Where to find the best insurance jobs in Australia

Where to find the best insurance jobs in Australia | Insurance Business Australia

Guides

Where to find the best insurance jobs in Australia

An insurance career can be both exciting and rewarding, but how can you land the right insurance jobs? Read on and find out

When searching for your next insurance job in Australia, what are your priorities? Are you dead set on taking a role that offers a great compensation package or one that matches your unique skills and capabilities? Or perhaps you’re looking for a position that allows you to thrive and grow professionally, while at the same time provides a healthy work-life balance.

But with a myriad of options available, the task of finding the right insurance jobs can be tedious and overwhelming. That’s why we created this guide to assist you.

To help you save time and energy, Insurance Business unveils the top websites in Australia where you can find the best insurance jobs. Our list contains a combination of global employment websites and specialised job search engines dedicated to the insurance sector. The list is arranged in alphabetical order. Read on and find out how these channels can help you land your dream insurance job.

1. Adzuna

Adzuna is a job search engine that uses artificial intelligence to match the most qualified candidates to specific roles. The website is accessible in more than a dozen countries and attracts more than 10 million unique users monthly. Adzuna has offices in Sydney, London, and Indianapolis.

One of the website’s most prominent features is the ValueMyCV tool, which provides candidates a free estimate of their potential salary based on their skills and experience. You can use this data as a bargaining chip, especially when negotiating for your pay. ValueMyCV can also check your resume for typos and formatting errors and give you tips and suggestions on your future career path.

Adzuna’s job board lists over 20,000 insurance jobs across Australia, with around 840 under general insurance. You can trim this number further by using its long list of filters. The website also gives users access to various industry-related figures, which provide a bird’s eye view of the insurance sector and the different career opportunities available.

2. CareerOne

CareerOne is a digital platform that allows Australian jobseekers to sift through thousands of postings from many of the country’s well-known brands. It holds a partnership with Monster, which is considered a pioneer and innovator in the global online recruitment and employment space.

One of the factors that make CareerOne a popular choice for jobseekers is its user-friendly interface. Upon visiting the website, you are immediately taken to its search page, where you can sort through jobs using a wide range of easy-to-understand filters, which include:

Diversity and inclusion

Perks and benefits

Work authorisation

Licences and certifications

Its job board lists around 400 postings for insurance jobs. CareerOne has a section on career advice and a tool that can help craft your resume. You can also create job alerts to notify you of openings that match your skills and experience.

3. CareerJet

CareerJet boasts an expansive global presence, sourcing more than 40 million job advertisements from over 70,000 websites in 94 countries. Its job board contains almost 10,000 insurance job postings across Australia, which you can filter by location, company, and working hours. CareerJet also has a tool called Apply Easily that allows you to submit your application to certain jobs with just a click of a button. There are currently slightly over 1,000 insurance jobs that you can instantly apply to.

Just like other job search engines, you can post your CV for free and create an alert to notify you of new job vacancies. Employers can also post job ads directly for a fee. CareerJet’s website can be translated into 28 languages, but exclude Mandarin and Arabic, which are among the top five languages in Australia.

4. Ensure Recruitment

Ensure Recruitment is a recruitment agency specialising in the insurance sector in Australia and New Zealand. If you don’t like sifting through hundreds or even thousands of job postings, then Ensure Recruitment’s job board is for you. It currently has about 20 detailed listings of insurance jobs. Users can also subscribe to job alerts and access news and blog posts on career development.

Ensure is widely recognised in the industry, receiving multiple awards for providing innovative and ethical recruitment solutions to its clients. To date, it has filled almost 6,000 job placements across Australia and New Zealand.

5. Hays

Hays is a global recruitment firm that aims to help “candidates find their next roles” and employers “reshape their workforces and deal with talent shortages.” Apart from talent acquisition, the company – which has offices in every state capital and regional New South Wales and Queensland – offers workforce advisory services, including career transition, learning and development, and brand positioning.

There are more than 250 insurance jobs in Australia posted on Hay’s job board. Its website also has a section on career advice, where experts share tips on a range of topics, including:

Job hunting

Resume writing

Salary negotiation

Interview preparation

Users can also register for job alerts to receive notifications of new listings as soon as they are posted.

6. Indeed Australia

Australia’s version of Indeed comes with all the features present in the global website, including its simplistic design and user-friendly interface, which make it attractive to jobseekers. More than 300 million unique users visit the site each month, making it one of the most visited employment websites worldwide.

Indeed’s job board has about 1,800 insurance job listings across the nation. It also has a range of filters to help narrow down your search. Users can likewise upload their resumes to the website’s database for potential employers to easily access. Indeed also has a section where employees can rate their jobs. This feature has become highly popular among jobseekers as it provides a snapshot of what a company’s culture is like and how it is to work there.

7. LinkedIn

LinkedIn is a social media platform where professionals can search for jobs, publish articles, and post and share content. It is also the world’s largest professional networking website, so it’s not surprising that it has a high volume of job postings. To date, there are more than 14,000 insurance jobs available for Australian jobseekers. Hundreds more are added each day.

LinkedIn has the standard filters present in most job boards. This allows you to trim down your search to a manageable number. The website’s configuration also makes it easy for you to send a direct response to the job listings. LinkedIn is likewise accessible as a mobile app.

8. Michael Page

Michael Page is a job search and specialist recruitment agency designed for mid-to senior-level professionals looking for permanent, temporary, and contract roles. Apart from Australia, it operates in the US, Europe, the Asia-Pacific region, the Middle East, and Africa. Its job board covers a range of industries, including:

Energy and natural resources

Financial services

Healthcare

Leisure, travel, and tourism

Media

Not-for-profit

Property

Retail

Technology

Because it is highly specialised, Michael Page has fewer postings compared to the other websites in the list. It currently has 10 postings for insurance jobs. But just like the others, you can upload your resume at no cost and subscribe to job alerts. The website also allows you to save the job postings that you like. Michael Page comes with accessibility tools, which enable you to modify the websites appearance.

9. Seek

Seek is considered the top employment marketplace in Australia and New Zealand, but also has a global presence spanning more than 10 countries in the Asia-Pacific region and Latin America. Because of this, users can access hundreds of thousands of postings in a wide range of industries. In Australia alone, the website lists more than 24,000 openings for insurance jobs.

Employers, meanwhile, can manage job advertisements, search the site’s comprehensive resume database for qualified candidates, and send them job invites.

Seek operates several other businesses, including:

Seek Learning: Provides educational opportunities for individuals

Seek Business: Provides a venue where franchises and businesses can be sold

Seek Volunteer: Offers volunteer opportunities across Australia

10. Workforce Australia

Workforce Australia is a government-funded initiative operated by the Department of Employment and Workplace Relations (DEWR) aimed at helping unemployed individuals find jobs. Its job board lists almost 3,000 vacancies for insurance jobs and has the standard filters to help narrow down your search. Overall, Australian jobseekers can sift through more than 255,000 openings in different industries.

Workforce Australia also provides education and training services, as well as coaching and support to help improve your job search and application skills. The program was previously known as JobActive before changing its name in July 2022.

A career in insurance can be both exciting and fulfilling as it gives you a great opportunity to make a positive impact on other people’s lives. But being an insurance professional is not for everyone. To be successful, you will need to have a combination of hard and soft skills that enable you to guide clients in getting the best financial protection. Here are some of the skills that will help you land the top insurance jobs and allow you to grow professionally.

Problem-solving skills: A career in insurance means you will be regularly met with issues that require you to come up with creative and innovative solutions. Insurance brokers, for instance, may need to find a policy for a customer’s unusual coverage needs while an insurance underwriter may have to assess a new and unpredictable risk.

People skills: Client-facing professionals need to provide outstanding customer service to be successful. This skill enables them to build trust and maintain partnerships with clients. Those with less direct contact with professionals also require good people skills to get along with their colleagues.

Attention-to-detail: With the financial protection of clients at stake, the ability to pay attention to the finer details plays a crucial role in helping provide the proper coverage. This may entail identifying the smallest errors in calculations or picking up technical requirements that can impact a policyholder’s ability to access cover.

Numeracy: Insurance professionals deal with numbers virtually every time. Because of this, strong mathematical skills are a must for all insurance jobs.

Communication skills: Insurance professionals need to have strong verbal and written communication skills to be able to convey vital information in a way that is simple and free of insurance buzzwords.

Time management: Insurance jobs often require one to multitask. This is where effective time management comes into play. Insurance professionals must be able to prioritise tasks and implement strategies that enable them to complete projects in an efficient and less stressful manner.

Negotiation skills: Insurance professionals may sometimes find themselves in disagreement with clients. In these situations, having the ability to find a middle ground is crucial.

Organisation: Insurance jobs often entail dealing with a huge volume of clients. To be successful, one needs to keep their records accurate and organised.

Self-motivation: Insurance professionals must have an intrinsic desire to perform to the best of their abilities.

Here’s a summary of the top skills that you need to succeed in an insurance job.

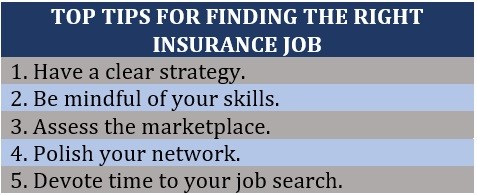

Finding insurance jobs that match your skills and qualifications requires careful planning and preparation, especially with an overwhelming range of choices available from various channels. Here are some practical strategies that you can employ to help you land the right insurance job.

Have a clear strategy: You should have a shortlist of the insurance jobs you’re targeting and a structured and organised plan on how you can nail them.

Be mindful of your skills: It is always important to ensure that your skills and qualifications match the job opening before submitting your application.

Evaluate the marketplace: You should be aware of the level of demand for insurance professionals with your skills and experience. This may entail you speaking with experts who can share useful insights on the state of the job market.

Polish your network: Sometimes, it may be effective to turn to your network as not all insurance jobs are advertised.

Devote time to your job search: A successful job search requires a commitment to the job-hunting process. This means you need to allot time to actively look for jobs even with your busy schedule.

Here’s a summary of the practical strategies you can implement to land your dream insurance job.

Our Best in Insurance Special Reports page features the top companies in Australia that are recognised as dependable and trusted leaders in the industry, including those who we think are the best insurance brokers in Australia. If you’re looking for world-class insurers that offer the best insurance jobs, then we recommend that you visit our page where you can find plenty of choices.

The insurance companies featured in our special reports are nominated by their peers and vetted by our panel of experts as respected and reliable market leaders. For those who want to pursue an insurance career, these insurers can provide you with a positive work environment, a diverse and inclusive culture, and a lot of opportunities to thrive and grow.

Have you used the websites above in your search for insurance jobs? Were they helpful or not? Share your experience in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!