Will IUL Loan Interest Tank Your Policy?

Podcast: Play in new window | Download

Universal life insurance is in no short supply of anecdotes and claims that rising fees will destroy the product. Much of this discussion is skewed “data” used for self-interest pushing some alternative agenda. And while these stories exist in the 10’s of incidences–which should cause any reasonable person to question the validity of any claim that such allusions are unique rather than evidence of a systemic problem–they have certainly caused some to pause and wonder if the product doesn’t pose more danger than they realize. I did this very thing at one point in my life.

We’ve addressed the issue of rising universal life insurance costs. We’ve also addressed this topic specifically for indexed universal life insurance. But today I want to revisit the subject and attempt to burden IUL with yet one more obstacle to see if we can finally break this product and provide the opposition party at least some credibility. I want to add loan interest costs to all the other expenses charges against an indexed universal life insurance policy and see how that compares to the cash value and index earnings.

IUL Fees with Loan Interest Included

I’m going to assume a scenario where a 40-year-old male offered preferred risk classification purchases a currently available indexed universal life insurance policy designed to maximize cash value. This means that we’ll build the policy around his planned premium versus specifying a death benefit and paying the calculated premium that corresponds with said death benefit. In this scenario, the policyholder will plan to pay $50,000 per year into the policy until he reaches age 65.

Since I had to choose a number, I’m going to assume that this indexed universal life policy will earn an index interest credit of 5.5% per year in all years. Though it’s of relatively little importance for this specific example, the IUL policy we’re using for modeling purposes has a 1% floor and an 8% cap rate.

At age 66, this individual will stop paying premiums and begin using the cash value in the policy as a source of income for retirement. I’m going to let the insurance company software calculate the maximum amount of income I can generate with this policy. It will do this by taking into consideration:

The amount of cash value at age 66

The assumed interest earnings in all years after age 66 (still 5.5%)

The expenses of the policy age 66 until expenses end (for the most part that happens to be age 97 for this specific policy)

The loan interest that will accumulate on loans taken against the policy to create income

The number of years we intend to generate income with the policy; that happens to be age 66 through age 100

With all of that taken into consideration, the maximum annual income computed is $172,320.

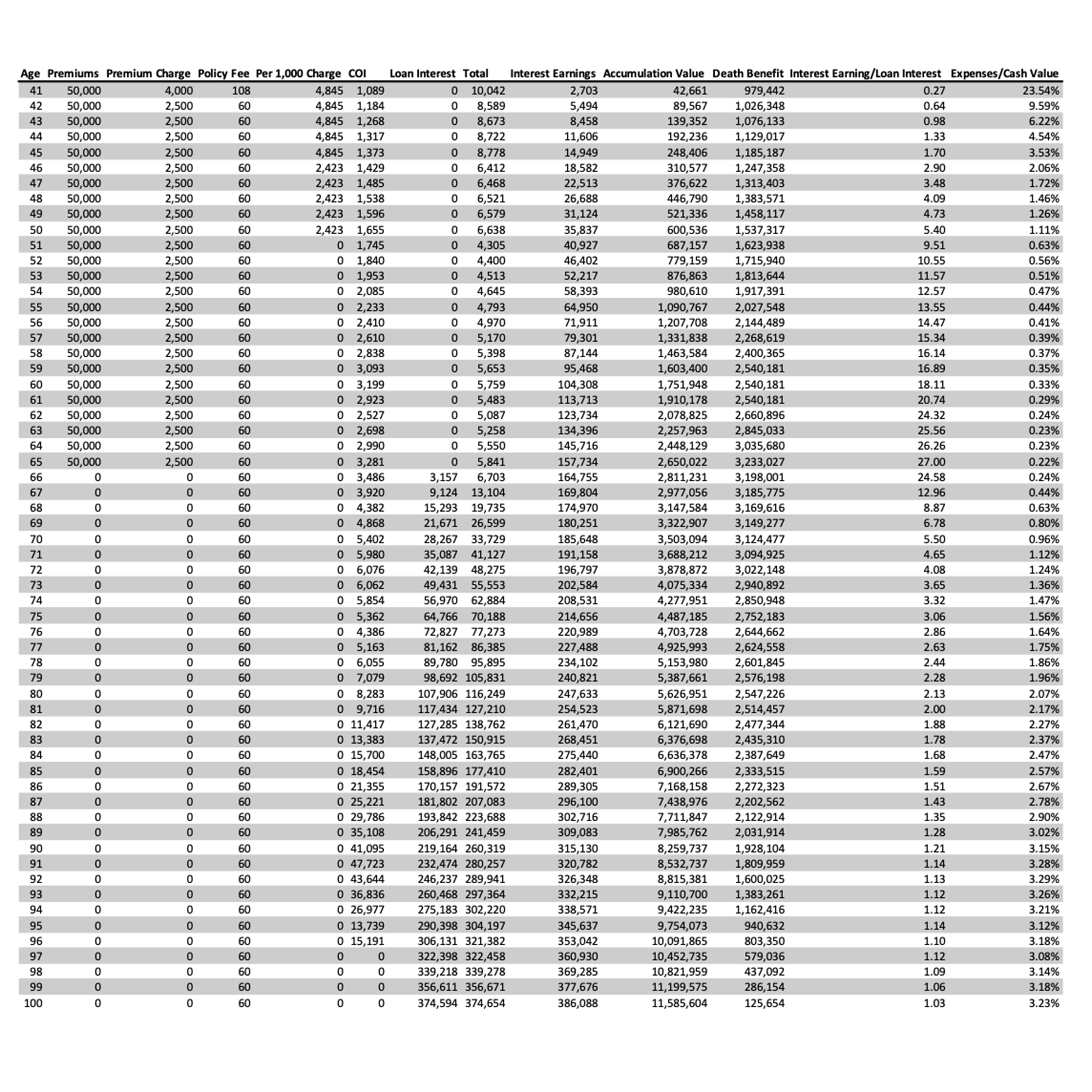

Since this is indexed universal life insurance, all of the expenses charged against the policy are available in hand report I can request from the insurance company. This details exactly what the policyholder will have deducted from his policy each year. Here’s how expenses–inclusive of loan interest–compare both to cash value and to the index earnings we assume will happen in this policy (click to enlarge):

Notice that in all but the first three years, the annual index interest earnings exceed ALL of the annual expenses charged against the policy. Even at advanced-age the annual expenses remain slightly below the index earnings for the year.

Also notice that notice how charges compare to total cash value. For the first five years, charges do represent a relatively high percentage of the cash value in the policy. We’ve noted this in past discussions about universal life insurance. However, this declines considerably over time. When we begin to take loans against the policy and add loan interest to outstanding policy expenses, there’s a modest bump in this percentage–this makes sense. Evaluating expenses relative to cash value in this context, charges against the indexed universal life policy’s cash value average 2.30% over the lifetime of the policy. This is, of course, higher than in our past discussions because we’re now adding loan interest to the expense tally.

But think about this fact in its larger context. While not perfectly matched up, we know from this exercise that this indexed universal life insurance policy must produce index earnings above 2.30% (or something near there as the exact timing of charges and index earnings will cause some variance) in order to remain ahead of expenses–even when we take loans against the policy and begin incurring loan interest. I’ve never looked at an indexed universal life policy where I felt we couldn’t assume a rate several basis points higher than 2.30%.

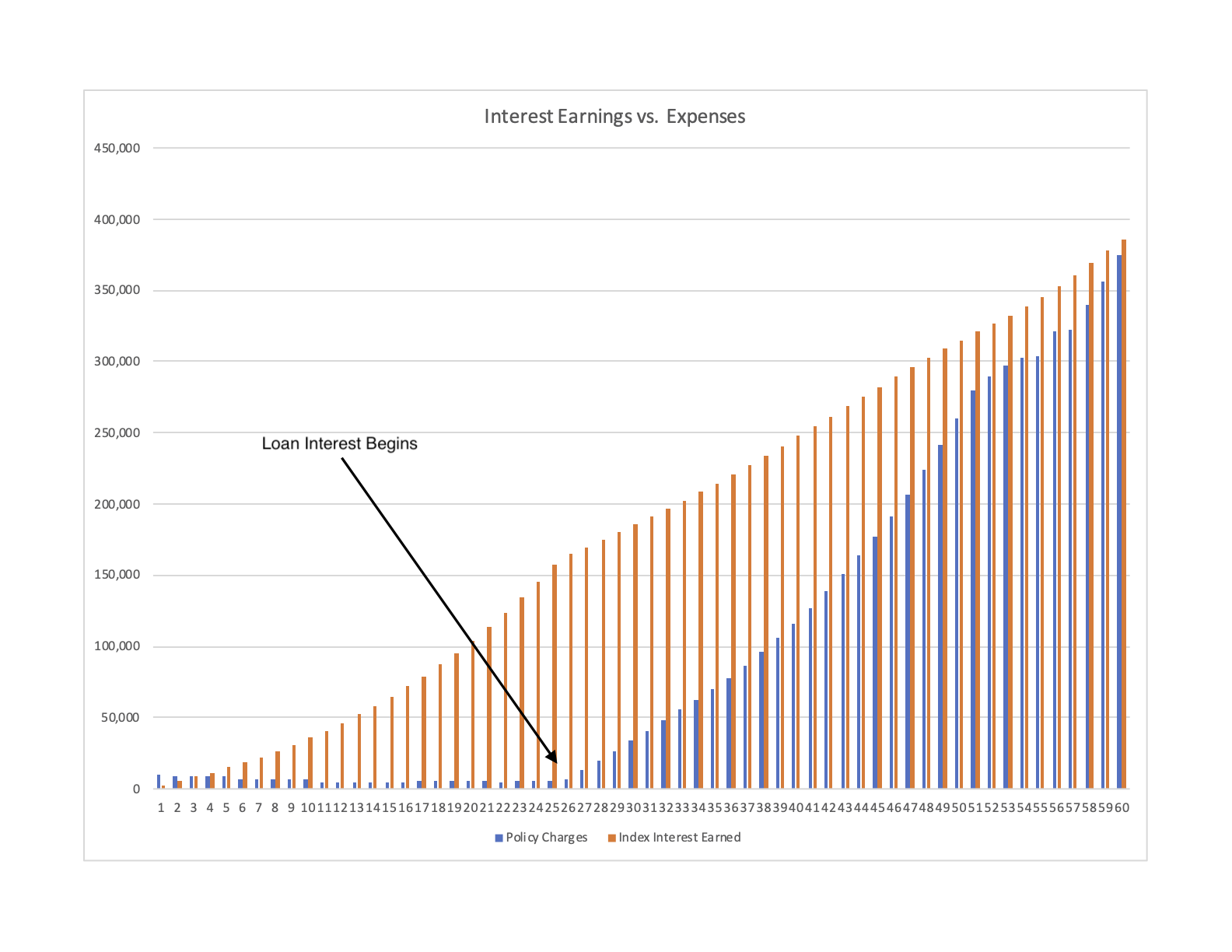

For those looking for a graphical representation of what’s going on. Here’s a chart that compares index interest credits to ALL charges inclusive of loan interest in all years:

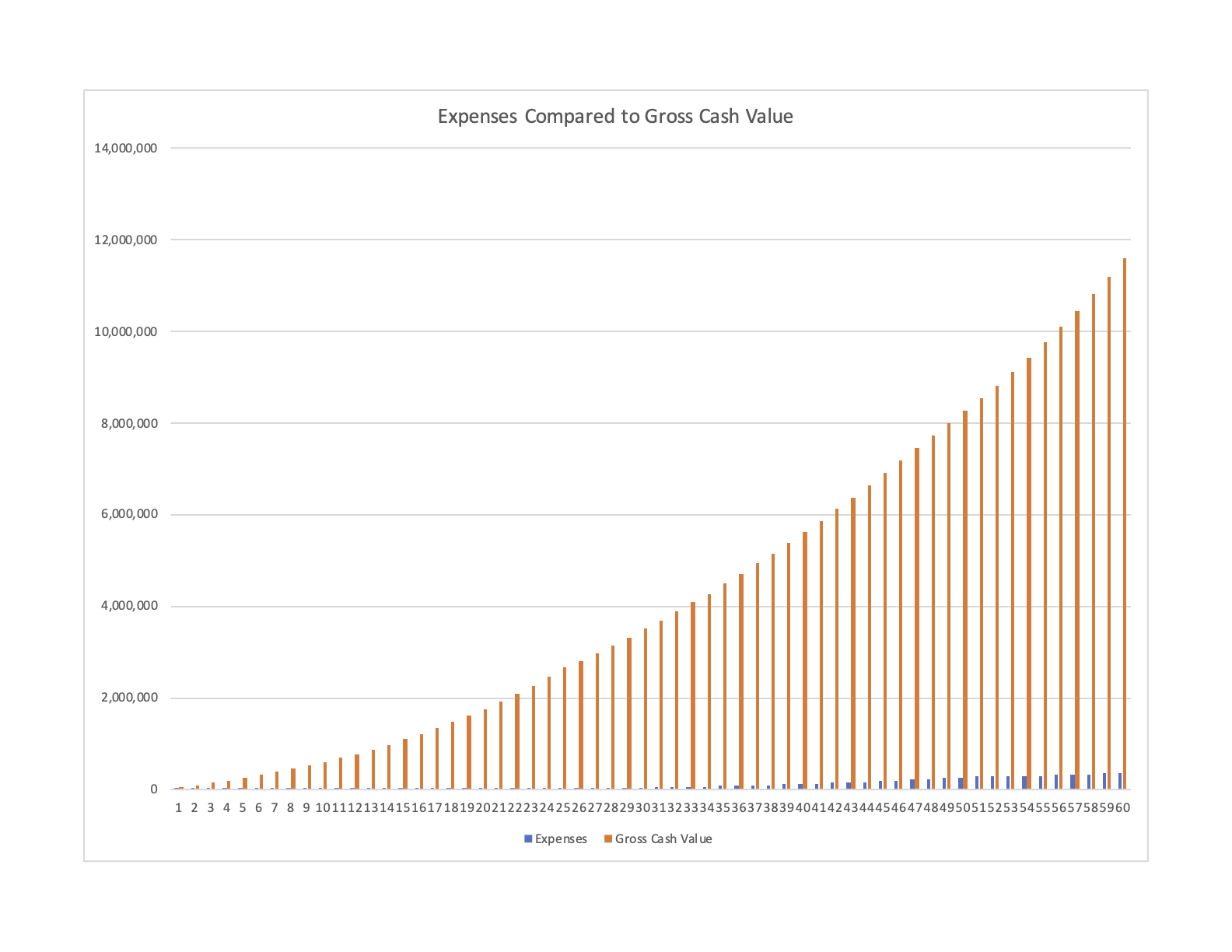

And here’s a chart that compares ALL expenses inclusive of loan interest against the gross cash value in the policy: Those little tiny blue rectangles that are nearly invisible for the first 30 years are the tally of expenses. Even as we add loan interest, we can see that total expenses comprise a small percentage of the overall accumulation value in the IUL policy.

Those little tiny blue rectangles that are nearly invisible for the first 30 years are the tally of expenses. Even as we add loan interest, we can see that total expenses comprise a small percentage of the overall accumulation value in the IUL policy.

Prior Claims of Out-of-Control Expenses Still Don’t Add Up

Those who continue to claim that indexed universal life insurance is a product with out-of-control expenses that terrorize aged policies continue to lose more and more credit the more we attempt to burden policies with expenses and cast doubt on the survivability of IUL policies held for a lifetime. We’ve down in past reviews that expenses comprise a low percentage of the policy accumulation value and even when we add the expense of loan interest–as in this case–the expenses still don’t reach a level that appears to cause any considerable concern.

This example also overlooks the variability of index earnings which can be much greater than assumed in our projections. While it’s also true that the indexed earnings could perform far worse than anticipated, the circumstances that would need to exist to create that reality are historically non-existent. Even when looking at indexed universal life insurance over a period such as the lost decade, the policy’s mechanics return very favorable results.