Visualising higher catastrophe bond spreads & pricing

With reinsurance rates having hardened considerably, pricing in the catastrophe bond and broader insurance-linked securities (ILS) market has followed suit.

In fact, the new reinsurance and retrocession pricing regime that has been installed through the January 1 2023 renewal season really became visible first in the catastrophe bond market, as Artemis’ data shows.

Today, we wanted to highlight some of our cat bond market charts and statistics that can help you to visualise the significant moves in pricing seen.

As well as tracking cat bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, or which risk modellers feature in cat bonds most frequently, plus much more, we also track pricing data, in particular expected losses, coupons, spreads and multiples.

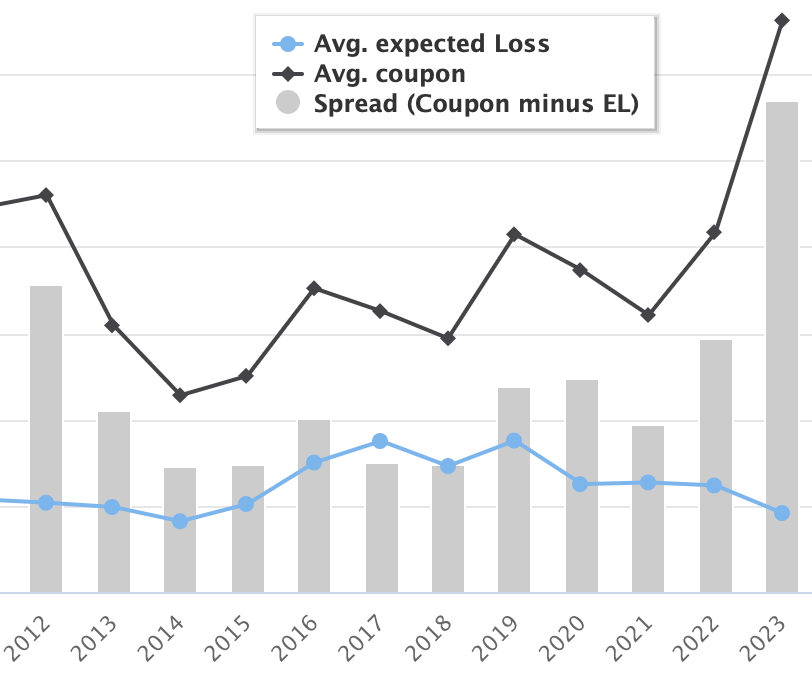

First, our chart displaying the average coupon, expected loss and spreads of cat bond & related ILS issuance by year.

This chart clearly shows the far wider spreads available at this time, although do remember this is only based on a few issuances so far in 2023.

The spread is at decadal highs and approaching the levels seen historically, if you click the image to view the full interactive chart.

Also, this chart shows that average cat bond expected losses, at issuance, are trending downwards, which suggests less risk being taken on, in return for significantly higher yield spreads.

The trend in cat bond pricing is even more visible in our chart lower-down that page, which displays the spread information by quarter.

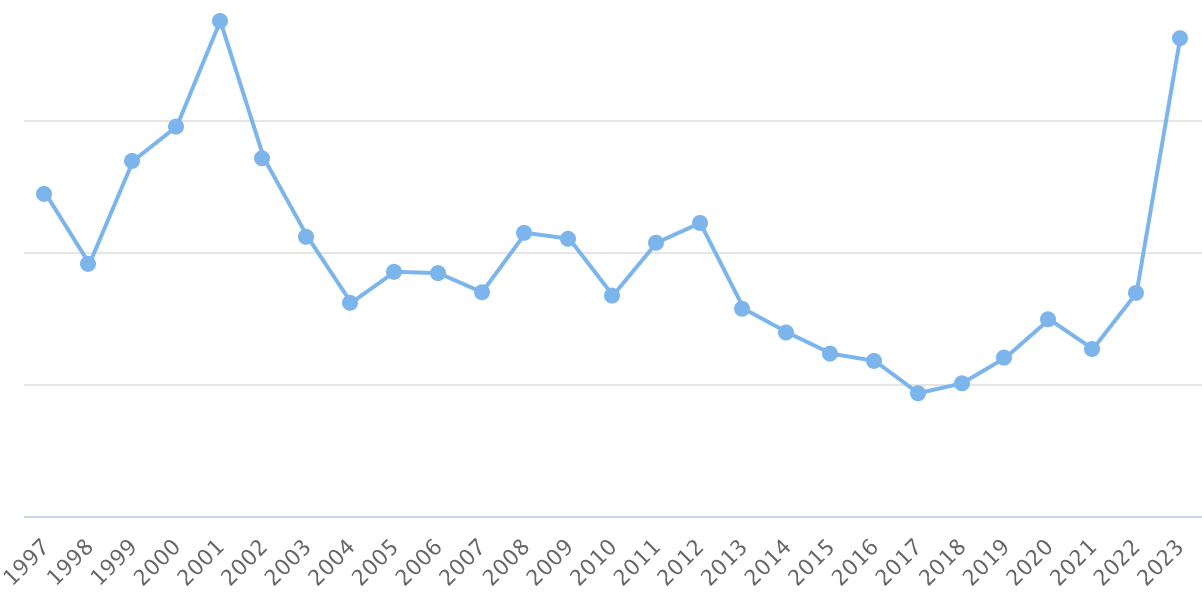

Second, our chart displaying the average multiple (expected loss to coupon) of cat bond & related ILS issuance by year.

Second, our chart displaying the average multiple (expected loss to coupon) of cat bond & related ILS issuance by year.

It shows the multiple-at-market of cat bond issuance in 2023 so far as being around the all-time-high, although again it’s important to note this is only based on a handful of new cat bonds so far this year.

Again, the trend is much more discernible in our cat bond multiple chart that displays the data by quarter of issuance, which shows that pricing has been on the rise in the cat bond market for some quarters now.

One additional data source you might find helpful, is our ILW pricing data, which is a unique data set on the development of rates-on-line for industry-loss warranty (ILW) coverage over more than a decade.

With ILW pricing at record highs, this is another valuable input to decision-making and helps in understanding the current reinsurance and ILS pricing environment.

Find all of our charts and data here, or via the Artemis Dashboard. All of these charts are updated as new cat bond issues complete, or older issuances mature.

Join us on February 10th 2023 in New York for our next catastrophe bond and ILS market conference, where you’ll hear more about pricing trends in the market. Register soon as tickets are expected to sell out!