What Counts as Proof of Trading for Motor Trade Road Risk Policies

Motor trade road risk insurance policies are designed for policyholders who actively run a full or part-time business within the motor trade industry. To qualify for this type of motor trade policy, you will need to be able to provide written evidence that this policy is being used in conjunction with your motor trade business.

In recent years motor trade road risk policies have been exploited by fraudulent proposers. Owners of multiple vehicles who are not genuine motor traders have attempted to use this policy type as a means to gain cheaper insurance than would otherwise be available on an appropriate fleet policy or via multiple single vehicle policies. This dishonest practice meant that insurers suffered trading losses and resulted in premium increases for genuine motor traders.

For this reason motor trade insurance underwriters may request proof of trade activity at any point in a policy term to ensure that this policy is being used correctly in conjunction with the declared motor trade occupation. Therefore you should keep records of financial transactions that take place in the course of running your motor trade business.

If your business buys, sells, repairs or modifies vehicles then Plan Insurance Brokers can source a tailored Motor Trade insurance policy for you. If you have any more questions or would like a quote call our expert team, request a call back or fill in a quote form.

How long will I have to provide proof of trading?

Once a motor trade insurance underwriting department has officially requested proof of trade activity you will normally have 7 days to comply with their request. Failure to provide proof of your motor trade activity or supplying inadequate proof could potentially result in your claim (if you have made one) being repudiated or your motor trade insurance policy being cancelled.

What counts as proof of motor trade activity?

Various documents can help demonstrate to the insurance underwriters that you are active in the motor trade. You may be asked to provide any of the following forms of trade activity:

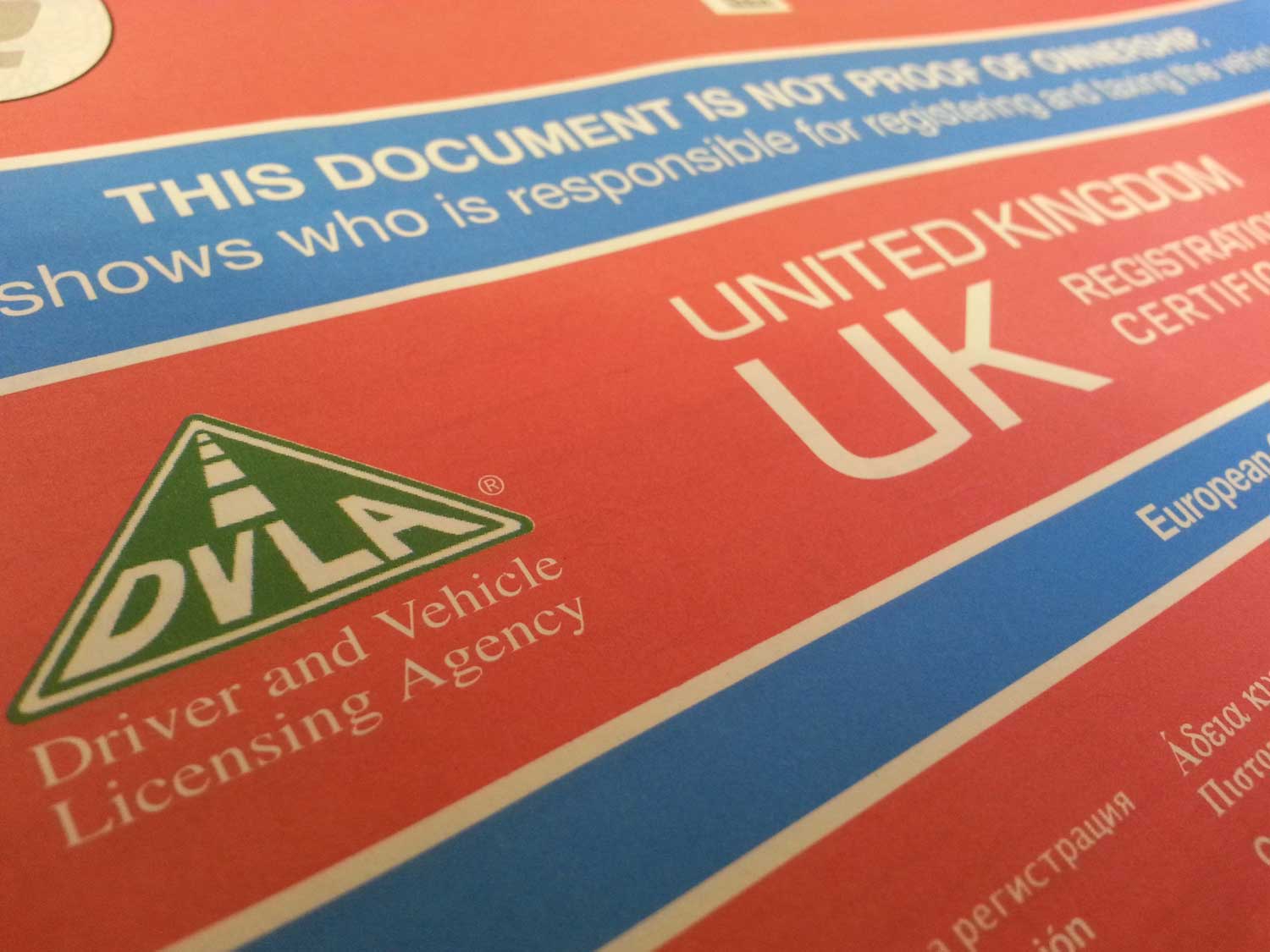

Advertising – Online or paper-based.Auction house invoices.Auction house membership confirmation.Business bank account details.Copy of your Company letterhead and logo.Copy of Tax self-assessment form.Purchase and Sale receipts of vehiclesPurchase and Sale receipts of Parts / Mechanical work carried outCopies of V5 registration documents.

If your declared occupation is vehicle sales your receipts must include (but are not limited to) the following information: – Contact details of both parties, Date, Price, Make, Model and Registration number.

How much trade activity will I need to demonstrate.

The minimum amount of vehicles to be sold and/or turnover to qualify as a motor trader on most policies is as follows:

Part time business = Minimum of 5 vehicle sales / £5,000+ TurnoverFull time business = Minimum of 10 vehicle sales / £10,000+ Turnover

Therefore you will need to supply sufficient proof of trading to satisfy these activity levels.

How should I supply the proof of my motor trade business?

You can take photos of your documents and email them to our customer service team. You can also send them physically in the post but we strongly recommended photocopying the documents and sending the duplicate versions as we cannot guarantee their safe arrival/return.

We hope this blog post proves useful to any traders that are required to supply proof of trading to a motor trade insurance underwriter. However should you need to ask any questions please do not hesitate to get in touch with our motor trade customer service team.