What Is General Liability Insurance for Small Business?

If you own or operate a small business, general liability insurance (GL insurance) plays an important role in protecting your company from unforeseen financial losses. As a business owner, you face daily risks that could result in accidents or injuries occurring on or around your business premises.

This is where GL insurance for small businesses becomes valuable – it provides coverage that can help cover bodily injury, property damage, or other losses you are obligated to pay due to a legal liability claim. This introductory guide will help explain the basics of GL insurance and why it is a crucial piece of risk management protection for small companies.

Why Small Businesses Need General Liability Insurance Coverage

As a small business owner, you work hard to care for customers, clients, or patrons. However, unexpected hazards or accidents may occur within your small business premises or arise from your operations, resulting in injuries, property damage, or other losses. If someone holds your small business you legally liable, lawsuits can be filed seeking compensation.

Defending yourself can present heavy cost burdens. Without GL insurance coverage, you’d need to either cover legal defense costs and any such legal expenses, damages, and fees from your company’s assets. Acquiring the right amount of GL insurance coverage protects your small business financially and allows you to focus on your work without stressing about legal defense costs and potential liability risks. This coverage can help cover legal defense costs and save your small business from unaffordable losses.

What Is Covered by Business Liability Insurance

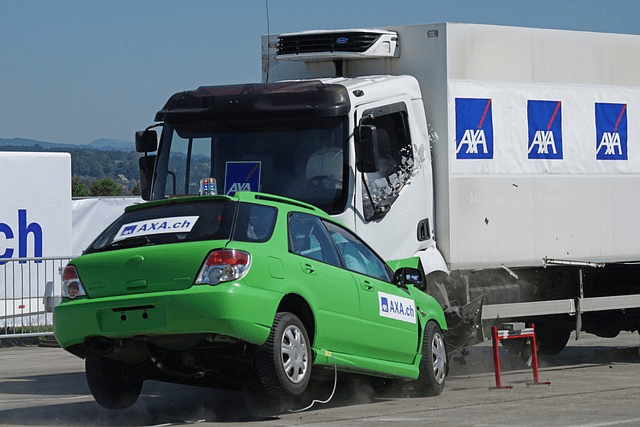

General liability insurance covers your legal liability if a third party suffers bodily injury, property damage, or other insurable losses due to your operations. A general liability insurance policy extends protection in case of accidents and injuries on your business premises or arising out of your products/services resulting in legal claims. Some key types of commercial general liability insurance claim exposures covered by cyber liability insurance include damages due to slips/trips and falls, vehicle accidents, defective products or workmanship, and fire or health hazards.

Coverage also extends to legal costs like attorney fees incurred in defending claims filed against your personal and commercial property insurance, advertising injury, or business that are covered under the policy terms. This coverage can provide peace of mind, knowing you have protection for uncovered costs from liability claims and court costs related to your personal and general liability insurancerequired for advertising injury or business operations.

Bodily Injury and Property Damage

Among the core components of a general liability insurance policy is coverage for bodily injury and property damage claims. Bodily injury protection helps cover legal compensation and medical costs if a person suffers harm, hurt, or sickness from an accident or exposure linked to your business or personal assets.

Property damage coverage pays for repairs, replacement, or compensation if a person’s property or someone else’s property is harmed, destroyed, or lost due to your operations. For example, if poor safety leads to employee injuries or a fire that ruins a neighboring store, any rebuild costs or inventory losses would be claim-eligible.

Personal/Advertising Injury

In addition to bodily harm and physical damage to property, general liability insurance policies also cover what are called personal and advertising injuries. Personal and other personal injury and personal and advertising injury you can get general liability insurance that applies to non-physical injuries like libel, slander, defamation of character and infringement of privacy rights.

This helps protect your business if someone accuses it of causing such non-physical harm. Advertising injury provides coverage for claims made against your business owner’s policy to your company due to unintentional infringement of copyright, unauthorized use of titles or slogans in advertisements, incorrect portrayal of goods or services in ads, and other such exposures. Both these protections offer recourse if your business faces legal fallout from unintentional damages to people else’s property, reputations or rights through advertising activities.

Medical Payments Coverage

In addition to liability insurance, general and business insurance policies may include medical payments coverage. This optional protection reimburses medical expenses incurred by any third party bodily injuries or parties who are accidentally injured on your business premises, regardless of who is found legally liable.

This allows your insurance company to demonstrate care for those harmed without needing to either cover medical expenses, medical treatment, and legal defense costs or wait through a legal investigation of professional liability coverage itself. Medical payments are particularly valuable if someone visits your store, slips, and needs emergency care since it simplifies cost handling outside of professional liability insurance claims. However, the coverage limits are usually lower than the bodily injury protection provided under the main insurance company’s policy.

Premises/Operations Coverage

One of the core parts of a commercial general liability and insurance policy is premises and operations coverage. This protects your business against liability claims that arise from accidents due to conditions or events related to the upkeep of your business property and the typical business operations conducted therein.

It helps cover lawsuits for injuries happening to a customer’s property, sues, customers, employees, or others due to slipping hazards, unsafe conditions, or dangerous activities carried out at the insured customer’s business property or premises. This cyber liability insurance enables small business owners to confidently ensure that core on-site work and property risk management are financially secured.

Products/Completed Operations

In addition to covering liabilities arising from premises risks, general liability insurance for small business also provides important protection for injuries or damages resulting from defective products or faulty services. Product liability insurance applies to situations where a consumer suffers harm from a product manufactured, sold, or distributed by the insured business. Completed operations coverage needs general liability insurance to protect your company if someone gets hurt or someone else’s property experiences damage from work performed that resulted in a defective service.

Both serve to relieve the financial responsibility if your goods, professional services, or work fail to perform as reasonably as expected, resulting in harm and a legal claim years later.

Contractual Liability Coverage

Contractual liability coverage protects your company from bodily injury or property damage claims that arise due to liability you assume through a written or verbal contract or agreement. This happens commonly when a business signs paperwork agreeing to defend and protect another from third party property damage. Without this protection, you could face financial responsibility for such claims.

The general liability insurance required also provides recourse should injuries or damages occur on job sites where contractors work or related to maintenance agreements at other properties. General liability insurance coverage helps fulfill obligations accepted through contracts to indemnify and hold harmless other parties involved in your business from getting general liability insurance for products and operations. This ensures your own business needs general business insurance coverage, and the policy itself is covered even when accepting additional responsibility through common commercial deals and written works.

Independent Contractors Coverage

Since many small businesses rely on independent contractors to assist with various jobs, commercial general liability insurance policies often include coverage for these workers. Independent contractors’ coverage under commercial auto insurance helps protect your company if a non-employee is injured or causes property damage during an authorized. Without this extension of workers’ compensation insurance, you may be held responsible for accidents or losses caused by freelancers involved in your work.

By including contractors under your business insurance policy, liability insurance, company or policy umbrella, you avoid the financial liability that could bankrupt your business.

Liability from the use of Mobile Equipment

For small businesses involved in complex operations, an additional feature of your general liability insurance quote and coverage is additional insured endorsements. These allow your own general liability insurance quote and policy to extend protection to other entities involved in your work activities. For example, if you do contract work for another company, the additional insured endorsement names that company as protected under your general liability insurance quote too.

Your commercial auto insurance insurer takes on responsibility for their legal costs and any damages for which they are additionally responsible. The commercial property insurance of most small business owners where you operate can also gain commercial liability insurance coverage through these endorsements. They offer flexibility to safely involve small business owners, their business partners, and other parties in your commercial auto insurance and business property and insurance through added coverage for their liability exposures relating to your business activities.

Host Liquor General Liability Coverage

Small-sized businesses dealing in high-risk operations or substantial assets, an optional upgrade is umbrella general liability insurance. This provides an added layer of coverage over and above the limits of the standard general liability policy. Umbrella general liability insurance only kicks in once the underlying policy limits are exhausted, increasing overall liability protection. It is particularly useful for minimizing exposure if facing an exceptionally high damage claim well beyond typical general liability coverage amounts.

Umbrella policies may extend individual claims protection up to millions of dollars depending on the needs of the specific business here. They offer higher caps for the legal fees, settlements, awards, and medical costs and get more general liability insurance cost, coverage, and insurance cost thresholds in total.

Damage to Rented Premises

For businesses that rent offices, stores, or industrial space, general liability insurance coverage can extend protection against legal responsibility for property damage to the premises you occupy. This general liability insurance coverage also helps absolve liability for medical expenses that could otherwise cut deeply into your business finances too.

Expected/Intended Injury Exclusion

Most general liability policies contain exclusions that bar coverage for certain types of risks that insurers do not want to take on. One important example is the expected or intended injury exclusion.

Accidents that occur despite prudent caution are insurable, but purposeful acts bringing about injuries are not. This exclusion prevents moral hazard and helps keep business liability insurance more affordable.

Electromagnetic Emissions Exclusion

General commercial liability insurance policies typically contain exclusions relieving insurers of responsibility for damages linked to electromagnetic emissions arising from insured operations. Exclusions preserve affordable premiums. However, commercial and general liability insurance policies still protect policyholders from bodily injuries proven to immediately result from on-premises accidents and property damage from regular business activities that accidentally cause tangible, evident harm.

Punitive Damages Exclusion

Another common exclusion in both commercial general liability insurance policy and professional liability insurance policies relates to punitive or exemplary damages. These are monetary awards ordered by courts above and beyond compensation for the plaintiff’s actual financial losses to punish parties for behavior deemed malicious, reckless, or willfully negligent. Insurers typically do not absorb responsibility for such punitive awards through commercial and general liability insurance policies or professional liability insurance coverage because that could undermine incentives for business owners’ policyholders to operate safely. It helps keep rates reasonable while still defending business owners against standard claims. Coverage remains intact for court-adjudicated damages meant to fairly offset proven losses from unintended incidents.

Key GL Insurance Terms to Know

Given general liability insurance plays a pivotal risk management role, small business owners need to understand some common terms associated with GL policies. Key provisions that need general liability insurance include deductibles, which are the out-of-pocket amounts policyholders pay per claim before insurance reimbursement kicks in. Premiums denote the annual costs for coverage.

Limits refer to the maximum amounts on claims the policy will pay, such as per occurrence limits and aggregate limits over the policy term. Coverage territories specify where insured incidents must take place. Retroactive or prior acts dates define the earliest dates claims can originate from to qualify for back coverage. Exclusions list uninsured risks, and endorsements modify coverage. Familiarizing oneself with crucial terminology helps navigate policies effectively.

How Much GL Insurance Coverage to Buy

Determining ideal coverage levels can help small companies appropriately safeguard their businesses through general liability insurance. When deciding the amount of protection, factors to consider include the nature of operations, assets, number of employees, risks of particular services or goods, minimum requirements of contractors and clients as well as the potential size of general liability claim awards. Coverage should be ample to ensure day-to-day operations can continue even after large claims.

Business owners may consult with business liability insurance agents and brokers while assessing adequate limits, weighing the cost of higher coverage against the future costs of insufficient protection. An initial assessment of risks and assets helps establish a baseline, with the option to re-evaluate annually as the business needs general liability insurance more or the company either grows or modifies its offerings. Appropriate amounts need general business liability insurance can vary by industry but commonly fall within the $1 million to $5 million range.

Additional Optional GL Insurance Coverage

Beyond standard general and liability insurance coverage, other supplemental insurance options exist. For instance, professional liability/errors and omissions insurance protects certain service-based firms from claims over negligent acts, errors, or poor advice. Liquor liability insurance coverage applies if serving or selling alcohol.

Property damage legal and general liability insurance cover or general liability insurance extends protection to losses clients’ property suffers due to business operations. If renting vehicles or equipment as part of operations, non-owned commercial auto and general liability insurance cover or equipment floater coverage may apply. Employment practices and general liability insurance cover cover safeguards against employee-initiated claims like wrongful termination or discrimination. Pollution and general liability insurance cover offer protection from environmental remediation costs if contaminants disseminate. These extensions can provide more comprehensive safeguards if certain exposures require cover.

General Liability Insurance Cost and How to File a Claim

If a mishap occurs, triggering potential general liability or professional liability insurance coverage, it is important for small businesses to know the proper steps to file an insurance claim. First, contact one’s insurance agent or broker immediately. They can guide filing paperwork and advise on the next moves. Have facts prepared about the date, location, and detailed circumstances of the incident. Gather evidence like photos, receipts for response activities, and contact information of any injured parties making claims.

Cooperate fully in investigations and negotiate in good faith. Do not admit or deny fault without authorization. Meet all reasonable insurer requests. Claims processing follows under policy provisions and applicable law. Payment for covered damages helps make claimants whole with minimal impact on the business. Questions about coverage, appeals process, and responsibilities can go to the agent.

Conclusion

Wrapping up and acquiring suitable general liability insurance coverage offers invaluable benefits small companies need to responsibly handle inherent business risks. From protecting commercial property to professionals who need general liability insurance coverage safeguarding against third-party lawsuits, GL coverage lightens stressors for low-risk businesses that could drag down operations or even threaten survival. While upfront premium costs must be weighed against potential future liability awards, the protection is a prudent investment for firms dealing with customers, vendors, contractors, or tenants.

No entity operates without vulnerabilities, so this business insurance and owner’s policy insurance policy strengthens continuity ability. Keeping business insurance and owner’s insurance policy optimized via periodic choices like raising limits, adding new supplementary protection, or changing insurers assists risk management efforts. With smart guidance from an expert broker, all businesses can access financial protection and safeguarding to focus on sustainable growth.