Why Berkshire Hathaway’s fidelity bond didn’t cover a Ponzi scheme

A fidelity bond issued by Berkshire Hathaway does not cover the loss of an investment firm arising from a Ponzi scheme perpetrated by one of its underlying fund managers.

The complicated, $31-million case turned in part on whether a limited partnership formed by a special purpose vehicle and a hedge fund were protected from theft or fraud committed by an ’employee.’

SureFire Dividend Capture LP (SDC) is a limited partnership formed as a special purpose vehicle to hold investments for its investors.

Working with brokerage Arthur Gallagher Canada, SDC’s general partner Ariel Shlien sought insurance coverage through a fidelity bond that would protect Surefire from any fraud or theft by its underlying fund managers.

SDC, Arthur Gallagher and Berkshire Hathaway negotiated the terms of the fidelity bond between September 2018 and February 2019. While they were negotiating, Shlien approached a hedge fund in the U.S. managed by Brenda Smith called Broad Reach Capital LP (BRC). Shlien was interested in one of BRC’s several investment strategies called ‘dividend capture.’

After speaking with Smith, Shlien decided SDC would invest in BRC. In several instalments, SDC paid a total of more than $4.5 million U.S. to BRC. In exchange, SDC received a limited partnership interest in BRC.

Shlien wanted the fidelity bond to cover SDC’s investors from a fraud or theft perpetrated by its underlying fund managers, including BRC. Berkshire Hathaway’s fidelity bond stated its coverage is for:

“Loss resulting directly from dishonest or fraudulent acts…committed by an employee acting alone or in collusion with others. Such dishonest or fraudulent acts must be committed by the employee with the intent:

(a) to cause the insured to sustain such loss; or

(b) to obtain improper financial benefit for the employee or other natural person acting in collusion with such employee.”

Berkshire Hathaway issued the bond in January 2019. One month later, the insurer agreed to add BRC as a ‘subsidiary’ of SDC so that the bond would apply to BRC, “but only with respect to its operations or activities on behalf of any of the SureFire funds,” as the court put it. But a misunderstanding emerged over what the bond exactly covered.

Related: Employee Dishonesty

BRC agreed to pay the premiums on the policy, which covered the period between Jan. 1, 2019, and Jan. 1, 2020.

Meanwhile, in attempting to take advantage of an agreement by which BRC would reduce its fees if SDC invested $50 million in capital, Shlien approached Brian Shevland, CEO of the asset management firm Bluestone Capital Management. In 2018 and 2019, Bluestone had $2.9 billion to $3 billion U.S. in assets under management.

Shevland created the ‘A Funds’ (three investment vehicles in Bluestone), which transferred more than $26.7 million U.S. to BRC as capital contributions. But in March 2019, after Shlien and Shevland talked about transferring the interest over to BRC as well, they received a letter from Smith’s lawyers accusing them of engaging in conduct that hurt BRC’s returns.

Shlien negotiated to receive a wire transfer redemption of SDC’s investments from Smith, but the transfer never came. On Sept. 9, 2021, Smith pleaded guilty to a one count of securities fraud in the U.S. District Court.

“Through the admission of allegations in the Indictment in the criminal proceedings, it was established that Ms. Smith had perpetrated a fraudulent Ponzi scheme using BRC,” Ontario’s Superior Court found in a decision released Friday.

“Instead of investing the money as promised [to investors], Ms. Smith diverted tens of millions of dollars of funds provided by investors out of BRC for purposes inconsistent with the trading strategies, including for personal use and to pay out millions of dollars to other investors.”

Shlien sought coverage through Berkshire Hathaway’s fidelity bond. But the insurer declined coverage, based on the fact that SDC’s limited partnership with BRC did not make Smith an ’employee’ of SDC. Furthermore, the insurer argued, Smith was the ‘directing mind’ of BRC, so even if the bond applied to BRC as a ‘subsidiary,’ BRC itself was not subject to a fraud by one of its employees.

Shlien sued, but the Ontario Superior Court sided with the insurer. Ultimately, the court said Smith of BRC was not an SDC ’employee’ by virtue of the limited partnership. Also, the bond would only cover BRC for a claim made based on fraud or theft by a BRC employee.

“Whether or not the bond should be interpreted such that Brenda Smith is an ‘employee’ of BRC is not, in my view, a relevant consideration where no claim is made by or on behalf of BRC,” Ontario Superior Court Justice Peter Cavanaugh wrote for the court. “This determination would only be relevant if a claim was made by or on behalf of BRC, as an insured, for coverage under the bond for loss sustained by BRC resulting from dishonesty or fraud committed by Ms. Smith.”

At any rate, the judge added in obitur remarks, even if the fidelity bond’s coverage did apply — and the court ruled it did not — it would have been excluded anyway, since Shlien did not report to the insurer that he worked with Bluestone to make its A-series capital transfer to BRC.

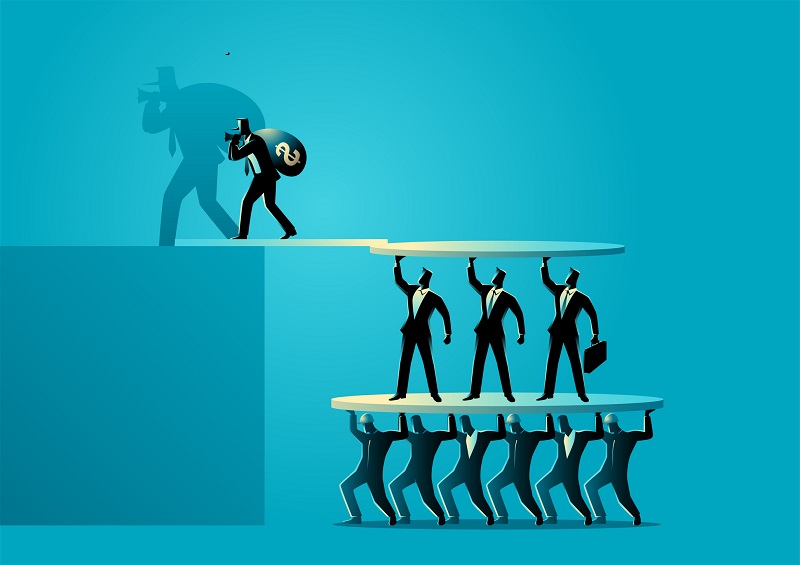

Feature image courtesy of iStock.com/rudall30