What is the Sandwich Generation, and what does it want?

We surveyed more than 1,000 members of the sandwich generation—people who care for both their children and their parents. Here’s what they told us.

John Latona, general manager at Haven Life, knows all about the worry. His father just turned 91, his mother is in her late 80s, and while both parents still live independently, Latona says “I’m just waiting for the call.” He and his wife have two children, both under seven years old, and every few months they make the 10-hour trip to visit Latona’s parents and ensure everyone’s doing okay — but even this arrangement won’t be viable long-term. “There’s going to be a point where my parents need more help.”

That’s going to be the reality for a lot of Americans: At some point, your elderly parent(s) are going to need more help, and we’re going to need to figure out how to provide it. The Pew Research Center reports that, as of 2013, nearly half of adults (47%) in their 40s or 50s had a parent age 65 or older and were simultaneously either raising a young child or helping a grown child financially — and roughly 15% of middle-aged adults were providing financial support to both a parent and a child.

People who provide long-term care to both older relatives and growing children are often referred to as the “Sandwich Generation,” since they have responsibilities pressing in on both sides. What do these sandwiched family caregivers need — both to help their family members and to help themselves?

The Sandwich Generation Report, conducted by online life insurance agency Haven Life, interviewed 1,078 participants between the ages of 30-55 years old who self-identified as providing care or decision-making support to both a dependent child (or children) and aging parents. Our goal was to learn more about where the Sandwich Generation feels the most strain, as well as what they believe could provide the most help as they continue to navigate this financially and emotionally difficult life stage.

The Sandwich Generation feels overwhelmed, often or constantly

Unsurprisingly, the majority of survey participants reported feeling overwhelmed with their responsibilities. In fact, 80% of respondents feel overwhelmed often or constantly. These same individuals also indicated they feel overextended nearly five out of seven days of the week on average.

Whether those in the Sandwich Generation are actively involved in day-to-day parental care or are trying to have difficult conversations with older relatives from a distance, balancing new caregiving responsibilities with existing responsibilities to partners, young children and careers becomes extremely difficult — and extremely stressful.

The Sandwich Generation needs help with financial planning, decision-making and mental health

What do Sandwich Generation caregivers want? More support. When asked what would help to reduce their stress, the top three choices selected by respondents included access to a mental health professional (63%), decision-making support from their family (61%) and a financial advisor (57%). And, if given the choice, they’d prefer those kinds of long-term support systems over day-to-day support like childcare or in-home care.

Kim Egel, a licensed marriage and family therapist in San Diego who works with clients both in person and virtually across the country, wants Sandwich Generation caregivers to understand the importance of prioritizing their own mental health. “There are consequences for not making time for something [your mental health] you can’t neglect.” Egel notes that, although a weekly or bi-weekly therapy appointment might seem like one more item on the calendar, prioritizing mental health can actually save caregivers time in the long run — by giving them an opportunity to process complicated thoughts and feelings, for example, instead of ruminating on their anxiety, anger and worries all day (and, as many Sandwich Generation caregivers know well, all night).

“I think sometimes, the feelings just need a space to be heard,” Egel says. A mental health professional can provide a fresh perspective, suggest self-care strategies, prescribe medication if necessary and simply provide emotional support to people who might feel like it’s their responsibility to support everyone else.

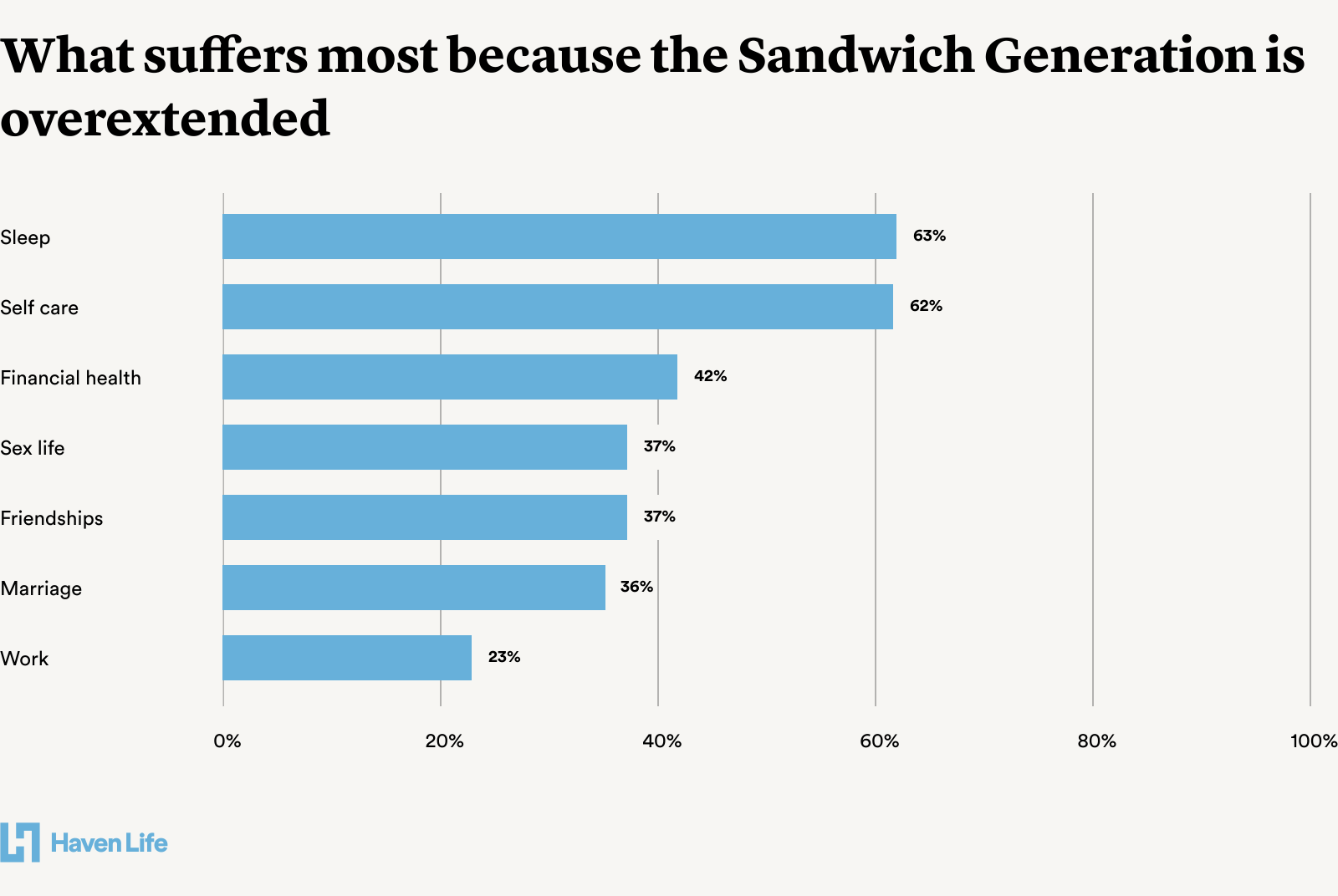

Sleep and self-care are most likely to suffer

A lot of busy Americans feel sleep-deprived. And when you’re dealing with both the mental load and financial responsibility involved in caring for aging parents and young children, you’re probably getting even less sleep than usual. You also probably don’t have a lot of time for self-care, which can be defined as the restorative aspects of life (exercise, socializing, rest and relaxation) and is essential for preventing burnout. At this point, a caregiver watching over their elderly parents and kids may feel like they are compromising their own health and well-being.

As Dr. Emily Nagoski and Amelia Nagoski explain in their book Burnout: The Secret to Unlocking the Stress Cycle, the typical person needs to spend roughly 42 percent of their time at rest. That’s 8 hours of sleep and two hours of restorative self-care per day, give or take — and Sandwich Generation members are more likely to give that time to others than take it for themselves.

Our survey respondents cited both sleep and self-care as two of the three aspects which had suffered most since they took on Sandwich Generation responsibilities. The top three choices included self-care (63%), sleep (62%) and financial health (43%). When you’re caring for others, it’s hard to care for yourself — and, as many people quickly learn, it costs a lot of money.

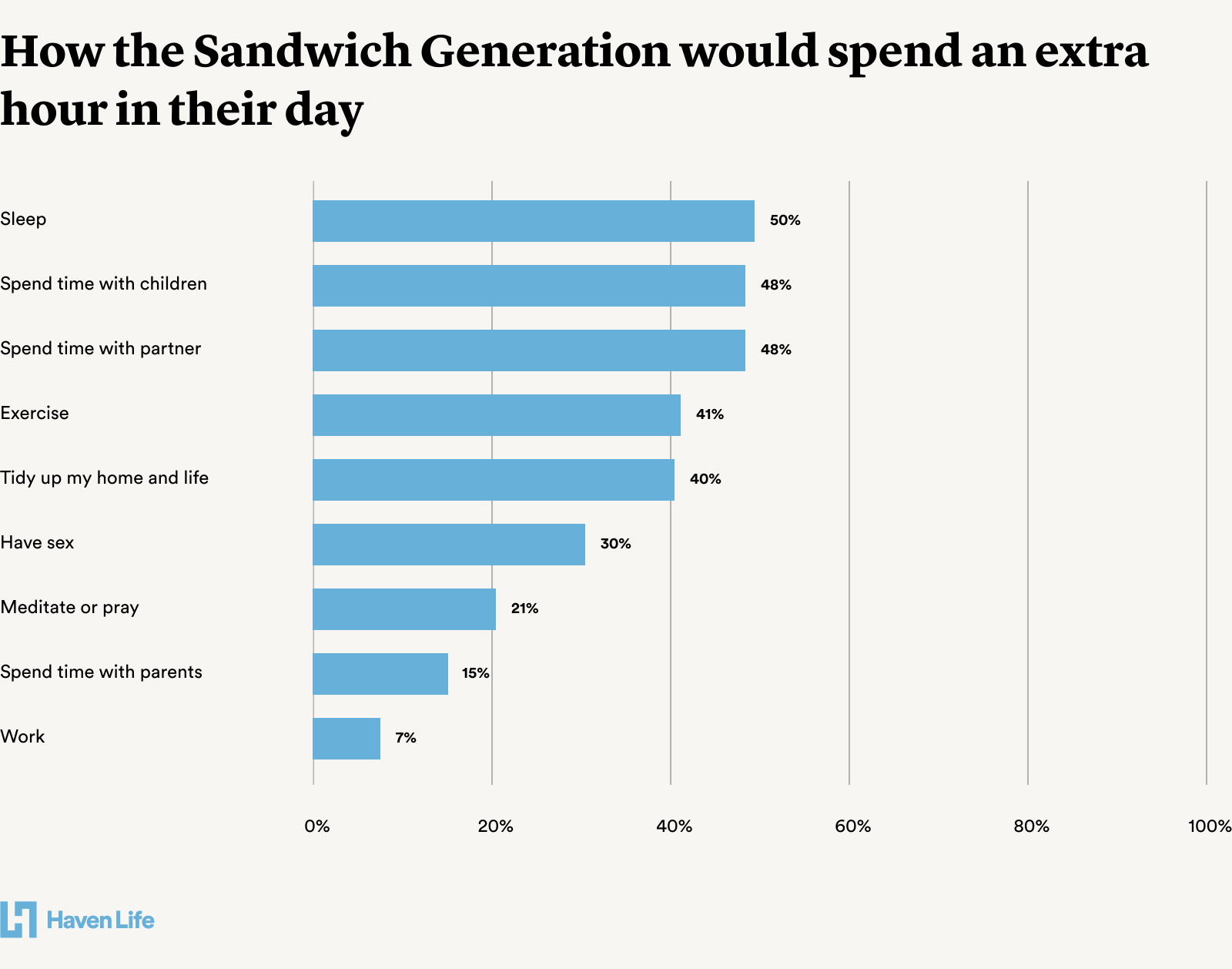

If the Sandwich Generation had an extra hour in their day, they would put it to good use. Respondents indicated they would spend time with their children and partner and grab some extra shut eye.

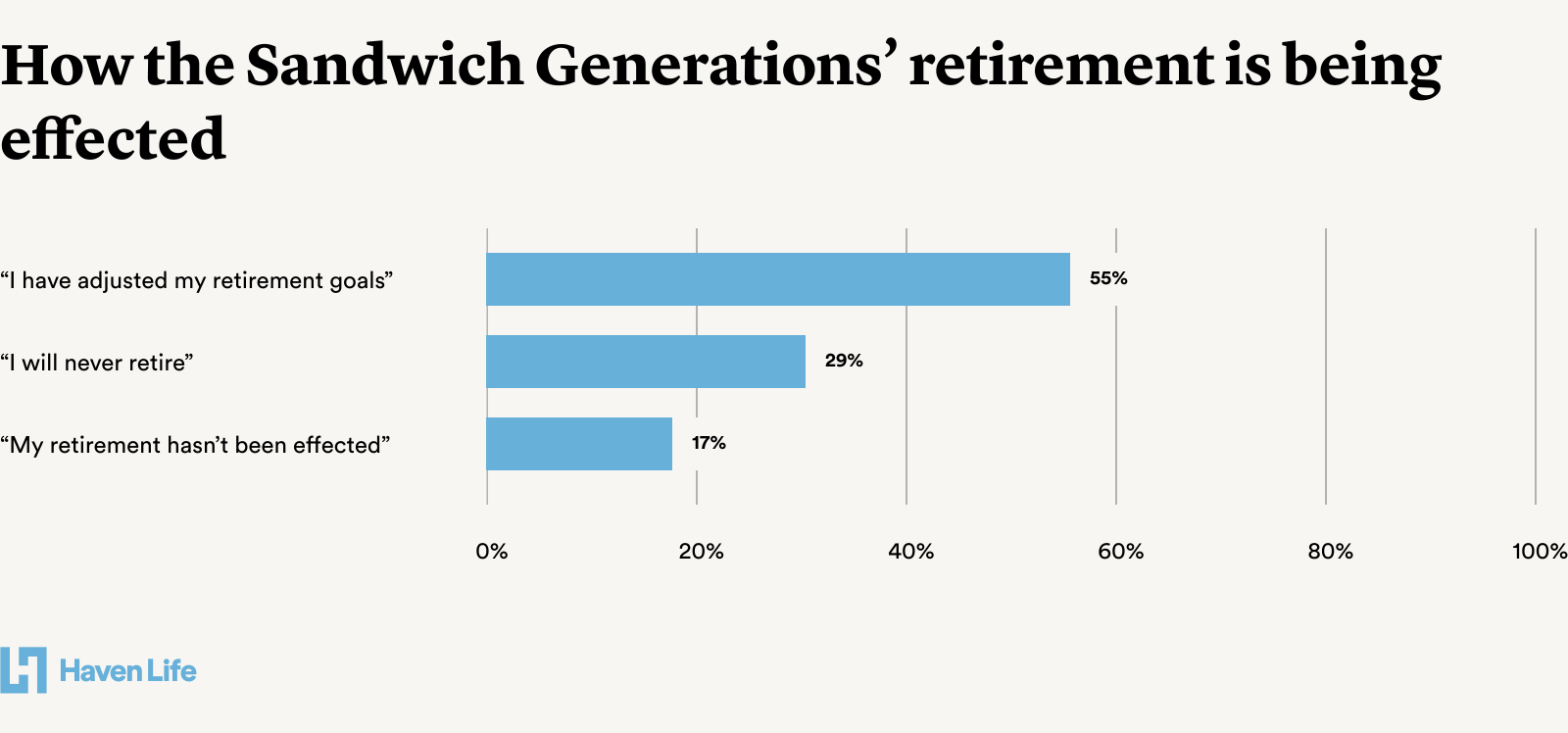

The Sandwich Generation is struggling to save for their retirement

Helping your parents through their retirement years often conflicts with saving for your own retirement — as does raising children. Fifty-nine percent of survey respondents expect to financially support their parents or in-laws as they age.

Whether Sandwich Generation members downscale their careers to spend more time with aging family or take out loans to help cover their children’s educational expenses, they often find themselves having to rethink their own long-term financial goals.

Fifty-nine percent of the Sandwich Generation expect to financially support their parents or in-laws as they age

Fifty-five percent of our survey participants report that they’ve adjusted their retirement goals as a result of their financial responsibilities. An additional 29% of the Sandwich Generation feel that they will never be able to retire, which is a slightly higher ratio when compared to the average American (23% according to a recent study). Overall, our survey participants who felt overwhelmed by their responsibilities were more likely to report that they would never retire.

As author Laura Zigman recently wrote in a powerful New York Times essay about caring for two generations simultaneously: “It didn’t occur to me then how caretaking would affect me financially — my ability to earn, to generate work, to preserve our savings and retirement — for years to come.”

Mary Beth Storjohann, CERTIFIED FINANCIAL PLANNER(TM) professional and the founder of Workable Wealth, advises Sandwich Generation members to think carefully before cutting back on a career or pulling money out of retirement accounts. Remember that you’re not just giving up today’s salary or savings; you’re also giving up all money you could be earning in the future, whether through investment growth or career growth. “Look at the numbers first and make an educated decision,” Storjohann says. There might be creative options that you and your family haven’t yet considered, that will allow your parents to get the help they need without requiring you to give up a job or jeopardize your own financial security.

If you do decide to use part of your nest egg to help aging parents or family members, Storjohann suggests making a plan to pay yourself back. “If you’re spending down your own savings to help your family, what will it take from you, and what kind of changes will you need to make to your own financial plan, to replace that?”

The majority of the Sandwich Generation has financial protection

Given the enormous responsibilities of providing physical, emotional and financial support for their parents and kids, the Sandwich Generation seems to understand the importance of financial protection — with two-thirds of survey respondents having life insurance. For this group in particular, life insurance is an important safety net for ensuring that your loved ones will be taken care of financially if you were to die.

Of those without life insurance, 66 percent of survey respondents reported that being a member of the Sandwich Generation prevents them from getting coverage — and Sandwich Generation caregivers who felt overwhelmed were less likely to have a policy.

Two out of three (61%) Sandwich Generation respondents have life insurance

Storjohann advises her clients to start thinking ahead about the financial plans and protections they’ll need to put into place before they become full-fledged Sandwich Generation caregivers — and to seek out professional support to avoid any financial burdens down the road. “If you’re trying to plan for your own financial future and your parents’, get professional help. It’s not something you want to try to do on your own.” A caregiver on a budget can seek out hourly-rate financial planners through reputable services like the XY Planning Network or the Garrett Planning Network.

Storjohann notes that finding a neutral third party to help you navigate the finances of elder care can also help with some of the more thorny emotional aspects as well. Financial planners may also be able to help caregivers have difficult conversations with their parents, whether those conversations involve budgeting, downsizing or simply getting an accurate picture of a parent’s financial assets. Once you begin talking with your parents about their financial needs — a conversation which Storjohann suggests having as early as possible — a trusted financial planner can help you leverage both your and your parents’ resources effectively.

That way, you’ll have one less thing to worry about — and will be able to devote more of your time towards taking care of your loved ones, raising children, and taking care of yourself.

Survey methodology: Haven Life conducted a quantitative survey between January 23 – 28, 2020 and collected N=1,078 completed responses. Respondents were required to be between 30-55 years old, have dependent young or adult children and provide decision-making support or care for at least one parent. About 75% of respondents were between the ages of 30 – 44, and 58% of respondents have a household income between $25,000 – $100,000.

Our editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Read more

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus.html

Read our disclosures

You might also like

What’s New at Haven Life

2021 Haven Life Annual Report

Every year, Haven Life puts together an Annual Report to celebrate our customers and all they’ve accomplished over the past 12 months. But in a year that felt like a rollercoaster, how could anything of true meaning be achieved? There’s only one way to find out.

Read more

Get our most-read stories, twice a month

Amazing experience with them. Very responsive and best quotes out there. Must have term insurance.

Very happy with the whole process from start to finish on my application. Only area that could be improved is that my wife also applied and was rejected and we did not get a reason. She is a 30 year old female without any existing conditions so I was surprised.

The whole process was seamless and easy. My application for term life insurance was all done online. The rates are fair, and the people at Haven Life seem to genuinely care about their customers.

Best life insurance company.

The process of getting life insurance with you is a very smooth process. I really liked the way you communicated through the process and were on top of the things. I really appreciate it. Thank You for my peace of mind and my family’s peace of mind.