What is trade credit insurance?

What is trade credit insurance? | Insurance Business America

Guides

What is trade credit insurance?

Trade credit insurance is an essential form of risk management tool. Find out how this type of coverage protects your business from potential losses

Accounts receivables comprise around 40% of a company’s assets, according to the latest research from Allianz Trade, one of the world’s largest trade credit insurance providers. Data also shows, however, that one in 10 of these unpaid invoices eventually becomes delinquent, highlighting the need for proper coverage.

This is where trade credit insurance comes into play. This form of risk management tool is designed to protect businesses against bad debts.

In this article, Insurance Business digs deeper into this type of protection. We referred to industry specialists to explain how the policy works and what benefits businesses can get by obtaining coverage.

If you’re searching for ways to protect your company’s cash flow, then trade credit insurance might help. Learn more about this essential type of business insurance in this guide.

Trade credit insurance is a type of business policy that protects your company’s accounts receivables against losses from unpaid commercial debt. If a customer fails to pay due to bankruptcy, insolvency, or other issues, the policy reimburses a percentage of the outstanding debt. Coverage may also kick in if the payment is extremely delayed.

You can take out coverage for both domestic and international clients, often with customizable features and benefits to match your business’ needs.

Depending on the insurer, trade credit insurance can also be referred to as accounts receivable insurance, debtor insurance, or export credit insurance.

Trade credit insurance protects sellers against buyers who are unable to pay. The policy insures against clients that have declared bankruptcy, insolvency, or a similar legal status. It also covers the policyholder if customers are allowed to delay payments under a bankruptcy protection arrangement.

Policies reimburse a majority of the trade debt, according to the International Credit Insurance & Surety Association (ICISA), the sector’s trade body.

“If a buyer does not pay, the trade credit insurance policy will pay out a percentage of the outstanding debt,” ICISA explains. “This percentage usually ranges from 75% to 95% of the invoice amount but may be higher or lower depending on the type of cover that was purchased.

“Trade credit insurance policies are flexible and allow the policyholder to cover the entire portfolio or just the key accounts against corporate insolvency, bankruptcy, and bad debts.”

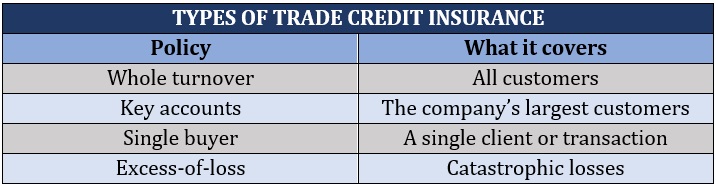

ICISA lists several ways a trade insurance policy can be structured:

Whole turnover coverage: This protects against losses from unpaid trade debt from all customers. Businesses can set if coverage applies to domestic or international sales only, or both.

Key accounts coverage: This covers a company’s biggest clients whose non-payment poses the greatest risk to its operations.

Single buyer coverage: Also called transactional coverage, this insures all sales to a particular customer or a single transaction with a client.

Excess-of-loss coverage: This covers catastrophic or exceptional losses of a business’ largest buyers that exceed the normal levels of bad debt. The policy comes with an insurance deductible.

Here’s a summary of the different types of trade credit insurance policies.

Your business faces risks and challenges that are different from those of other businesses. That’s why there’s no single policy that can cater to every need. Find out which types of business insurance policies are essential to your operations in this guide.

Trade credit insurance generally provides coverage for two types of risks:

Commercial risks: Policies cover instances where clients are unable to pay outstanding debts due to financial reasons. These include declared bankruptcy or insolvency, and protracted default.

Political risks: Events outside your customers’ control may also be covered, including political upheavals like war and terrorism, and natural disasters such as hurricanes and earthquakes. If a client is affected by its country’s rules or economic condition restricting the transfer of money, coverage may kick in as well.

At the start of the policy, the trade credit insurance provider evaluates the creditworthiness and financial stability of a business’ insurable clients based on these risks. The insurer then assigns a suitable coverage limit. This is the maximum amount the insurance company will reimburse if a customer fails to pay.

Depending on the insurance provider, they may keep monitoring your clients’ financial standing to ensure their creditworthiness. You can also request additional coverage for a particular customer or new buyer if the need arises, although this is subject to your insurer’s approval.

Some insurers notify policyholders if a certain client is experiencing financial difficulty. They may also work with you to create a plan to mitigate potential losses.

The risk being transferred must connect directly to an underlying trade transaction to be covered by a trade credit insurance policy. If no direct trade link exists, outstanding debts cannot be covered.

Allianz Trade also reminds companies that they cannot rely solely on their policies to lessen the risk of potential losses due to bad trade debt.

“Credit insurance is not a substitute for prudent, thoughtful credit management,” the insurer explains. “Sound credit management practices should be the foundation of any credit insurance policy and partnership. Credit insurance goes beyond indemnification and does not replace a company’s credit practices, but rather supplements and enhances the job of a credit professional.”

Small businesses are particularly vulnerable to bad trade debt. But there are other policies that can protect small business owners financially. Our guide to small business insurance gives you a rundown of these policies.

Annual premiums for your trade credit insurance policy generally cost between a tenth and a quarter of a cent for every dollar of your total sales for the year. This means that if you make $2 million in sales, you can expect to pay around $2,000 to $5,000 in yearly premiums.

But apart from sales, there are several variables that come into play when determining how much you need to pay for coverage, including:

The type of policy (whole turnover, key accounts, or single buyer)

Level of risk covered for each transaction

Your trading history, including the bad debts you’ve incurred

Your clients’ creditworthiness

Credit terms with your customers

The industry you’re in

The country where your clients are based

Find out more about how insurers determine you rates in this comprehensive guide to insurance premiums.

Businesses tend to turn to trade credit insurance when they already have a credit problem or foresee exposure. But that’s often too late for insurers to take on the risk, according to Yue Ma, vice-president and senior underwriter for political risk and sovereign credit at Sovereign Risk Insurance Ltd.

“Trade credit insurance can help companies apply longer term risk management strategies,” he explains. “We would advise firms to consider trade credit insurance when business is good, so that when a problem does strike, they don’t find themselves trying to get coverage for an uninsurable risk.”

The main alternative to trade credit insurance is self-insurance, a practice particularly popular in the US where trade credit insurance take-up is lower than 5%. Businesses that choose to self-insure can put a reserve on their balance sheet to cover any bad debt that may incur over a financial year.

However, according to James Daly, CEO of Americas region at Allianz Trade (formerly Euler Hermes), self-insurance is “not the most capital efficient solution.”

“Rather than have capital in your balance sheet doing nothing but waiting for bad debt, why not purchase trade credit insurance and then invest that excess capital into growth or new products?”

Daly believes that the shift in the distribution of insurance towards digitalization and technology platforms presents huge opportunities in the trade credit insurance space.

“Today, if you want to buy a trade credit insurance policy, we’ll talk to you around all the business you’re doing on open credit,” he says. “We’ll take a look at the clients you’re supplying to and we will underwrite those buyers.

“Then, during the year, if any of those buyers go bust or don’t pay, then we will make the payment. We look at the whole turnover of a company and we underwrite the entirety.”

Daly adds that the rise of online platforms facilitates tracking and payment processing.

“What we’re seeing through digital platforms is that people can go online and can sell a single invoice. In the new fintech world, people are going to be able to go on to a platform and upload their accounting records.

“The platforms can see the invoices that are outstanding and can make an offer to buy those outstanding invoices. What the customer can then do is make the choice to insure that single invoice. Once that invoice is insured, it’s basically a guarantee that the invoice will be paid.”

The global trade credit insurance market was valued at $9.2 billion in the last financial year, according to the numbers obtained by data analytics company Global Market Insights (GMI). The firm expects the sector to become a $23.9 billion industry in the next decade for a compounded annual growth rate (CAGR) of 10.2%.

Growth will be primarily driven by expansion of international trade activities, the emergence of new markets, and rising awareness about the benefits of trade credit insurance.

Europe remains the biggest market, accounting for more than a third of the total. Large companies, meanwhile, comprise around a tenth of the overall market.

Trade credit insurance can be a vital element of your business coverage. If you want to find out what types of policies can help your business run smoothly, you can check out our comprehensive guide to business insurance.

Do you think trade credit insurance is worth having? What are the pros and cons of getting coverage? Share your thoughts below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!