Wall Street Hit by Fears Economy Is in 'Danger Zone'

“This is very reminiscent, so far, of 1987,” Yardeni said on Bloomberg Television’s Bloomberg Surveillance. “We had a crash in the stock market — that basically all occurred in one day — and the implication was that we were in, or about to fall into, recession. And that didn’t happen at all. It had really more to do with the internals of the market.”

To Michael Gapen at Bank of America Corp., markets are getting ahead of the Fed again.

“Incoming data have raised concerns that the US economy has hit an ‘air pocket.’ A rate cut in September is now a virtual lock, but we do not think the economy needs aggressive, recession-sized cuts.”

Investors should hedge their risk exposure even if they own high quality assets as U.S. stocks extend losses, according to Goldman Sachs Group Inc.’s Tony Pasquariello.

“There are times to go for the gas, and there are times to go for the brake — I’m inclined to ratchet down exposures and roll strikes,” Pasquariello wrote in a note to clients. He added that it’s difficult to think that August will be one of those months where investors should carry a significant portfolio risk.

Equity markets experienced one of the most severe rotations in years in July, with small cap and value stocks surging and mega cap tech stocks selling off. A key question for investors is whether this move continues or fades out similar to previous rotations, according to Jeff Schulze at ClearBridge Investments.

“While a growth scare could spark a retracement of this rotation, we ultimately expect a pickup in economic growth which should favor small cap, value and cyclicals,” he said. “Leadership rarely moves in a straight line, and we believe the near term (the next several months) could see an oscillation that favors the previous leadership on the perception of safety if the economy cools further. Ultimately, we believe a soft landing will play out.”

As the selloff in global stocks intensified Monday, JPMorgan Chase & Co.’s trading desk said the rotation out of the technology sector might be “mostly done” and the market is “getting close” to a tactical opportunity to buy the dip.

Buying of stocks by retail investors has slowed quickly, positioning by trend-following commodity trading advisers has fallen a lot across equity regions and hedge funds have been net sellers of U.S. stocks, JPMorgan’s positioning intelligence team wrote in a Monday note to clients.

“Overall, we think we’re getting close to a tactical opportunity to buy-the-dip and our Tactical Positioning Monitor could dip further in the next few days,” wrote John Schlegel, JPMorgan’s head of positioning intelligence. “That said, whether we get a strong bounce or not could depend on future macro data.”

Cryptocurrencies reeled from a bout of risk aversion in global markets, at one point sending Bitcoin down more than 16% and saddling second-ranked Ether with the steepest fall since 2021.

The U.S. stock plunge is vindicating some of Wall Street’s most prominent bears, who are doubling down with warnings about risks from an economic slowdown.

JPMorgan Chase & Co.’s Mislav Matejka — whose team is among the last-standing high-profile pessimistic voices this year — said stocks are set to stay under pressure from weaker business activity, a drop in bond yields and a deteriorating earnings outlook. Morgan Stanley’s Michael Wilson warned of “unfavorable” risk-reward.

“This doesn’t look like a ‘recovery’ backdrop that was hoped for,” Matejka wrote. “We stay cautious on equities, expecting the phase of ‘bad is bad’ to arrive,” he added.

As the selloff in global stocks intensified Monday, JPMorgan Chase & Co.’s trading desk said the rotation out of the technology sector might be “mostly done” and the market is “getting close” to a tactical opportunity to buy the dip.

Buying of stocks by retail investors has slowed quickly, positioning by trend-following commodity trading advisers has fallen a lot across equity regions and hedge funds have been net sellers of US stocks, JPMorgan’s positioning intelligence team wrote in a Monday note to clients.

“Overall, we think we’re getting close to a tactical opportunity to buy-the-dip and our Tactical Positioning Monitor could dip further in the next few days,” wrote John Schlegel, JPMorgan’s head of positioning intelligence. “That said, whether we get a strong bounce or not could depend on future macro data.”

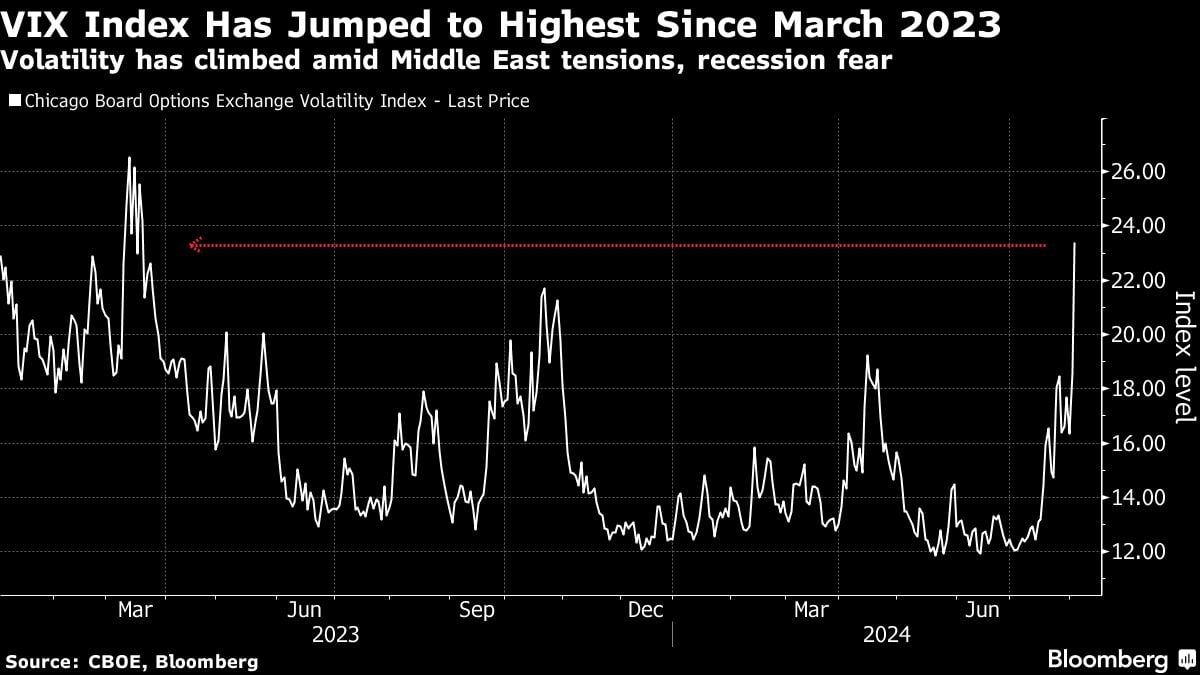

(Credit: Bloomberg)