What’s the Difference Between Term and Whole of Life Assurance?

Life insurance is life insurance, right?

Well, no.

It would make far more sense for insurers to create one singular type of life insurance to avoid confusion and complication.

But if we know anything, it’s that insurance companies love complexity.

So let’s try and decipher what’s going on.

Put simply; there are two types of insurance where your cover is fixed (i.e. doesn’t reduce over time, the one that reduces over time is mortgage protection).

Fixed cover: If you buy €500,000 worth of cover, the insurer will pay out €500,000 whether you die on the first or last day of your policy.

Those types of cover go by Term Life Insurance and Whole Life Assurance.

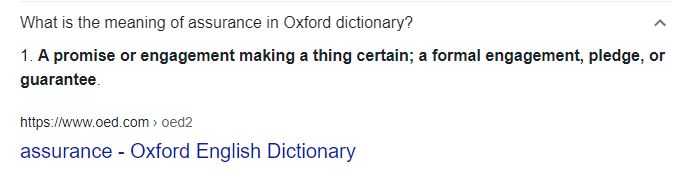

The more eagle-eyed among you will notice one is insurance and one is assurance.

Why?

Howld your horses, we’ll get to that later.

What is Term Life Insurance?

Level term life insurance is easy enough to understand.

Choose a term and an amount of cover – say 35 years and 500k – pay for your life insurance during those years, survive those 35 years and, well, you no longer have life insurance, but you’re alive.

Well done you, have a biscuit.

However, if you die within those 25 years, unlucky for you (no biscuit), but your family gets half a mill tax-free cash.

With term life, the insurance provider insures your life for €500k for 35 years.

If you think about it, you are betting you will die in the 35 years; the insurer is hoping you won’t.

#warped #dark

To compare the cost of the different insurance options, I will use Joe Average, 35, non-smoker, no health issues, buying €500k over 35 years.

Quote Type: Life Insurance

First Person: Non-Smoker, born on 11/03/1987

Cover Amount: €500,000 paying monthly, over 35 years.

Let’s call it €45.

So, What is Whole-of-Life Assurance?

Whole life cover, however, covers your entire life from the start of your policy to the day you croak it.

A payout is assured if you continue to pay the premiums.

Sounds pretty straightforward, but no, there are different types of whole life covers too.

Just.

Because.

So, let’s break them down into itty bitty bite-sized chunks because some of them are great, others you’ll want to avoid, like a Bounty bar in a box of Celebrations.

1. Guaranteed Whole Life Cover

This is the luxurious version of the whole life cover that you’ll want to dig into and dig deep to pay for.

It’s like the Galaxy Caramel of life insurance.

Firstly, it covers your entire life: no cut-off date or date renewal. You won’t have any policy reviews, so your premium is fixed from day one.

So, if you pay 75 euros a month on your whole of life insurance policy when you are 35, you’ll still be paying the same price as an 85-year-old even though the risk of a claim for the insurer is much greater as you’re closer to knock knock knocking on heaven’s door.

As long as you don’t cancel your policy during your life.

So let’s see how much this will cost Joe Average

€404 per month for a guaranteed payout in the future of €500,000.

In other words, Joe would have to live until 138 to pay more premiums than this policy will payout.

You may be thinking, “but how can the insurer make a profit”.

Don’t worry; the insurer will immediately invest each €404 Joe contributes and generate a strong enough return on investment to make up for their “loss” on his policy. Also, many Joes will cancel their policy before it pays out, so the insurer will trouser these premiums too.

2. Whole Life Cover With Cashback

If you add the ‘Life Changes Option’ to your whole of life plan, it unlocks new levels, so after 15 years, you can:

a) Stop paying your premiums and get a guaranteed payout on your death.

Say you’ve paid your life insurance for 15 years. Your insurance provider will consider the premiums you have paid, how many premiums you have left to pay (assuming you live to the age of 100) and the original amount of your policy cover.

Then work out a reduced cash amount that will pay out on your death if you want to stop paying your premium right now.

So you’re left with a whole-of-life policy guaranteed to pay out a fixed amount, but your premiums stop.

b) Cancel your policy entirely and get back 70% of the premium you have paid up to this point.

How much for this option?

An extra 10% – see the quote above.

Whole of life of €500,000 + Life Events Option = €444 per month

More here: Life insurance with Cashback

3 Hybrid Term & Whole of Life Cover (Pay For Itself Whole Life Cover)

The Malteser’s Teaser of Whole of Life Insurance.

The title is a little misleading; it doesn’t actually pay for itself.

But, it does give you the option to set up the free whole of cover when your term policy ends, and if you structure it correctly, it will pay out more than you paid in on your death.

Hence the “pay for itself” description.

This policy is made up of two policies.

A term life plan

A whole-of-life plan that kicks in when the term life plan ends (your premiums stop at this point)

You can set up this free cover to kick in when you retire so that when your income falls, and you settle in for the golden era of your life, you no longer have a life insurance premium to pay.

Pretty handy, eh.

Yes, your premiums during your non-retired life will be a little more expensive, but it’ll give retired you the peace of mind that your funeral will be paid for without burdening your kids.

So how much will Joe pay?

Quote Type: Life Insurance

First Person: Non-Smoker, born on 11/03/1987

Term Life Cover Amount: €470,000 paying monthly, over 35 years.

Free Whole of Life Cover: €30,000

Premium: €70.30

So, over 35 years, Joe will pay €29,526 but the minimum this policy will pay out is €30,000 – it pays for itself!

I love this policy.

People’s biggest issue with life insurance is “so I get nothing if I outlive my policy”. With this type of policy, there is a guaranteed payout.

More here:

Whole of Life Insurance that Pays for Itself

4. Reviewable Whole Life Cover

I’ll let you in on a little secret – the reviewable whole life cover is a big steaming pile of crap.

Avoid at all costs.

No, seriously, there are not many times I will tell you to head for the hills, but if you are close to signing the dotted line on a reviewable whole life cover policy, I beg you to reconsider.

This ridiculous policy format leaves you open and vulnerable to a policy review every ten years until you turn 60. Then you can expect a policy review every year until you die.

And why is that bad?

Because those money-sucking leeches will no doubt increase your monthly premium every chance, they can get.

And I don’t mean by a tenner here or a fiver there. On average, these increases reach a staggering 400%. Every. Single. Time.

Even worse, when you retire, you will ultimately become more financially vulnerable.

With a reviewable whole life cover policy, as your incomings go down, your insurance provider could begin to increase your outgoings.

Not ideal in the slightest.

This policy is like the loan shark of the life insurance game.

They are preying on the vulnerable until they’ve lost more money than they can afford and eventually have to cancel their policy, losing all protection planned for the end of their lives.

How is this legal?

It beats me; they shouldn’t be able to offer this bogus deal, but it’s out there, and you need to be aware of it so you can sidestep it like a piece of dog crap on a public path.

Beware of policy reviews; they can lead to constantly increasing premiums

So Which Is Best? Term Life or Whole Life Insurance?

If you want to get your money’s worth, I suggest guaranteed term life cover with the whole of life add-on. It offers the best of both worlds.

For me, term life is too limited.

Yes, it offers financial protection for a couple of decades, but if you want to extend the policy, it will inevitably cost a lot more because you’re an old git now.

Yes, the insurers will offer a conversion option where you can extend your policy without providing further medical info. However, they will still recalculate your premiums based on your future age, which will cost an arm and a leg.

But that’s just me.

I’m a lazy sod, so why would I add an extra to-do in the future when whole life cover does the job from beginning to end and can pay out more than I pay in.

Still, need a little help deciding what life insurance is best for you?

Complete this questionnaire, and I’ll work my magic.

Or schedule a callback:

Thanks for reading

Nick