What is life insurance? Everything you need to know

Life insurance is a type of policy designed to provide a financial safety net to your loved ones at the time of your death. This level of protection makes it one of the most popular forms of insurance in the country.

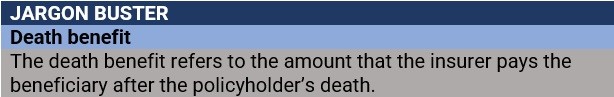

Life insurance in Canada works by providing the beneficiaries with a tax-free lump sum after the policyholder dies. According to the Financial Consumer Agency of Canada (FCAC), your beneficiaries can use the payout – also called the death benefit – in a variety of ways, including:

Paying off debts, such as mortgage and other loans

Replacing your income so your family members can maintain their lifestyle

Providing for your children and other dependents, including for their education

Covering funeral and burial expenses

Making a charitable donation

You may also opt to leave the death benefit to your estate – where the funds can be used to cover any remaining bills and costs – or a trust – which gives you greater control over how the benefit is distributed, as well as protect it from creditors.

There are really no restrictions on how you and your beneficiaries can use a life insurance payout. You can also use the money to keep a business going after you pass away. Find out how Canadian business owners can utilize life insurance to their advantage in this handy guide.

Picking the right life insurance in Canada can be a confusing endeavour because of all the jargon involved. If you’re having a difficult time making sense of the different life insurance buzzwords, you can check out our glossary of common insurance terms.

Life insurance policies in Canada are available in several variations but generally fall into two categories.

1. Term life insurance

A term life insurance plan provides coverage for a set period. This type of policy pays out the death benefit if you pass away within a specified timeframe, meaning your beneficiaries can only access the payment in the years the plan is active. But what happens when your term life insurance policy expires? You have three options:

You can renew the policy for another term.

You can convert the policy to a permanent plan, which we will discuss later.

You can terminate the plan.

Bear in mind that if you pick the third option, your beneficiaries will not receive any death benefit.

If you choose to renew your policy, you can do so in five, 10, or 20-year “steps,” according to CLHIA’s factsheet. You can also expect your premiums to increase each renewal time. Turning your plan into permanent coverage, meanwhile, allows you to adjust coverage features to address your long-term needs. This also does not require further underwriting if it is done with the same insurance company.

Couples are also given the option between two additional types of term life insurance plans:

Single-term life insurance: Provides each partner with their separate policies and pays out the death benefit if they die during the length of the policy. The main advantage of taking out this type of plan is that the surviving policyholder will still have coverage even after their spouse or partner dies.

Joint first-to-die term life insurance: Covers both partner’s lives, but only pays out after one person dies, after which coverage ends. The death benefit goes to the surviving partner, unless other arrangements were made. This type of plan cannot be converted into two single policies.

Unlike permanent plans, term life policies do not accumulate cash value. This means you cannot borrow against your policy or get any cash value back if you cancel.

2. Permanent life insurance

Permanent life insurance policies in Canada have two main features that separate them from term life plans. These are:

Guaranteed lifetime coverage

Cash value element that builds up over time

You can also use this cash value as collateral should you decide to borrow against your policy.

Permanent life plans also come in two major categories:

1. Whole life insurance

A whole life insurance plan offers coverage for your entire lifetime and savings that grow at a guaranteed rate. You can access two main types of whole-life policies. These are:

Non-participating whole life insurance: Provides your beneficiaries with a tax-free benefit and accumulates a guaranteed cash value that the policyholder can borrow against.

Participating whole-life insurance: Apart from the guaranteed death benefit, this type of plan can generate dividends, depending on how your insurance company performs. These dividends are typically issued to the policyholder every year.

Most whole life insurance policies operate with level premiums, meaning the rates do not change for the length of the policy. Others use a limited payment structure where you pay higher premiums in the first few years before the rates decrease in the latter years. Some plans follow a modified premium model. This works the opposite, imposing cheaper premiums early in the policy before the rates go up.

A portion of the premiums you pay goes to your policy’s savings component, allowing it to build up cash value over time on a tax-deferred basis. If you want to know how you can access this accumulated amount, you can check out our comprehensive guide to whole life insurance.

2. Universal life insurance

Universal life insurance in Canada also provides lifetime coverage and combines the death benefit with a savings component. But unlike whole-life plans where premiums stay the same for the duration of the policy, universal policies follow a flexible premium structure, which you can adjust depending on your coverage needs, subject to certain limits. This is the reason why this type of plan is also called adjustable life insurance.

In addition, the returns for universal life insurance policies are based on how the market performs. Because of this, there is a probability that your policy can become underfunded, especially if the market struggles. This can cause your premiums to increase significantly. Bear in mind that if you fail to make premium payments, your life insurance policy can be terminated.

Find out the different ways you can use life insurance to build wealth in our handy guide.

Life insurance in Canada covers almost all types of death, including those resulting from accidental and natural causes, homicide, and suicide. Most plans, however, come with a suicide clause, which voids coverage if the policyholder commits suicide within a specific timeframe, usually two years after the policy takes effect.

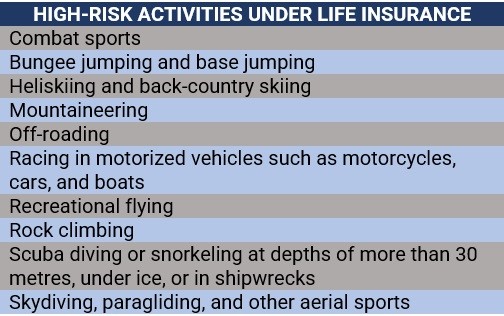

Some policies do not provide cover if the policyholder dies while engaging in high-risk activities. The table below lists some of these activities.

Life insurers may also deny a claim based on the circumstances surrounding the death. For instance, if one of the beneficiaries is responsible for or involved in the policyholder’s death.

Life insurance plays a crucial role in providing families with a certain level of financial security after the death of a primary income earner. With the right policy, this type of coverage can help families pay off loans and debts and meet daily living expenses. While not everyone may need this form of coverage, certain types of individuals and groups can benefit the most from getting life insurance. These include:

Breadwinners

Business owners who want to continue their businesses

Businesses with key employees who are difficult to replace

High-net-worth individuals who expect to incur estate taxes

Individuals with pre-existing conditions, although premiums may be higher

Families with existing mortgages

Parents of school-aged children

Parents who have special-needs dependents

Seniors who want to leave money to adult children who cared for them

The Financial Services Commission of Ontario (FCSO) also listed several questions that you can ask yourself to help you determine if taking out life insurance is necessary. These are:

How much do I contribute to my family’s income? If I die, will my family be able to take care of themselves?

Do I have any other dependents, including parents, grandparents or siblings?

As a single parent, what kind of support payments am I receiving or paying? If I die, how will these continue?

Do I want my mortgage paid off after I die?

Do I want money placed aside for my children’s education?

Do I want to leave money to family members or organizations?

Will I leave behind unpaid debts that will reduce the value of my estate or may burden my family?

How will my death affect my business?

Does life insurance play a part in my long-term financial goals?

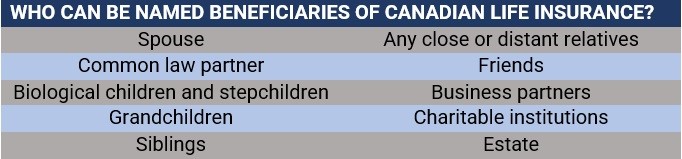

As the policyholder, you are required to designate a beneficiary of your life insurance plan. These can be anybody of your choosing, including individuals and entities listed in the table below.

You are also allowed to name several beneficiaries for your life insurance plan and assign how much benefit each person or group will receive.

There are two types of life insurance beneficiaries in Canada:

Revocable beneficiary: Who can be replaced at any time without the need for you to tell them.

Irrevocable beneficiary: Who you need a written permission from before you can make changes.

One important thing to remember is that if you live in Québec and name your spouse as a beneficiary, it is automatically irrevocable. This is unless you have specifically stated that the designation is revocable when you took out the policy.

Meanwhile, for beneficiaries under 18-years old, you will need to set up a trust and designate a trustee or administrator to hold the proceeds on behalf of the minor. If you fail to name a trustee, the death benefit will be held in trust by the province or territory and paid out when the beneficiary reaches legal age.

If you name your estate as the beneficiary, it is legally bound to distribute the death benefits according to the terms of your will. The proceeds will also become part of your estate and will be subject to estate taxes. Creditors may likewise claim the benefit to pay for your debts.

Check out the top life insurance companies in Canada in our latest industry rankings.

There are several factors that impact the premium prices of life insurance policies in Canada. These include:

Age: The younger you are when you take out life insurance, the cheaper the premiums as you are less likely to develop a serious medical condition. The main drawback is you’ll be paying premiums longer.

Lifestyle: Unhealthy lifestyle choices push up rates as it increases the likelihood of health issues.

Smoking status: Smoking is associated with various health risks and has a corresponding effect on your premiums.

Medical history: If your family has a history of serious medical conditions, insurers may view you as risky and charge you higher rates.

Driving record: A clean driving history tells insurers at you’re at low risk of getting into an accident and can help get you cheaper prices.

Occupation: Some jobs pose greater risks than others, driving up premiums.

Policy type: Permanent life insurance policies are more expensive than term life insurance plans.

Premiums are calculated differently depending on the type of policy. If you want to understand how this insurance component works, you can check out our comprehensive guide on insurance premiums.

Two of the biggest factors that can impact both your eligibility and premiums for a life insurance policy are your age and health status. This has led some industry experts to recommend taking out coverage while you are still young and healthy. They argue that as you get older, health issues begin to develop, which can prevent you from qualifying for coverage and push up the price of your premiums. Some compare the “economic impact” of missing out on buying life insurance while younger to delaying saving for retirement.

But there are also industry specialists who say that in your younger years, you tend to have more expenses, including mortgage, car loans, student debt, and childcare, and life insurance just adds to your financial burden. In addition, buying a term life plan while younger guarantees that you will be facing more expensive premiums 10 to 20 years down the road when it is time to renew.

The bottom line is, there is no one-size-fits-all life insurance that can cater to every need – and the answer to the question of when the best time is to purchase a policy all boils down to your personal preferences and situation.

The financial benefits that life insurance provides make it a popular form of coverage not just in Canada but also across the world. You can compare how this type of policy works in different countries by checking out our global life insurance primer.

If you want to find out which type of life insurance policy best fits your coverage needs, an experienced insurance agent or broker can help you. Our Best in Insurance for Canada page can link you up with reliable and trustworthy insurance professionals across the country.

The insurance companies featured on this page are nominated by their peers and vetted by our panel of experts as respectable market leaders. By dealing with these providers, you know you’re getting the best coverage from someone you can depend on during difficult times.

Do you think it is worth taking out life insurance in Canada? Tell us why or why not in the comments section below.