What does a program administrator do?

What does a program administrator do? | Insurance Business America

Guides

What does a program administrator do?

Program administrators play a key role in providing coverage for hard-to-place risks. But what does a program administrator do exactly? Read on and find out

Program administrators hold a collaborative relationship with insurance carriers. While program businesses offer specialist expertise that enables insurers to cover hard-to-place risks, insurance companies provide the financial stability and resources needed to keep coverage rolling.

But what does a program administrator do exactly?

Insurance Business answers this question and more in this article. We will shed light on what these essential industry players bring to the table by going over their duties and responsibilities. We will also discuss the pros and cons of working with them.

If you want to gain a deeper understanding of how program administrators fit into the insurance scheme of things, this guide can prove handy. Read on and learn more about the vital role these industry professionals play.

Program administrators, also called PAs, provide specialist expertise for niche markets on behalf of insurance carriers. It’s impossible for carriers to underwrite risks in every field or continuously add staff to handle new programs. Program administrators play an important role in addressing these needs.

As the name suggests, program businesses take charge of the day-to-day administration of programs targeting complex risks, difficult classes, or new lines of business. Among the expertise and services program administrators offer are:

Underwriting

Policy administration

Billing

Binding

Claims management and loss control

Marketing

Premium collections

Data gathering

Risk sharing

Jack Russell, head of program sales for North America at Allianz Global Corporate and Specialty (AGCS), likened program administrators to “miniature carriers.” He added, however, that program businesses are more agile than carriers when it comes to navigating market trends and work much closer to the end-consumers.

“Insurance carriers have the opportunity, or some might say the luxury, of letting PAs bring the entrepreneurial drive,” Russell explained. “And there’s a reason they’re comfortable doing so.

“The PAs are closer to the customer, which means if there’s a problem, they have to fix it. If customer demands change, they have to change, too. The PAs have to innovate, and anyone with an eye on the business can see it happening.”

Program administrators and wholesale insurance brokers both deal with hard-to-place risks. That’s why it’s often easy to confuse them with each other.

But the biggest difference between PAs and wholesalers is the specialist expertise. A huge part of what program administrators do is specialize in niche markets, handling difficult-to-place risks and exposure.

Wholesale brokers, meanwhile, are generalists. These insurance professionals work in different areas, providing coverage that retailers need. They don’t often possess the level of knowledge that PAs have in certain niches.

Wholesalers also rarely ever work directly with insurance buyers, mostly dealing with retail brokers instead.

For program administrators, collaboration is key. They often work directly with insurance carriers, retail brokers, and consumers.

Program businesses play a key role in helping insurance companies expand their operations, particularly in challenging markets. Here are some of the benefits insurance program administrators bring to the table.

1. Specialized expertise

PAs are vital resources for agents and brokers working with clients in niche markets. Because program administrators focus on highly specialized risks, they also possess a high level of underwriting expertise when it comes to their target markets. Insurance carriers can rest assured that their program partners can evaluate risks accurately and offer underwriting authority for the business.

2. Established network

Program administrators boast an established network of specialty providers that their partner carriers can take advantage of. PAs often use these specialist networks to find the best coverage possible. This enables insurance administrators to provide customized quotes, deductibles, policy limits, and coverage features for specific needs.

3. Fast and efficient service

PAs’ deep understanding of the market allows them to cater to clients’ unique needs quickly and efficiently. It also helps that program businesses are granted underwriting, claims handling, and binding authority by insurance carriers, enabling them to streamline the process.

4. Risk management services

Also part of what program administrators do is educating policyholders on how to mitigate risks. This is helpful since PAs have a better understanding of the risks management and loss control issues impacting their niche markets. These educational campaigns are often done through informational videos, newsletters, brochures, emails, and blog posts. Program businesses can also produce resources for a specific target audience.

5. Innovation

Program administrators can use their expertise to come up with creative and innovative solutions for new and emerging risks. If their clients’ needs evolve, program businesses are often at the forefront to address these changes.

Among these developments, according to Russell, is the emergence of insurtech.

“As the industry evolves, insurance carriers are trying to pursue insurtech,” he told Insurance Business. “As they do that, they’ve got to keep the campfires lit where they are and continue doing business as usual.

“They can’t burn their boats, get over to the insurtech island, and then figure out things don’t work quite like they thought they would. It’s a world of AND, not a world of OR.

“As carriers try to figure out insurtech, they’re not necessarily investing in their own systems. This is where outsourcing to program administrators becomes very attractive. Among the many financially important roles PAs are playing, that’s certainly one of the top three. They’re allowing carriers to offload things they’re not very good at.”

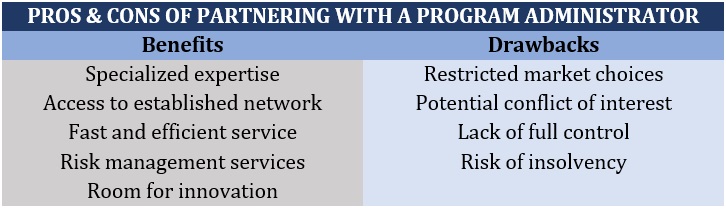

While partnerships with program administrators provide several opportunities for insurance carriers to grow their businesses, there are also potential drawbacks. Some of these are:

Restricted market choices: Many program administrators have exclusive partnerships with insurance carriers. This means that those looking for coverage may have limited options, especially in very specific markets.

Conflict of interest: For program businesses working with multiple insurers, there’s the unenviable task of balancing the needs of their partner carriers. This can potentially lead to conflicts of interest.

Lack of full control: Because carriers are entrusting program administrators with the day-to-day management of their insurance programs, this also means they are giving up some level of control over key decisions.

Risk of insolvency: Insurance carriers must practice due diligence when choosing a partner administrator to ensure that the ones they work with are financially stable. If a program administrator experiences financial troubles, it can have a cascading effect on the insurance policies they manage.

The table below sums up the pros and cons of working with an insurance program administrator.

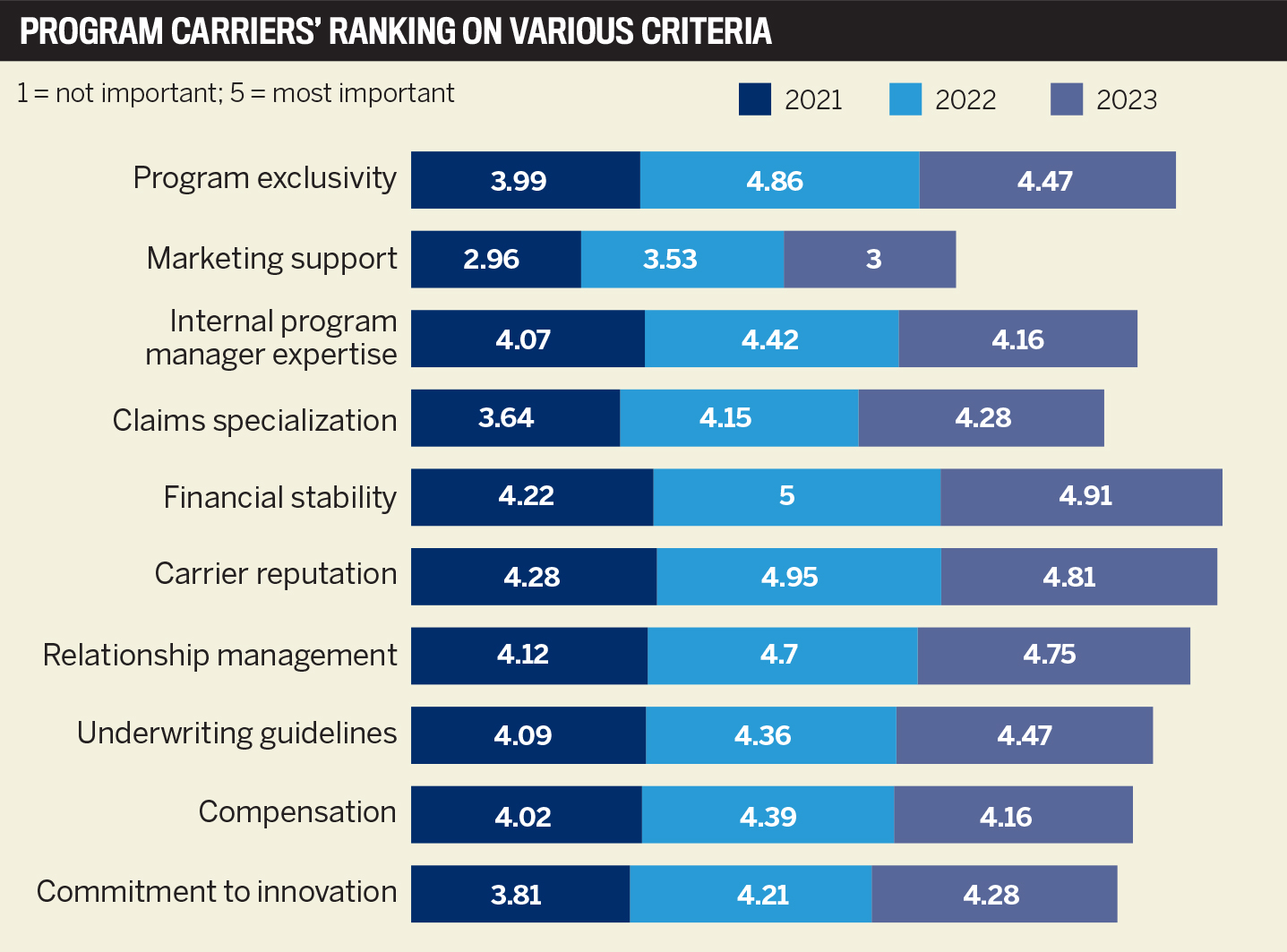

Every year, as part of our Best Program Administrators and Carriers in the USA special report, Insurance Business surveys program administrators to find out what factors they consider important when looking for a partner carrier. These attributes are then ranked from a scale of one to five, with five being the highest.

These are the top factors that program administrators consider when looking for a partner insurance carrier, ranked by level of importance:

Financial stability: 4.91

Carrier reputation: 4.81

Relationship management: 4.75

Program exclusivity: 4.47

Underwriting guidelines: 4.47

Claims specialization: 4.28

Commitment to innovation: 4.28

Internal program management expertise: 4.16

Compensation: 4.16

Marketing support: 3.00

Mark Williams, executive vice-president of business development for Atlas General Insurance Services, agreed mostly with the poll results. Atlas is a subsidiary of Risk Placement Services (RPS), one of the largest program administrators in the country.

“Financial stability is paramount,” he noted. “You want a carrier with a healthy balance sheet and a good reputation that you know can take on a significant portion of the risk.

“Exclusivity is also important. You definitely don’t want to go down the path of having channel conflicts. You want your own paper. That’s a huge value proposition that you could bring to your retail agents.

“And, of course, compensation. It’s important for you to be able to handle your expense load and pay your retail brokers a going rate.”

The bar graph below shows the survey results from the past three years.

On the insurance carrier’s side, Williams pointed out the benefits of working with an established program administrator.

“The advantage of working with a larger program administrator such as RPS, which manages multiple programs and works with multiple carriers, is not just the niche expertise,” he explained. “A larger organization such as ours can bring a lot of options.

“We all know the volatility of the program space. Choosing a program administrator with a large number of carrier partners means our retail agencies have less to worry about having to remarket their accounts. The program administrator has relationships they can leverage for consistency and coverage.”

The biannual report also showed the PA market growing at a faster pace than the overall commercial insurance sector, which experienced only a 9.3% rise in premiums between 2018 and 2020.

Program business premiums have surged 207% from $17.5 billion since the TMPAA began conducting research in 2010. The number of program administrators across the US, however, remained steady at around 1,000 companies. This is despite active mergers and acquisitions (M&A) happening within the sector.

You can check out our Best in Insurance Special Reports page if you want to find the top program administrators to partner with. The program businesses featured in our special reports have been nominated by their peers and vetted by our panel of industry experts as reliable and respected market leaders.

By choosing to work with these companies, you can be sure that you’re collaborating with a program administrator that has a deep understanding of the unique risks you face. You are assured that they can provide the best coverage possible for your niche market.

Do you think what program administrators do is essential to the insurance industry? Do you have experience working with these professionals that you want to share? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!