Where brokers and insurers stand on seamless data interfaces

Working on application programming interfaces (API), the industry’s leading-edge technology for broker-carrier connectivity, is a lot like doing a home renovation project, said Michael Loeters, ProLink’s senior vice president of commercial insurance and risk management.

“You think it’s going to be two hours and one trip to Home Depot. And then, once you start getting into it, you realize this is going to be a two-week job and five trips to Home Depot.

“You realize you have to start doing things that you never could have anticipated. But the great thing is, it’s all very foundational. You just have to fix it once, and then you’re good.”

Loeters is referring to the exchange of data between broker management systems (BMS) and the back-end tech systems of insurance companies. For the past two decades, the dream has been what some brokers refer to as an industry-wide, single-entry, multiple-company interface (SEMCI) solution.

How does a SEMCI solution work?

Say a broker gets a call from a client asking to make a policy change or a billing inquiry. The broker enters the client’s data into the brokerage’s BMS. Those queries get sent electronically from the BMS to the back-end systems of multiple carriers.

The responses are returned in real time from carriers’ systems back into the broker’s BMS. No data re-keying for each client into proprietary, individual company web portals. All the client’s information goes into the broker’s BMS. Once and done.

“It will be awesome to get to a place where, no matter what inquiry a customer calls with, the broker’s response won’t be, ‘I’ll find out and call you back.’ That’s what’s going on right now,” said Centre for the Study of Insurance Operations (CSIO) board member Steve Earle, president of Bauld Insurance. “It would be great if the information comes directly from our BMS.”

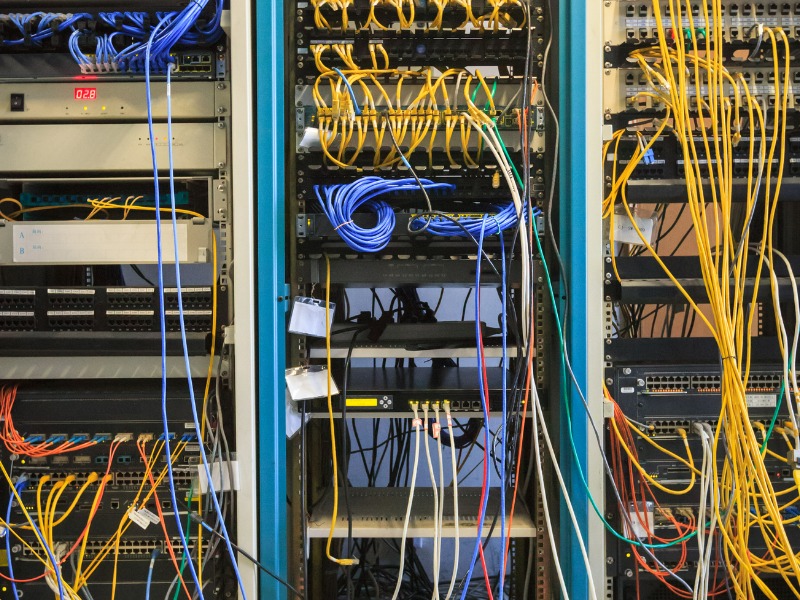

This situation of the independent broker, who must share client data with multiple companies, is in stark contrast to that of a direct agent, who represents a single insurance company. Direct writers can provide consumers with immediate information, without having to contend with the spaghetti-tangle back-end systems of multiple insurers.

For brokers, API’s success would erase the theoretical advantage directs have over the broker channel.

“My own personal feeling is that the broker market share has sort of held its own for the past decade or longer,” said Earle.

“If we introduce as slick a customer experience as what directs are doing, and connectivity is the thing that will get us there, we will be regaining market share. Because once we get APIs to the same spot [as direct agents’ tech], plus we offer choice, advice and advocacy, that’s a recipe for success that’ll crush [the broker channel’s competition].”

This article is excerpted from on that appeared in the February-March edition of Canadian Underwriter. Feature image by iStock.com/bjdlzx