We dug deep into the Claims Statistics of a local Insurer. Here are 3 sobering insights we found

“Curiousity killed the cat” is an oft quoted idiom, with negative connotation towards exploration of the unknown.

Yet the second half (and commonly missing) of the idiom also goes: “But Satisfaction brought it back”.

One of our readers pointed out to us that NTUC Income makes their claims statistics available for viewing, and that triggered all our curiousity tendencies.

What sort of demographic would make up the most common claims?

Are people claiming more these days?

And what are people claiming for?

Join us as we delve into the numbers, and let curiousity get the better of us.

Understanding the data: What is available and given?

NTUC Income provides the claims statistics for the last 5 years, and broken down at a monthly level.

For each month, we can see:

– The type of claims made (Broken into the 3 main categories – Death, Critical Illness, and (TPD) Total & Permanent Disability)

– The number of each claim

– The total amount claimed for that month

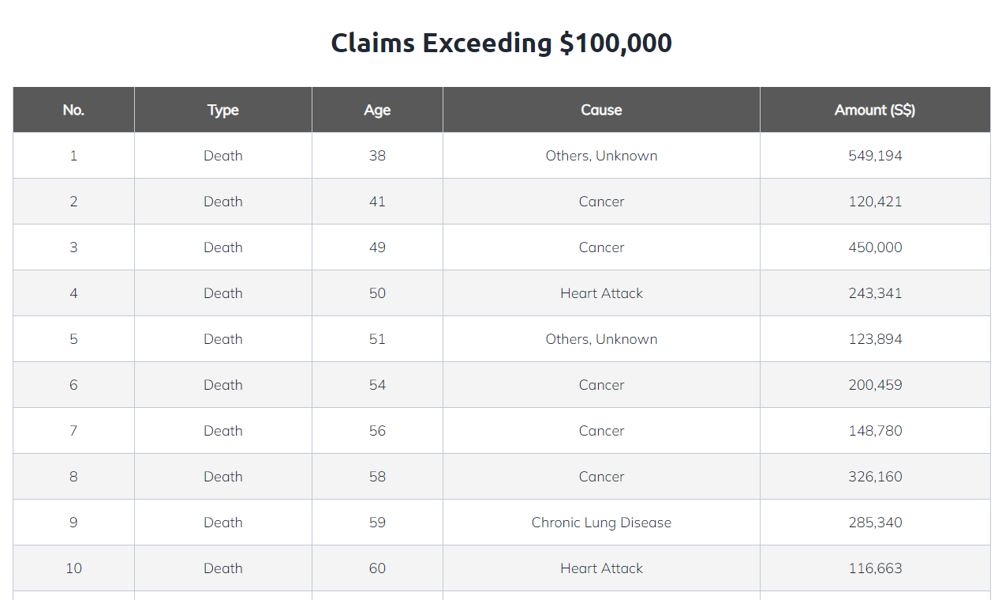

Furthermore, it provides more detail into claims of more than $100,000.

– Type: Death or CI or TPD

– Age of the Claimant

– Cause of Claim

– Amount claimed

We painstakingly collected the claims details for the whole of 2022 and here are the 3 most sobering insights that we found.

1. A significant portion of claimants are young people, and the true figure affected could be a lot higher

There were a total of 294 death claims made in 2022, of which 8.2% were made by people aged 40 and younger (the youngest was 19!)

31.3 % of death claims were made by people aged between 41 and 60, and 60.5% of death claims were made by people older than 60.

For Critical Illness claims, the figures are even more sobering.

Out of a total of 446 CI claims:

13.0% were made by people 40 and younger (the youngest was aged 22)

56.5% were made by people between 41 and 60

30.5% were made by people aged 61 and above

Feeling young and invincible is normal, but it may cost your family dearly

For those thinking that they are young and are therefore invulnerable, this should serve as a big wake up call for two reasons:

A) The claims statistics are significantly attributed to people aged 40 and below, which is considered the peak of health and just entering the peak of economic productivity.

B) The true figures could be alot higher since younger people may delay buying insurance, thinking “nothing will happen to me since I am young and healthy”.

The numbers state otherwise, my friends.

2. Cancer is the leading cause for death, and also the leading cause of Critical Illness Claims

Unfortunately, Cancer tops the list for both claims categories: Death and Critical Illness.

Thats what the MOH has been saying all these years, and now it is reflected in the numbers as well.

45.5% of deaths were caused by cancer, and 78.9% of CI claims were also due to cancer.

In a distant second comes Heart attack, cited as causing 10.9% of death claims and 8.1% of Critical illness claims.

Having ribbons for cancer is nice. Having enough protection against it is better

3. People tend to be insured for a higher amount for Death, instead of Critical Illness

We compared the average payout for Death vs Critical illness, and here is what we found:

Average Death Claim: 245 k

Average Critical Illness Claim: 204 k

On average, this means that our death cover is higher than our Critical Illness cover by 20%.

Might this be an issue?

Probably, because due to medical advances, we are living longer than before, as more and more treatments are available to us.

Not only that, due to our longer but more stressful and hectic lifestyles, we are encountering cancer (and other critical illnesses) more often.

These two realitties suggest an urgent need to close the gap between death and critical illness cover.

Lessons for us all

So is it all doom and gloom for us?

Not really, as statistically speaking, a sizable majority of us still lead long, healthy lives. But this article is meant to draw attention to the fact that:

Even if you are young, there is still a significant chance that premature death and critical illness may strike.

Protection against cancer cannot be understated.

And finally, we should really look into the protection gap for Critical Illness compared to Death.

Yes I have 9 lives hooman, but you don’t have that luxury

What do you think about these statistics? Did we miss out any insight? Share your thoughts with us in the comments below!