Where to find the best car insurance in Florida

Where to find the best car insurance in Florida | Insurance Business America

Guides

Where to find the best car insurance in Florida

Car insurance in Florida costs among the highest in the country. But there are ways for you to find the best coverage. Learn how in this guide

Car insurance in Florida ranks as among the nation’s costliest, primarily because of the state’s unique insurance situation. But this doesn’t mean that drivers there don’t have access to cheaper coverage.

In this guide, Insurance Business will list some of the state’s leading auto insurance providers offering affordable coverage. We will also give you a walkthrough of how Florida car insurance works and what factors are driving up premiums.

If you’re searching for a local insurer that can provide protection that best fits your needs, this article can give you options. Read on and find out how you can access the best car insurance in Florida.

Florida is one of the most expensive states when it comes to car insurance. That’s why it can be tempting to go with an insurer that offers the lowest premiums. But as we have stressed in our previous guides, cheaper doesn’t necessarily mean better when it comes to insurance.

The table below lists some of the leading providers of car insurance in Florida, along with the types of coverage they offer and their average annual premiums.

This table also includes links to each company’s auto insurance page, where you can request a quote or find a local insurance agent.

Top providers of car insurance in Florida

Insurers

Coverage offered

Average premiums*

Allstate

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Roadside assistance

Ride for hire coverage

Rental car reimbursement

Monthly: $367

Annual: $4,400

Amica Mutual

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Auto/loan lease coverage

Full glass coverage

Roadside assistance

Rental car reimbursement

Monthly: $184

Annual: $2,215

Auto-Owners

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Gap coverage

Rental car insurance

Diminished value coverage

Additional expenses insurance

Accident forgiveness

Monthly: $218

Annual: $2,620

GEICO

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Emergency road service

Rental car reimbursement

Mechanical breakdown insurance

Monthly: $175

Annual: $2,100

Kemper

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured motorist

Monthly: $294

Annual: $3,530

Liberty Mutual

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Rental car reimbursement

Gap coverage

Original parts replacement

Accident forgiveness

Lifetime repair guarantee

Deductible fund

Teachers’ auto insurance

New car replacement

Roadside assistance

Mexico car insurance

Undisclosed**

Mercury

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Emergency roadside assistance

Rental car insurance

Rideshare insurance

Mechanical protection

Monthly: $312

Annual: $3,740

National General

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Accidental death and dismemberment

Roadside assistance

Auto protection plan

Monthly: $282

Annual: $3,385

Nationwide

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Rental car expense

Gap insurance

Towing and labor coverage

Monthly: $376

Annual: $4,515

Progressive

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Loan/lease payoff

Rental car reimbursement

Roadside assistance

Trip interruption

Rideshare coverage

Deductible savings bank

Pet injury coverage

Monthly: $240

Annual: $2,885

State Farm

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Car rental and travel expenses

Emergency road service

Rideshare coverage

Monthly: $148

Annual: $1,770

The Hartford

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Roadside assistance

Full glass coverage

Monthly: $226

Annual: $2,715

Travelers

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Roadside assistance

Rental car coverage

Monthly: $245

Annual: $2,945

United Automobile

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Rental car reimbursement

Towing coverage

Monthly: $460

Annual: $5,525

USAA

Property damage liability

Personal injury protection

Bodily injury liability

Uninsured/underinsured motorist

Comprehensive

Collision

Roadside assistance

Monthly: $120

Annual: $1,450

*Premiums are based on full coverage for 35-year-old driver with a clean record and good credit history.

**Liberty Mutual doesn’t publicly disclose insurance rates, but you can get personalized quotes based on your driving profile and coverage needs by contacting the insurer directly.

If you want to get a national perspective, you can access our car insurance comparison guide, where you can do a side-by-side analysis of the country’s largest auto insurance carriers.

Car insurance is mandatory in Florida just like all other states except New Hampshire and Virginia, where coverage is not legally required.

Unlike other states, Florida doesn’t require bodily injury (BI) liability insurance, which pays for the injuries you caused others.

Instead, Florida’s no-fault car insurance laws require you to file claims with your own insurer for the injuries you sustain in a vehicular accident, regardless of who is at fault. That’s why personal injury protection (PIP) coverage is compulsory. This covers your medical expenses and lost income if you’re injured in a car collision.

But being a no-fault state doesn’t mean that an at-fault driver is immune from lawsuits. While no-fault car insurance laws prevent injured motorists from suing at-fault drivers for compensation, you can still file a lawsuit if your injuries are severe. You can also file a lawsuit if your medical bills go over the state’s minimum requirement to sue.

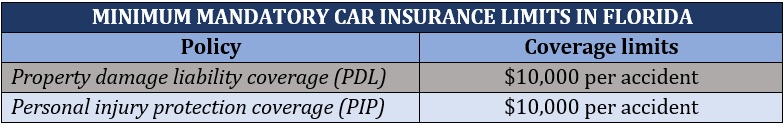

Each state has its own minimum requirements when it comes to coverage limits. The table below shows the minimum mandatory coverage you need to operate a vehicle in Florida, according to the Florida Highway Safety and Motor Vehicles (FHSMV) department.

Because the figures above are just minimum requirements, they don’t always provide sufficient coverage.

Industry experts recommend that you take out the highest coverage you can afford, as well as other optional policies – including collision and comprehensive car insurance– to get full coverage. You can learn more about the benefits of full coverage car insurance in this guide.

Florida SR-22 and FR-44 policies

Motorists with traffic-related offenses may be required by the courts or the FHSMV to get an SR-22 or an FR-44 form, which raises the minimum coverage needed to legally drive.

While these are often mistaken for insurance, these documents serve as proof of financial responsibility. They certify that you have coverage that meets Florida’s minimum requirements. Your insurer files these with the FHSMV to prove that you have adequate car insurance.

You may need to obtain an SR-22 form if one of the following applies:

You have been caught driving without insurance.

You have committed too many traffic violations or repeat offenses.

You haven’t paid court-ordered child support.

If you’re required to get an SR-22 form, your car insurance needs an additional:

$10,000 of bodily injury coverage per person

$20,000 of bodily injury coverage per accident

These are on top of the mandatory minimum coverage for car insurance in Florida.

An FR-44 form, meanwhile, is needed if you have committed more serious traffic offences. These include the following instances:

You have been found liable for a vehicular accident that injured others.

You have been convicted of a DUI or DWI.

You have been caught driving with a revoked license.

You have been caught driving uninsured.

If you need this form to drive, you need to take out coverage of at least:

$100,000 of bodily injury coverage per person

$300,000 of bodily injury coverage per accident

$50,000 of property damage coverage per accident

$10,000 personal injury protection coverage

These requirements can increase your premiums considerably – but there are still ways for you to reduce insurance cost. Check out our guide to finding cheap car insurance for practical tips.

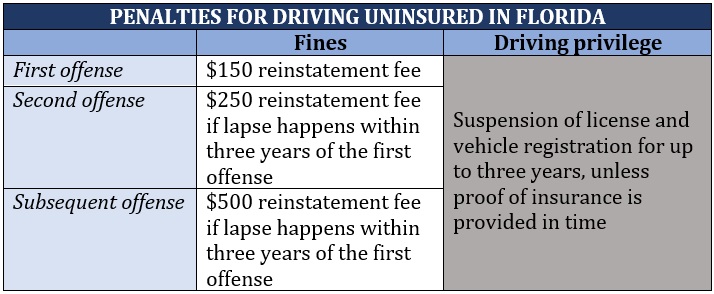

Because you’re legally required to take out coverage before operating a vehicle, getting caught driving without one has serious legal and financial ramifications. The table below details the penalties for driving uninsured on Florida’s roads.

Annual premiums for car insurance in Florida are about double the national average. This can be attributed to a range of factors, including:

Litigation costs: Being a no-fault state, all parties involved in an accident are required to submit claims to their own insurers. According to the Insurance Research Council (IRC), this increases the likelihood of attorney involvement, which often leads to higher costs. Insurers then pass on these additional costs to the policyholders.

Busy roadways: Florida’s world-class beaches and amusement parks make it an attractive tourist destination. But the high volume of visitors also means increased traffic and busy roads. These instances raise the likelihood of vehicular accidents.

Healthcare costs: Florida is among the states where residents are spending a bigger portion of their income on healthcare, according to data from the Commonwealth Fund. This includes treatment and medical care resulting from vehicular accidents.

Uninsured drivers: Figures from the Insurance Information Institute (Triple-I) rank Florida as sixth among the states with the highest percentage of uninsured drivers at slightly over 20%. This means that Florida motorists are at higher risk of getting in an accident involving an uninsured driver, which has an impact on premiums.

Weather-related exposure: The state’s geographic location places it in the path of destructive hurricanes and storms, which are among the top causes of vehicle damage.

Florida’s exposure to these weather-related events is also among the reasons why many insurance companies are pulling out of the state.

I’ve always said that when big decisions are made on insurance the policyholder is rarely in the room; unfortunately @WeAreFarmers proved me right. I’ve asked my team to put their heads together in holding Farmers Insurance accountable. I want additional scrutiny on this company. pic.twitter.com/fDgadXndfx

— Jimmy Patronis (@JimmyPatronis) July 12, 2023

Because of the high cost of car insurance in Florida, it can be tempting to go with the insurer that offers the cheapest coverage. But doing so comes with a risk. You may end up losing more, especially if the level of protection you get is inadequate.

To get the most out of your auto insurance, you need to understand what options are available to you and what kind of coverage these policies offer. Shopping and comparing quotes can help provide a picture of the policies you can access. Triple-I suggests that you compare the policies of at least three insurers before picking one with the best coverage.

Apart from the price, the institute recommends that you base your decision on these factors:

The types and amount of coverage: Your policy should provide sufficient protection when unexpected accidents occur. It must also meet the state’s minimum coverage requirements.

Deductibles: A higher deductible lowers your premiums because your insurer will be taking on less risk. Be sure to choose an amount that you can afford. Some insurers also offer discounts or reduce your deductible amount for every claims-free year.

Auto insurer: Check the insurer’s financial strength as it indicates its capability to pay for your coverage. You can also read customer feedback to see how it handles claims.

Auto insurance works differently in each state. If you want to learn more about this type of coverage, you can check out our complete guide to car insurance in the US.

Do you have additional tips on finding the best car insurance in Florida? Type in your suggestions in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!