What Is The Best Life Insurance For Young Adults In 2022? Get Instant Quotes & Coverage!

Finding the best life insurance for young adults can be confusing and very time-consuming, it just makes you want to say, “ain’t nobody got time for that.”

But guess what:

You can get cheap life insurance as a young adult in an instant.

These insurance policies are super simple to understand, and there are no waiting periods.

In this post, you will learn how to purchase life insurance as a young adult, how to get no medical exam life insurance, and when you should get life insurance as a young family.

How Old Do You Have To Be To Get Life Insurance?

There is no minimum age required for you to get life insurance, you can have coverage from the time you are a baby until you are a much older adult. However, to purchase your own individual policy, most insurance companies require you to be 18 years of age or older. If you are in your early 20’s you might still be on your parent’s policy but once that ends you should get covered asap.

Is There A Life Insurance Age Limit?

There is a life insurance age limit and it is based on the type of life insurance coverage you are looking for. Most no-medical exam term life policies have a maximum age at issue of 65, while traditional term life policies and whole life policies usually go up to age 85. You can also find a few final expense or burial insurance policies that go up to age 90. Once you are covered, a term policy will last until the term expires and a whole life policy last until you pass away.

No Exam Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get no exam life insurance coverage within minutes of getting your quotes and applying.

At What Age Should You Get Life Insurance?

You should get life insurance as early as 18 years old, but especially in your 20’s or 30’s. That’s because you are going to get the lowest rates and get your premiums locked in for the longest period. As a young adult you are probably going to be in excellent health which affords you the lowest rates.

The older you get before you buy life insurance the higher the rates will become and the more you become at-risk for not qualifying for coverage due to health issues.

Do You Need Life Insurance In Your 20s?

Yes, you should buy life insurance in your 20s because the older you get the higher the possibility of health problems and you could find yourself paying much higher premiums or even become uninsurable.

There is also the issue that the older you get, the higher insurance premiums become. Even if you don’t have any health issues you are going to pay more per month at 30 years old then you would have at 20 years old.

Do You Need Life Insurance At 30?

Yes, when you look at life insurance for someone in their 30s like me, I have a 30 year $2 Million life insurance policy, and I only pay about $129.00 per month.

I purchased this policy over 6 years ago and my rates are still locked in, if I purchased that same policy today my rates would be close to $190 per month.

This means that buying my life insurance early has saved me around $21,000 in insurance premiums.

Just think about this, I have all the time I need to build something great for my family, and if I were to pass away before that, then my Husband would be set financially.

When we have certain life events like having kids, it will be very easy to just add them as a beneficiary.

What’s The Best Life Insurance For Young Adults?

The best life insurance policy for young people in their 20’s and 30’s is going to be a Simple Issue Life Insurance policy often called No exam life insurance. This is a type of life insurance that allows you to get covered at a much faster pace by avoiding the medical exam. It is by far the best term life insurance option available for young people because:

Which Policy Provides The Most Coverage At The Lowest Cost For A Young Family?

Term life insurance will provide the most coverage at the lowest cost for a young family because term insurance was created to let you pay a lower monthly premium over a specific amount of time. The expectation is that if you get a 20 or 30-year term policy, by the time the term has ended, you would have paid off your home, and if you have kids, they would be out on their own. You wouldn’t need as much coverage 20 years from now that you need today.

Myths About Life Insurance for Young Adults

There are so many myths and just straight up lies when it comes to life insurance for a young adult.

In all honesty, If I hadn’t sold life insurance for over 13 years, I probably would be believing the same myths.

Today I am going to put an end to these and give you real answers:

Myth 1 – You Don’t Need Life Insurance If You Have No Dependents

People argue that if you don’t have anyone that you are responsible for, then as a young adult you don’t need life insurance.

The problem with this theory is that if you pass away, someone is still going to be responsible for burying you, packing up your things if you had an apartment and other things that might not be on your mind.

The nationwide average cost for cremation is about $2,500, and the average cost for a funeral is closer to $10,000.

Now, according to Smartasset.com the average savings of people that actually have a savings accounts is $5,200.

This means that your parents, or friend, whoever takes over that role for you, will either be spending half of their savings or won’t have enough to assist with burying you.

With life insurance costing less than my monthly cell phone bill, trips to Starbucks (unless I am using my rewards), or a few drinks when hanging out; there isn’t any reason to go uninsured.

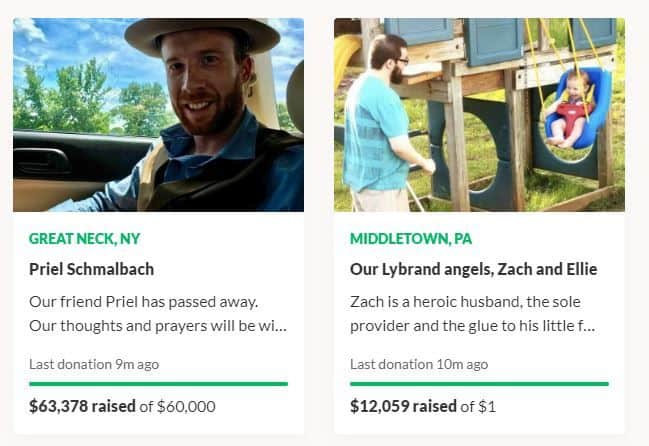

Myth 2 – GoFundMe Is Life Insurance

This might not be an official myth, but enough people use this option to ask for money for a burial.

Even as I write this post people still need help with money to cover the final expenses for their family members.

Just check out the screenshot below that I just took from GoFundMe, these people are both young adults and if they had life insurance, this wouldn’t be required.

Now, I am not taking any shots at GoFundMe; I think its an excellent platform.

However, it shouldn’t be used for life insurance because there are companies that offer coverage for very affordable rates.

Myth 3 – Term Life Insurance Is A Waste Of Money

There is so much content on the internet that tries to make an argument that Term Life Insurance isn’t a good deal because your coverage will end.

However, the truth is that by the time your term life insurance policy is up for renewal, you should have created a substantial nest egg and paid down some debt.

Term life insurance is going to lock your rate in for the length of the policy so the sooner you purchase it, the more savings you will have up front.

You can also add on family members as you have life events like getting married, or adopting or having a baby.

The amount of money you spend on a term life insurance policy is going to be much lower compared to other products.

Essentially, it is probably the best term life insurance and is definitely worth the peace of mind it will give you.

No Exam Life Insurance made easy.

Agents not required.

Get quotes and sign up online without talking to an agent. But, we are here if you need us.

Unbiased, expert advice.

Get unbiased insurance education from licensed experts and also avoid dodgy sales calls.

Coverage in minutes.

You can get no exam life insurance coverage within minutes of getting your quotes and applying.

The Best Life Insurance Companies For Young Adults

Bestow, Haven Life, and Fabric are hands down the best term life insurance companies for young people. Not only do they offer a 100% online application process, but they can approve you fast with the best rates, and what’s even better is that their primary focus is young families. Below we have a brief overview of each company along with some sample rates.

![]()

Available For Ages:

18 to 60 Years Old

Coverage Amounts:

$50,000 to $1,500,000

Term Lengths:

10, 15, 20, 25, & 30

20 Year $250,000 Quote:

$17.50/month

Check out our Bestow life review

Available For Ages:

18 to 65 Years Old

Coverage Amounts:

$50,000 to $3,000,000

Term Lengths:

10, 15, 20, & 30

20 Year $250,000 Quote:

$18.90/month

Check out our Haven life review

Available For Ages:

21 to 60 Years Old

Coverage Amounts:

$100,000 to $1,000,000

Term Lengths:

10, 15, & 20,

20 Year $250,000 Quote:

$20.39/month

Check out our Fabric life review

The above quotes are based on a 36 year old male non-tobacco user in perfect health.

Out of the above three products I would suggest to first start with Bestow because they have the fastest online approval process as well as the most term life options than any company.

Life Insurance For Millennial Entrepreneurs

If you work from home, are a freelancer, self employed, a small business owner, or have a few side gigs, having life insurance as a millennial is essential and you can’t afford to go without it.

Being young and running a business is definitely going to be challenging, but you must build a solid financial foundation and life insurance is key.

As a entrepreneur you are responsible for every part of your business, your savings and investments and your loved ones.

The products we offer gets you approved super fast so that you can focus on running your business.

How To Get Cheap Life Insurance As A Young Adult Today?

Now that you know who has the best life insurance for young adults and why it’s essential to get covered, it’s time to take action, and as Cottonmouth said in Kill Bill, “Now’s the F*king Time!”

So, to get some term life insurance quotes, you can click here or on any of the above buttons to get the process started.

You can get anonymous quotes and be covered in under 5 minutes if you choose to move forward.

Frequently Asked Questions

Should young adults get life insurance?

Yes, as a young person, you will get the most affordable rates and find it much easier to get approved. As a young adult, you are probably in the process of starting things like a new job, getting married, or having a baby; you must have life insurance.

What is the best life insurance for young adults?

The best life insurance for young adults is no exam term life insurance because it allows you to get up to $1.5 Million in term life insurance coverage 100% Online and in under 5 minutes, at an affordable rate. You also get a choice of several term options from 10, 15, 20, 25, and 30 years.

Is life insurance worth it for a single person?

Yes, life insurance is worth it if you are single because if you pass away, someone will still have to pay for your funeral and final expenses. It isn’t a good idea to leave that burden on anyone else.

At what age should you get life insurance?

It would be best if you got life insurance as early as possible, or at least until you can no longer be on your parent’s policy. The earlier you get life insurance, the better because it will be super cheap. If you are in your mid 20’s or early 30’s then getting a life insurance policy should definitely be at the top of your list.

How long should I get life insurance for?

Your best option will be a 20 year or 30 year term life insurance policy as a young adult. Not only will this lock your rates in for a long time, but it also assures that you would have paid things off over 20 to 30 years and no longer need a large amount of life insurance.

Do I need life insurance if I have no debt?

You should get life insurance even if you have no debt because as soon as you pass away, there will be a new debt of around $10,000 to bury you. Also, your family will still need to replace your income if you pass away.