What Illnesses Affect Mortgage Protection?

Once upon a time Johnny got a life insurance quote.

His quote was €26 per month.

Feeling happy with that quote, Johnny thought,

I’ll have a bit of that

and hit the apply button.

Three days later, the insurer offered him cover at €39 per month!

You see, Johnny wasn’t as healthy as he thought.

He wondered what illnesses affect mortgage protection?

Johnny should have read this blog first!

Getting Life or Mortgage Insurance if you have Health Issues

Health issues are the main reason an insurer will increase your life insurance premium.

Here are the top 10 reasons you’ll pay more for your life insurance, starting with smoking (which isn’t a health condition, I know, but it’s the number one reason insurers increase premiums):

1. How Smoking Affects Mortgage Cover?

Smokers die younger and get more illnesses than non-smokers.

If you’re a smoker, you’re well aware of this, and you know you should stop.

But then there’s the whole addiction thing.

As an ex-smoker, I know how hard it is to give up for good.

Paying more for your life insurance won’t make you quit, but hopefully, it will add to the list of reasons you should quit—the straw that finally broke the camel’s back, if you like.

Anyway, you’ll pay around double the price of non-smokers for your life insurance.

But what if I only have the occasional cheeky one when I’m out?

I’m not going to get into a moral argument about how far you should push the truth on your life insurance form.

All I can say is if you smoked in the last 12 months, you are a smoker in the eyes of the insurance.

What about e-cigarettes and life insurance?

The insurers will charge you full smoker rates if you use any kind of “crutch” to help you quit. And this includes 0% nicotine vapes.

You’ll pay twice as much as a smoker.

By the way, if you intend to quit after you take out your policy, make sure you choose an insurer that will reduce your premium when you quit.

How Smoking Affects Life Insurance Premiums

2. Will High Blood Pressure Increase Your Premium?

Hypertension is a common condition in Ireland.

It’s one you can control through medication and a change in diet, exercise and lifestyle.

Most insurance companies won’t charge extra if your blood pressure is under control with medication.

If you let us apply to the most sympathetic insurer, you’ll get you the normal price.

Life Insurance and High Blood Pressure.

3. Asthma

Again, if you’re managing your asthma well, the insurer won’t increase your premium.

But if you’re not keeping your asthma under control, the insurer will classify you as a higher risk.

Higher risks atrracts higher premiums.

Life Insurance with Asthma

4. How Depression / Anxiety / Stress Affects Your Application?

Severity is all important when it comes to mental health issues.

Mild : If you suffer with mild anxiety, you’ll get the normal price.

Moderate : If you’re on medication for long term depression, the insurer will increase your premium

Severe : If you have been hospitalised on more than one occasion because of your mental health, you might not be able to get cover at all, unfortunately.

Mild mental health issues = standard price

Moderate mental health issues = increase in premium

Severe, recent mental health issues = decline or postpone

Life Insurance with Depression

5. High Cholesterol

Insurers are concerned because high cholesterol can contribute to many life-threatening health conditions.

But like high blood pressure, if it’s well-managed you’ll pay the normal price.

Life Insurance with High Cholesterol

6. Heart Disease

There’s no getting around this one; heart disease will trigger special terms on your life insurance premium.

You will pay more for your cover and if you have heart disease.

If you’re a young male (under 40) with heart disease, you will struggle to get cover especially if there are any other complicating factors like smoking, obesity, hypertension or raised cholesterol

How to be Financially Healthy if you’ve got Heart Disease

7. History of Cancer

Like heart disease, it’s difficult to avoid a loading if you have had a history of cancer.

Although from December 2023, if you are in remission and off treatment for over 7 years, you will be able to get the standard price for mortgage protection up to €500,000.

We look at this in detail here: The Right to be Forgotten For Cancer Survivors in Ireland

If you are less than 7 years post treatment, please choose your insurer wisely because some are much stricter than others when it comes to underwriting.

Insurer A may increase your premium temporarily while insurer B may charge you a higher price for the whole term of your policy which will cost you a fortune.

This is why it’s so important to use a broker who deals with all the insurance companies.

Doing so will give you the best chance of getting the lowest price.

8. High BMI/Obesity

Insurance companies use your body mass index (BMI) when determining whether to increase your premium due to your weight.

It’s not perfect but we’re stuck with it.

If your BMI is less than 32, you’ll get the normal price at one of our insurers.

However, if your BMI is >32, you will have to pay more for your cover.

What if I lose weight?

If you lose weight in the future, you can contact your insurance company to review your premium or reapply to another insurer if they don’t play ball.

Unfortunately if you BMI is over 50 for males, and 55 for females, all of the insurers will decline your application

Am I Overweight for Life Cover?

9. Should you be Concerned by Your Family History?

As the saying goes, you can pick your friends but not your family.

This rings true in relation to life insurance too.

Your family history has long been recognised as an important factor in identifying the chances of you suffering a disease during your lifetime.

This is why the health of your parents and siblings is taken into consideration when underwriting your application.

Please be aware that the insurer cannot take a genetic test result into consideration, either positive or negative.

If you have a history of cancer or a hereditary condition like cardiomyopathy, please use a specialist broker to shop the whole market, don’t just apply to the first insurer who flutters their eyelids at you.

Some insurers are more sympathetic to a particular family history than others.

How Does Illness in my Family Affect Life Insurance?

10. Diabetes

All of the insurers are very strict when it comes to Diabetes.

Their concern is the risk of developing additional conditions with poorly controlled Diabetes.

Therefore of you have diabetes you will pay more for your life insurance (unless you have Type 2 and your control is exemplary)

Generally people with Type 1 Diabetes will pay more than someone with Type 2.

Insurance underwriters look favourably on your application if your diabetes is well-controlled evidenced by low HbA1c readings. The higher the HbA1C reading, the more you will pay for your cover.

Getting Life Insurance if you Have Diabetes

Conclusion | What Illnesses Affect Mortgage Protection Premiums?

Some of the listed health issues can’t be avoided and can be hard to manage so I do feel for you.

It’s not fair that you’re being punished for something outside of your control.

But if you can show you are manging well with the help of your doctor, you can limit the impact on your mortgage protection premiums.

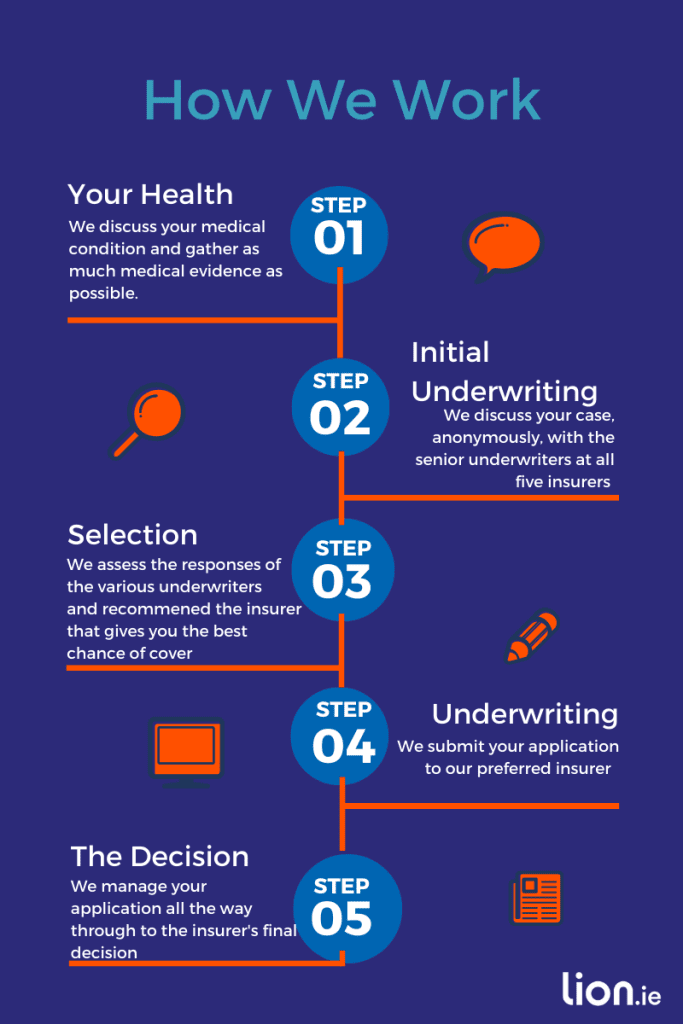

I’m biased but the best way to ensure a lower life insurance premium is to use an advisor who can approach all the insurers on your behalf.

All the providers underwrite health conditions differently – one may hit you with a massive loading, but another could offer you the normal price (or a lower loading)

If you’re concerned about a health condition, please complete this questionnaire so I can help you.

Over to you

So that’s the top 10 conditions we advise on, if you want a list of all the conditions we help with, you can find them here

Remember if you get a mortgage protection quote online, the calculator will assume you’re in perfect health.

That’s why we have a medical questionnaire on our quote system.

You complete it before you apply and we’ll get you an accurate quote based on YOUR HEALTH.

This prevents any nasty surprises when you get your final quote.

We know which insurer to apply to depending on your health history.

Applying to the wrong insurer could result in an unnecessary premium increase or even worse, a decline or postpone.

This will make it much more difficult to get the normal price at another insurer.

So make sure you apply to the most sympathetic insurer first time around.

Need some help finding the correct insurer?

Give me a quick outline using this form below and I’ll be right back.

Thanks for reading

Nick

lion.ie | Protection Broker of the Year 🏆

Editor’s Note : We first published this blog in 2017 and have updated it regularly since