Vitality Health Insurance Review [Save Up To 37% On Your Policy]

![Vitality Health Insurance Review [Save Up To 37% On Your Policy]](https://www.cheapsr22.us/wp-content/uploads/2022/02/Vitality-Health-Insurance-Review-Save-Up-To-37-On-Your.jpeg)

Introduction to Vitality

As one of the UK’s most well recognised and respected health insurers, Vitality has innovated and modernised the industry by rewarding those who live healthier lives. First, however, we should point out that health insurance is merely part of their product range. They offer everything from car and life insurance to investments and pensions; in this guide, we’re going to focus specifically on their health insurance.

Like many of the best providers in the UK, Vitality offers health insurance to businesses and consumers, with a range of products to suit most needs.

Results of our Vitality health insurance review

We know people tend to be short of time, so let’s jump to the outcome of this Vitality review.

Vitality is one of the best-reviewed financial services companies in the UK, having amassed some 22,763 customer reviews at the time of writing (Jan 2022). They currently have a Trustpilot score of 4.3 out of 5, which is mightily impressive considering the number of customers. Of course, we should point out that the reviews they have collected are for all of their products and services, not just health insurance, but still, it’s an excellent indication of the quality they provide as a whole.

Vitality’s Personal Healthcare comprehensive product is one of only a few policies in the UK to receive a coveted five-star rating from Defaqto, meaning that it stands up to external scrutiny and is one of the best policies in the UK.

Based on all of the information we’ve reviewed and have heard from many customers, Vitality customers first hand, we can wholeheartedly recommend their health insurance.

Compare Health Insurance Policies

Compare the UK’s leading health insurance providers and save up to 37% on your policy.

Compare Policies

on

Navigate this page

If you would like to jump to a particular section of this guide, please use the links below.

Who is Vitality?

Vitality is a UK based company that provides a range of financial services, including health, life and car insurance, along with investments and pensions.

Vitality’s history

In 2004, PruHealth was launched, a joint venture between Prudential plc and South-African based Discovery ltd. It promised to offer a different kind of health insurance that covered people when they were ill and helped them stay fit and healthy by providing incentives and rewards.

By 2010 Discovery Ltd had acquired Standard Life Healthcare, propelling it to the UK’s fourth-largest private medical insurance company. Fast forward, and the re-branded Vitality had approximately 1 million customers in the UK.

Today, Vitality is a household name, not leased due to their sponsorship of AFC Bournemouth, their bright pink livery and of course, their Dachshund, who goes by the name of Stanley.

Interesting facts

Vitality currently subsidises over 600,000 gym memberships for its members and records over 1.6m readings from wearable devices every day!

Vitality private medical insurance – for individuals, couples and families.

Like most private health insurance policies, a Vitality plan will give you fast access to high-quality private healthcare services at a time and place that suits you. Covering you specifically for acute conditions, you’ll get access to the latest drugs and treatments.

Benefits of Vitality health insurance

A Vitality private medical insurance policy will give you all of the following benefits, plus more if you choose additional options:

Quick access to private medical treatment when you need itFlexible cover to suit your requirementsAccess to a wide range of private hospitals and healthcare providersAccess the newest drugs and treatments, some of which may not be available on the NHSMore choice over who treats you, when and wherePrivacy and comfort at a time when you need it

Why Vitality health insurance?

Vitality has many positive reviews from customers on Trustpilot (22,763 at the time of writing), making them one of the best-regarded financial services companies in the UK.

Vitality’s health insurance is underpinned by award-winning customer service – with a dedicated team that ensures you receive brilliant interactions with them.

Their reputation, history, awards and commitment to quality highlights them as one of the best reviewed health insurance companies in the UK.

Really pleased with how quick and easy comparing policies was.

Steve Hamilton-Jones

5.0

on Google

Compare Policies

Recent awards and ratings

Here are some of Vitality’s recent awards and ratings. These are just a small selection; for a complete list, please visit their website.

Defaqto 5-Star Rating Individual Private Medical Insurance 2012-2021 Best Individual Private Medical Insurance Cover Excellence Awards 2017 – 2019 (Highly commended in 2020)Customer Experience Awards 2020 – Overall Winner Best Private Medical Insurance – 2020 Money Facts

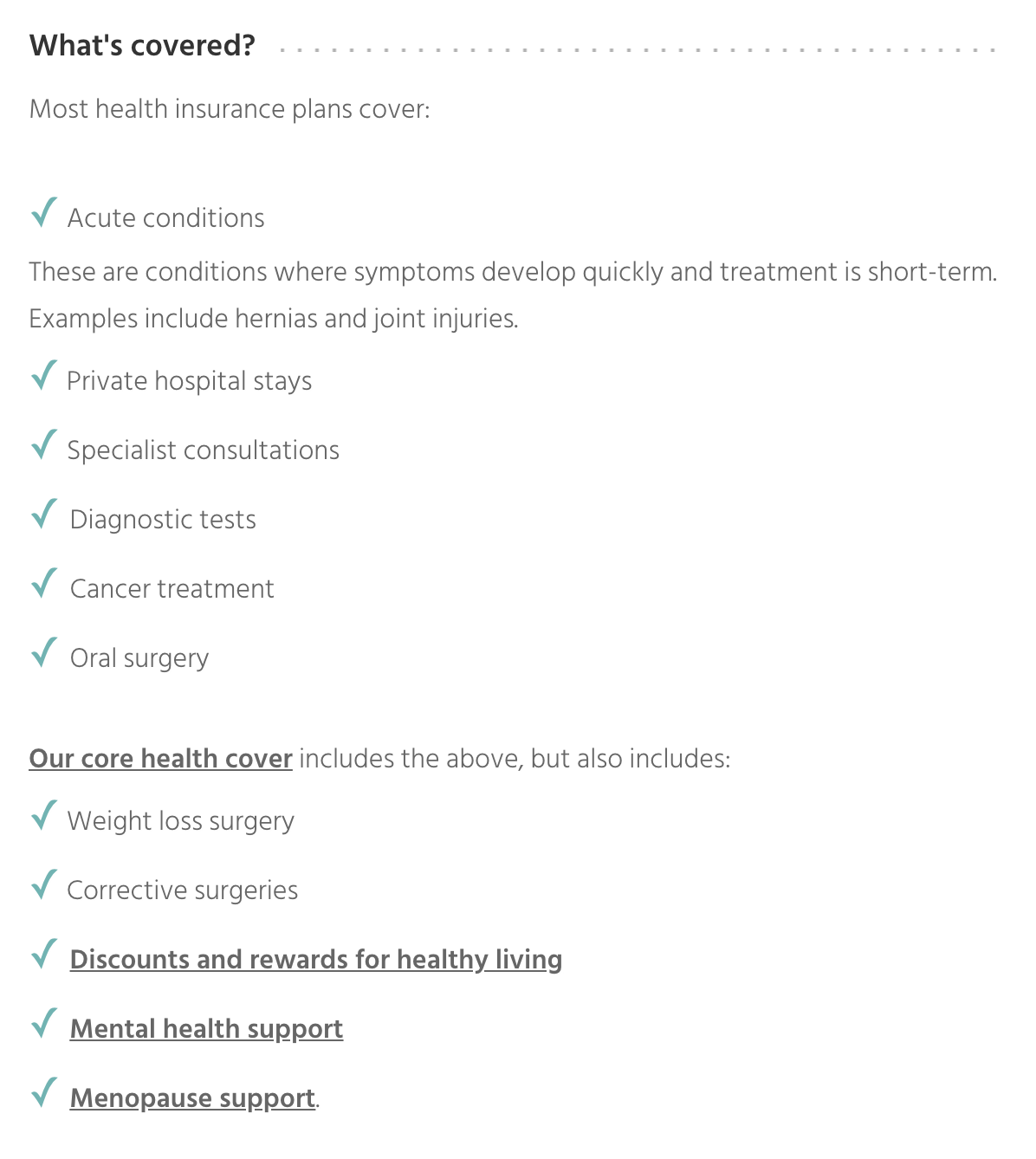

What is covered by health insurance

What is and isn’t covered by private medical insurance will vary from provider to provider, but here are a couple of tables showing you what you can expect with most policies.

What isn’t covered by most health insurance?

Coverage and policy options

All Vitality policies start with their Core Cover, which can then be configured to include additional protection where required.

Vitality Core Cover

Vitality’s Core Cover is pretty extensive, even before you start to think about additional options. Their policies include in-patient and day-patient treatments, integrated primary care, mental health support, and, importantly, advanced cancer cover. For many people, Vitality’s Core Cover is more than enough for their requirements, so let’s look at precisely what’s included.

In-patient and day-patient treatment

All health insurance policies in the UK provide at a minimum in-patient and out-patient treatment, so it should come as no surprise to see it included with Vitality’s Core Cover. They provide Full Cover for all of the following:

Hospital fees

Vitality will cover costs relating to overnight stays, drugs and nursing you may need while you’re in a hospital. They’ll also cover the cost of intensive care treatment and fees relating to the use of operating theatres.

Consultant fees

Included in your Core Cover is any consultant fees while you’re in a hospital. This includes surgeons, anaesthetists, physician fees and other consultations.

Diagnostics tests

While you’re in hospital as a day-patient or in-patient, Vitality will pay for the cost of diagnostic tests you may need, such as blood tests, MRI, CT and PET scans, along with x-rays too.

Advanced Cancer Cover

Vitality’s Advanced Cancer cover provides you with comprehensive treatment and support should you need it. As one of the first UK insurers to cover biological therapies, they’re at the forefront of providing ground-breaking treatment for their customers.

What’s covered:

Cancer screening – discounted screens and risk assessments for cervical, bowel and breast cancer.Biological therapy, targeted therapy and immunotherapy – full coverReconstructive and cancer surgery – full coverWigs – up to £300 per conditionMastectomy bras and external prostheses – some limitations applyFollow-up consultations – full coverEnd of life care – some limitations apply

Mental health support

Vitality’s approach to mental health looks to provide support regardless of your health. They aim to engage and promote positive behaviours and provide quick access to counselling and CBT when required. (You may need supplementary Mental Health Cover to access their full range of benefits)

What’s included:

Talking therapies – Up to 8 sessions of CBT (Cognitive Behavioural Therapy (CBT) or counselling.Vitality Healthy Mind – a way to earn points and rewards for taking up practices such as mindfulness.Together all -an anonymous forum for people that are experiencing mental health issues.

Adding the optional Mental Health Cover, you can get unlimited access to talking therapies up to £1,500 as an out-patient and 28 days of in-patient or day-patient treatment if you need it.

Primary care

While never a replacement to NHS GP services, Vitality’s Primary Care cover gives you access to several supplemental services so you can speak to and see a GP as quickly as possible.

What’s included:

Vitality GP – Get a virtual Gp appointment within 48 hours, and if needed, the GP can refer you for further diagnostic tests. Face-to-Face GP – See a GP face in Greater London for only £20 per consultation.Additional services – using the Vitality GP app, you can refer yourself for physio and even talking therapies.

Out-patient surgical procedures

Included with Vitality’s Core Cover is full cover for surgical procedures when treated as an out-patient. This inclusion is a rarity among insurers’ base offerings, so the fact it is included is a big plus.

This part of your policy doesn’t cover out-patient consultations and consultant fees, which you can access by taking additional out-patient cover.

Additional benefits of Vitality’s Core Cover

Alongside the inclusions we’ve already mentioned, there are many supplementary benefits of Vitality’s Core Cover.

Private ambulance

Full cover for private ambulance transfers between hospitals if a consultant recommends it.

NHS hospital cash benefit

If you opt to receive NHS treatment rather than private, Vitality will give you a cash amount based on the length of your stay in the hospital.

In-patient treatment – £250 per night (max £2,000 per plan per year)Day-patient treatment – £125 per day (max £500 per plan per year)

Childbirth cash benefit

Vitality will give you a cash payment if you have a baby or adopt a child and you have had your policy for at least ten months. They pay once per child, even if both parents are covered – £ 100 per child.

Home nursing

Full cover for home nursing if your consultant recommends it instead of more in-patient treatment.

Parental accommodation

Full cover for hospital accommodation if you need to stay overnight in the hospital with your child under 14 and on the policy.

Oral surgery

Full cover in specified conditions:

Surgical removal of impacted teeth or partially erupted teeth causing repeated pain or infections.Treatment of complicated buried rootsSurgical drainage of a facial swellingRemoval of cysts of the jaw and apicectomy

Pregnancy complications

Full cover for in-patient and day-patient treatment for any of the following:

Hydatidiform moleEctopic pregnancyMiscarriageMissed abortionStillbirthPost-partum haemorrhageRetained placental membrane

Rehabilitation

Up to 21 days of rehabilitation treatment following a severe brain injury or stroke.

Lifestyle surgery

Subject to a 25% contribution to the costs includes removing port-wine birthmarks on the face, breast reduction, ear reshaping, and weight loss surgery. *)restrictions apply)

SuperCarers Services

Access to advice and care services at a discounted rate for you and your family.

Summary of Core Cover

As you can no doubt see, what’s included with Vitality’s Core Cover is extensive, with many benefits. Next, we’ll look at some of the additional options you can choose from.

Vitality’s additional cover options

Many of you will find that the Core Cover will be sufficient, but for those who wish to customise your policy and have access to even more private medical treatment options, this next section is for you.

Out-patient cover

If the standard cover of out-patient surgery isn’t sufficient, we’d suggest you look at Vitality’s out-patient cover. In addition to your Core Cove, it will give you access to out-patient consultations and fees relating to your treatment, such as MRI, CT and PET scans, blood tests, x-rays and more.

The costs Vitality covers will depend on what you add to your plan:

Limited out-patient cover, including consultations, consultant fees, tests and physiotherapy up to a pre-agreed value. MRI, CT & PET scans are covered in full regardless of the limit you choose.Full out-patient cover includes all out-patient consultations, consultant fees, diagnostics tests, scan and physio with no limits.

Physiotherapy

Vitality’s physio network consists of over 7,000 physiotherapy clinics, which means that you will typically not need to drive more than 10 minutes from your home or work to reach your closest clinic. Vitality gives you two options with physio cover; you can either just be covered for treatment by clinics within their network or opt for cover for treatment with that outside of it.

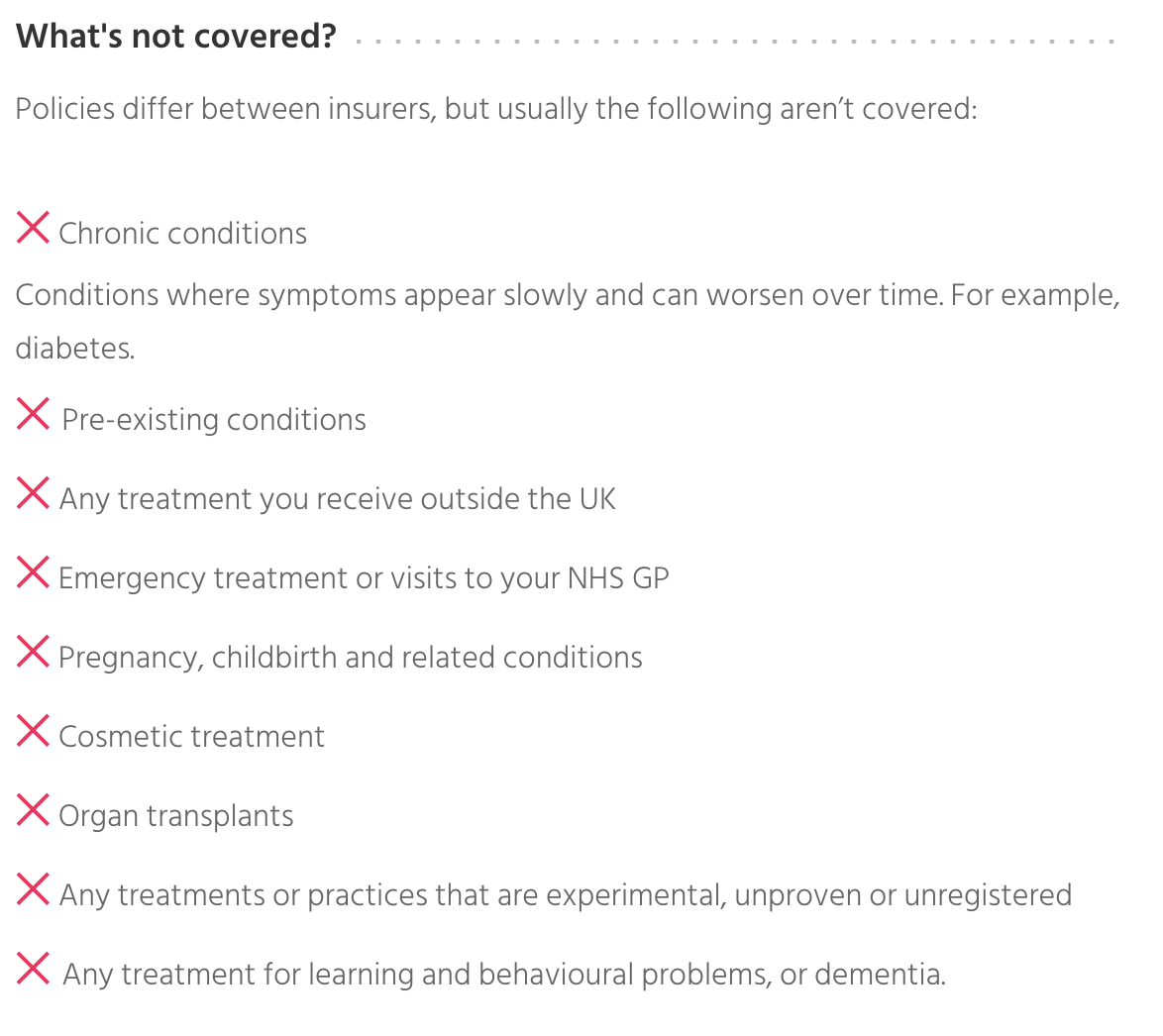

Mental health cover

While every Vitality policy includes core mental health cover, limitations do apply. Those can be removed or reduced by upgrading to full mental health cover. The diagram below shows the levels of cover and support you can get from Vitality.

Diagram Showing Vitalities Mental Health Cover Levels

Diagram Showing Vitalities Mental Health Cover Levels

Therapies cover

Therapies cover will give you access to a range of additional treatment options, including:

AcupunctureHomoeopathyChiropractic treatmentOsteopathyChiropody / PodiatryTwo consultations with a dietician (following GP referral)

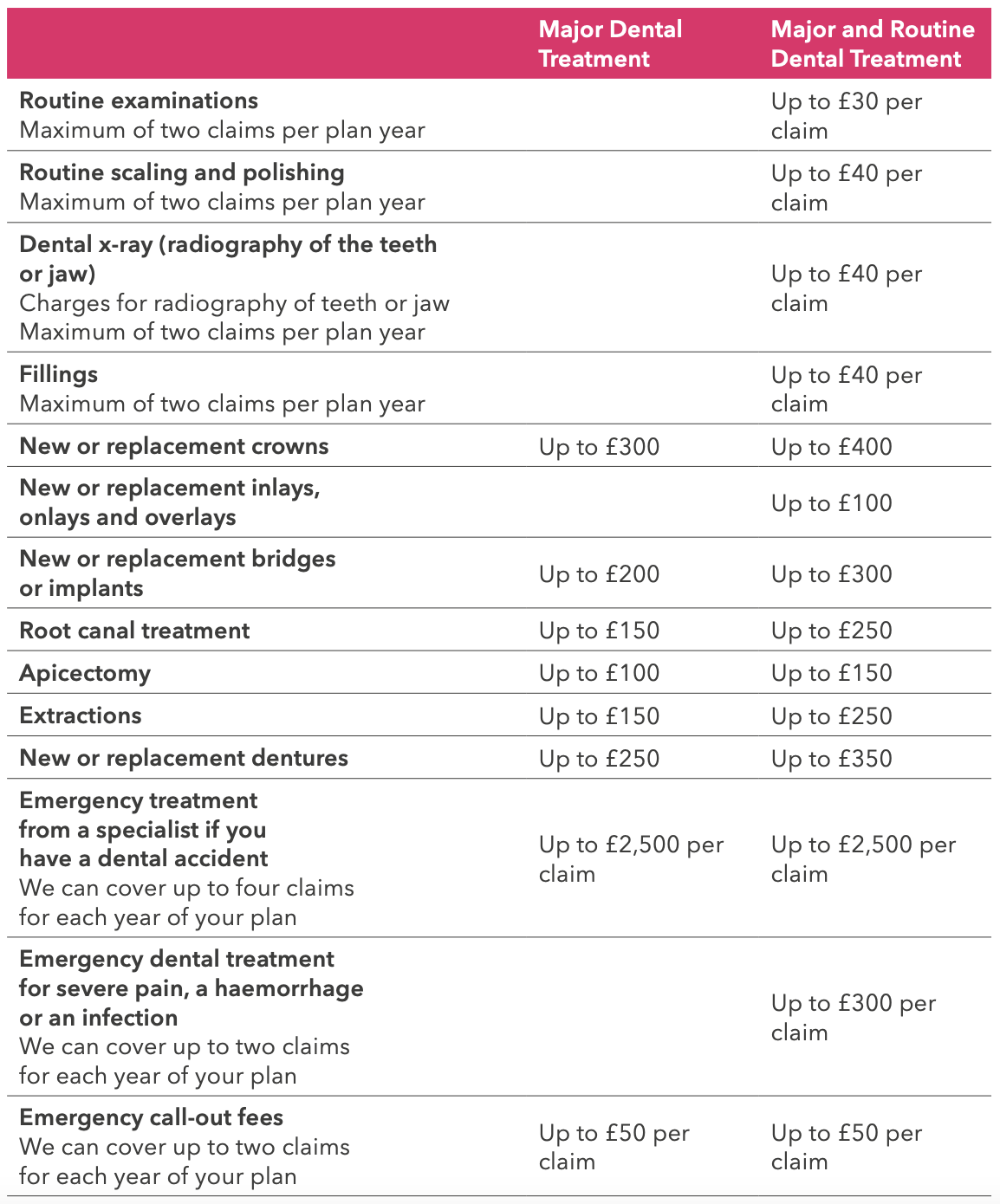

Dental cover

Vitality offers two levels of dental cover to make it easier and affordable to look after your teeth. Both options allow you to pick your dentist of choice:

Major dental treatment: cover for root canals, bridges, crowns, extractions, dentures and emergency dental work.Major and Routing Dental Treatment: all of the above and routine examinations, polishing, scaling, dental x-rays and fillings.

The able below shows what is covered under the two dental cover plans:

Worldwide travel cover

Another important consideration when taking out your policy is whether you’d it to extend to overseas travel. Vitality gives you the option to add on Worldwide Travel Cover, giving you comprehensive travel insurance while you’re abroad.

Hospital options

When and where, along with who treats you, are important considerations and should be discussed with your health insurance broker when you’re configuring your policy. Vitality gives you two options to choose from in this respect:

Option 1 – Consultant Select:

With Vitality’s Consultant select, you will be seen by the consultant who has the best track record of excellent treatment outcomes. Vitality uses an intelligent ranking system to determine which consultant is best for you, considering their past performance and patient feedback. Because high-quality treatment leads to a reduction in subsequential claims, Vitality can charge lower premiums for those of you who choose this option without sacrificing policy quality.

Option 2 – Hospital List

If you would like the flexibility to choose the consultant who treats you and the hospital you are treated in (subject to being recognised by Vitality), you’ll need to opt for Option 2 of a Hospital List.

You can then choose between three standard lists:

Local hospitals

This hospital list will include all hospitals at the leading private healthcare providers, such as BMI Healthcare, Nuffield Health, Spire Healthcare, and Ramsay Health Care. In addition, you will get access to a select number of local providers such as Aspen Healthcare and the New Victoria Hospital.

This list excludes Central London Hospitals.

Countrywide hospitals

The countrywide hospital list includes all of the above local hospitals, with select Central London facilities including The London Clinic, The Hospital of St John & St Elizabeth, King Edwards VII Sister Agnes Hospital and the Royal Marsden Hospital.

The countrywide list gives you access to most other private hospitals outside London and all NHS private patient units outside London.

London hospitals

The most expensive option is the London Care hospital list, which gives you access to all private hospitals in the UK and all NHS hospitals with private facilities in the UK. Effectively this is the gold standard of hospital lists.

Setting an excess

One of the final decisions you need to make about your policy is how large an excess you would like. With Vitality, you can choose between £0 – £1,000 for your excess; be sure to make it affordable as no one wants a hefty bill when they’re unwell.

Vitality Underwriting

Hopefully, you’re still with us at this point as we move onto some of the more technical parts of configuring your policy. Underwriting is a process in which an insurer decides on the cost of your premiums based on several factors, but most importantly, the risk and probability of a claim and the likely cost to them when it happens. Several factors will determine the figure they come up with, some of which you have to control, such as your chosen excess, policy options, and hospital list, but there will be many outside of your control. Where you live, your occupation, your age, and your medical history will be all factor into their equations.

All types of insurance have underwriting, but what is unique about health insurance is that you and your broker can stipulate which type you would like applied to your policy, with there being three to choose from. Today, 95% of policies are written on a moratorium basis, not least because they tend to be the easiest to set up, but that’s not to say it’s the best option for everyone.

Full medical underwriting

If you’re happy for Vitality to spend some time asking you questions about your medical history and speaking to your GP, too, you can choose Full Medical Underwriting. With this type of underwriting, your policy is configured based on your medical history, so you will know from the outset whether anything is excluded based on prior conditions. This is particularly valuable if you want clarity on inclusions and exclusions before you take out the policy. Still, as a full medical assessment is required, it does take a considerable amount of time.

Moratorium underwriting

If you’d prefer to get your policy set up as quickly as possible or would like to defer the review of your medical history, you can choose Moratorium Underwriting. With this type of underwriting, the insurer effectively defers the process of reviewing your medical record until you make a claim. This means that when you take out a policy, there is no medical questionnaire to complete, and they won’t contact your GP. However, what they do, is automatically any condition related to a pre-existing medical condition, meaning once you’ve suffered from or received treatment in the past five years. That’s a fairly broad brush, and for some, it can leave them wondering whether they do or don’t have cover for all eventualities. The trouble with this type of underwriting is that you only find out what is covered at the point of claim, as it’s then that the insurer will review your medical history and make a decision.

While any conditions you’ve received treatment for in the past five years will be excluded from your policy, if you go for two years without receiving treatment or having symptoms, they will automatically be added back in. So just because those conditions are excluded at the outset doesn’t mean they will be forever.

Continued Personal Medical Exclusions (CPME / Switch)

Suppose you already have a private health insurance policy with another provider. You can choose to Switch and Save, which allows you to retain the closest level of health insurance cover with Vitality. We need to write an article on this topic, but in short, Vitality will look to match your provider’s current terms but for a lower monthly fee.

Brilliant from start to finish.

Peter Ernes

on Google

Compare Now

Vitality incentives and rewards

As we mentioned at the start of this guide, a significant part of Vitality’s ethos and approach to insurance is encouraging healthier living. They do this via rewards for keeping active, tracking your health and engaging in mindfulness activities: the more beneficial your efforts, the more points and rewards you earn.

Vitality has three key parts of their rewards program, as we’ll outline now.

One – Understand your health with checks and screens

When you start and assuming you would like to take part in their rewards scheme (you don’t have to), you will need to have a Vitality Healthcheck through their pharmacy network. This entails having a quick 30-minute health check to measure your blood pressure, BMI, glucose and cholesterol levels.

Two – Get active and get healthier

Vitality gives you a range of discounts and exclusive offers to help you on your way to better health and fitness; these include:

50% off flexible monthly gym membership at selected Virgin Active, Nuffield Health and David Lloyd clubs.50% off of a pair of running shoes for each member per year.Up to 40% off selected health trackers.Earn Vitality points on every park run you complete.Up to 25% cashback on selected Waitrose health products.Allen Carr’s Easy way to Stop Smoking work £299Vitality Healthy Mind, Headspace, The Mindfulness app75% off one, two and three-night spa stays and days at Champneys

Three – be rewarded

Here are some of the rewards you can get for getting healthier with Vitality.

Free Cineworld and Vue cinema ticketsFree coffees at Caffe NeroAn Apple Watch for only £37 upfrontAmazon Prime for free20% discount on four hotel bookings each plan year

Summary

For some customers who already lead healthy lives and enjoy keeping in shape, many of the benefits of the discounts and rewards Vitality provides more than covers the monthly cost of the policy.

As we’ve said, you don’t have to use these benefits, you aren’t obliged to, but you will be rewarded if you decide to.

How much does a Vitality health insurance policy cost?

A question at the tip of most people’s tounges is how much does a Vitality health insurance policy cost? It should go without saying that the price of a Vitality policy will depend on a range of variables, and therefore to give you accurate pricing is impossible. If you would like a quote for you or your family, please request a quote from us, and we’ll compare all of the UK’s leading providers and come back to you with the best price for you and the level of cover you require.

The following pricing is meant only as an example; the price you pay will be different.

How much does Vitality health insurance cost for individuals?

For this guide, we have requested quotes based on some fixed information, only changing the person’s age for each quote. We’ve established the quote on the individual living in Bournemouth, Dorset. They will choose core cover only with no extras. They’re happy with £500 out-patient cover and a £250 excess, and they will use the Consultant Select hospital list option. Finally, the policy will be underwritten using Moratorium underwriting.

Vitality Core Cover for a 30-year old – £40.95 per monthVitality Core Cover for a 40-year old – £51.39 per monthVitality Core Cover for a 50-year old – £66.74 per monthVitality Core Cover for a 60-year old – £97.63 per month

Price comparison completed via the Vitality website 17/06/21

How much does Vitality health insurance cost for couples?

For our next set of quotes, we have simply added a partner who is of the age as the lead applicant. Again these prices should only be used for reference.

Vitality Core Cover for a 30-year old couple – £75.04 per monthVitality Core Cover for a 40-year old couple – £96.64 per monthVitality Core Cover for a 50-year old couple – £124.78 per monthVitality Core Cover for a 60-year old couple – £181.56 per month

Price comparison completed via the Vitality website 17/06/21

How much does Vitality health insurance cost for a family?

For our family comparison quote, we have added a five-year-old and a ten-year-old to the policy, with the adults being the same age.

Vitality Core Cover for a 30-year old couple with two children – £95.74 per monthVitality Core Cover for a 40-year old couple with two children – £120.80 per monthVitality Core Cover for a 50-year old couple with two children –£145.85 per monthVitality Core Cover for a 60-year old couple with two children – £200.94 per month

Price comparison completed via the Vitality website 17/06/21

How to get a quote for a Vitality plan

As with any type of insurance, it always pays to compare policies before you buy. Yes, Vitality is an excellent provider, but you may well find Bupa, Axa, WPA, or another better fit for your requirements and budget. Before you buy, we strongly recommend you request a quote through us. When you do, we’ll perform a thorough market review on your behalf, and then an expert FCA adviser will be on hand to help you choose the right policy. Best of all, the service that brokers and we provide is completely free of charge to you.

Frequently asked questions

Is Vitality health insurance any good?

Yes, Vitality health insurance is excellent, and they are one of the best insurers in the UK. Currently, they have over 20,000 positive reviews on Trustpilot, and both their private health insurance and business policies have a 5 Star Defaqto rating.

How much is Vitality a month?

The cost of policies varies based on several factors, but here are some examples for some different age ranges:

Vitality Core Cover for a 30-year old – £40.95 per monthVitality Core Cover for a 40-year old – £51.39 per monthVitality Core Cover for a 50-year old – £66.74 per monthVitality Core Cover for a 60-year old – £97.63 per month

*Prices accurate as of 1st January 2022 and are based on several assumptions about the policyholder and cover. The price you pay will be different, and you should always request a quote to compare the best providers before making a decision.

Can I add my partner to Vitality?

Yes, you can, although it’s sometimes best to check to see if your partner can get better elsewhere before committing. You both are different people, and therefore, the quotes you get from providers will vary. We always suggest speaking to an independent broker before buying or adding people to policies.