Why claims frequency is trending for electric vehicles

Repairable claims frequency for electric vehicles (EVs) in Canada and the U.S. continues to increase slightly with each passing quarter, albeit very slowly, according to a new report from Mitchell, an Enlyte company.

EV repairable claims frequency increased 2.41% in Canada and 1.13% in the U.S. in 2023 Q1 compared to 2022 Q4, up a modest 0.15% and 0.03% respectively, Mitchell said in its latest Plugged-In: EV Collision Insights publication.

The top North American EV markets based on repairable claims frequency are British Columbia at 4.8% (up 0.33% quarter-over-quarter), California at 3.7% (also up 0.33%) and Quebec at 3.14% (up 0.39%).

But despite the increased claims frequency, average repairable severity decreased quarter over quarter in both the U.S. and Canada.

Mitchell told Canadian Underwriter in 2022 Q4 Canadian repairable severity was $6,591 for all EVs. In 2023 Q1, that number dropped by $185 to $6,406. Still, the repair costs remain higher than for internal combustion engine (ICE) vehicles.

Of concern to auto insurers is OEM parts usage and the percentage of parts repaired. Again, both increased slightly to 90.76% (up 0.65%) for OEM parts utilization and 12.68% (up 0.52%) for the percentage of parts repaired.

“Refinish time is nearly an hour more than for ICE automobiles, adding to claim costs,” Mitchell said in a press release Tuesday, adding that models new to the market are now entering U.S. collision repair facilities for the first time.

“EVs continue to lead the way when it comes to automotive complexity and their repair represents a significant cost delta over vehicles with internal combustion engines,” notes the report from Mitchell, a technology and information provider for the P&C claims and collision repair industries. “As EV adoption increases, the impact to industry stakeholders is expected to grow.

“Collision repairers will face additional training, tooling and equipment requirements to properly and safely restore these interconnected vehicles to OEM standards. Automotive insurers, on the other hand, will need to account for higher than average repair costs and cycle time when determining policyholder premiums.”

EV sales broke records in 2022 and the combination of high gas prices, government incentives and increased vehicle production helped drive consumer demand, Ryan Mandell, director of claims performance at Mitchell, said in the release. “With more EVs on the road, there will naturally be more EV collision claims.”

According to the International Energy Agency (IEA), global EV sales are expected to grow another 35% this year and reach 14 million by the end of 2023. If the latest IEA projections are met, the share of EVs in the overall car market will have risen from approximately 4% in 2020 to 14% in 2022 and 18% in 2023.

Insurance costs have long been a concern with EVs. Rate aggregator RatesDotCA reported late last year that “hardware powering advanced safety systems (not to mention the battery pack) tends to be pricey to replace if damaged, which can drive your annual rate up.”

But seemingly counter to Mitchell’s report, RatesDotCa found “many EVs come with advanced safety systems that make them less likely to be involved in a collision, which can drive rates down.”

The semiconductor chip shortage — a byproduct of the demand for advanced EV technology —has also caused repair challenges for car rental services.

“We are seeing an unprecedented increase in collision repair cycle time and related length of rental,” Mary Mahoney, vice president of the replacement and leisure division at Enterprise Holdings, said in October 2022 at the Insurance Brokers Association of Ontario Conference.

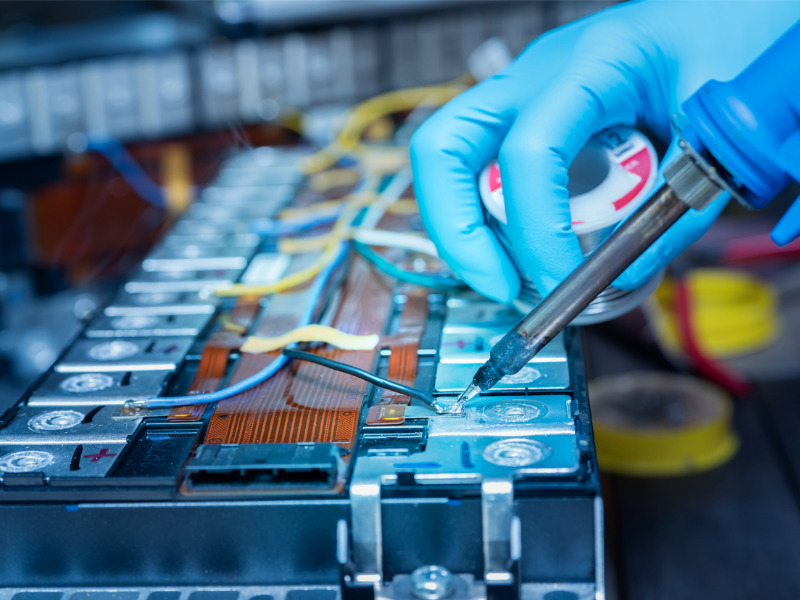

Feature image by iStock.com/Fahroni