What Is a Hold Harmless Agreement?

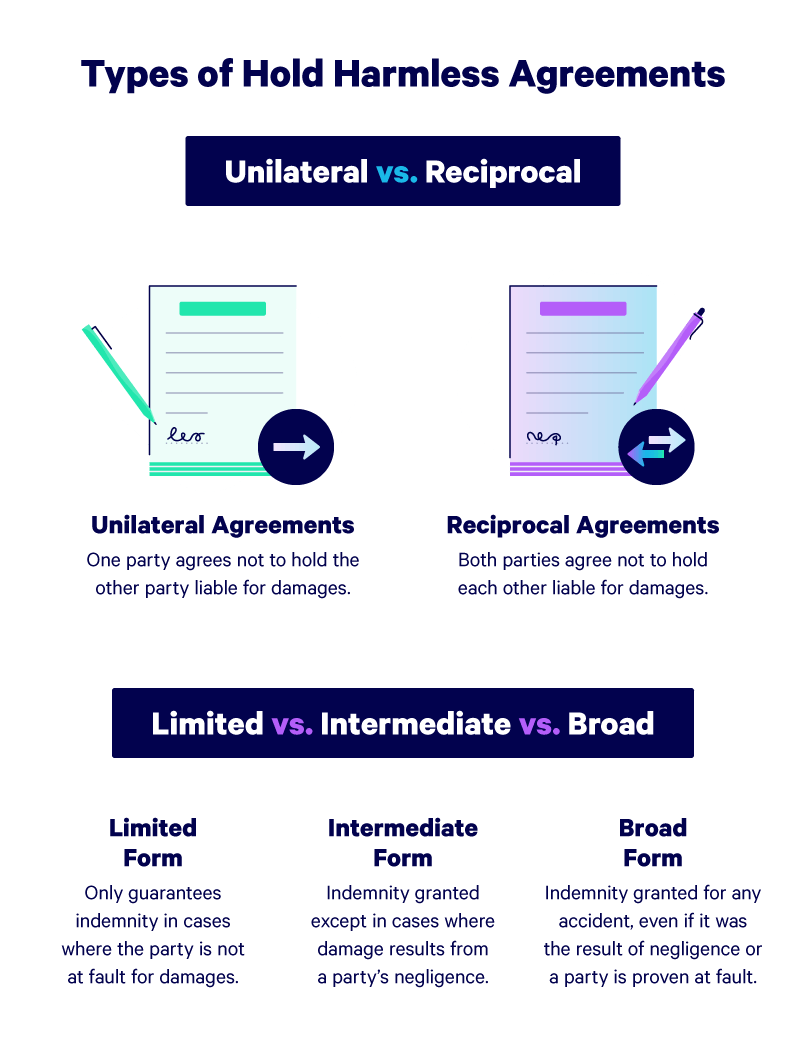

A “hold harmless agreement,” sometimes called an indemnification agreement or indemnity clause, is a contractual statement in which one or both parties agree not to hold the other party responsible for damages that occur while doing business. Hold harmless agreements can be unilateral (one party waives their right to sue and the other party is protected from being sued) or they can be reciprocal (both parties waive their right to sue the opposite party, and both parties are protected from lawsuits).

These agreements are most common in industries that involve more risk, like construction, event planning, hospitality, and outdoor recreation. However, there are plenty of cases where small businesses and startups would benefit from the protection of a hold harmless agreement.

Here we’ve broken down everything you need to know about hold harmless agreements and how (and when) to use them for your business. You can also download our hold harmless agreement template to use yourself.

Types of Hold Harmless Agreements

There are three “levels” of hold harmless agreements, each of which waives a different level of liability. In order from most to least protective, the three types of indemnity agreements are broad form, intermediate form, and limited form.

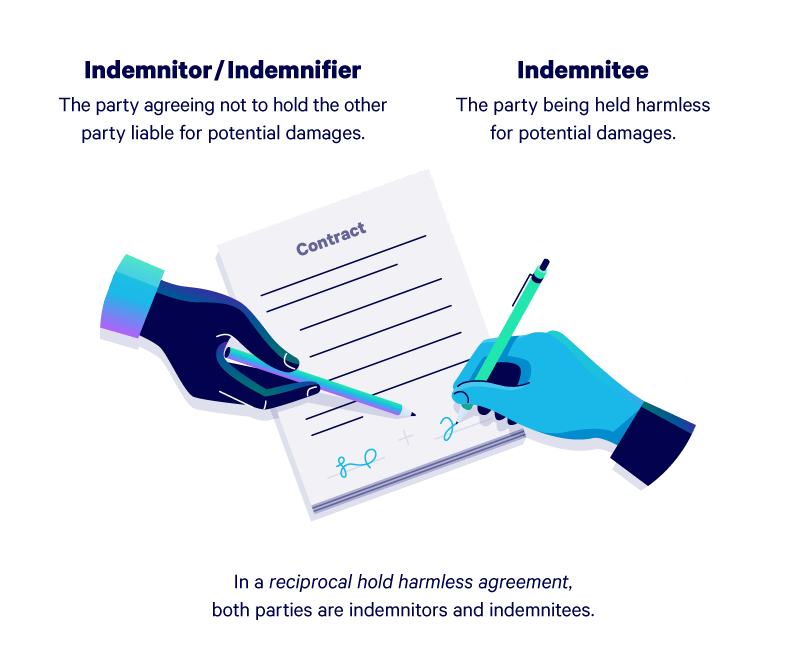

In the explanations below, we will refer to parties as either indemnitors or indemnitees. The indemnitor is the party waiving their right to hold the other party responsible for damages. The indemnitee is the party whom the agreement protects against liability for potential damages.

Broad Form

The most protective type of hold harmless agreement is a “broad form” agreement. When signing a broad form indemnity clause, the indemnitor agrees to hold the indemnitee harmless for any damages that arise in the course of doing business, regardless of which party is negligent.

Intermediate Form

In intermediate or moderate form indemnity agreements, the indemnitor waives their right to hold the indemnitee responsible for damages that arise due to the indemnitor’s negligence or negligence on the part of both parties.

Limited Form

The strictest type of hold harmless agreement is the limited form, in which the indemnitor waives their right to hold the indemnitee liable only for damages that arise due to the indemnitor’s own negligence. If damages arise due to shared negligence, typically the indemnitor’s liability will be limited to whatever degree the courts determine the indemnitor was negligent.

Are All Hold Harmless Agreements Enforceable?

In a word, no. Thirty-nine states have anti-indemnification laws prohibiting one or more forms of hold harmless agreement. Some of these laws only apply to certain industries, while some differ according to whether a contract is private or public.

Never sign a hold harmless agreement before having an attorney verify that it’s enforceable.

Broad form hold harmless clauses are prohibited in the 39 states listed below. The 25 bolded states prohibit both broad and moderate form indemnity agreements.

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Massachusetts

Maryland

Michigan

Mississippi

Missouri

Montana

Nebraska

New Hampshire

New Jersey

New Mexico

New York

North Carolina

Ohio

Oklahoma

Oregon

Rhode Island

South Carolina

South Dakota

Tennessee

Utah

Virginia

Washington

West Virginia

When to Use a Hold Harmless Agreement

You should consider adding an indemnity agreement any time you’re entering into a contract in which you could be held liable for damages, injuries, or delays.

It’s easy to see why hold harmless clauses are so common in construction, where accidents happen frequently and minor things like supply issues or poor weather can cause costly delays. However, there are also many situations where a startup or small business might also use an indemnity agreement.

Hiring or Working as a Contractor

A hold harmless agreement may be useful when you partner with another company on a project. Whether or not you need a hold harmless agreement depends on how potentially damaging a mistake or delay could be.

For example: a small business hires a videographer to create a local television commercial, but the designer’s equipment is stolen shortly thereafter, delaying completion of the commercial. This delay is unlikely to have a costly impact on the small business.

However, if that videographer had been working on a commercial for the Super Bowl, an equipment robbery could prevent the commercial from being completed in time to air on game day. Since the client likely paid multiple millions of dollars for that advertising slot, the question of who is liable for those costs is much more pressing. A hold harmless clause signed beforehand will help sort out who is responsible.

Leasing a Property

If you’re operating a business from a leased property, your business owners’ insurance will cover things like slip-and-falls or property damage. But if the damage arose from the negligence of the property owner—say, neglected maintenance led to an electrical fire or a break-in occurred after the owner put off fixing a lock—then the damages should be covered by the property owner’s insurance.

Hold harmless agreements protect all parties involved in a lease, including the owner. Particularly when a building has multiple units, liability can get complicated. For example, let’s say an office in a building with four units floods over the weekend after an employee leaves a faucet running. But since the bathroom is in a hall shared by two companies, it’s unclear whose employee is responsible. To complicate matters further, it turns out that the maintenance company that’s contracted to check the building each Saturday skipped the property this weekend without informing the owner.

In a complex situation like this, hold harmless agreements should have been included in each tenant’s lease as well as in the contract between the building owner and the maintenance company. This will protect all parties involved and ensure the correct party or parties are held liable for the appropriate portion of the damages.

Hosting an Event

Special events like conferences or banquets involve a hefty amount of risk. A small vendor error can leave you stranded on the day of the event without something crucial, like food. If you’re renting the event space, the same risks involved with leasing a property also apply to the circumstances of your event.

Most importantly, issues that are normally covered by general liability insurance—like an individual injury or accidental property damage—won’t always be covered if they occur during an event. Special event insurance can be purchased in small increments, so you only pay for coverage on the days of the event.

When events involve some type of risky activity, like a company retreat or adventure activity, you should have attendees sign liability waivers as well. Many states consider these waivers too broad to be enforceable, but even in these states liability waivers can be effective so long as they’re drafted properly and the terms are well-defined.

Benefits and Things to Look Out For

The protective benefits of a hold harmless agreement are obvious, as they prevent parties from being held responsible for damages they didn’t cause. However, there are several other advantages to indemnity agreements as well:

Lower legal expenses: not only do hold harmless agreements prevent your company from being sued, they also simplify legal proceedings when matters do go to court. Less court time means less billable hours for your attorney.

Fewer insurance claims: without a hold harmless agreement, your company may be held liable for damages that are covered by your insurance policy. While this will protect you from paying damages out of pocket, your premiums will also increase with each additional claim.

Less risk of reputational harm: when liability for damages is unclear, lawsuits take more time and garner more public interest, which can be damaging to your company’s brand. Hold harmless agreements help settle liability issues quickly and quietly.

Be aware, however, that contracts that involve hold harmless agreements can sometimes invalidate coverage from your existing liability policies. Make sure you’re aware of all of the coverage exclusions included in your insurance policies, including contractual liability exclusions, which invalidate coverage for damages that result from working with a third-party contractor. If you work with third-party vendors frequently, you can cover these contracts with third-party liability insurance.

It’s essential to have an attorney review hold harmless agreements before you sign them. In situations where liability is likely to be tricky, it’s best to have an attorney draft a hold harmless agreement for you. Additionally, you should also review hold harmless agreements with your insurance broker before signing, and ask for a thorough outline of what potential losses would not be covered by your policy. Performing a thorough review ahead of time gives you the opportunity to purchase additional coverage if necessary, which will always be less expensive than getting stuck paying for damages on your own.