When defense is the best offense

From the desk of CIO Paul Holba: In this latest update from the Empire Life Investments team, Paul Holba discusses how 2022 continues to be a challenging year—but it’s not all bad news.

Market recap

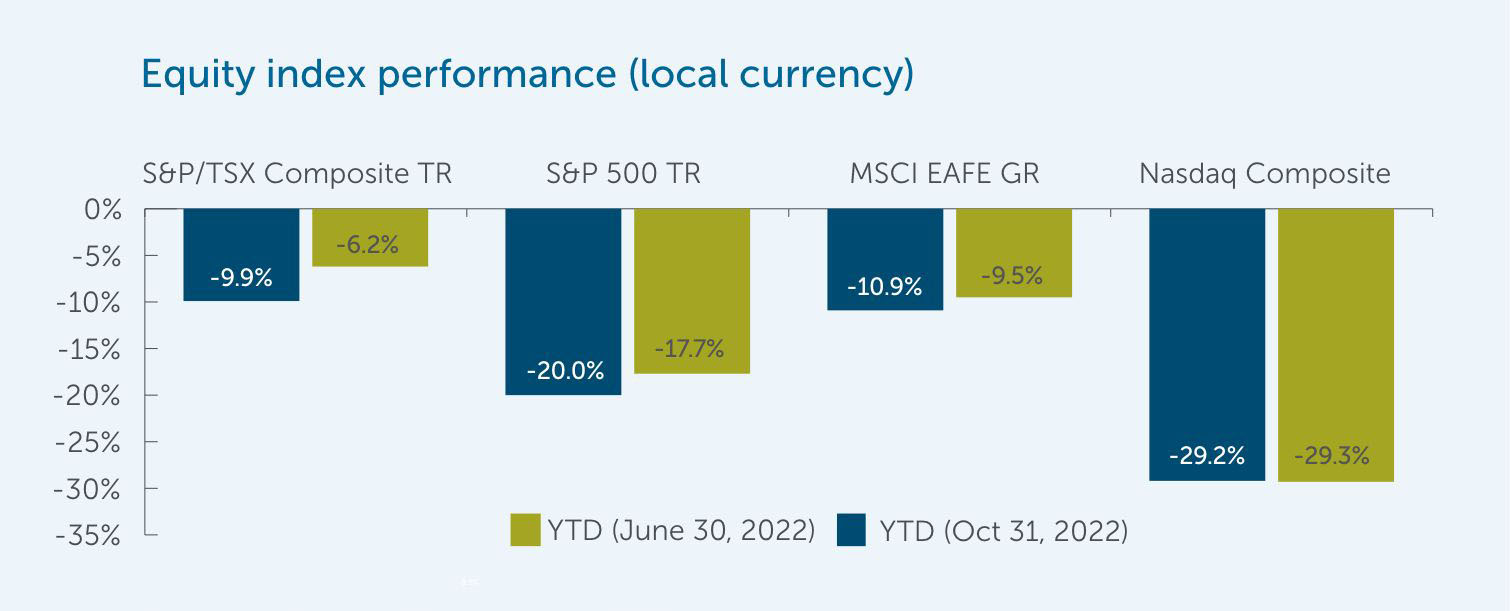

2022 continues to be a challenging year for investors. As mentioned in my July update, the first half of the year produced some of the worst year-to-date returns in decades for many markets. At the end of the third quarter, market returns continued to incrementally trend in the wrong direction (albeit at a slower clip). However, many markets experienced a strong October rally, trimming the year’s losses to varying degrees. Supported by its resource sector orientation, Canadian equities held their value better over other markets, while the growth-oriented Nasdaq Composite continued to lag materially.

![]() Download the PDF

Download the PDF

Source: Morningstar Research Inc., TD Securities as at October 31, 2022.

Source: Morningstar Research Inc., TD Securities as at October 31, 2022.

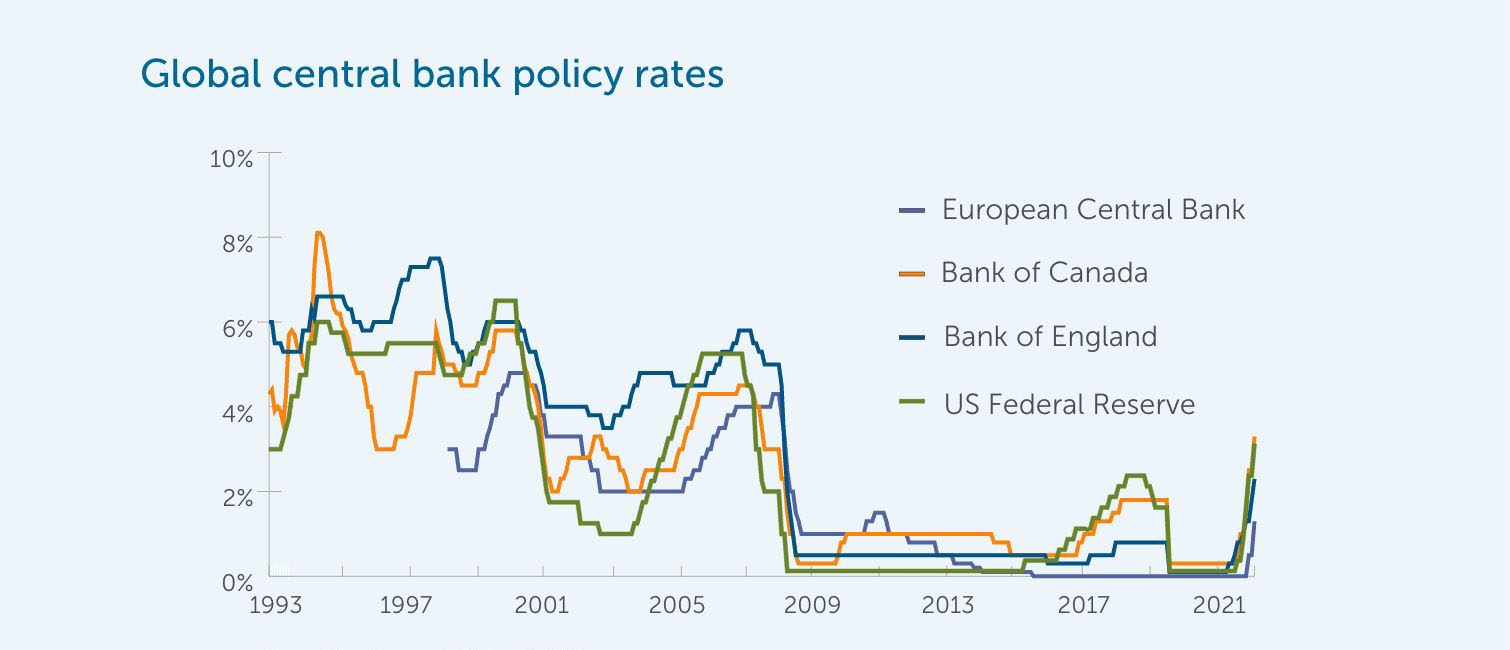

Market sentiment continues to be pressured by Central banks aggressively raising interest rates to combat high inflation not seen in decades, leading to increased recession fears.

Source: Bloomberg, as at October 31, 2022.

Outlook – a degree of caution warranted

Heading into the closing months of 2022, we are maintaining our cautious view of the market environment in the presence of multiple headwinds. As mentioned, the inflation/interest rate environment remains challenging and we expect inflation to be elevated for longer. Structural challenges to global growth have emerged such as heightened geopolitical risks—most recently exacerbated by US actions on semiconductor exports to China—which may result in a more divided supply chain with increased local sourcing, and in turn, feed inflationary pressures over the medium term.

Economic indicators continue to show signs of weakness. Examples include both a composite of US leading economic indicators and US manufacturing gauges trending lower, and US consumer sentiment remaining at depressed levels consistent with past recessions. European consumer confidence plummeted to multi-decade lows while the continent continues to face an energy crisis.

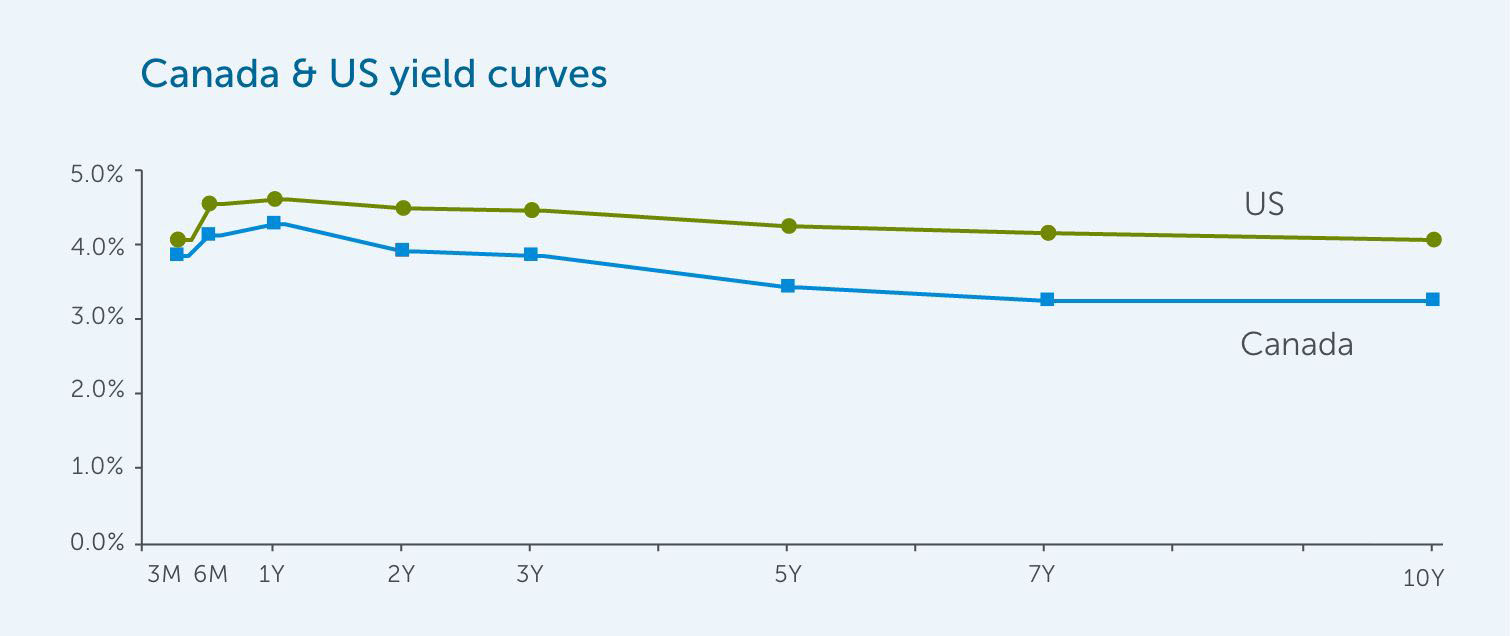

The less-than-rosy environment is reflected in bond yield curves, which remain inverted in Canada and the US. An inverted yield curve historically preludes recessions. In fact, our base case scenario is a mild recession in 2023.

Source: Bloomberg, as at October 31, 2022.

The news, however, is not all bad. Specific economic signals appear to be bottoming, although off very low levels. Overall equity valuations are now at more reasonable levels than earlier in the year, and bond yields have become much more attractive. Although interest rates are likely to rise further, we believe we are closer to the end of the current hiking cycle than the beginning, particularly in Canada.

Opportunities and positioning

The positioning of our investment strategies reflect our cautious view of the market environment—at a very high level, this is best described as being defensive. This can take the form of elevated cash weights, asset mix (where applicable), regional allocation (where applicable), or sector weights.

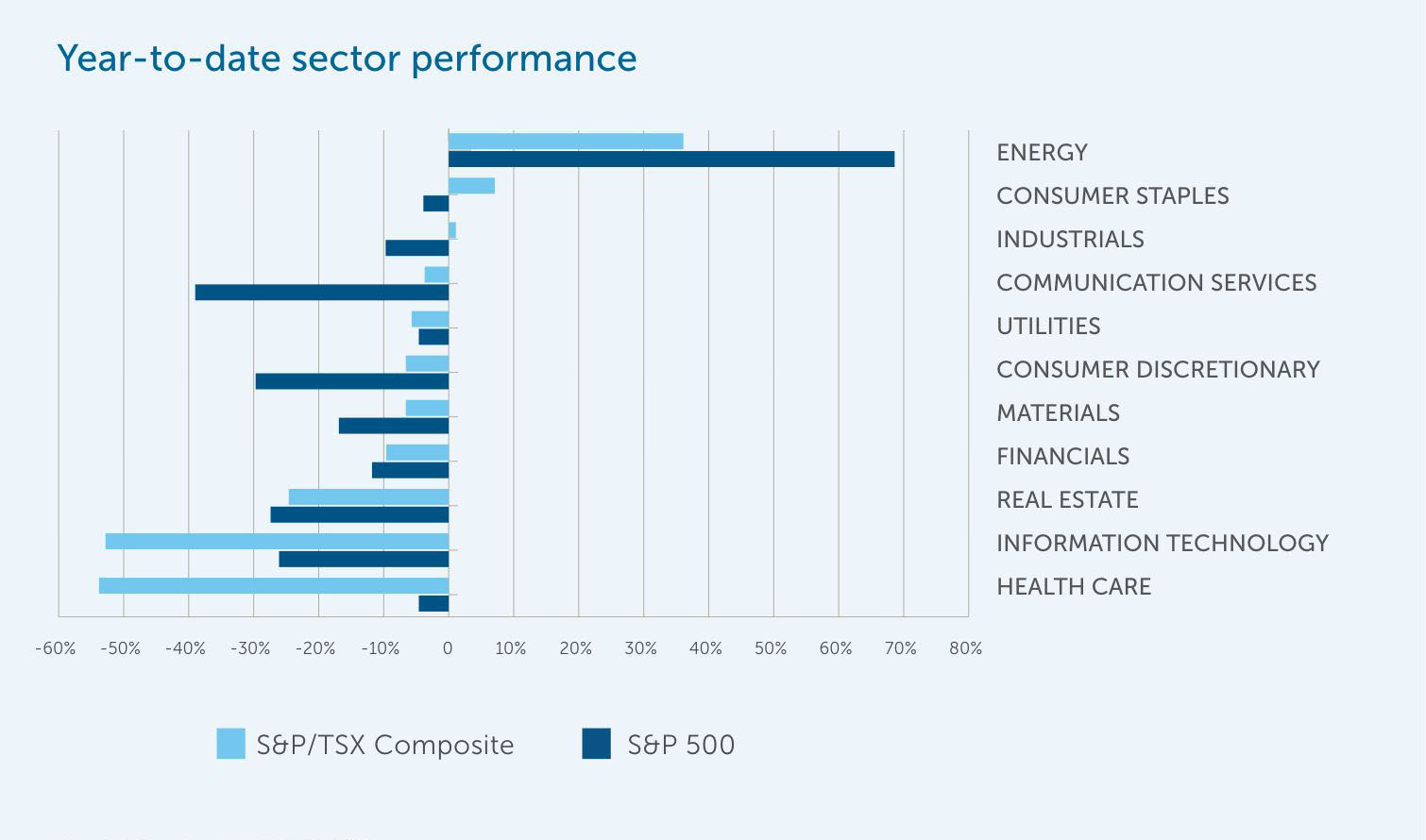

Within equities, we believe Canada offers opportunities due to the market’s composition of being less growth-oriented and more commodity focused; the latter sectors typically able to benefit from higher commodity prices in an inflationary environment. Energy in particular, not just in Canada, has been strong and we believe will continue as energy security remains a global issue and years of underinvestment in fossil fuel development has contributed to current supply constraints (another structural challenge to the global economy).

Source: TD Securities, as at October 31, 2022.

Although the above comments are more from a top-down perspective, I believe it important to emphasize we are primarily fundamental bottom-up investors. A significant contribution to our portfolio characteristics comes from individual security selection. As such, there has been a shift in orientation to companies that may best tolerate a slowing global economy. Additionally, we have taken advantage of market volatility to acquire shares in some very high-quality companies whose valuations have pulled back to levels not seen in quite some time.

Our core fixed income portfolio has adopted a “barbell” strategy with an overweight position in short term bonds issued by companies with resilient balance sheets, overweight longer-dated government bonds, and underweight the belly of the yield curve. These short-term corporate bonds provide meaningful yield pick-up (or spread) over comparable government bonds and some of the highest all-in yields since the financial crisis, while their resilient balance sheets and short-duration limit their default and mark-to-market risks. At the other end of the spectrum, longer-dated government bonds are likely to benefit should economic risks heighten. We are also adding duration as opportunities arise.

.

Cautious strategy working well so far

Although avoiding negative performance so far in 2022 was too much of a hurdle given the market environment, we believe our cautious strategy significantly contributed to many of our strategies outperforming their respective segregated fund peer groups. On aggregate, 71% of segregated fund assets managed by Empire Life Investments performed in the 1st or 2nd quartile over the first three quarters of 2022.

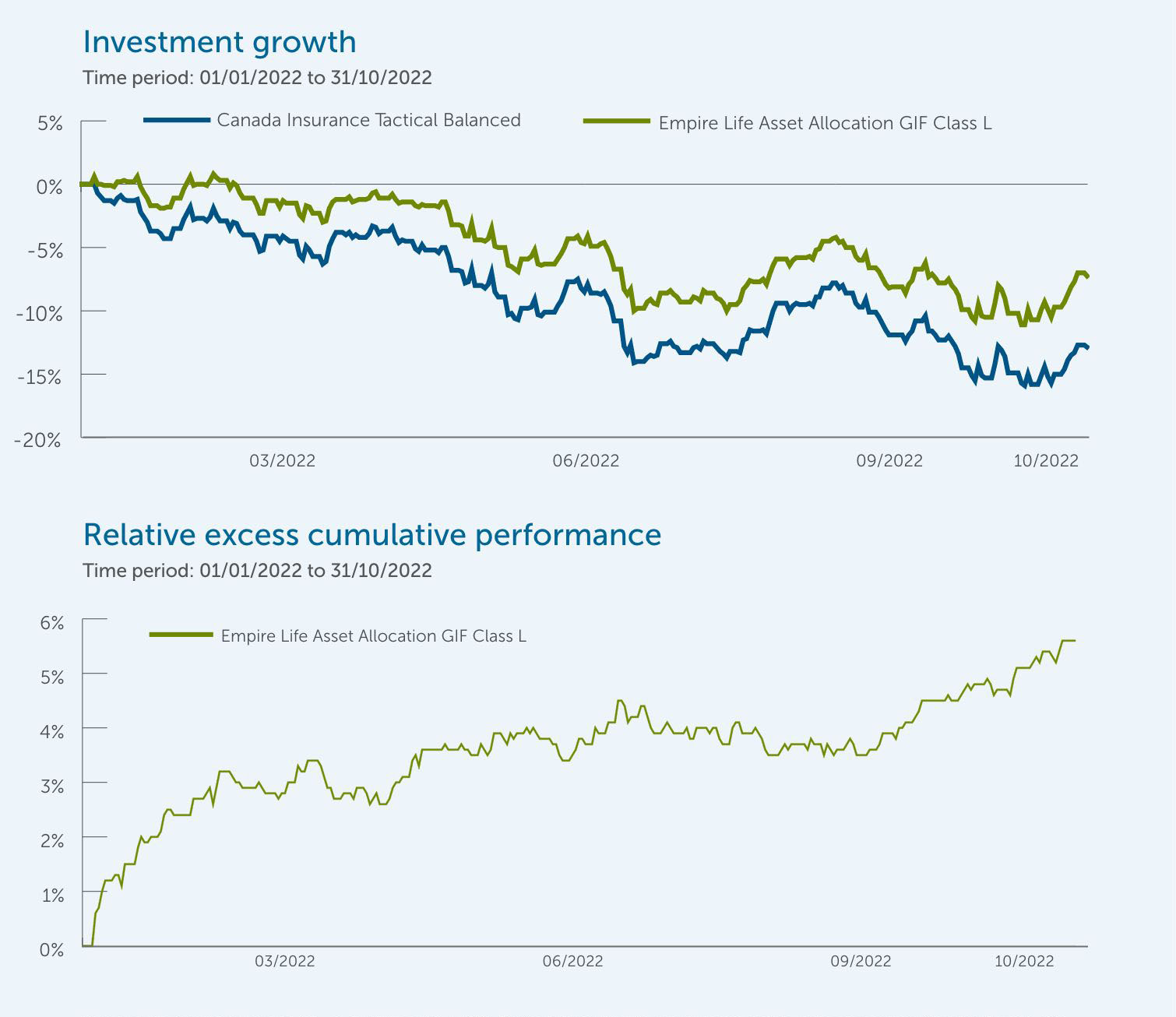

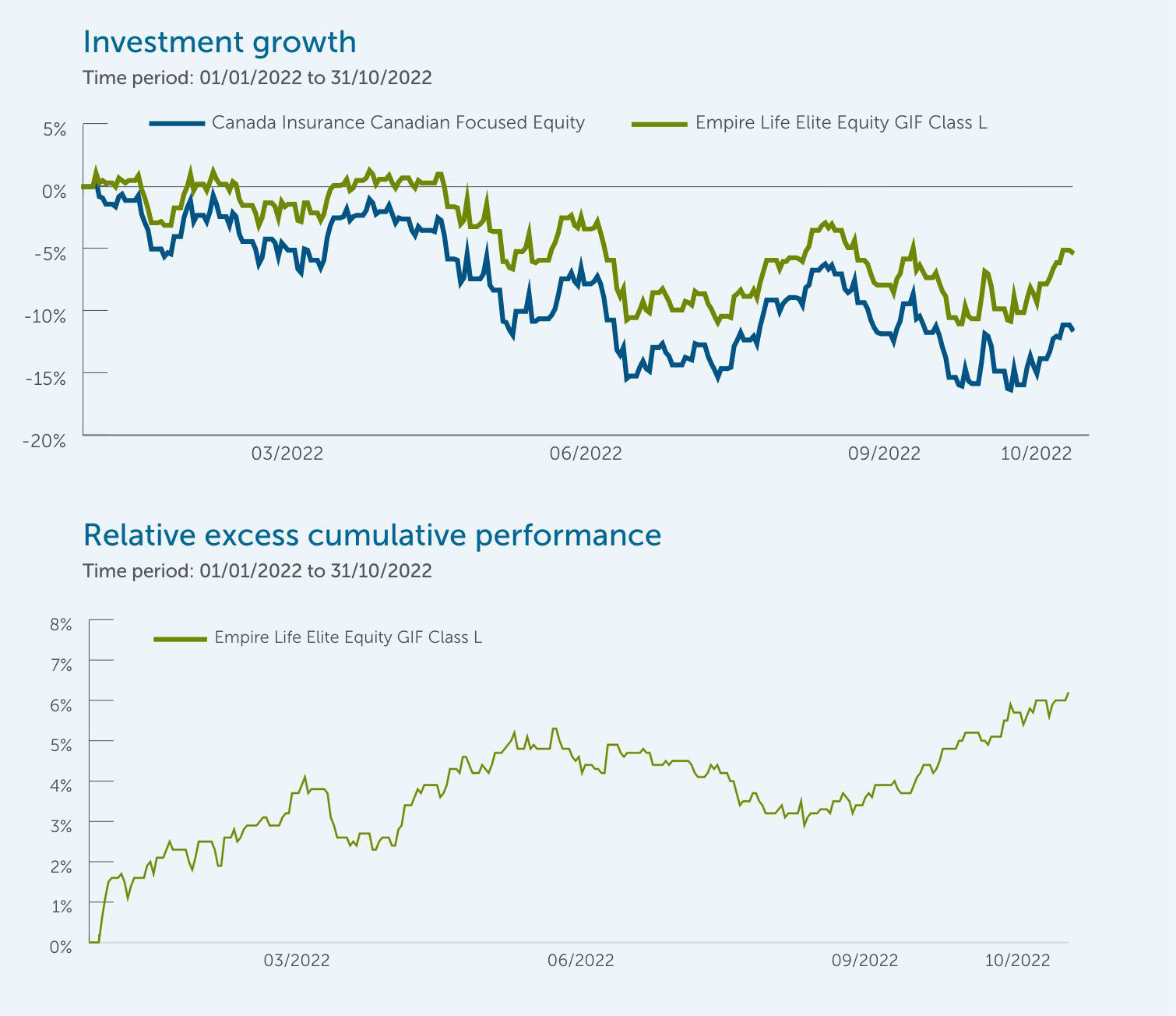

Take for example our two most popular funds, Empire Life Asset Allocation GIF and Empire Life Elite Equity GIF. To a large degree, these funds reflect our core Canadian, US, and international equity strategies as well as our core Canadian bond strategy in the case of Asset Allocation GIF.

Although Asset Allocation GIF’s YTD return was down 7.3%, our active strategies led the fund to outperform the average Tactical Balanced fund by over 5%.

Source: Morningstar Research Inc. as at October 31, 2022 . Derived by subtracting performance of the category average from the Empire Life Asset Allocation GIF Class L.

.

Elite Equity GIF’s return over the same period was -5.3%, yet the fund outperformed the average Canadian Focused Equity fund by over 6%.

Source: Morningstar Research Inc. as at October 31, 2022 . Derived by subtracting performance of the category average from the Empire Life Elite Equity GIF Class L.

Importance of downside protection

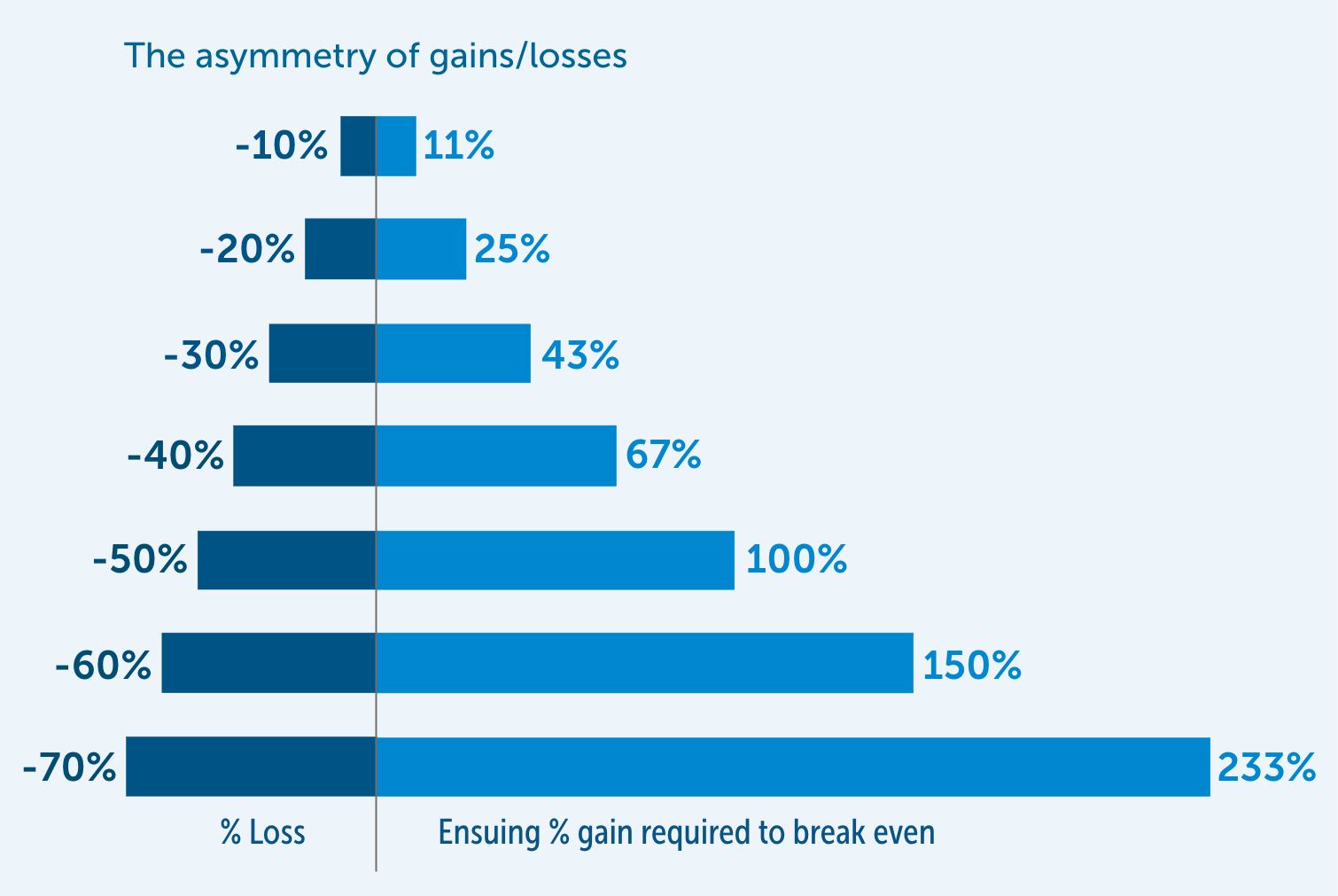

Protecting during down-markets is critical to wealth creation over the long term. It’s just simple math. A fund down 10% in one period needs to recover by 11.1% in the following period just to break even. However, a fund that is down 20% needs to recover by 25% in the next period to get back to even. This is called the asymmetry of gains/losses and becomes more extreme the larger the loss.

Final thoughts

As mentioned above, our base case scenario is a mild recession and our strategies are generally positioned accordingly. That doesn’t mean we are not actively looking out for other outcomes. No doubt, avoiding a recession would be a welcome development. In our view, however, we are more concerned that the recession may become more than mild. The structural challenges of nationalism and de-globalization, combined with the end of ultra-accommodative monetary policy and heightened geopolitical tensions will likely place investors in a paradigm much different than what we’ve been accustomed to.

Whichever scenario unfolds, we believe our investment expertise and experience will serve our customers well, especially when combined with Empire Life’s powerful segregated fund guarantees.

This article includes forward-looking information that is based on the opinions and views of Empire Life Investments Inc. as of the date stated and is subject to change without notice. This information should not be considered a recommendation to buy or sell nor should they be relied upon as investment, tax or legal advice. Information contained in this report has been obtained from third party sources believed to be reliable, but accuracy cannot be guaranteed. Empire Life Investments Inc. and its affiliates do not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and do not accept any responsibility for any loss or damage that results from its use.

Past performance is no guarantee of future performance.

Empire Life Investments Inc., a wholly owned-subsidiary of The Empire Life Insurance Company, is the Manager of Empire Life Mutual Funds and the Portfolio Manager of Empire Life Segregated Funds. The units of the Funds are available only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such units. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund and segregated fund investments. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Segregated Fund policies are issued by The Empire Life Insurance Company.

October 2022