What’s driving an E&S property boom?

What’s driving an E&S property boom? | Insurance Business America

Property

What’s driving an E&S property boom?

Clue: It’s not just the weather…

The non-admitted insurance market is experiencing a property premium boom, and natural catastrophe exposed states are leading the charge but are by no means the only contributors in a hard market.

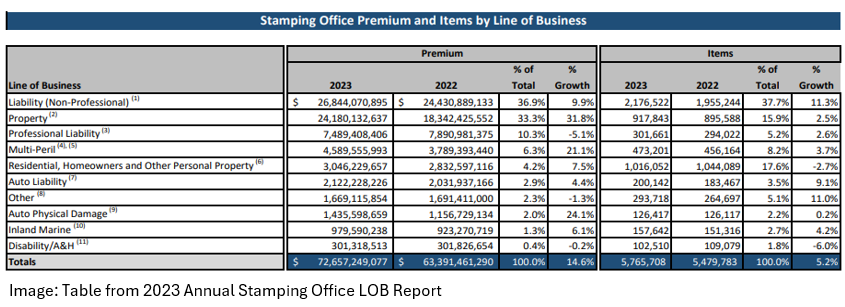

Stamping offices across the US reported 2023 surplus lines property premiums written growth of 31.8%, or $5.84 billion, far outstripping 2022’s 25.9% increase. Property now accounts for a third of surplus lines business written across the 15 reporting states.

Insureds turn to the surplus lines market when standard market insurance availability is tight. It may come as little surprise then that natural catastrophe prone states that have tussled with capacity crunches led the charge in terms of actual premium added.

“As the standard market’s risk appetite changes, that’s always going to drive the flow of certain lines of coverage into the surplus lines market, and that’s what we’re seeing on the property side here, especially when it comes to some of the tougher, riskier property coverages, particularly cat exposed property,” Wholesale & Specialty Insurance Association (WSIA) executive director Brady Kelley told Insurance Business.

Florida, California and Texas may have represented the top three states in terms of total premium, but just Texas made the top three for E&S premium percentage growth. Coastal exposed North Carolina took the top spot, while Minnesota was third. Just New York State saw property premiums written fall.

All but one state saw surplus lines property premium growth

State

2023

2022

Property as a % of total premium

% change from 2022

Florida

$7,169,426,485

$5,058,287,251

46.50%

41.70%

Texas

$5,778,498,526

$3,960,589,972

39.60%

45.90%

California

$3,795,673,668

$3,204,131,429

22.80%

18.50%

New York

$2,363,238,618

$2,366,817,444

29.20%

-0.20%

Illinois

$1,130,269,723

$853,472,855

28.30%

32.40%

Washington

$746,041,474

$585,508,452

33.10%

27.40%

Pennsylvania

$722,069,738

$506,264,253

26.10%

42.60%

North Carolina

$668,095,653

$456,273,607

33.40%

46.40%

Mississippi

$389,744,329

$286,278,761

41.10%

36.10%

Oregon

$343,175,350

$260,922,998

33.50%

31.50%

Minnesota

$338,609,318

$236,648,919

27.20%

43.10%

Arizona

$274,828,133

$210,547,869

17.90%

30.50%

Utah

$207,531,617

$165,266,782

24.60%

25.60%

Nevada

$142,392,450

$111,479,870

14.70%

27.70%

Idaho

$110,537,555

$79,935,091

33.00%

38.30%

Source: Stamping Office Premium and Transaction Report – 2023 Annual Report

E&S property premium growth – a confluence of factors

In addition to severe weather exposures, insurance professionals pointed to a confluence of factors driving the upwards E&S property premium trend.

Rising reinsurance costs was chief among these for Bob McNamee, Jimcor VP of commercial binding authority.

“There are a few different factors, the biggest one probably being that reinsurance costs are increasing, which ends up resulting in higher premiums and rate to the end consumer,” McNamee said. “That can significantly increase pricing and all indications are that as we move into 2025 that will stabilize, but it’s still impacting the 2024 premiums pretty significantly.”

Reinsurance rates have continued to harden since 2018 following the triple-threat hit of hurricanes Harvey, Irma and Maria (HIM).

In Hurricane Ian’s devastating wake, 2023 saw carriers scramble to obtain reinsurance amid rate hikes and tightening. For some, US property reinsurance rates rose as much as 50% in July 1, 2023 renewals, according to Gallagher Re. The trend echoed into Jan. 1, 2024 for previously catastrophe hit property, but rates reportedly began to settle for others.

Construction challenges and building valuations impact

An uptick in building valuations has further added to a premium swell, McNamee and other insurance professionals said. Also piling on upwards pressure, rising construction costs and labor shortages have left some buildings going without updates, leaving them subject to higher property insurance rates.

Hit by severe weather and buildings claims cost challenges, property capacity across both London and the domestic markets has shrunk amid heightened demand, culminating in price hikes.

Admitted carriers have brought in stricter underwriting requirements and in cases shied away from certain regions. This has pushed property business into the surplus lines market.

“Standard carriers continue to pull out of various classes and are implementing firmer underwriting requirements – such as wiring types and restricted geographical areas – which is pushing more business into the E&S lines market,” said Rich Gobler, SVP, Western United States, Burns & Wilcox. “Due to these tightened requirements, each carrier is limited to what they will write, creating less capacity.”

E&S supply and demand dynamics

Surplus lines property capacity caution and supply and demand dynamics also have a role to play. E&S carriers have been burned before and this has boosted price increases.

“E&S carriers are raising rates substantially due to increased volume of submissions and unprofitable results in property over the past five-plus years, with high construction costs being a major factor,” Gobler said.

With many E&S carriers cutting back on certain classes, Gobler noted that those that are willing to quote will “likely get the rates they want”.

The average line size in the E&S market shrank last year, with more policies required to achieve the same “or even lower” limits than in 2022, RPS national property president Wes Robinson said.

More competition could push pricing and premiums back down, but it has yet to emerge, insurance sources said.

“We haven’t seen [significant entrances into the market] and if you add supply, it’s eventually going to put pressure on the price,” said Doug Davis, SVP large property division, Skyward Specialty. “We haven’t seen that but that doesn’t mean that markets that have had one good year out of say six [won’t] say that now’s a good time to go and grow. If you have enough markets doing that, then eventually there’ll be some pressure on the market as a whole.”

Overall, surplus lines premium written grew 14.6% in 2023 following a record-setting 2022. Residential, homeowners’ and other personal property saw growth of 7.5%. WSIA’s Kelley said this was not “typical”, with catastrophe prone states like Florida and California pushing up premium figures further than in the prior year.

Kelley was buoyant on continued wholesale and specialty growth into 2024 and beyond.

“While the supplemental nature of our industry certainly creates cyclical ebbs and flows, our members comprise an industry focused on integrity, service, innovation, financial stability, and access to markets that can customize solutions for the most complex insurance risks,” Kelley said. “That approach to business is going to continue to create opportunity, in my opinion, for the wholesale and specialty market.”

Got a view on surplus lines growth? Drop a comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!