Why 2024 could be the year of the telemedicine revolution

Why 2024 could be the year of the telemedicine revolution | Insurance Business America

Life & Health

Why 2024 could be the year of the telemedicine revolution

The digital health market is set to be worth $286.22 billion by 2030 – are insurers ready to hop on the telemedicine wagon?

Life & Health

By

Emily Douglas

In 2024, the medical cost trend in the US is expected to rise by 7%, according to research from PwC’s Health Research Institute. This rise, an uptick from 5.5% in 2022 and 6% in 2023, is largely due to inflammatory pressures as well as a general rise in pharma costs, the report states.

But could these added costs and ongoing economic uncertainty be indirectly driving an interest in telemedicine and its integration into insurance?

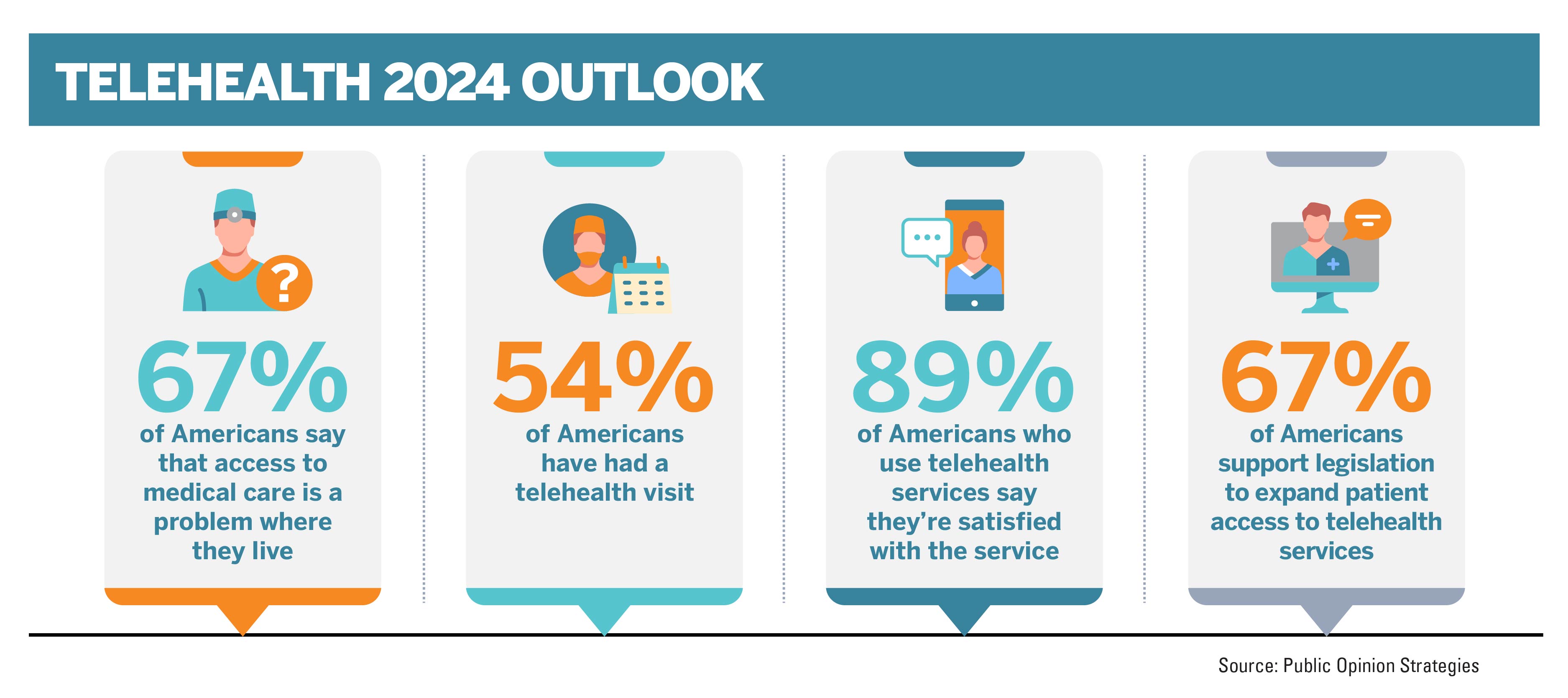

Telemedicine seemed to come into its own during the pandemic, with 88% of Americans preferring to use digital health tools post-pandemic, and it seems as if the market’s popularity is only set to surge even further. Speaking to IB, Karen Thomas (pictured above), vice president of clinical solutions at CorVel, said that telemedicine, as a clinical solution, is rapidly gaining traction “not only enhancing access to healthcare for policyholders but also potentially lowering costs for insurers.”

A concierge model

And, by reducing the need for in-person doctor visits, it’s an evolution that sees insurance policies keeping pace with technological advancements and changing consumer expectations, something that Thomas has seen replicated in CorVel’s personalized model.

“The most unique thing about our telehealth program is it’s very concierge oriented,” Thomas said. “In this day and age, the challenge within healthcare is how fragmented it’s become – even though we’re so connected, the communication [between injured workers and healthcare providers] is terrible. When someone is injured, obviously it’s a very stressful time in those first hours, first days following the injury. [That’s] because most people don’t know the ins and outs of workers compensation or that it even exists.”

Thomas’ interest in telehealth isn’t just professional; it stems from a number of lived experiences over the years. As a registered nurse, she’s always had an interest in patient relations and offering people a certain level of care – something she craved herself when she suffered a workplace injury.

“I was in a serious car accident as a home health nurse,” Thomas told IB. “My experience with navigating the workers compensation industry ignited a passion in me to lean into patient advocacy. That led me to case management – I practiced in many different areas, including, group health and in hospitals, and the last area that I needed to gain experience in was workers’ compensation.”

Hand-holding in telehealth

After going on to teach case management to student nurses at George Mason University, in Fairfax, Va., Thomas returned to the business world, determined to improve the customer experience within the insurance industry. It was this that fed into CorVel’s more streamlined process, one which begins with a triage nurse who assesses the situation and determines if telehealth is suitable.

“We literally hold that individual’s hands to get them into a virtual waiting room,” Thomas said. This high-touch approach is powered by partnerships with technology companies that support robust platforms for real-time support and interaction with telehealth physicians. Furthermore, the adaptability of this model to meet the diverse needs of various carriers is significant.

Thomas is hardly alone in her furore for more personalized digital healthcare plans. According to data from Tech Report, the telemedicine market was valued at nearly $115 billion in 2023, with that figure set to rise to $286.22 billion by 2030. And with AI on the rise, it’s no surprise that employers are eagerly eyeing up digital health tools’ potential both in terms of accessibility and cost reductions. At CorVel, Thomas said that they partner with these tech startups to help support their online platforms. Insurance companies, however, offer a little bit of a challenge due to the number of different customers sitting under their umbrella.

“A one-size-fits-all program isn’t going to work for a carrier,” Thomas said. “And we work with many carriers – so we customize at the next level for them, for their customers and for the employers they’re working with.”

“That enables a lot of real-time support and connection with the telehealth physicians. Being able to customize protocols that we follow, always making sure that that entire person gets the best care possible in the most cost-effective way.”

Cyber risks in telehealth

But it’s not all rainbows and sunshine – telemedicine does raise significant questions around data security and cyber risk. In 2016, the Hollywood Presbyterian Medical Center was forced to hand over $17,000 in Bitcoin to gain access to their files following a ransomware attack. Another instance, in 2015, saw healthcare company Anthem hacked – meaning the data of thousands of individuals could have been stolen.

In order to mitigate those cyber concerns, companies should invest in more cybersecurity training including educating employees and encrypting data. And, looking to what the future holds for both telemedicine and its place in the insurance market, Thomas believes addressing rising costs will be a core concern – as is stabilizing healthcare in general.

“Dealing with medical inflation…that’s always a concern in the insurance market,” she said. “How can we overcome this and the fragmented approach to health care?. [It’s about] partnering claims with medical expertise so we can overcome those obstacles and make sure that people are getting timely care in the best way possible. That’s going to decrease cost and decrease risk.”

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!