What is the Motor Insurance Database (MID)?

It is a legal requirement to have motor insurance if you use your vehicle on roads and in public places in England, Scotland and Wales. An uninsured vehicle could land a registered keeper in serious trouble, whether they were driving it at the time or not, including:

a fixed penalty of £100a fixed penalty of £300 and 6 penalty points if the vehicle is being driven at the timethe vehicle wheel-clamped, impounded or destroyedif impounded, proof of insurance and £150 fee is required to release ita court prosecution with an unlimited fine and disqualification from drivinga knock-on effect is that the owner would be subject to higher insurance premiums after being caught.

As a minimum, every vehicle used on the roads should have Third Party insurance.

So how is this enforced? The Motor Insurance Database is key.

What does the Motor Insurance Database do?

The Motor Insurance Database is a central record of all insured vehicles in the UK – and it’s updated 10,000 times an hour! It is used by the police and the DVLA to enforce motor insurance laws.

All insurers who underwrite motor insurance for vehicles on UK roads are obliged to be members of the MIB and to submit the policy details of all vehicles to the Motor Insurance Database.

The most important function of the Motor Insurance Database is to work to reduce uninsured driving, which kills and injures thousands of people every year.

askMID.com states that around 30,000 claims are made to the Motor Insurers Bureau (MIB) every year for accidents caused by uninsured drivers, and drivers that leave the scene. It is estimated that the cost of covering uninsured drivers adds around £30 to each honest driver’s policy.

How are uninsured drivers caught using the Motor Insurance Database?

The good news is that the Motor Insurance Database works in partnership with insurers, the police and the DVLA which has resulted in a 50% reduction of uninsured vehicles on the roads over the last ten years.

The police use ANPR (Automatic Number Plate Recognition) technology using information from the database – and it works! If an uninsured vehicle passes an ANPR camera it is likely to be stopped by the police. More than 500 vehicles are seized every day, while one person is convicted for uninsured driving every three minutes!

The DVLA sends a registered keeper of a vehicle that does not appear to be insured according to the database a warning letter that will advise the recipient on how to stay legal and avoid a fine and penalty points.

This could mean providing evidence that of insurance, obtaining insurance, correcting a mistake or declaring your vehicle ‘SORN’, i.e., off the road. Unless a vehicle is ‘SORN’, it will need insurance.

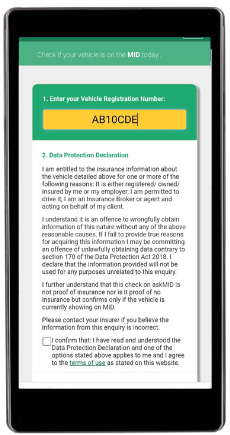

Can I check insurance on the Motor Insurance Database?

Yes. You can check your own car insurance is accurately displayed, and search for insurers of other vehicles, if you are in an accident where the other party flees the scene, for example.

You will need to use the askMID.com website to run a search. You will need to enter the vehicles number plate and the service will confirm whether or not the vehicle is insured and lists the type of vehicle it is.

If you are in an accident and need to find out who the other party is insured by, or if they are insured at all should they fail to share their details, you can use the Motor Insurance Database for this too.

This service is £10, and you will need to have made a note of their licence plate and have the date of the accident to hand. If their registration is found, this service will provide you with the name of their insurers and policy details, along with their claims contact details to help you progress a claim.

Those requesting the information could be pedestrians, cyclists, a property owner or other vehicle owners.

How do I contact the Motor Insurance Database?

You shouldn’t need to. If you find that your vehicle make and model is incorrectly listed on the database, you will need to contact your insurer urgently to correct this. askMID.com is unable to do this for you.

If your vehicle make and model aren’t shown, but your registration is acknowledged, you are still insured but your insurance company have not supplied the full details.

You may also find yourself in receipt of a warning letter, stating that you do not have insurance. If you know you have insurance, contact your insurer immediately to rectify the error.

It’s best to contact your insurer directly in the event of any errors or omissions that you spot on the database, or any letters that you receive.

What happens if I’m pulled over for driving without insurance?

Firstly, let’s assume that you do have insurance on your vehicle, as it is illegal to drive without at least Third Party insurance. If you’re pulled over because your insurance is not listed on the Motor Insurance Database, your policy documents are proof of your insurance.

It is not a legal requirement for your insurance to be displayed on the Motor Insurance Database, so you will be given an opportunity to provide proof of insurance.

What is the Motor Insurance Bureau (MIB)?

Often referred to as the ‘Motor Insurance Bureau’, the ‘MIB’ actually stands for the ‘Motor Insurers’ Bureau.’ The MIB manages the MID. The MIB was established in 1948 in the UK as a fund to compensate victims of uninsured or untraced drivers, such as hit and run accidents.

If someone is in an accident and the other party leaves the scene, the onus is on the victim to do all they can to work out who the registered keeper of the offending vehicle is. To put in a claim, the victim will need to download a form from the website, or a solicitor can do it on the victim’s behalf. It’s worth noting however, that the ‘MIB’ will no pay compensation if the victim has already been compensated via another source, or if the victim is driving an uninsured vehicle.

Be aware of Motor Insurance Database scams

Like the NHS, Royal Mail, Amazon and many more, scammers can use the Motor Insurance Database’s name to cold call and fraudulently obtain details or payments from members of the public.

The Motor Insurance Database is currently warning members of the public about scam calls from companies or individuals claiming to be them. The caller may claim that they obtained your details from the database and would like to talk to you about an accident. They may even ask you for your bank details, claiming they need them to pay compensation. This is a hoax.

The Motor Insurance Database never contacts members of the public about an accident unless you have already made a claim directly to them. They will never call you to ask you for your bank details. If you have any doubts, hang up the call, wait 5 minutes and call the Motor Insurance Database on 01908 830001. Please ensure that you do report any instances of attempted scams here.

Sources: Gov.uk, askMID.com, MIB.org.uk