What can brokers learn from this new educational offering?

What can brokers learn from this new educational offering? | Insurance Business Australia

Technology

What can brokers learn from this new educational offering?

“Understanding what your clients are thinking”

Technology

By

Daniel Wood

Kaplan Professional, the Australian financial education company, recently launched three new globally recognised courses. One of these qualifications could be of interest to insurance brokers: Accredited Behavioural Finance Professional (ABFP).

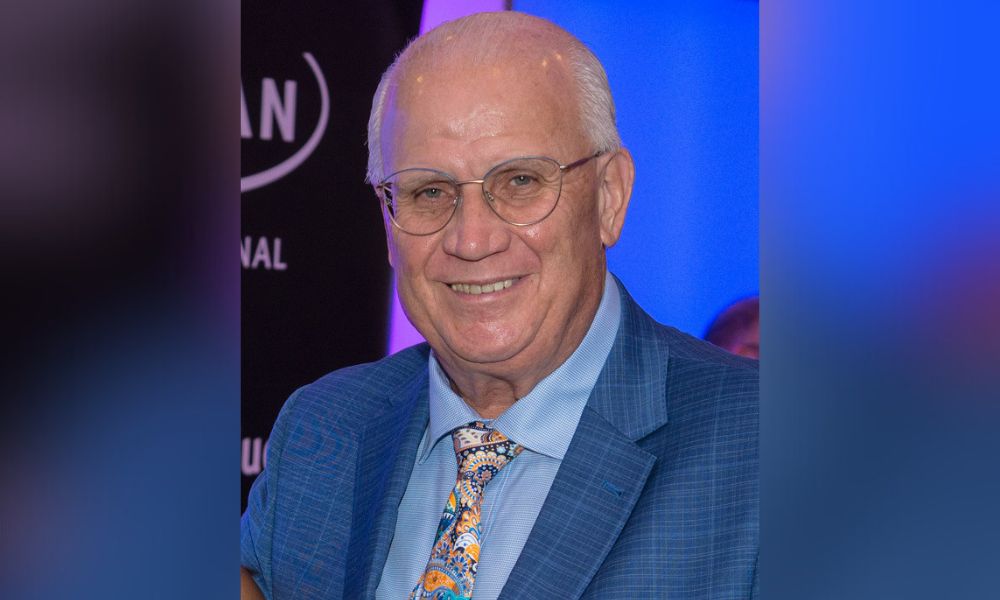

Insurance Business asked Brian Knight (pictured above), CEO of Kaplan Professional, what’s in this qualification, or designation, for a broker?

“You’d be learning a lot more about what influences clients to make decisions,” said Sydney-based Knight. “You’d also be learning a lot more about what are the biases clients can bring to the table that you need to be aware of.”

Critical thinking and decision making

He said the course has a focus on critical thinking and decision making.

“It goes into emotional intelligence so that you can understand what your clients are thinking,” said Knight. “It goes into communication styles and the behaviours that clients may engage in.”

There’s also, he said, education around investment theories.

Client engagement

One key area of study, he said, is client engagement.

“It covers emotional intelligence, decision making, behavioural biases and communication skills,” said Knight. “It’s getting to the bottom of consumer behaviour and it allows you to understand your clients more and what they’re looking for.”

Knight said to receive the global designation after studying the ABFP course, five masters level subjects are required as pre-requisites. However, he said the course can also be studied as a stand-alone subject.

He suggested that the pre-requisite courses themselves would also be useful learnings for a broker.

“In these courses you’ve got to have an understanding of the economic, legal and regulatory environments in Australia,” said Knight. “There’s an ethics and professionalism subject and you also cover superannuation and investment.”

Based on interest in similar courses in the United States he expects the ABFP course to be “extremely popular.”

Insurance industry’s increasing focus on education

Knight said that in Australia he’s noticed “an increasing focus in insurance on education.” Partly in response to this demand, his firm recently upgraded its insurance diplomas and last year built a new life insurance qualification.

“Our Tier 2 level general insurance subjects are all state of the art,” he said. “We want to continue to focus more on what we’re doing in the insurance space in the next few years.”

Insurance education: Australia versus the US

The ability to offer new courses in Australia with global designations was a result of Kaplan Professional teaming up with its global US parent firm. IB asked Knight how financial services education standards compare between Australia and the US?

“Our standard was way high,” he said. “In fact, for the behavioural finance [ABFP] subject, they [the US parent firm] wanted the course because they thought it was better than anything they’ve seen.”

Knight said he thinks Australia’s education and training standards in financial services, particularly in financial advice, “are probably as high as anywhere.”

However, he said comparing the education level of the insurance industries in the US versus Australia is tricky because, rather than Australia’s national standards, each US state has its own standards.

“They all have to do a pre-licensing [insurance] course and that can range from one day long to about 40 hours long,” said Knight.

This course varies, he said, depending on the insurance line.

“Everyone does a general insurance component of about 12 hours,” said Knight.

Then separate courses cover property, personal lines, casualty and life insurance. Each, he said, is about 20 hours long.

“After that, it’s different in each state but generally once they’ve finished that course, they have to be able to show evidence that they’ve done those courses so they have to sit an official licensing exam,” he said. “Once you pass that exam you apply for your license.”

He suggested that the education requirements to work in the insurance industry in Australia are more demanding.

“Whereas in Australia for life insurance they’re mandating a certificate 4 qualification and insurance brokers now generally have to do a diploma in insurance broking.”

Brown is head of policy and industry capability for Financial Education, a Sydney-headquartered training provider that offers financial services education including technical training and licensing compliance.

One area of demand is from experienced insurance professionals, she said, “wanting to refresh their credentials or even progress to full qualifications.”

These professionals, she said, feel the need to stay up to date with regulations, “which have changed substantially in recent years.”

“Also, brokers and anyone in insurance advice generally, values competence as a personal and professional quality,” said Brown. “It’s seen as a competitive advantage to be able to say you’ve studied the latest and greatest.

“I believe it’s important that we continue to promote education and career progression within our network,” said Mick O’Bree, Ausure’s general manager of Operations & Underwriting. “The more training and improvement we provide should result in more advice to our clients, which is the whole reason we exist as insurance brokers.”

Are you an insurance professional? Are you currently studying or upskilling? Please tell us all about it below

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!