Why Florida insurance rates are going up

Why Florida insurance rates are going up | Insurance Business America

Guides

Why Florida insurance rates are going up

Florida insurance rates are going up and there seems to be no letting up. Find out what factors are causing premiums to skyrocket in this article

Florida ranks among the most expensive – if not the costliest – states for home and car insurance. Still, rate increases there are not showing signs of letting up. What’s causing the upsurge? Insurance Business sheds light on this matter by digging deeper into the reasons why Florida insurance rates are going up. Read on and find out what makes the state’s insurance situation unique in this article.

Florida’s geographic location places it in the direct path of many destructive hurricanes. While these weather-related events play a significant role in driving up insurance costs, there are several other factors impacting how much premiums the state’s residents pay. We will discuss these factors in more detail below.

Florida home insurance rates

Homeowners in Florida are paying annual premiums that are about four times higher than the national average, according to the latest figures. This is due to a combination of geographical, legislative, and economic factors.

According to data gathered by this report, home insurance is costing Florida homeowners an estimated $6,000 per year compared to the national average of $1,700, in what the Insurance Information Institute (Triple-I) described to be a “man-made crisis.”

Here are some of the biggest factors why Florida insurance rates are going up:

1. Reinsurance costs

One factor that makes Florida’s insurance sector unique is its heavy reliance on reinsurance. The market consists mainly of small and medium-sized insurers that operate exclusively in the state, filling the gap left by large national insurers that chose to limit their business in Florida because of the higher level of risks involved. For these local companies, reinsurance serves as a form of “shock absorber,” taking on the risks that are beyond what insurers are willing to assume.

The National Association of Insurance Commissioners (NAIC) defines reinsurance as “insurance for insurance companies.” Because of Florida’s susceptibility to natural catastrophes, reinsurance plays an essential part in the local insurers’ capability to manage risks and pay out claims.

Between 2006 and 2017, reinsurance costs in Florida went down as the state experienced only a few destructive storms. But these weather-related events have become stronger in recent years, primarily due to climate change. Among these is 2022’s Hurricane Ian, which has caused almost $114 billion in inflation-adjusted losses. This makes Hurricane Ian the third costliest hurricane in the country, trailing Hurricane Katrina in 2005 and Hurricane Harvey in 2017.

To learn more about how reinsurance works, our comprehensive guide to Florida reinsurance can help.

The increasing frequency and severity of natural catastrophe claims have pushed Florida reinsurance rates to go up between 45% and 100% in January and another 20% to 40% in the June renewals, something that will be passed on to the consumers.

To ease the burden on both the insurers and the policyholders, Florida has passed two bills creating these programs:

Reinsurance to Assist Policyholders (RAP) Fund: Reimburses 90% of an insurer’s covered losses and 10% of its loss adjustment expenses up to the limit of coverage for the two hurricanes causing the largest losses for an insurer during the contract year. The RAP Fund provides a $2 billion reimbursement layer of reinsurance for hurricane losses, an amount that is significantly lower than the $8.5 billion mandatory layer of the Florida Hurricane Catastrophe Fund (FHCF).

Florida Optional Reinsurance Assistance Program (FORA): An optional hurricane reinsurance program that allows insurance companies to purchase reinsurance at between 50% and 65% of the rate online.

2. Litigation costs

Another challenge that insurance companies in Florida face that has an impact on insurance premiums is litigation costs. A recent analysis by Triple-I has found that despite accounting for less than a tenth (9%) of all homeowners’ claims in the US, Florida leads the country in insurance-related litigation, taking up almost four-fifths (79%) of the nation’s total.

The institute attributed the situation to a “legal system that invites litigation.” Previously, the state allowed a “one-way attorney fees” system for property insurance claims, requiring insurers to pay the attorney fees of policyholders who successfully sued over claims, while also shielding the policyholders from paying the fees when they lose.

Although this practice has since been repealed during Florida’s late 2022 special session, the change is not retroactive. This means all policies in force before January 1, 2023, will still fall under the previous regulations.

3. Misuse of assignment of benefits (AOB)

AOBs, where homeowners agree to sign over their claims to contractors who then work with insurance companies, are standard practice in the industry. However, Triple-I’s analysis revealed that this has instead become a “magnet for fraud.” With the previous legal system eliminating financial accountability from insurance plaintiffs, it has also encouraged contractors to solicit unwarranted AOBs from unsuspecting homeowners, conduct unnecessary expensive work, and file lawsuits against insurers when their claims are disputed or denied.

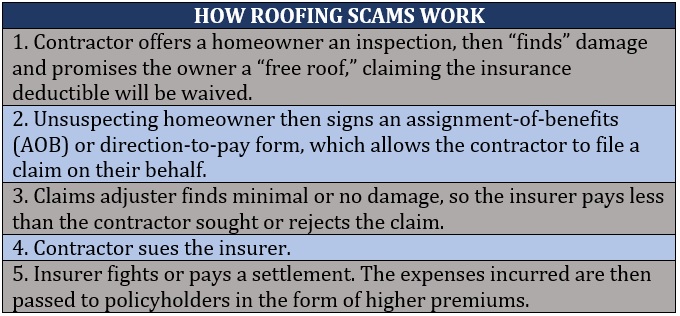

One of the most common methods that unscrupulous contractors use is the roofing scam, which, according to Triple-I, works like this:

The recent legislation also eliminated AOBs, resulting in a significant drop in fraudulent claims.

Insurance scams are not victimless crimes as widely believed. Often, it’s the policyholders who bear the brunt of the financial impact. However, this hasn’t stopped some people from going to great lengths to commit a crime for their own financial gain. Take a look at these cases that made our list of the worst insurance frauds of all time.

4. Worsening catastrophe claims

Because of its shape and location, Florida is among the states in the US with the highest risk of exposure to natural catastrophes. And with climate change resulting in more frequent and devastating weather-related events, the risks facing Florida homeowners are magnified. Hurricane Ian is a testament to that.

As more destructive storms are expected to hit the state in the future, home insurers are forced to raise premiums to cover potential claims.

5. Rising inflation

Skyrocketing costs of raw materials directly impact how much it would take to repair or replace a home if destroyed. Across the US, construction materials saw a 19% increase from pre-pandemic levels, according to this report. These elevated prices are among the reasons why Florida insurance rates are going up.

Florida car insurance rates

Florida car premiums are likewise not immune to external factors driving up insurance rates. A recent report has shown that annual auto insurance costs across the state are about double the national average. The rise can be attributed to several factors, including:

Litigation costs: Being a no-fault state, all parties involved in an accident must submit claims to their own insurer, increasing the likelihood of attorney involvement, according to the Insurance Research Council (IRC). Attorney involvement can result in higher costs, which insurers can pass on to policyholders.

Busy roadways: Florida’s world-class beaches and amusement parks make it an attractive tourist destination. But visitors pouring in also means increased traffic and busy roads, which raises the likelihood of car accidents.

Weather-related exposure: Florida’s geographic location puts it in the path of destructive storms and hurricanes, which are among the top causes of vehicle damage.

Healthcare costs: Florida is among the states where residents are spending a bigger portion of their income on healthcare, according to data from the Commonwealth Fund. This includes treatment and medical care resulting from vehicular accidents. Higher healthcare costs play a role in pushing up premiums.

Uninsured drivers: Recent figures from Triple-I ranks Florida as sixth among the states with the highest percentage of uninsured drivers at slightly over 20%. This means that Florida motorists are at higher risk of getting in an accident involving an uninsured driver, which has an impact on premiums. To be protected, it pays to take out uninsured/underinsured motorist (UM/UIM) coverage, even if it isn’t required in the state.

Here’s a summary of the different reasons why Florida insurance rates are going up.

With the cost of home insurance on the rise, Florida homeowners can benefit from knowing different strategies to cut insurance costs. Here are some practical ways to reduce your home insurance premiums:

Shop around: Look for cheaper premiums but avoid just comparing prices. Pay attention to the benefits as well. Be wary of the cover differences that may be offered for cheaper premiums.

Get windstorm mitigation inspection: Home insurers in the state are required to offer credits to homeowners who make their properties more wind resistant. In addition, the report will show you what improvements you need to make to protect your home and slash your insurance costs.

Raise your deductible: The higher your deductible, the lower your premiums because insurers take on less risk. But be sure to set the amount to a level that you can afford to pay. You can check out how an insurance deductible works in this comprehensive guide.

Check out discount options: Insurers often offer a range of discounts to help lower your rates. Having your home and car insurance coverage with the same insurer, for example, may qualify you for a discount.

Upgrade to hurricane clips: Installing hurricane clips in your home can make you eligible for up to 50% on your annual premiums as these reinforce the connection between the roof truss and the wall plate.

There’s a range of factors that impact how much a person pays for car insurance premiums, including their age, gender, address, and driving behavior. But regardless of these variables, there are several practical strategies that you can take to slash auto insurance cost. These include:

Keeping a clean driving record: Maintaining a spotless driving record is among the best ways you can access lower rates. Safe driver discounts vary between insurers, but these usually range between 10% and 25% reduction in premiums.

Skipping unnecessary coverage: Auto insurers offer several coverage options that impact how much premiums will cost. To reduce premiums, it is best to stick with essential coverage.

Taking advantage of discounts: Drivers can often get discounts by bundling auto and home policies, opting for annual payments, installing security features, and taking defensive driving courses.

Switching to usage-based or pay-per-mile insurance: Enrolling in a usage-based insurance (UBI) program is beneficial if you log fewer than 10,000 miles every year. This device also tracks driving behavior, allowing you to access discounts based on when, how well, and how much you drive.

Raising the deductible amount: Just like with home insurance, it is best to keep the value at a level you can afford as this increases the amount you need to pay before your insurer picks up the tab.

Not letting your policy auto-renew: Review your policy before it renews so you can be sure that you are getting the best coverage that fits your current needs at the cheapest price.

Because each driver comes with a different profile, it can be tricky to find a low-price insurance option that suits everyone. Find out which insurers in the US offer cheap car insurance for different types of drivers.

Why do you think Florida insurance rates are going up? Can the latest legislation help lower insurance costs? Feel free to use the box below for your comments.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!