What a “digital twin” can do for climate ILS product design

The insurance-linked securities (ILS) market has long designed its risk transfer products and solutions using the insights gleaned from the outputs of catastrophe risk models, but in the future a “digital twin” could be a far more intuitive solution that can drive significant ILS innovation, we believe.

“A digital twin is a virtual representation that serves as the real-time digital counterpart of a physical object or process,” Wikipedia explains.

Imagine a representation of the built-environment integrated into your catastrophe risk modelling tools, along with all the necessary construction material, roof type, and related data that can help you visualise potential impacts and therefore design products that provide the most valuable response for insurance clients and reinsurance cedants.

This kind of technology seemed a long-way off, but right now there is a wave of activity in the development of digital twins, spurred on by current fads such as the metaverse and Web3.

But a company is making specific advances in these fields that are going to be incredibly relevant to insurance, reinsurance and insurance-linked securities (ILS) markets, we believe.

One Concern is a resilience-as-a-service solutions provider with a focus on providing upfront information on potential financial impacts of climate related loss events.

As we’ve explained before, One Concern has a unique approach in using artificial intelligence to try and understand, estimate and forecast the potential implications of climate and weather catastrophes.

As well as resilience and mitigation, One Concern’s insights and outputs can be extremely useful for implementing risk transfer against catastrophe events and climate linked weather events.

Now, One Concern has announced the launch of its first full digital twin, alongside a data service to help companies understand the implications of events.

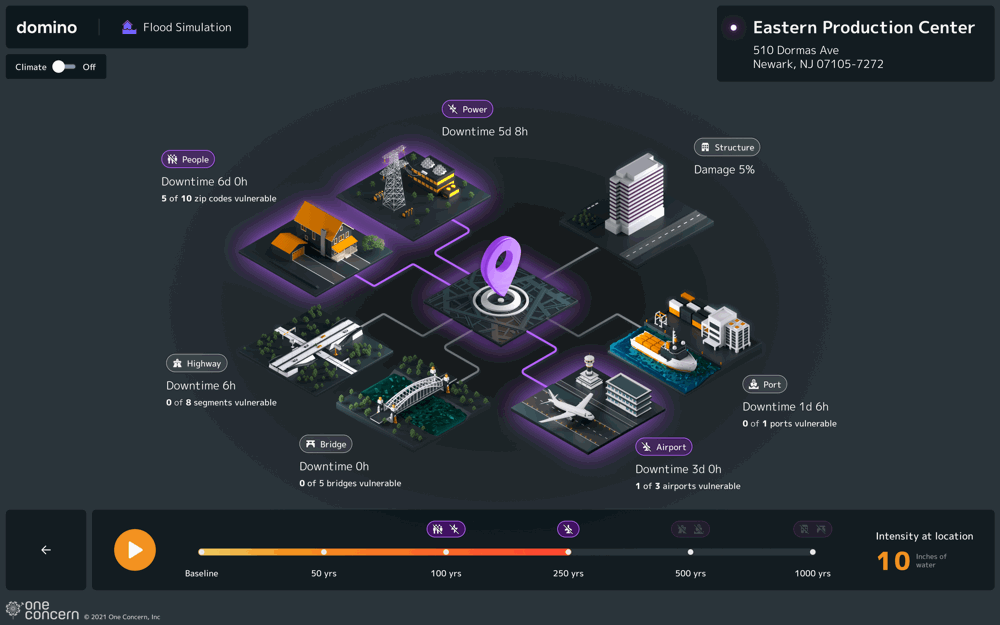

Domino is an advanced digital twin of the United States, which One Concern says is “capable of identifying where organizations and communities are at most risk from climate impacts and can anticipate the potential length of downtime of vital business operations, such as utility and transportation infrastructure, enabling strategic resilience investments for climate risk mitigation.”

Sound interesting? It should.

The Domino digital twin of the US could provide important insights into how climate or catastrophe events can impact economic activity, so its outputs can become inputs to risk transfer decision-making.

But, take the digital twin alongside another launch from One Concern, a product called One Concern DNA, and things get even more interesting.

One Concern DNA is a data-as-a-service product that One Concern says “enables portfolio analysis for precision risk selection, asset valuation, and risk pricing.”

One Concern DNA also powers Domino, so the two are intrinsically linked and DNA can provide rich insights to support decision-making in resilience, mitigation, and importantly for our readers, risk transfer decisions.

The ability to analyse portfolios in a digital twin representation of the real-world, while assessing the impacts of climate related risks to them, could be a fantastic tool for risk transfer and ILS product design, allowing specialists to identify gaps in protection where coverage is currently not sufficient, as well as new opportunities for helping actors in the economy to hedge their exposure to climate related events and other natural catastrophes.

It’s a new paradigm for risk modelling and one we expect the established players will also look to pursue, but One Concern has focused its mission on the climate risk space and has a head-start on the technology front as well.

The company believes these new products will help insurance or reinsurance firms and asset managers or owners to better manage physical climate risk. That goes for insurance-linked securities (ILS) players too.

We’ve written numerous times about the opportunities ILS players may have in helping asset owners and holders to carve out climate related exposure from portfolios of physical and financial assets.

Climate risk is deeply embedded in so many asset classes and types, which are going to require financial protection and hedging tools in years to come, particularly if forecasts for climate change related impacts are accurate.

But even without the scientific forecasts playing out as negatively as many expect, there is still “current” climate risk exposure deeply embedded and largely unprotected by insurance today in the portfolios of many asset owners and holders around the world.

Creating new risk transfer products to enable economic actors to mitigate, hedge and offset, or fully transfer, climate risk exposure from their portfolios and assets, is one of the key opportunities and responsibilities of the insurance, reinsurance and ILS market.

The more granular the insights that can be gleaned the better and the more product design innovation will be possible and stimulated, so we feel digital twin representations could be a significant step forwards in how climate risk related insights are delivered and can be used by the markets we care about.

One Concern believes that its approach helps by “uncovering hidden vulnerabilities in the infrastructure that powers enterprise, such as the electrical grid, transportation networks, and communities.”

If vulnerability is identified and understood, then mitigation, in terms of resilience, risk financing and risk transfer can be applied.

But the products need to exist to support this and it feels like there could be new categories or classes of business that emerge, as our understanding of climate risk exposure and impacts improve, something for which a high-resolution view of the real-world, in the form of a digital twin, could be a significant innovation driver.

“We’ve under-estimated the level of climate disturbance we have now,” Dr. Steve Howard, One Concern Advisor and Chief Sustainability Officer at Temasek explained. “We need to be smart about how we build everyday resilience into systems, supply chains, infrastructure, and communities. We can’t just build sea walls, flood defenses, and reinforcements. We need a smart way that builds in the inevitable increase in extreme events.”

“Unless decision-makers are equipped with the knowledge and insights around how our changing climate will impact our world, it will be nearly impossible to enact meaningful resilience,” added General (Ret.) David Petraeus, One Concern Investor and former Director of the CIA.

The digital twin, Domino, has been developed using data-centric machine learning and delivers a high-resolution, digital twin solution that can help in the identification of vulnerability and the measurement of resilience, two key goals for the climate risk focused community, including financiers.

Domino “identifies the ripple effects of perils across society’s complex networks and ecosystems, including the power grid, transportation networks, and communities,” One Concern says, highlighting that this enables “business resilience” to be measured.

This allows asset-specific risks to be identified and measured, as well as projected network impacts to dependencies, across a broad range of variables, such as planning horizons, return periods (important for our markets), and first climate change scenario (RCP 4.5).

“Releasing our first digital twin, a simulation of the world around us, allows us to run climate models and decipher the direct and indirect impacts of extreme weather and climate change on business operations, people, and infrastructure,” Ahmad Wani, CEO and Co-Founder, One Concern explained. “Armed with better data and machine learning, we’re bridging the critical gaps in actionable disaster and climate risk information. As a result, we’re able to measure climate resilience using data like never before.”

Data is critical and One Concern has collected a lot, having calculated 3.3 trillion recovery data points, 87 billion downtime data points, and 34 billion damage ratio data points.

“The innovation behind our products is the type of data we’ve been able to create, collect, and aggregate into a single location,” said Nicole Hu, Chief Technology Officer and Co-Founder, One Concern. “It is a huge task to even bring trillions of data points together in a unified, structured way that is understandable to customers. Moreover, we are doing predictive modeling for dependency risks and providing those impacts at scale across different lenses.”

One Concern’s Domino and DNA are immediately available in the U.S. and will become available in Japan in the coming months.

“At Verdantix, we are seeing a significant drive towards spending from corporates and investors on climate risk assessments for physical assets, with a key component of these engagements being the technological solutions capable of delivering detailed insights,” Sam Renshaw, Verdantix Industry Analyst said. “One Concern’s newly released resilience solutions are driven by digital twin capabilities and collectively encapsulates the ability to perform resilience planning across supply chains and develop in-depth insights into the underlying risk analytics of a credit or equity portfolio that could be most impacted by climate risk.”

We’ve seen some evidence of new entrants to the ILS and cat bond market seeking to carve out catastrophe risks from their businesses, or portfolios, in the last few years.

We’re also seeing positive developments in terms of carving out climate related risks from portfolios of physical and financial assets, to de-climatise or hedge them from the rising exposure linked to climate change.

The kind of resolution and visibility a digital twin could provide may be enough to stimulate and facilitate the design of new risk transfer products on its own, but aligned with data services on impacts and where societal pain points will emerge, this could be a significant source of insight and driver of innovation for insurance, reinsurance and ILS markets.

We wrote recently that climate risk is likely the biggest ESG opportunity for the re/insurance and ILS market.

Designing and delivering climate risk and resilience financing solutions will naturally result in the construction of ESG positive portfolios of risk, in the majority of cases, so the granular insights gained from technology such as a digital twin can perhaps be one driver for the insurance-linked securities (ILS) industry towards climate risk focused, ESG positive ILS product development.