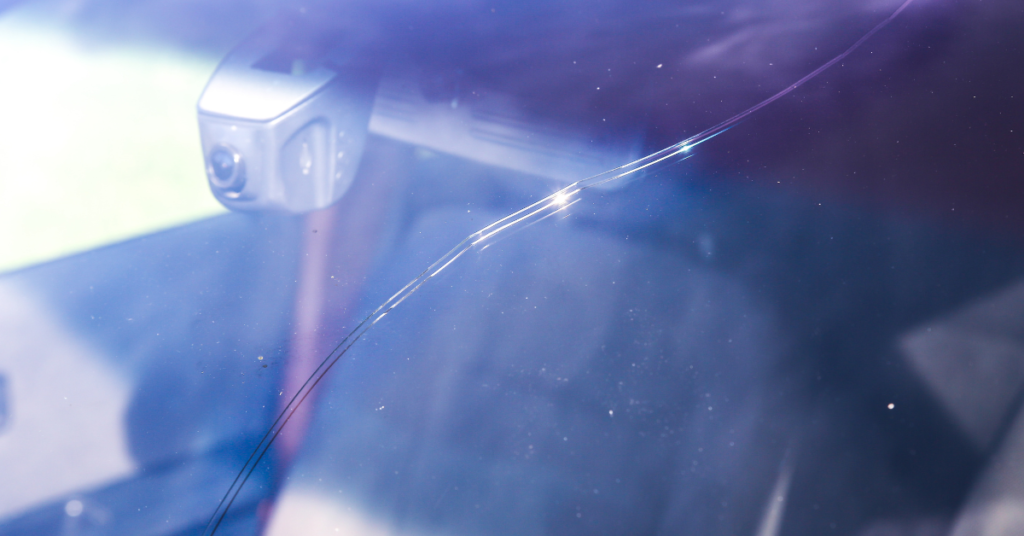

What Does Insurance Cover for Windshield Scratches?

Your auto insurance policy might cover windshield scratches, but you’ve got to check the specifics. All-encompassing coverage usually handles non-collision incidents like these, minus the deductible, if applicable. However, the extent of coverage, including deductibles and exclusions, varies widely. Some policies offer full repair coverage with no out-of-pocket cost for you, distinguishing between repair and replacement regarding coverage and cost implications. It’s vital to scrutinise your policy’s fine print to understand the coverage offered for windshield scratches fully. This precise examination guarantees you’re adequately informed about what protection your auto insurance provides, hinting at further insights into maximising this aspect of your policy.

Key Takeaways

– Coverage for windshield scratches is included under comprehensive or specific windshield repair clauses in car insurance policies.

– Some policies offer full coverage for windshield repair with no deductible, while others may require a deductible.

– The extent of coverage, deductibles, and exclusions can vary, so it’s important to scrutinise the policy’s fine print.

– Policies may differentiate between repair and replacement, affecting the costs covered by insurance.

– Thorough coverage provides a safety net for windshield scratches, but it’s essential to confirm the details within your specific insurance policy.

Understanding Windshield Coverage

Understanding your car insurance policy’s windshield coverage is essential for determining its capability to handle repairs or replacements due to scratches. This coverage is typically outlined under thorough or specific windshield repair clauses, focusing on non-collision incidents that result in windshield damage. You need to scrutinise your policy’s fine print to ascertain the extent of coverage, deductible amounts, and any exclusions that may apply.

Thorough coverage, for instance, usually covers glass damage but the specifics can vary immensely between policies. Some insurers offer full coverage for windshield repair with no deductible, recognizing the safety implications of maintaining clear visibility. Others may require you to pay a deductible, which could influence your decision to claim minor scratches. It’s vital to understand whether your policy distinguishes between repair and replacement, as costs and coverage can differ markedly.

Analysing your policy’s details allows you to weigh the financial implications of filing a claim for windshield scratches. You’ll be equipped to make informed decisions about whether to proceed with a claim or handle the repairs out-of-pocket, based on deductible costs and potential impacts on your insurance premiums.

Types of Auto Insurance

Having explored the specifics of windshield coverage, it’s crucial to examine the broader landscape of auto insurance types to fully grasp your policy’s protections and limitations. Auto insurance encompasses various forms, each designed to address distinct aspects of vehicle ownership and operation.

Liability insurance, a mandatory element in most jurisdictions, covers damages or injuries you may cause to others in an accident. It’s split into two categories: bodily injury liability and property damage liability. These components don’t cover your vehicle’s damages but protect you from financial liabilities towards third parties.

Collision insurance steps in to cover damages to your vehicle resulting from collisions, regardless of fault. This type ensures repair or replacement costs are covered, minus your deductible, in the event of an accident with another vehicle or object.

Personal injury protection (PIP) and medical payments (MedPay) coverage are designed to handle medical expenses for you and your passengers after an accident. While PIP also covers additional losses such as lost wages, MedPay focuses strictly on medical and funeral expenses.

Each type of auto insurance plays a critical role in your financial protection strategy, offering a web of coverage that shields you from diverse risks on the road.

Comprehensive Coverage Explained

Extensive coverage forms an essential part of your auto insurance policy, safeguarding you against non-collision incidents such as theft, vandalism, and natural disasters. This coverage is pivotal when addressing windshield scratches, especially if they result from factors beyond your control. Comprehensive insurance is designed to cover the repair or replacement of your windshield, without necessitating a collision to activate the coverage.

When considering thorough coverage for windshield scratches, it’s crucial to understand its scope:

Deductibles: Before your insurance steps in, you’re responsible for a deductible. This is the amount you pay out-of-pocket towards the repair or replacement of your windshield. The lower your deductible, the higher your premium, and vice versa.

Limits of Coverage: Your policy will have a limit, which is the maximum amount your insurer will pay for a covered claim. It’s indispensable to ensure your coverage limit is adequate to cover the potential cost of windshield repairs or replacements.

Exclusions: Certain situations or types of damage mightn’t be covered under your thorough policy. It’s crucial to review your policy’s exclusions to avoid surprises when filing a claim.

In essence, thorough coverage provides a safety net for windshield scratches, but it’s imperative to understand the specifics of your policy to fully leverage its benefits.

Liability Insurance Limitations

While full coverage addresses a variety of non-collision damages, liability insurance won’t cover the costs of repairing or replacing your windshield if you’re at fault in an incident. Liability insurance, fundamentally, is designed to cover the expenses related to the damage or injuries you cause to others in an accident, not the damages to your own vehicle. This means that if you’re responsible for an accident that results in damage to another party’s property or their physical well-being, your liability insurance will step in to cover those costs up to the limits of your policy.

However, when it comes to your own vehicle’s damages, such as windshield scratches or cracks, liability insurance offers no protection. This limitation underscores the importance of understanding the scope of your auto insurance coverage. For windshield damages, you’re typically looking at either full or collision coverage, depending on how the damage occurred. It’s vital to review your policy details and confirm the coverage types you’ve selected. This way, you can make certain you’re adequately protected against potential windshield damage and avoid unexpected out-of-pocket expenses.

Collision Coverage Insights

Understanding the limitations of liability insurance for windshield damage underscores the importance of exploring how collision coverage can offer protection in such scenarios. Collision coverage, distinct from liability insurance, is designed to cover the cost of repairs or replacement of your vehicle’s windshield if it’s damaged due to a collision, regardless of fault. It’s imperative to dissect the protective measures this type of coverage entails for windshield scratches specifically.

Here are three pivotal insights:

Scope of Coverage: Collision coverage typically extends to damages incurred during an accident involving another vehicle or a stationary object. This means if your windshield is scratched as a result of such an incident, the costs for repair or replacement can be covered.

Claim Process: Filing a claim for windshield damage under collision coverage requires an assessment of the damage by an insurance adjuster. The precision in documenting the scratch’s extent and cause is crucial for claim approval.

Coverage Limitations: It’s crucial to understand that collision coverage isn’t a blanket policy for all types of damages. Exclusions may apply based on the policy terms, necessitating a thorough review to ensure windshield scratches fall within the covered perils.

Navigating the technicalities of collision coverage emphasises the importance of being well-informed to secure the right protection for windshield scratches.

Deductibles and Windshield Repair

When considering windshield repair, it’s important to factor in the role of deductibles and how they can influence out-of-pocket costs. Deductibles are the amount you’re responsible for paying before your insurance coverage kicks in. In the context of windshield repair, this means that if the cost to repair the scratch is less than your deductible, you’ll be paying entirely out of pocket.

It’s vital to understand your policy’s specifics, as some insurance providers offer glass coverage with no deductible for repairs, while replacements may still require a deductible. This distinction greatly impacts your decision-making process, especially when evaluating the cost-effectiveness of proceeding with a repair versus a replacement.

Moreover, the type of coverage you have plays a pivotal role. Extensive coverage often includes glass repair, but the applicability of deductibles can vary. Hence, thoroughly reviewing your policy or consulting with your insurance agent is essential to navigate these nuances.

Analysing the cost of repair in relation to your deductible is a technical calculation that requires precise consideration. If the repair cost is marginally below or above your deductible, it may influence your decision on whether to claim the repair or pay out-of-pocket, sans involving your insurance.

Filing a Windshield Claim

Having assessed the impact of deductibles on your decision to repair or replace a windshield, it’s now important to navigate the process of filing a windshield claim with your insurance provider. The path to successfully lodging a claim is fraught with technical details and procedural nuances that can greatly influence the outcome.

Here are three critical steps to follow:

Document the Damage: Begin by meticulously documenting the extent of the windshield damage. This involves taking clear photographs from various angles and noting any circumstances that led to the damage. Precise documentation can expedite the assessment process by your insurance company.

Review Your Policy: Before initiating a claim, it’s essential to thoroughly review your insurance policy. This step involves identifying specific clauses related to windshield damage, understanding coverage limits, and determining if your policy includes comprehensive coverage, which typically covers such damage.

Contact Your Insurance Provider: With documentation in hand and a clear understanding of your policy, the next step is to contact your insurance provider. This process typically involves filling out a claim form, either online or over the phone, and providing all necessary documentation.

Navigating these steps with precision and attention to detail can streamline the claims process, ensuring you receive the coverage you’re entitled to without unnecessary delays.

Preventing Windshield Damage

To effectively prevent windshield damage, regularly inspecting and maintaining your vehicle’s glass surfaces is essential. This proactive approach involves a meticulous examination for minor chips and scratches, which, if left unaddressed, can escalate into more substantial, irreparable issues. Employing a high-quality glass cleaner removes debris and reduces the risk of scratches caused by abrasive particles. It’s also vital to utilise soft, microfiber towels to avoid inflicting damage during the cleaning process.

Moreover, installing windshield protection film acts as a barrier against the elements and road debris, greatly reducing the likelihood of scratches and chips. This thin, transparent layer doesn’t compromise visibility but provides a durable shield. Parking strategies play a pivotal role; opting for shaded or covered areas minimises exposure to environmental factors such as hail or falling branches that can cause sudden impacts. Finally, maintaining a safe distance from vehicles, especially on highways where the projection of stones and debris is common, is imperative for minimising direct hits to your windshield.

Adhering to these strategies requires a disciplined and informed approach but ultimately extends the lifespan of your windshield and enhances driving safety.

Frequently Asked Questions

Can DIY Windshield Scratch Repair Methods Void My Insurance Coverage if They Worsen the Damage?

Yes, using DIY windshield scratch repair methods can void your insurance coverage if they worsen the damage. It’s important to check with your insurer before attempting any repairs, as policies vary widely.

How Does the Age and Model of My Vehicle Influence the Insurance Coverage for Windshield Scratches?

Your vehicle’s age and model have a substantial impact on insurance coverage for windshield scratches. Insurers evaluate risk and potential costs differently, often resulting in varied coverage terms. It’s vital to understand your policy’s specifics.

Are There Any Specific Scenarios or Types of Scratches That Are More Likely to Be Fully Covered by Insurance?

Yes, scratches caused by vandalism or accidents are often fully covered, especially if you have all-encompassing insurance. However, coverage can vary based on your policy’s specifics, including deductibles and limitations on glass repair or replacement.

How Do Insurance Companies Verify the Legitimacy of a Windshield Scratch Claim?

To verify a windshield scratch claim’s legitimacy, insurance companies typically require a detailed inspection report. They’ll examine the damage’s nature, evaluating if it aligns with your account of events, ensuring it’s not pre-existing or fabricated.

What Are the Implications for My Insurance Premiums if I Make Multiple Windshield Scratch Claims Within a Short Period?

If you file multiple windshield scratch claims in a short period, your insurance premiums might increase. Insurers view frequent claims as higher risk, which could lead to higher costs for you in the long term.

Conclusion

To sum up, grasping the intricacies of your auto insurance is crucial when dealing with windshield scratches. As fate would have it, your all-encompassing coverage usually steps in, minus the deductible, offering solace amidst the nuisance of damage.

However, don’t overlook the limitations of liability and collision coverage in such scenarios. By carefully examining your policy and promptly filing a claim, you safeguard your vehicle’s integrity.

Let this knowledge empower you to proactively mitigate potential windshield woes, preserving your peace of mind on the roads ahead.