What is a wholesale insurance broker?

What is a wholesale insurance broker? | Insurance Business America

Guides

What is a wholesale insurance broker?

A wholesale insurance broker plays a key role in helping clients find cover for hard-to-place risks. Find out what this job entails in this guide

A wholesale insurance broker plays an important part in helping retailers access coverage for complex risks. This kind of partnership not only benefits both parties, but the insurance buyers as well.

In this article, Insurance Business highlights the crucial role wholesale insurance brokers play in the insurance-buying process. We will discuss the benefits these industry professionals bring to the table and how they differ from other types of brokers. We will also give you a rundown of what to consider when searching for a partner wholesaler. Read on and find out everything you need to know about what a wholesale insurance broker does in this guide.

A wholesale insurance broker is an industry professional who acts as an intermediary between a retail broker and an insurance carrier. These sales professionals rarely interact with insurance buyers. Instead, retail brokers turn to them for policies that cover hard-to-place risks and sell these to their clients.

According to the International Risk Management Institute (IRMI), wholesale brokers often specialize in one line of coverage or “in a line of coverage that’s unusual.” This gives them easier access to unconventional insurance markets, which is crucial when dealing with difficult-to-place risks.

To give you an idea of how the wholesale-broker-retail-broker dynamics play out in the insurance-buying process, here’s an illustration:

Let’s say a client searching for specialized coverage – tree surgeon insurance, for example – approaches a retail broker. If the retail broker doesn’t have access to an insurer that writes this form of coverage, they can tap the services of a wholesale insurance broker.

The wholesaler then obtains coverage and quotes for this type of policy, which the retail broker can present to their client. The insurance buyer then can make a pick, and the retailer can close the sale.

IRMI categorizes wholesale insurance brokers in two types. These are:

1. Surplus lines brokers

These brokers carry special licenses that allow them to access policies for highly complex risks that traditional insurers aren’t willing to cover. They can act either as a wholesale broker or retail broker and offer products from surplus lines specialists, which are sometimes called non-admitted insurers.

2. Managing general agents (MGA)

This specialized type of insurance broker or agent operates on the insurer’s behalf while also working closely with clients to meet their needs. These professionals are sometimes referred to as managing general underwriters (MGUs). What sets MGAs apart from other types of brokers is the binding authority granted to them by the insurance companies.

The main difference between a wholesale insurance broker and a retail broker is the type of clients they serve.

Retail insurance brokers are client-facing professionals. This means that they work closest with the insurance buyers, guiding them in their search for the best possible coverage. These insurance professionals also often handle less complex policies that cover common risks.

Wholesale insurance brokers, meanwhile, provide coverage for more specialized risks. Retailers typically turn to them for policies that cover more complex risks. As a result, they rarely interact directly with insurance buyers.

By establishing a partnership with a wholesale insurance broker, retail brokers get the chance to greatly enhance the value of their offerings. Global insurer Zurich lays down the three key areas where wholesale brokers continue to add value:

1. Expertise

Wholesale brokers boast years of experience in their areas of specialty. This deep industry expertise enables them to access favorable policy terms and conditions for hard-to-place risks, while minimizing costs.

For more complex risks that require multiple insurers, wholesalers can play a vital role in program design, using their expertise to ensure consistency and eliminate coverage gaps.

“As the market becomes more dynamic, it may be worthwhile to align with an established wholesale broker who has been there through soft and hard markets,” Zurich notes.

2. Speed and efficiency

Apart from non-admitted carriers, many wholesale insurance brokers work with conventional insurers and reinsurers. These carriers rely on the wholesaler’s expertise to bring them appropriate risks and provide the necessary information to help them make sound underwriting decisions.

“Experience shows that wholesalers are able to go to the market more quickly because of their flexibility and open structure,” Zurich explains. “These brokers often have better access to certain insurance markets and that access may prove very beneficial when dealing with difficult-to-place risks.”

3. Strong relationships

A strong relationship with a wholesale broker can contribute to a retailer’s long-term growth. This is because such partnerships also allow retailers to establish solid relationships with clients, which can help attract new customers.

“As an intermediary, wholesalers focus on relationships with both retail brokers and carriers,” Zurich notes. “Because wholesalers are capable of helping place business in both soft and hard markets, they are an important part of the excess and surplus insurance equation.”

Links to the London market

The London insurance market also has very close ties to wholesale brokerage practices around the world. It’s one of the world’s leading centers for complex commercial and specialty risks, controlling more than £55 billion ($66.4 billion) in gross written premium in 2021, according to the UK Financial Conduct Authority (FCA).

“Given the size of the wholesale insurance sector and the type of large-scale risks it covers, the way it functions can have a wide-ranging impact on the broader economy,” explains Christopher Woolard, EY partner and former FCA chair of review of change and innovation in the unsecured credit market. “If businesses cannot get appropriate cover or pay more for services than they should, it can impact on their ability to operate and grow. Brokers play an important part in the wholesale insurance sector, ensuring clients get appropriate coverage at good value.”

Andrew Walsh, CEO at Lloyd’s wholesale broker Citynet, adds: “The beauty of having a wholesaler [linked to the London market] is that the broker can simply pass on a small piece of business to us and say – you guys know what you’re doing, sort it and come back and tell us how much it is.

“Even if as a broker you don’t have a huge amount of business, what you get when you come to a wholesaler is you’re buying into that collective muscle and buying power that we’re putting into the market. Even if you’re a small fish, you can actually benefit from what other brokers are placing with us.”

The most common way wholesale insurance brokers get paid is through the commissions they receive from retailers. The rate varies depending on a range of factors, including the type of coverage, the insurance provider, and state regulations.

Insurance brokers can also earn an income in different ways. These include:

Broker salaries: Most insurance brokers, particularly those working in insurance brokerages, receive regular wages. If you want to get an idea of how much insurance brokers earn in salaries, you can check out this guide.

Broker fees: Some insurance brokers offer consultative and advisory services, which come with a corresponding fee. Just like commissions, these are often state-regulated.

Profit sharing: Insurers may also give insurance brokers bonuses if they reach a certain profit target.

Wholesale insurance brokers play a key role in helping retailers find coverage for hard-to-place risks. This involves:

informing retailers about the different coverage options, along with key exclusions

negotiating rates and policy inclusions on behalf of the retail agent or broker

providing underwriters with the necessary information to help them make sound decisions regarding coverage

helping design insurance programs for more complex risks

Insurance brokers primarily serve as a representative of the consumers. These industry professionals help buyers evaluate their risks and assist them in getting the right policies based on their risk profiles and financial resources. Some states also impose fiduciary duties on brokers. This means that they are legally bound to act only in the best interests of their clients.

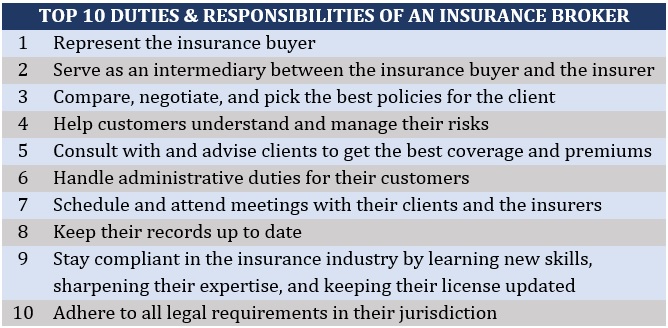

The table below lists some of the top duties and responsibilities of an insurance broker:

One of the biggest reasons why a career as an insurance broker is worth pursuing is the chance to change people’s lives for the better. The sense of fulfillment this career path provides is just among the several factors that make the profession rewarding. Here are some of the benefits of choosing a career as an insurance broker:

Challenging and rewarding work: Insurance brokers face challenges that require them to think creatively and provide innovative solutions. This results in a gratifying feeling at the end of the day.

Strong earning potential: A career as a wholesale insurance broker offers great compensation with high potential for growth.

Job security: Because people will always need insurance to protect their assets, the services of an insurance broker will likewise remain in high demand.

Career progression: The insurance sector offers several opportunities for professionals to continuously develop new skills to help them flourish and grow in their careers.

Social relevance: Insurance brokers have the chance to help people overcome hardships, be it replacing lost investments and possessions or helping them recover from losing a loved one.

Continuing education: Insurance professionals are encouraged to pursue educational opportunities to keep their skills and knowledge updated and continue moving up careerwise.

Insurance jobs are always on demand. If you’re looking to enter the industry or want a fresh start to your career, we have compiled a list of the top websites to search for insurance jobs to assist you.

Our Best in Insurance Special Reports page lists the leading wholesale insurance brokers in the country providing top-notch services. The brokerages featured in our special reports were handpicked by their peers and vetted by our panel of industry experts as dependable and trusted market leaders.

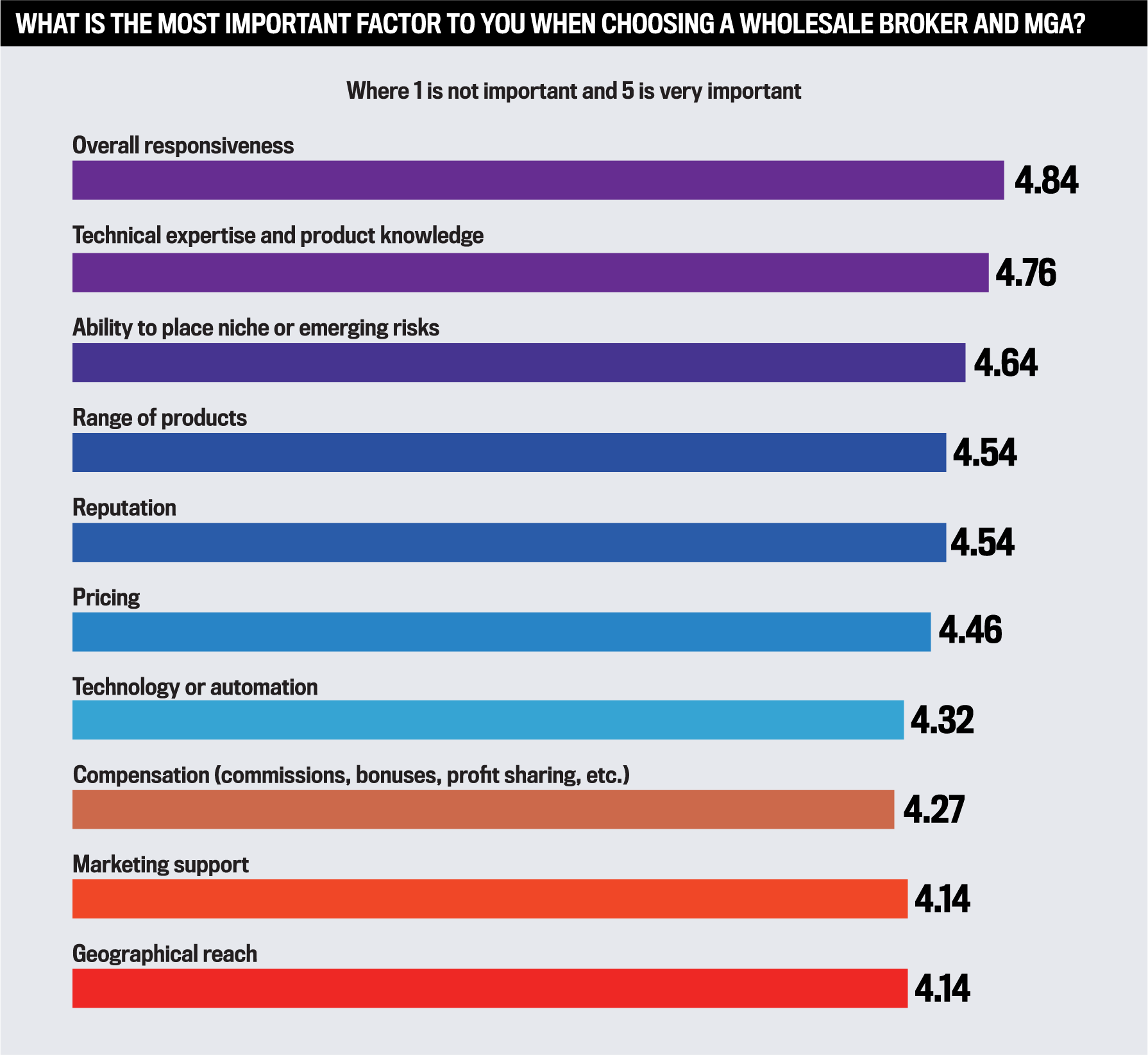

To find the top wholesale insurance brokerages for this year’s list, Insurance Business America conducted a survey asking retailers to rate the performance of each wholesaler based on 10 factors. These variables are listed in the table below and arranged by what retailers consider as most important.

Based on the retail brokers’ responses, IBA ranked the top three winners for each type of insurance and awarded them gold, silver, and bronze medals. The four insurance products that received the most votes from brokers were also awarded the Brokers’ Pick medal.

Do you have any experience working with a wholesale insurance broker that you want to share? We’d love to see your story in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!