Will My Final Life Insurance Price Be the Same as My Quote?

Will the final price of my life insurance policy be the same as my online quote?

Do you prefer to learn by watching? We answer this question in a video below. Click here to jump ahead.

If you have compared your quotes for term life insurance and filled out your application online, you may be wondering what the final pricing for your life insurance policy will be.

In this post, we explain why your final offer from your life insurance company could be more or less than the quote you received while shopping online.

The more you understand how life insurance underwriting works, the easier you can evaluate your policy options and determine the pricing that is best for you and your family.

Will my term life insurance policy rate be the same as my online quote?

If you are using an online shopping tool (such as Quotacy’s) to compare term life insurance policy quotes side-by-side, you’ll notice that each life insurance company offers a different price for the same term length and coverage amount.

In the screenshot above, you see quotes ranging from $17.43 to $18.16 per month for a $500,000, 20-year term life insurance policy.

Each life insurance company has their own pricing structure. At Quotacy, we’ve made the process of comparing term life insurance quotes from dozens of trusted companies easier for you.

» Calculate: Life insurance needs calculator

In minutes, without entering any personal contact info, you can quickly get a ballpark estimate of how much your life insurance could cost per month based on your own preferences that you select in our quoting tool.

Get Started by Answering 4 Simple Questions

Our ballpark quotes are fairly accurate for most individuals, but for some with more complex health conditions, risky hobbies, or a high-risk job, for example, the life insurance company may need to ask you for additional information to accurately determine your mortality risk and, therefore, your final cost for life insurance.

Determining policy rates that are fair to you and that don’t represent an unacceptable risk for the life insurance company is what underwriters do.

They look at the big picture of your risk factors, such as the combination of your age, gender, health, family medical history, and so on, as they evaluate your application.

Factors that Impact Your Life Insurance During Your Application Process

Risk factors are what the insurance company refers to as aspects of an applicant that may impact his or her life expectancy and, therefore, pose a risk to insure.

The insurance company evaluates these risk factors by looking at your application, medical exam results, medical records from your doctors, your driving record, financial records, and criminal history records.

Insurance companies won’t take a deep dive into these records for ALL applicants. Some applicants are eligible for accelerated underwriting, which speeds up the process and does not require you to take a medical exam.

If you are required to take a medical exam, don’t worry. The exam is free. No copays, deductibles, or fees of any kind. The examiner comes to your home or office, wherever is more convenient. And the exam only takes 15-30 minutes.

The medical exam results provide the insurance company the most up-to-date look at your overall health. The following conditions are some common factors that may cause a final life insurance price to be different from a quoted price.

Blood Pressure & Hypertension

If your blood pressure reading is high during your medical exam and you have not stated on your application that you suffer from hypertension, your life insurance company may investigate further. This may influence your life insurance policy quotes and cause them to be higher than your online quotes.

If you do indeed have hypertension, but your blood pressure is under control and you have not experienced end-organ damage, then your application may be considered within a standard risk class.

If, however, your blood pressure reading indicates formerly undetected hypertension, you may receive a higher rate.

It’s important to fully disclose all of your medical conditions on your life insurance application. Doing this allows Quotacy’s in-house underwriters and life insurance agents to help place you with a life insurance company that works best with your health history.

Our in-house underwriters can do what’s called an “underwriter’s first look” before submitting your application. The first look uses their industry experience to guide you in the right direction from the start. That’s one advantage of working with a life insurance broker like Quotacy.

Cholesterol Levels

When preparing for your medical exam, it’s important to be aware of the impact of what you eat near the time of your exam.

If you are not being treated for high cholesterol levels, then an appearance of elevated levels of low-density lipoprotein (LDL), which is an indicator of coronary artery disease or stroke risk may cause your life insurance policy quotes to be higher than your first online quotes.

Eating fatty foods around the time of your exam can temporarily raise your cholesterol levels, causing you to receive a reading that presents an inaccurate portrait of your health. It’s best to fast 8-12 hours prior to your medical exam.

Height and Weight

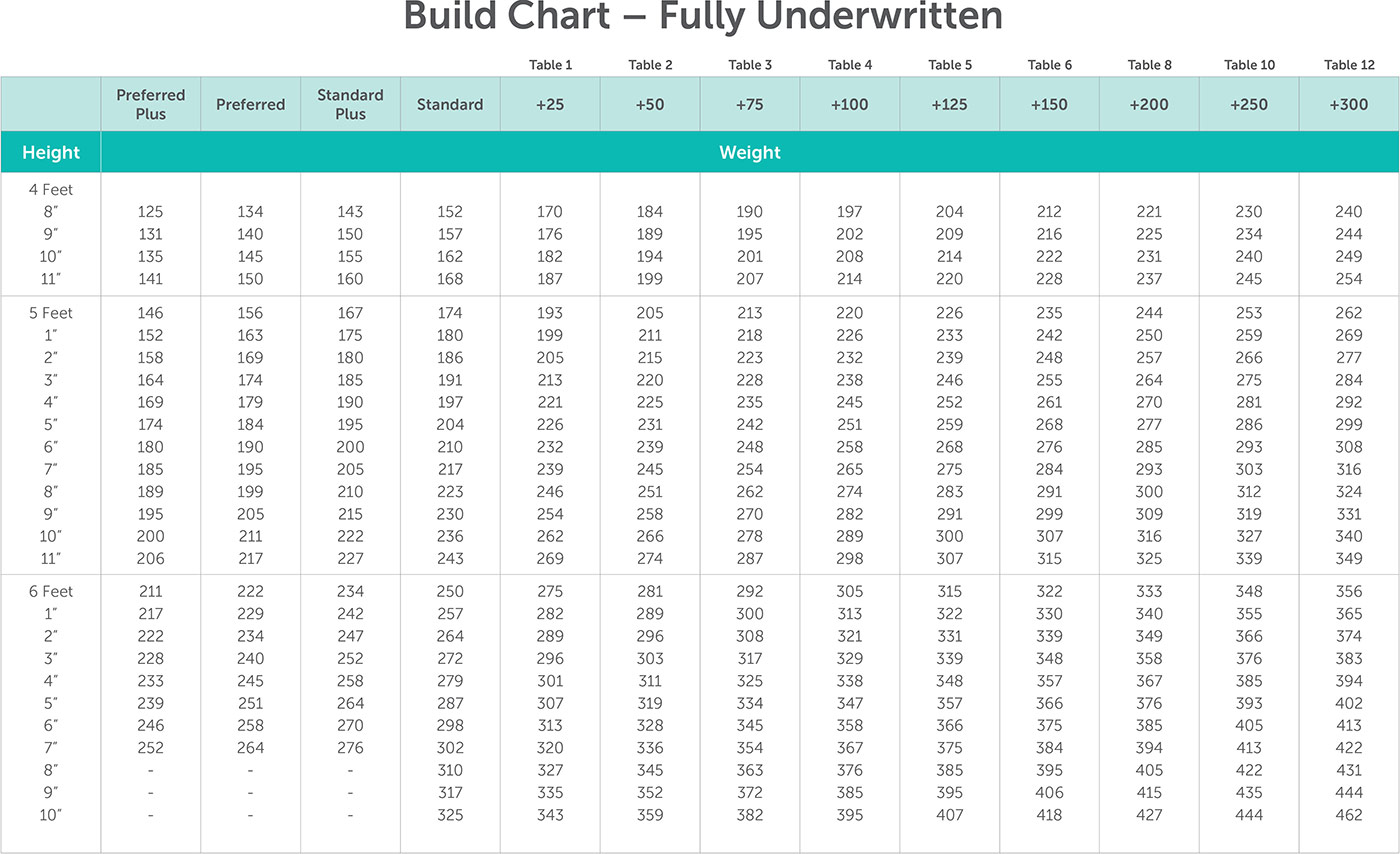

Changes in your height and weight will influence your life insurance policy quotes. Insurance underwriters look at your Body Mass Index (BMI) differently than your doctor might. They use a special Build Chart to place you within a specific risk class.

If your weight is different than what you reported when you received your initial quote, then your life insurance policy quotes may be higher or lower than the premiums that you found online.