What is Multi Claim Protection Cover?

You know how in Batman – the cartoon, film, or comic (you choose) – the big lad himself will go toe-to-toe with a villain.

Then he’ll reach into his trustee utility belt to get whatever tool he needs to save the day?

Well, Batman stores his tools in ten pouches (I Googled this, dear internet, for I am not a nerd who automatically knows such things) and includes his Batarang, napalm (as ya do), a tranq gun and smoke pellets.

Now watch me shoehorn Batman into a comparison with life insurance.

Ya ready??

Multi-Claim Protection Insurance from Royal London is the Bat-belt of life insurance!

Mind you, I wouldn’t recommend using it to fight crime, as throwing a policy document at The Joker wouldn’t accomplish much (maybe a paper cut if you throw it at precisely the right angle)

No doubt, news of a different type of insurance is wildly exciting for all of us.

So, on the count of three: 1, 2, 3.

YAAAAAAAAY INSURANCE.

The number one reason I recommend Multi-Claim Protection Cover

Before we get into the nuts and bolts of how it works, here’s why I think it’s an excellent idea.

It’s more inclusive than some other types of protection cover.

For instance, if you have diabetes, cancer, or heart issues, you can still get Multi Claim Protection coverage, albeit with relevant exclusions. However, those conditions will disqualify you from standard serious illness cover and income protection.

As we specialise in helping clients with pre-existing conditions, I know how relieved they will be to have this option.

Before now, all we could offer clients with certain pre-existing conditions was Cancer Only Cover.

What is Multi-Claim Protection Insurance

Or: ‘oh God, do we really need more insurance’

Multi-claim Protection Insurance (MCPC) is the new-ish kid on the block

Straight from the horse’s mouth:

MCPC is, “is a unique, severity-based policy aligned with the progression of modern medicine and health.

So what does that mean, exactly?

With MCPC, Royal London is moving away from paying out only when you meet the definition of a specific illness.

Instead, MCPC will pay claims based on:

The impact caused by a medical condition or treatment

How severe that impact is

It protects you from a broad range of possible health setbacks that may impact you and your lifestyle. It is designed to be easy to understand and to potentially payout multiple times over the lifetime of your policy

An easy-to-understand policy that’s designed to pay out multiple times over the lifetime of your policy?

Call me a cynical old fart, but that’s a first for insurance.

What makes Multi-claim Protection Insurance different from Serious Illness Cover?

The words ‘severity’ and ‘multi-claim’ are significant differences.

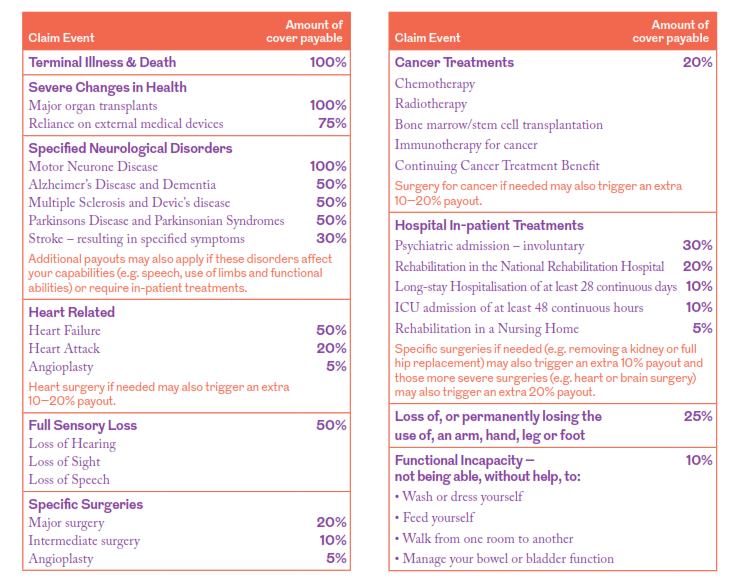

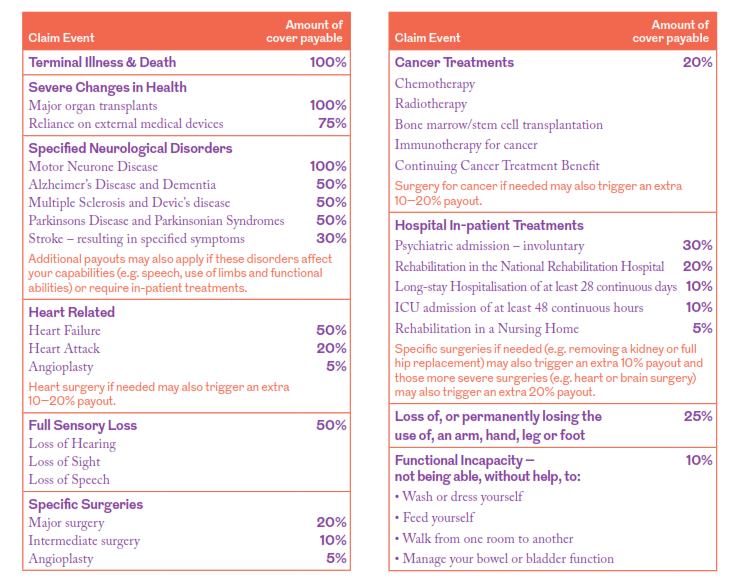

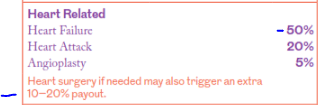

Namely, you can make multiple claims (up to the value of your cover) for a range of things covered in your policy (known as claim events – see table below)

For example, you might get ill and have to stay in the hospital for five weeks.

If this happens, you claim against your policy for 10 per cent of your cover.

Later on, you might become reliant on medical devices (let’s not get into the specifics and jinx your actual life) and make a claim for 75 per cent.

Later again, when you’re much older, you’ll have a touch of angioplasty (just a touch now – we’re not about to kill you off just yet), and you can claim another 5 per cent of your cover.

And the beautiful thing is even if you make a claim, your premium won’t increase!

Just remember that you can’t exceed the maximum amount of cover you’re insured for – for example, €100,000.

For those who love bullet points, here’s what makes MCPC different from serious illness cover.

Payouts depend on the impact of a medical condition or treatment.

You can make multiple claims.

Claims can be paid for medical conditions (like MS), treatment (such as chemotherapy) and the inability to perform specific day to day tasks without help.

It’s easier to know when you can make a claim. For example, if you need chemo, you can make a claim; you don’t have to prove your illness meets the strict definition of cancer found in a serious illness policy.

Unfortunately people who have had cancer are at a higher risk of getting a second cancer, similarly, people who have had a stroke have a higher risk of a cancer diagnosis. MCPC continues after your first claim allowing you to make multiple claims for various health issues.

Why would an insurer give you the option to make multiple claims?

If you remove the cynical specs, it looks like this could be a good deal for you and that you stand to benefit.

According to the folks at Royal London, the motive here is that because medicine has improved, people are getting earlier diagnoses, faster treatment, and recovering quicker so illnesses are having less of an impact on people’s lives.

Following treatment, many people return to life and work as normal in a short space of time. Therefore, there isn’t such a need for a product that pays out 100% of the claim in one go.

You could say that Multi-claim Protection Insurance is an insurance company finally stepping up to the plate with an illness cover policy that actually reflects modern life.

Of course, you could also say it’s a marketing-driven move to win market share.

But sure, look at it; you didn’t hear that here first.

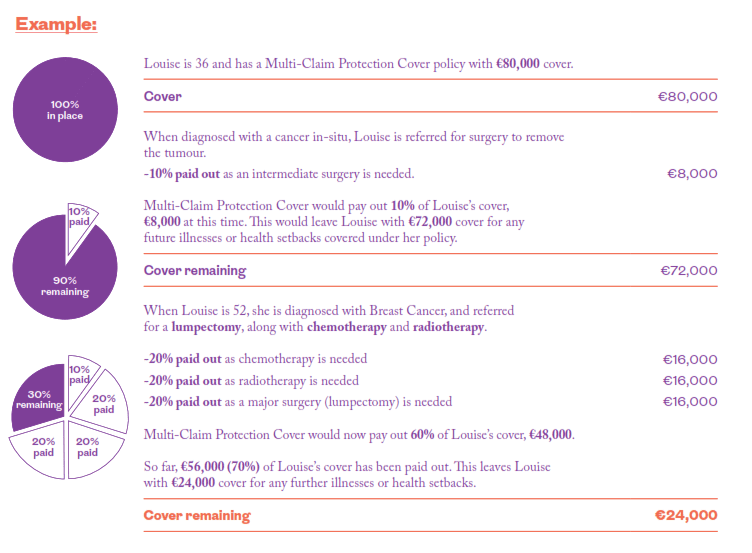

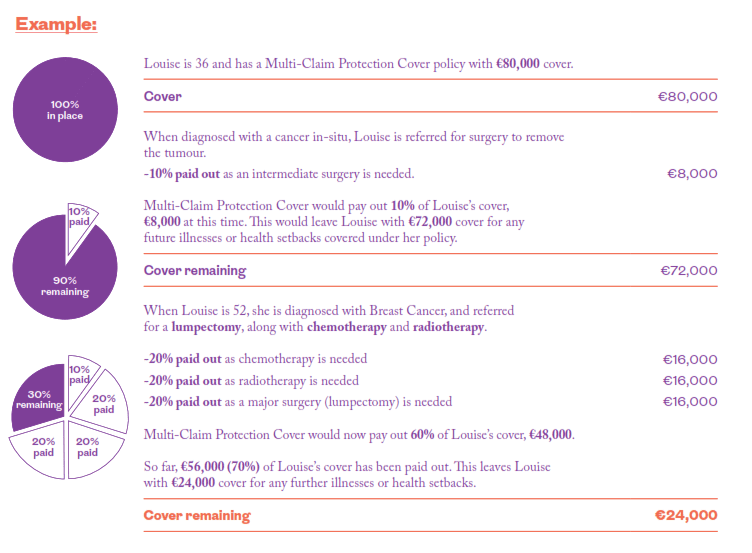

Let’s see an example of how it might work in real life.

Jim is 50 and has a policy for €100,000. He’s been working as the Financial Controller of the National Children’s Hospital for the last seventeen thousand years and suffers a heart attack.

He claims 20 per cent of his cover, receiving €20,000 while the political world continues to spin into havoc around him.

Six months later, he loses his hand in a non-hospital-related accident and claims an additional 25 per cent leaving him with 55% cover on his policy.

Finally, several years later, as the doors of the hospital finally slide open, Jim has heart failure and requires heart surgery.

He’ll get the remaining 55 per cent, or €55,000, to cover his costs.

Will anyone think of the children?

If your child gets seriously ill, Royal London will make a payment (completely separate from your policy) of up to €25,000 to help you out.

Your kids are covered until they turn 18 (or 25 if in full-time education) i.e. when they officially become adults (and become professional leeches, instead of unpaid leeches).

There’s also a death payment of €7,000 if they die, which honestly doesn’t bear thinking about – but it’s good to know it’s in there too.

Royal London also includes an additional benefit of €5,000 if you have a premature baby born before the end of the 32nd week of pregnancy.

I find it difficult to discuss children’s covers, but here’s an article I wrote if you want to learn more.

If you’re not a fan of bullet points but love a list, you’re in for a treat.

Seven reasons you should at least consider Multi-Claim Protection Cover

It’s an improved form of serious illness cover mixing the old; pays out should you meet the definition of an illness like MS) and the new; pays out for treatment (e.g chemotherapy) and the impact of an illness (e.g. if you can’t dress without help for six months or more)

It can payout multiple times so you can retain some cover even after making a claim. For the most severe health events, such as death and terminal illness, the full amount is paid out.

It’s easier to understand what’s covered (see Claims Trigger table above)

It covers the illnesses that give rise to the majority of serious illness claims (cancer, heart failure, stroke, MS).

The scope for making a claim is broader, so it’s more likely to be paid out even if that payout is smaller. If you like to hedge your bets, or prefer an each-way bet to an on-the-nose, it’s for you.

It’s more affordable than serious illness coverage.

You automatically qualify for access to Royal London’s Helping Hand service, which includes unlimited one-to-one telephone access to your personal nurse advisor. The service is available to you, your spouse or partner and children as soon as your policy starts.

One reason you shouldn’t

The name.

Multi Claim Protection Cover.

Seriously, could they not have chosen a snazzier name?

I still get the name wrong.

MPCC,

I mean MPCP

Or is it MCPP?

How much does Multi Claim Protection cover cost?

The Big Question!

A 35-year-old non-smoker with no health issues can buy €100,000 MCPC for less than a tenner per week.

What’s that, a couple of fancy coffees?

Over to you…

If you’re looking for the best cover that pays out while you’re still alive and kicking but unable to work, your best bet is still Income Protection.

Still, if that’s not an option, you can’t go too far wrong with Multi-Claim Protection Insurance – just make sure you know what’s covered in your policy.

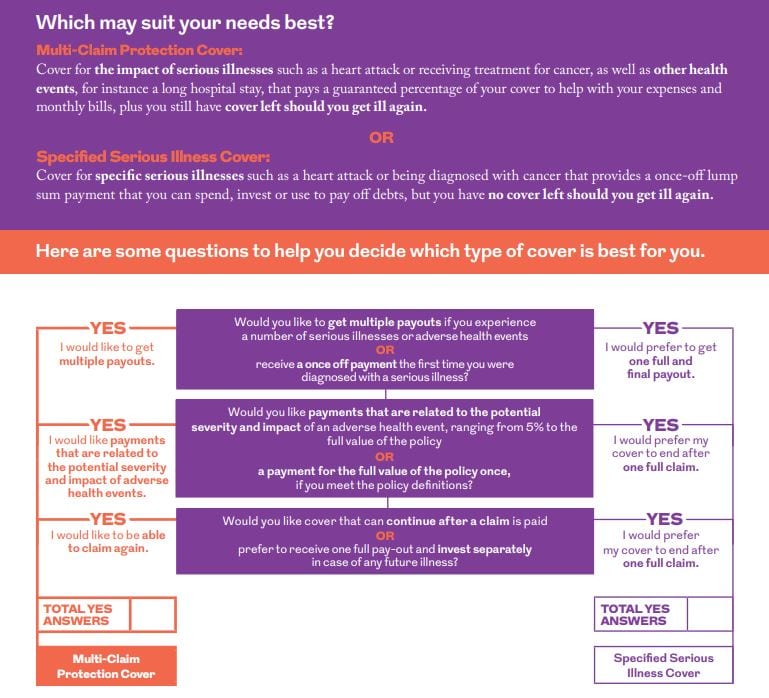

If you’re trying to decide between serious illness coverage and MCPC – this is useful.

Are you wondering if MCPC is for you or if there are better options?

Complete our financial questionnaire so I can get to know you better and make a personalised recommendation.

![]()

![]()

Right, that’s enough from me; I’m outta here.

Nick

Editor’s Note: We first published this blog in 2019 and have regularly updated it since.