin easing its long-standing practice of pumping money into the U.S. Economy. This means they are looking to push interest rates up on the broader economy–a day many of us have been awaiting.

A lot of things will come with higher interest rates, but one major negative everyone is bracing for is the higher cost to borrow money. This will–theoretically–impact cash value life insurance policies. At least those using a variable loan interest rate.

So as rates tick up this year, will those of you with outstanding policy loans be paying more interest over the year? The short answer is probably not. This said, now is a great time to re-visit the subject of policy loans in the tactical sense.

Variable Loans and Their Common Pegged Index

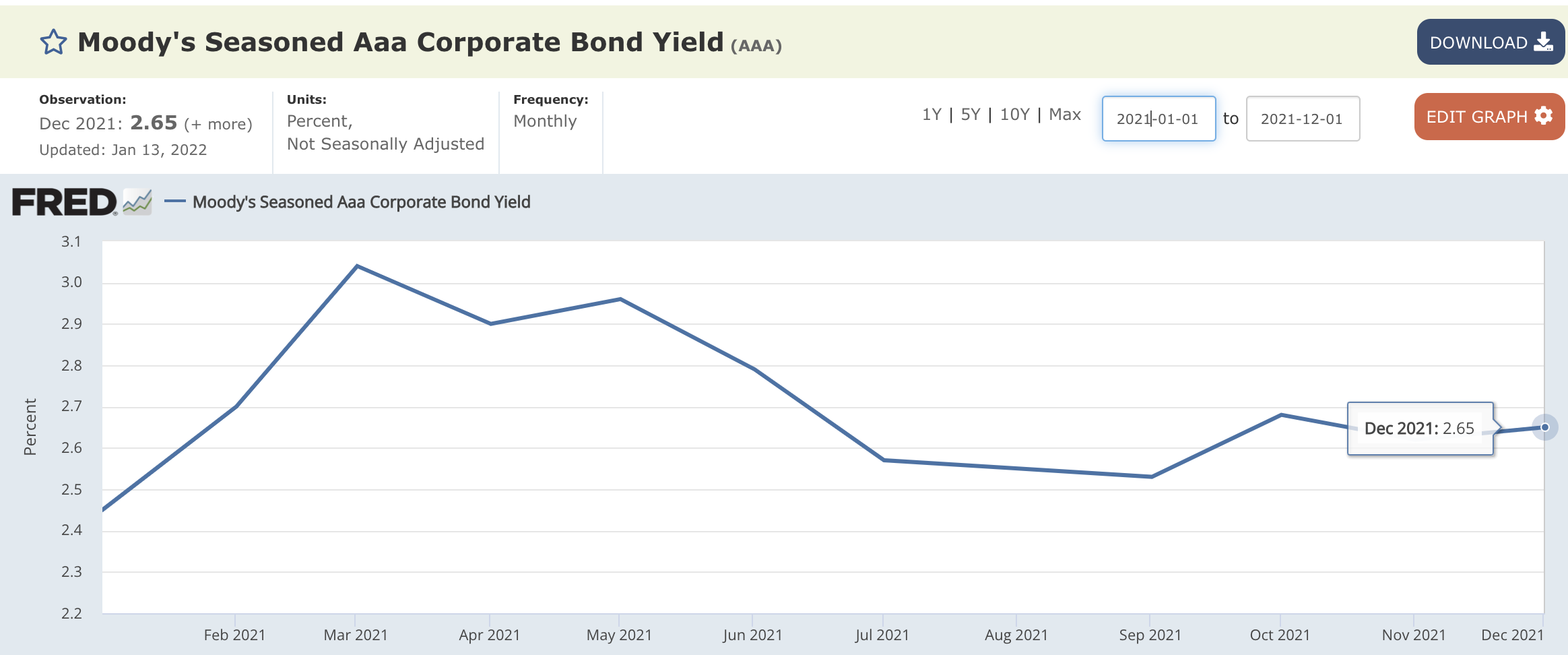

Most insurance contracts with variable loans–at least in the whole life space–peg the loan rate to the Moody’s Corporate Bond Index. These contracts also usually include a succession plan should this index cease to exist.

As of January of 2022, the index sits at 2.65%.

Source: https://fred.stlouisfed.org/series/AAA

Most whole life policies do not allow the loan rate charged on policy loans to fall below the guaranteed accumulation rate of the policy–in fact most place a spread between the guarantee accumulation rate and the minimum loan interest rate.

On average, the minimum loan rate for these variable loans is 100 basis points above the guaranteed accumulation rate. This means that for a large number of policies in existence, the minimum loan rate is 5%–this assumes policies issued under a 4% minimum guarantee, which was the norm until the beginning of 2022.

With loan rates typically sitting at 5% and the Moody’s Index at 2.65%, we have a lot of ground to cover before life insurance policy loans experience an increase in interest rate. While it’s entirely possible that Fed activity will eventually get us there, I wouldn’t predict interest rates rising that far that fast within the year.

But What Happens if We Do Get There?

If inflation continues to be a bee in Jerome Powell’s bonnet, it’s possible we find out selves in a world, where the Moody’s Index does surpass 5%. In this scenario, it’s absolutely possible that loan rates on these policies increases. But, nothing takes place in a vacuum.

Rising interest rates also give strength to the likelihood of rising dividend rates. Once insurers can buy bonds with higher yields, investment profits will rise. This increase in investment profits will produce a positive movement in dividends.

I’d predict that getting to an interest rate environment where the Moody’s Index is higher enough to cause an increase in these variable loans will also be an environment capable of producing higher dividend interest rates on whole life insurance products.

Direct Recognition Likely Has an Advantage Here

While I still don’t believe that dividend recognition has an absolute advantage regardless of which method is practiced, sharply rising interest rates that cause loan rates to jump before company-wide dividend rates do may not be as big a problem for direct recognition contracts.

Since most direct recognition contracts peg the dividend payable on cash values that back a loan to the loan interest rate, a rising loan interest rate will potentially increase the dividends payable as well.

We’ve been Planning for This

We’ve been planning for higher interest rates for over a decade. Part of our product selection process included looking at how products behaved under an array of scenarios, and rising interest rates has always been a top-of-mind circumstance.

We’ve long held the opinion that contract provisions matter–it’s why we don’t get hung up in silly meaningless details like dividend recognition just in and of itself. The recommendations we’ve made over the years took the possibility of rising rates, and the impact it would have on policy loans into account, and we’re pretty convinced that we have a solid strategy for this.