What Are The Top 4 Life Insurance Mistakes in Ireland?

a stupid person; an idiot.

“don’t stand there like a feckin eejit!”

Here in the midlands, it’s commonly pronounced with a hard G as in g-obshite.

So how do you avoid looking like an eegit (or a gobshite) when it comes to protecting you and your family?

You can start by avoiding these daft errors when you’re taking out life insurance, mortgage protection, income protection or serious illness cover.

The biggest Life Insurance Mistake is Not Protecting the Homemaker / Stay at Home Parent

Ah, the blessed Homemaker AKA

Domestic Engineer

Child Development Associate

Household Coordinator

Human Growth Technician

or my personal favourite, PA to the TDP (Tiny Drunk Person).

Regardless of the job title, a stay at home parent (SAHP) should have their own life insurance.

Homemakers don’t have an income, so why do they need life cover?

Think about all the homemaker does, from cooking and cleaning to driving the kids to their various activities. Imagine if he or she was no longer around. Would you have to employ someone to help around the home, or would you have to reduce your hours to take care of the children?

Either way, you’re going to be out of pocket.

Taking on someone doesn’t come cheap and working reduced hours means a reduction in take-home pay.

The untimely passing of a homemaker will cause a financial loss for the family; therefore, you should always protect the homemaker.

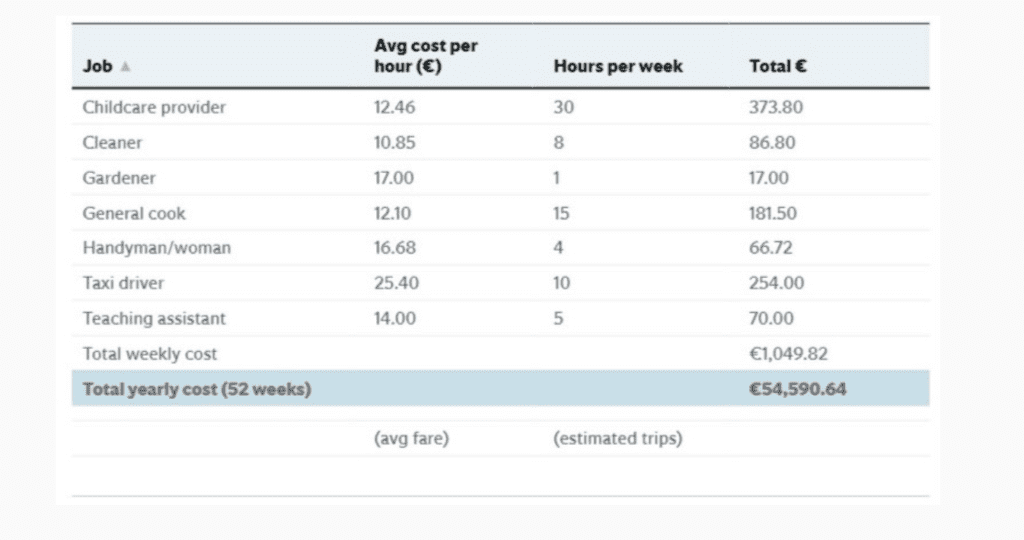

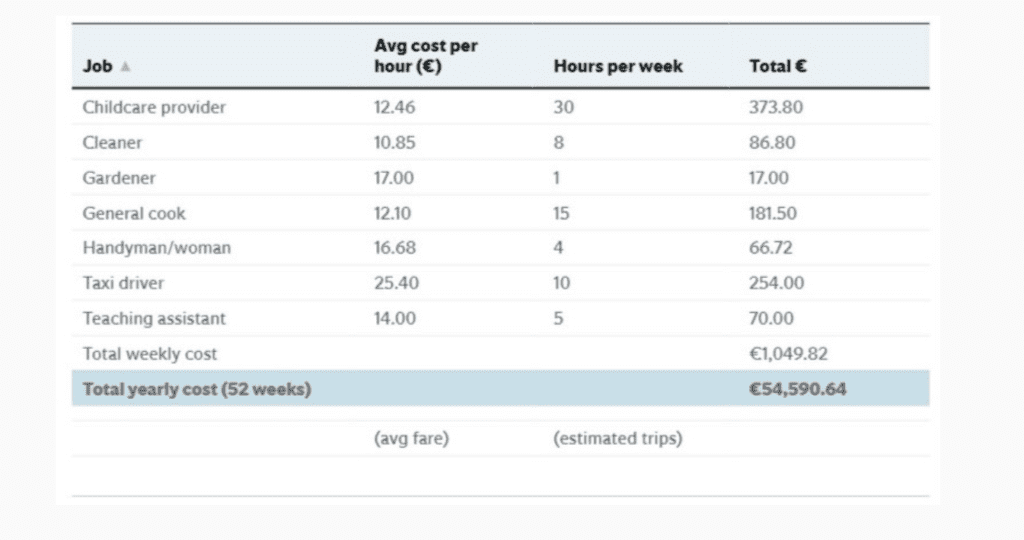

How much should homemakers earn?

Yeah, I know, chance would be a fine thing but you should be getting €54,590 per year for all you do in the home.

This is up from last year’s estimate of €53,480!

Time for a pay rise? 🙄

Karen O’Flaherty, Senior Propositions Executive of Royal London Ireland:

Each year we ask the same question and each year we’ve found that most people underestimate the likely ‘salary’ of a stay-at-home mam or dad. While the role of the stay-at-home parent is often described as ‘priceless’, it is interesting to see how some people can misconceive the role of a stay-at-home parent and the financial cost,” Ms O’Flaherty said.

Buying Joint Life Cover is a Criminal Mortgage Protection Offence

There are three types of mortgage protection:

Single Life – easy one, you’re on the policy, you die, your policy will the mortgage.

Joint Life – two people on the policy, you die, the policy clear their mortgage, and the policy ends. There can only be one payout.

So what’s dual life mortgage protection?

Dual life mortgage protection is like combining two single life policies. On the first death, the policy clears the mortgage, BUT cover then continues on a reducing basis for the second person. If they pass away, there is a second payout to their family.

Dual life mortgage protection is the same price as joint life mortgage protection, so it really is a no-brainer.

Why haven’t I heard of dual life mortgage protection?

The banks in Ireland are wedded to either Irish Life or New Ireland Assurance. Neither of them offers dual life mortgage protection, so they’re hardly going to make a song and dance about a superior product that they can’t provide!

Choosing the Wrong Insurer is THE Income Protection Mistake to Avoid

The cost of your income protection depends on:

Age

Smoker

Health

Amount of Cover

Deferred Period

Ceasing Age

Occupation Class

The only factor that varies from insurer to insurer is Occupation Class.

What is an Income Protection Occupation Class?

Let me give you a quick crash course.

The insurer categorises your job according to how “risky” it is. In other words, compared to another occupation, how likely is it that you will make a claim. Everything else being equal, someone who swings a sharp tool is more likely to have a claim than a desk jockey. Therefore, it’s reasonable to assume that a labourer on a construction site will pay more than an administrator. To differentiate between the risk of injury, the insurers slot your job into a Risk Class. e.g. Class 1 (office worker), Class 4 (carpenter).

But occupation classes are not identical across all of the insurers.

Take a Mechanical Engineer as an example:

At Irish Life and Royal London, it’s a Class 2. At New Ireland, it’s a Class 3, and at Aviva, it’s a Class 4.

Oh, did I mention that the higher the Class, the higher your premium?

That may have piqued your interest:

Quote Type: Income Protection

First Person: Non-Smoker, born on 17/02/1977

Cover Amount: €34,444 per year until age 65.

Occupation Class: Mechanical Engineer (RL) (Class 2)

Deferred Period: 26 weeks

Class 2: €99 per month

Class 3: €127 per month

Class 4: €162 per month

We arranged cover recently for a client who described himself as a Mechanical Engineer. On further inspection of what he did daily, we secured him Class 1 rates with Aviva as a Consultant Engineer for €65 per month, saving him €97 per month!

Always check occupation classes before choosing an income protection provider.

Don’t Be Seduced by a Slew of Serious Illnesses

Insurer A: “We cover 62 illnesses.”

Insurer B: “We cover 68 full illnesses and 16 partial illnesses.”

Insurer C: “We cover 126 illnesses, including Stoneman Syndrome and Alice in Wonderland Syndrome.”

Logically, you would choose Insurer C as they cover the largest number of illnesses, so it’s the sensible choice.

WRONG!

Instead, what you should look out for are the definitions of the illnesses the insurer covers. Which insurer makes it easiest to claim an illness you’re likely to suffer?

The chances of Stoneman Syndrome are 1 in 2,000,000.

The chances of cancer are 1 in 3.

Choose the provider that makes it easiest to claim for cancer.

Over to you…

If you’re an avid reader, I hope you have learned nothing from reading this article. If so, well done, you are a learned life insurance legend – kudos to you, my friend.

However, if you have just stumbled upon this post and are now scratching your head going, “Jaysus, I knew none of this”, then maybe I can help.

Complete this short questionnaire, and I’ll be back with a recommendation on the types of cover you should consider and how to avoid ALL the mistakes.

If you want a quick chat first, that’s cool with me, you can schedule a call here, and we can go through your questions.

Talk soon!

Nick