What are the best ways of finding life insurance leads?

What are the best ways of finding life insurance leads? | Insurance Business America

Guides

What are the best ways of finding life insurance leads?

Finding good life insurance leads is the most important element of a successful sales career. But where can you find the best ones? Read on and find out

Finding good leads is the lifeline of a career in insurance sales. But in a highly saturated market such as life insurance, it is also the biggest challenge. Life insurance agents often compete for a few qualified prospects. And for one to enjoy a long and lucrative career, catching the attention of these potential buyers before other agents do is crucial.

Insurance Business lists down the different ways of getting life insurance leads in this guide. We will explain the pros and cons of these methods and how effective they are in leading to a sale.

If you’re new in the industry, this piece can give you an idea about which lead generation techniques suit your skills and sales experience. Industry veterans, meanwhile, can get a fresh take on tried and tested means. Read on and learn about the various ways of finding life insurance leads in this article.

In general, there are two ways you can access life insurance leads, which reflect the source of the information. These are:

1. Company-provided life insurance leads

Company leads are generated by insurance agencies using their internal data sources, which can include demographic data, purchase history, and online marketing campaigns.

If you choose to start your life insurance career in an agency, company-provided leads are often the fastest and simplest way of getting a steady lead flow. Some agencies even use the promise of leads to attract new agents.

While the prospect of not having to scour for sales leads can be enticing, it is important to remember that company life insurance leads come with their share of pros and cons.

The biggest benefit of using company leads is that you don’t have to spend money to access them. It also saves a huge chunk of your time that you would’ve otherwise spent searching for leads. This allows you to focus your energy on contacting prospective clients and selling life insurance.

However, having your employers generate life insurance leads for you doesn’t mean that they’re free. While you are not charged an upfront fee, you actually pay for these leads in the form of lower commissions. Also, these leads are not exclusive. These prospects may have already been contacted by your colleagues or even former agents of your company.

2. Third-party life insurance leads

You can also access sales leads from third parties that specialize in generating leads, aptly called lead generation companies. These firms often source information through online campaigns, including search engine marketing (SEM) and social media advertising. You purchase these leads yourself, so these don’t get deducted from your commission rates.

You have two options when buying third-party life insurance leads. These are:

Shared life insurance leads: These are leads that a provider sells to multiple insurance agents, meaning you face more competition. This type of leads costs less than exclusive ones.

Exclusive life insurance leads: These are leads curated exclusively for you. You will face less competition, but you will also pay a bit more.

Most lead generation companies allow you to customize leads to target a specific audience. You will need to pay extra but this gives you more control over the quality of leads you receive. Providers often enable you to filter leads based on a range of criteria, including:

Active life insurance policies

Address

Credit score

Demographic

The biggest drawback of third-party leads is the level of risk. Since you paid for the leads upfront, the only way for you to get back the money you spent is to close sales. Fail to do so and you may end up having negative earnings. Some lead generation companies, however, have a return policy that gives a refund if the leads have inaccurate information or cannot be contacted. Having a return policy is a good sign that a company is confident with the quality of leads it provides.

Apart from company-provided and third party generated leads, you can secure life insurance leads in other ways. These methods can suit you depending on your sales expertise, industry experience, and level of commitment.

Social media: Professional networking platforms such as LinkedIn can give you access to prospective buyers, but you must be adept in using it. A great LinkedIn profile can help you build a reputation as a trusted industry expert, which in turn helps in attracting clients.

Websites and search engine optimization (SEO): A website that details your profile and describes the products you sell is another way to build trust with buyers. Coupled with sound SEO practices, your website can rank higher in search engines. This method, however, can take time away from building leads and, depending on your SEO know-how, may require expert help.

Referrals: A satisfied customer may refer your business to another person. Referrals entail very little cost. In addition, these clients are already actively shopping for a product, so they are generally an easy close. However, you cannot solely rely on referrals for life insurance leads as they often come few and far between.

Lead aggregators: Aggregators differ from lead generators in that they purchase leads and resell them rather than generating them. Leads from aggregators are also less expensive, which can allow you to purchase large lists. The main drawbacks, however, are these leads are often not delivered in real time and have a high share rate. This means the prospects may already have bought a policy or have been contacted by several other agents.

Cold calling: This involves contacting clients who you haven’t had any prior contact with to give a sales pitch. This is one of the oldest and cheapest forms of generating leads. If you have impeccable sales skills, this could work for you, but winning prospective buyers this way entails plenty of time and effort.

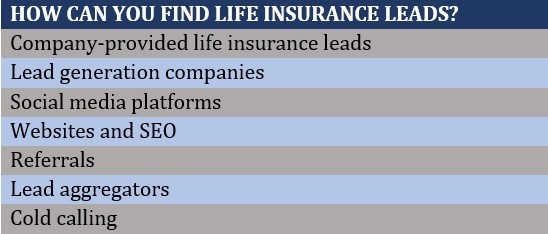

Here’s a summary of the different ways to get life insurance leads:

Life insurance leads are potential clients who may be interested in purchasing the life insurance policies that you’re selling. They come in three types:

Cold leads: These are prospective customers who don’t know much about or seem interested in the products you’re selling. Most of them may not even be sure if they need life insurance. You just got their contact information, and the challenge is learning more about them, so you can recommend products and services they may need.

Warm leads: These are prospects who have opted into your mailing list or replied to a cold email. Many of them may also have been searching for various life insurance-related topics online. Warm leads often show intent to buy insurance, that’s why there’s a higher likelihood that you can talk to them and potentially close a sale.

Hot leads: These are clients who are ready to buy life insurance. They are prepared to talk to an insurance agent and make a purchase.

Just like in any profession, choosing a career selling life insurance has its share of benefits and disadvantages. To find out if a sales role in the sector is a good fit, you must first weigh the pros and cons. Here are some of the advantages and drawbacks of pursuing a job in life insurance.

Pros of a life insurance sales career

1. Minimal entry barrier

While some life insurance companies prefer candidates with a college degree, several client-facing positions don’t necessarily require one. These include insurance agents and brokers. To help prepare sales professionals for their roles, most insurers implement mentorship and training programs, especially for those new to the industry.

Life insurance agents and brokers, however, need to obtain licenses to sell insurance products. Licensing requirements vary by state.

2. High earning potential

A sales career in life insurance provides opportunities to earn a high income with strong growth potential. Life insurance agents and brokers earn commission-based incomes that are among the highest in the entire insurance industry.

3. Job security

Life insurance plays an important role in providing families with a financial safety net after the death of a loved one. This type of policy helps families pay off debts and meet living expenses. These benefits make life insurance among the most in-demand products in the industry. And because of the large number of people looking for coverage, this means plenty of job opportunities are also opening within the sector. These include vacancies in some of the biggest names in the business.

1. High-pressure work environment

Many life insurance sales professionals work long hours and are under constant pressure to meet different targets and quotas. This creates a work environment that’s conducive to stress and burnout, especially for new agents.

Figures obtained by this website has shown that 90% of new life insurance agents quit within the first year because of the highly competitive nature of the work. The number goes up to 95% if stretched to the first five years.

2. Unstable income

Most sales roles in life insurance are commission-based. This makes it difficult to predict how much your next paycheck will be as this will depend largely on the number of sales you close. This also means that if you want to earn more, you need to push yourself harder.

3. Finding life insurance leads can be challenging

Agents are often tasked with finding life insurance leads on their own. While some insurance agencies provide staff with leads, there is a high chance that these leads may have already been contacted by several other insurance agents. This is especially true in a notoriously competitive line such as life insurance.

Agents, however, can also pay to obtain exclusive life insurance leads. This can be an expensive option. But if you have a high close rate, the amount you pay can be just a fraction of your earnings.

Your success as a life insurance agent depends primarily on the type of relationship you establish with customers, including your life insurance leads. Here are some strategies to help you build a strong professional relationship with your clients.

Practice good customer service: The key to building and maintaining trust with your client is providing excellent customer service. Successful life insurance sales professionals can understand a client’s unique needs and consistently provide quality service.

Identify clients’ needs: When it comes to life insurance, people often already know that they need coverage. However, they may not necessarily know what specific types of policies fit their needs. The best life insurance agents possess the empathy to identify what kind of protection clients need.

Play the long game: You must understand that trying hard to sell policies right away is a sure-fire way of ruining clients’ trust. The best life insurance agents focus on establishing relationships instead. By being patient, you are more likely to secure a long-term customer who may be willing to refer you to other potential clients.

Leave a professional impression: If you want to be taken seriously in the industry, you must know how to dress and communicate in a professional manner. A sales role, for example, entails working outside a professional setting, so the choice of place to meet clients plays a crucial role in establishing professionalism.

Do you want to know what makes life insurance a good career path? Check out this guide if you do.

Finding good leads is the most essential aspect of a life insurance agent’s job – but it is also the most difficult. It doesn’t matter if you have thorough knowledge of the policy you’re selling and can explain its benefits and features in the clearest way possible. Without good leads, you can’t survive in the industry.

There are several ways for you to access life insurance leads, each with its own pros and cons. And the answer to the question of which method is the best depends on your sales skills, industry experience, and drive to succeed.

Life insurance leads are important elements of any life insurance business. But so does having proper coverage. If you want to find out the different types of policies every business must have, you can check out our comprehensive guide to business insurance.

Do you have tips on finding the best life insurance leads that you want to share? Please do so in our comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!