Want to build a career selling insurance? Here are the pros and cons

Want to build a career selling insurance? Here are the pros and cons | Insurance Business America

Guides

Want to build a career selling insurance? Here are the pros and cons

Selling insurance can be an attractive career because of the many potential benefits, but it also comes with challenges. Find out if the role suits you

Selling insurance can be an enticing option for sales professionals who want to work in a thriving industry and see their dedication and hard work pay off. Choosing this career path, however, also comes with its share of challenges.

If you’re working out if a career in insurance sales is a great fit, then this guide is for you. Here, Insurance Business will give you an overview of the profession. We will provide a rundown of the benefits and disadvantages, how you can make money, and what it takes to succeed. Read on and find out if selling insurance is the best move for you careerwise.

Just like any profession, pursuing a career selling insurance has its share of advantages and drawbacks. To find out if the role fits your talent and skills, you must first weigh the pros and cons. Here are some of the benefits and disadvantages of an insurance sales career.

Pros of a career selling insurance

One of the biggest reasons why many professionals pursue a career in insurance sales is getting the opportunity to leave a positive impact on people’s lives. This sense of fulfillment, however, is just one of the several factors that make the profession rewarding. Here are some of the other benefits of the job:

1. Fewer entry barriers

All industry professionals involved in sales are legally required to obtain the necessary insurance licenses before they can sell policies. Apart from this, there are very few entry barriers if you want to build a career selling insurance.

The role doesn’t require a college degree, although having one can be an advantage. Most insurance companies and brokerage firms also provide training and mentorship programs for new hires to help them learn the ropes of the job.

2. Job security

Insurance products and services will always be in demand as long as people need financial protection. This includes when they are driving their cars, buying homes, seeking medical treatment, and running businesses.

The Bureau of Labor Statistics (BLS) predicts that employment of insurance agents will increase about 8% in the next decade, opening an estimated 42,500 jobs each year. These figures reflect a thriving sector.

3. Strong earning potential

A career selling insurance can be a good way to make money. It provides many opportunities to earn a high income with strong potential for growth.

Because your income will mostly come from commissions, there can be no limit to how much you earn. If you have a great work ethic and are willing to place yourself out there to establish relationships with clients, you will get more opportunities to earn a higher income. Selling insurance may even make you a millionaire.

4. Flexible work arrangements

Many insurance sales professionals are given the freedom to set their own work schedules. The nature of the job offers plenty of opportunities to work from home, although you may need to leave your residence to meet with clients in person.

Some insurance companies also implement measures to ensure work-life balance among employees by providing them with sufficient time to pursue interests outside work. This strategy has been proven to boost engagement and productivity in the workplace.

5. Challenging and rewarding work

Insurance is a continuously evolving industry. Because of this, you will often face challenges that will require you to come up with innovative and creative solutions.

As an insurance sales professional, you will also often act as an expert resource person, helping clients make informed decisions on the types of policies that can provide the best protection. This gives you a lot of opportunities to leave a positive impact on people’s lives.

These are some of the reasons that make selling insurance both an exciting and rewarding career.

Cons of a career selling insurance

An insurance sales career has its fair share of challenges, including:

1. Unpredictable income

Working in a commission-based role has its drawbacks. Since your earnings depend on the number of successful sales, it can be difficult to predict how much your next paycheck will be. If you don’t push yourself hard, your income will reflect that.

2. High-pressure work environment

Selling insurance can be stressful. It requires long work hours. You can also experience constant pressure to meet different quotas and targets. The highly competitive nature of the profession can create a work environment that often leads to stress and burnout.

3. Finding new leads can be challenging

Your success as an insurance sales professional is highly dependent on the number and quality of leads you find. Given the fiercely competitive market, there’s also a strong chance that the leads you find may already have been contacted by several other insurance agents.

4. Limited paid time off

If you choose to work as an independent agent or broker, you won’t have access to a full range of employee benefits, including paid time off. Additionally, taking time off from selling insurance can cost you a portion of your earnings. It also takes time away from finding leads and establishing relationships with clients.

5. Experiencing a lot of rejection

No matter how noble your intentions are, you will eventually meet people who treat insurance sales professionals with disdain and disrespect. You will also receive a lot of nos – sometimes even laced with obscenities – before getting a yes. Excellent people skills paired with a thick skin will help you thrive in this career.

Here’s a summary of the pros and cons of a career selling insurance.

There are generally two types of industry professionals involved in selling insurance – insurance agents and insurance brokers. Some of their roles overlap, that’s why it’s easy to confuse one from the other. The jobs they perform, however, have several key differences.

1. Insurance agents

Insurance agents serve primarily as intermediaries between the insurers and potential clients. They represent one or several insurance companies and provide customers with information about these firms and their products and services.

This type of sales professional often has contracts with the insurance carriers detailing what policies they’re allowed to sell and how much they can earn from selling insurance.

Insurance agents come in two types:

Captive insurance agents

Captive agents represent just one insurance company. They work either full-time for an insurance agency or carrier, or as an independent contractor.

These insurance sales professionals may also receive operational backing from their partner insurers. This includes office space and equipment and administrative support. They may likewise receive referrals and leads on potential clients from insurers.

Independent insurance agents

Independent agents hold partnerships with multiple insurers. Since they’re not tied down to just one carrier, they can offer buyers a broader range of policies.

Independent insurance agents earn higher commissions than their captive counterparts. But they also shoulder their own business expenses, which can offset the difference.

Both captive and independent agents have the power to bind insurance coverage. This means they have the authority to place coverage even if the policy hasn’t been finalized yet. This is something that most insurance brokers can’t do.

2. Insurance brokers

Just like agents, insurance brokers act as intermediaries between the buyers and the insurance companies. The main difference is who they serve.

As a representative of the consumers, brokers are responsible for helping the insurance buyers. They assist clients in evaluating their risks and match them with the right policies based on their risk profiles and financial resources.

Some states impose fiduciary duties on these insurance sales professionals, requiring them to act only in the best interest of their clients. They are also expected to guide consumers through the entire insurance-buying process.

In your job search, you will also encounter the term insurance producer. The National Association of Insurance Commissioners (NAIC) defines an insurance producer as a collective term for industry professionals who are involved in soliciting, negotiating, and selling insurance policies. This covers both insurance agents and brokers.

You can make a decent living selling insurance – this one’s obvious. What’s not is what goes behind the process. Here’s a rundown of the different ways you can make money by being an insurance sales professional:

1. Commission

The most common way you can get paid by selling policies is through commissions. The commission rate depends on a range of factors, including:

the role you choose (captive or independent agent, or broker)

the type of policies you sell (home, car, life, and health)

the number of successful sales

whether the insurance policy is new or a renewal

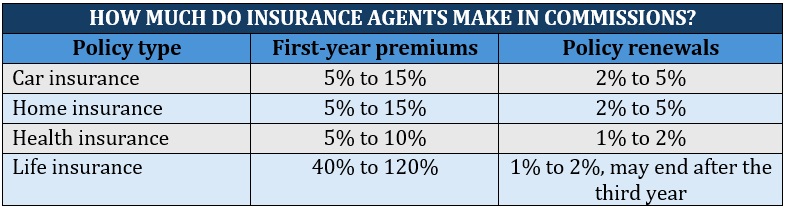

Here’s a summary of the commission rates insurance agents receive for the different types of insurance products.

For insurance brokers, insurers typically pay between 2% and 8% of the policy’s annual premiums depending on state regulations.

2. Salary

Some insurance sales professionals work as full-time salaried employees for insurance companies, agencies, or brokerages. Depending on their contract, they may receive commissions apart from their fixed wages.

Salaried insurance sales professionals only make the amount they have agreed with their employer for that given year. Their performance, however, is still dependent on the number of insurance policies they can sell.

3. Profit sharing

Some insurers have profit-sharing programs for their partner agencies. If these companies achieve certain revenue targets, insurance carriers reward them with a percentage of either premiums written or earned as a bonus.

4. Service fees

Many insurance agents and brokers offer consultative and advisory services. These come with a corresponding fee. Just like commissions, the amount they can charge is often state regulated.

A successful insurance sales career depends largely on the kind of relationship you build with potential and existing clients. Here are some practical tips on selling insurance that you can employ:

1. Practice good customer service.

Quality customer service is key to building and maintaining trust with your clients. Successful insurance sales professionals can understand every potential buyer’s unique needs. This enables them to consistently provide outstanding service.

2. Develop empathy.

Most people already know they need financial protection. The issue, however, is that they don’t necessarily understand what types of policies can address their needs. Empathy enables you to place yourself in your clients’ shoes and identify the right type of policies for their needs.

3. Play the long game.

Trying too hard to sell insurance is a sure-fire way to ruin clients’ trust. That’s why the best insurance sales professionals focus on building good relationships instead. By being patient, you’re more likely to secure a long-term client who may be willing to endorse you to other potential customers.

4. Leave a professional impression.

Be conscious of how you dress and communicate. These are important if you want to be taken seriously in the industry. When meeting clients, choose an attire that exudes professionalism. The choice of venue also plays a role in leaving a professional impression. Talk to clients respectfully and communicate important concepts clearly and free of buzzwords.

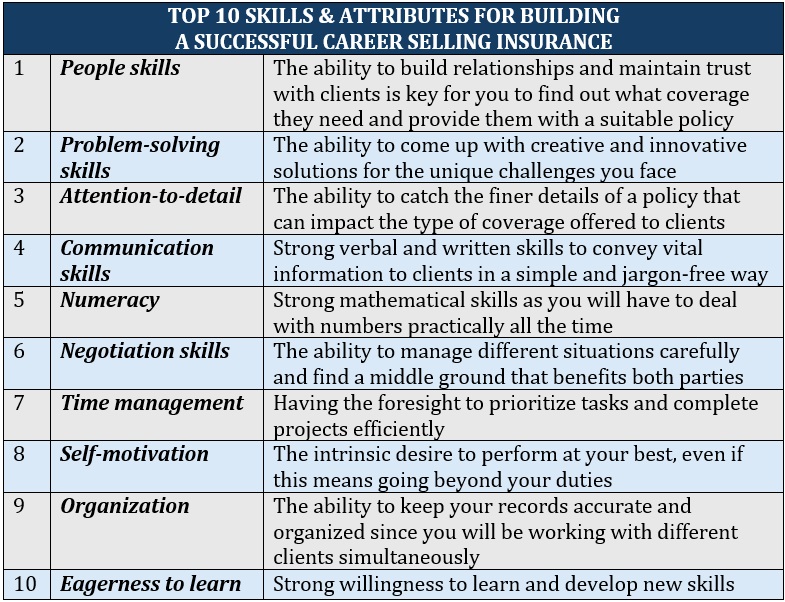

Having the right combination of hard and soft skills is also crucial for a successful career selling insurance. Here are some of the skills and attributes you need to thrive in the profession.

Having a role model that you can look up to also plays a vital role in helping you succeed in the profession. If you want to find one, all you need to do is visit our Best in Insurance Special Reports Page.

We recently unveiled the five-star awardees for the Top Insurance Agents and Brokers in the US. The industry professionals on the list were handpicked by their peers and vetted by our panel of experts as trusted and dependable market leaders. By taking the time to learn more about these talented professionals, you can find out what they did to rise from the ranks and become among the most respected players in the industry.

Do you think selling insurance is the right move for you careerwise? Tell us why or why not in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!