Visualising cat bond pricing coming off the top of a hard market

As we’ve been reporting for some weeks now, there is increasing evidence in the way catastrophe bonds are pricing that rates for reinsurance and retrocessional coverage from the cat bond market are now coming off the top of the hard market.

Nowhere can this be better visualised in real-time than with Artemis, as we update our charts and data analytics as each new catastrophe bond that we have details on gets priced and settles.

As a result, our charts tracking average spreads, coupons, expected loss and multiples-at-market by year are valuable in showing how pricing and demand trends develop in the catastrophe bond market.

But even more valuable at this point in time, given how fast moving the pace of change has been of late, are the fact we also have this data available by quarter, so you can much more clearly see the cat bond issuance market pricing trends as they develop.

As we’ve previously reported, catastrophe bond spreads above expected loss reach an all-time-high earlier this year.

Our latest catastrophe bond market quarterly report shows that the average spread above expected loss dropped towards the end of the first-quarter, but still remained at a record high.

The catastrophe bond price environment is developing quickly though and it’s now clear in our data that spreads have come off their highs, while the multiple-at-market of cat bond issuance has also slowed its seemingly inexorable climb.

To see the pricing trend most clearly, our two key cat bond pricing charts are most useful.

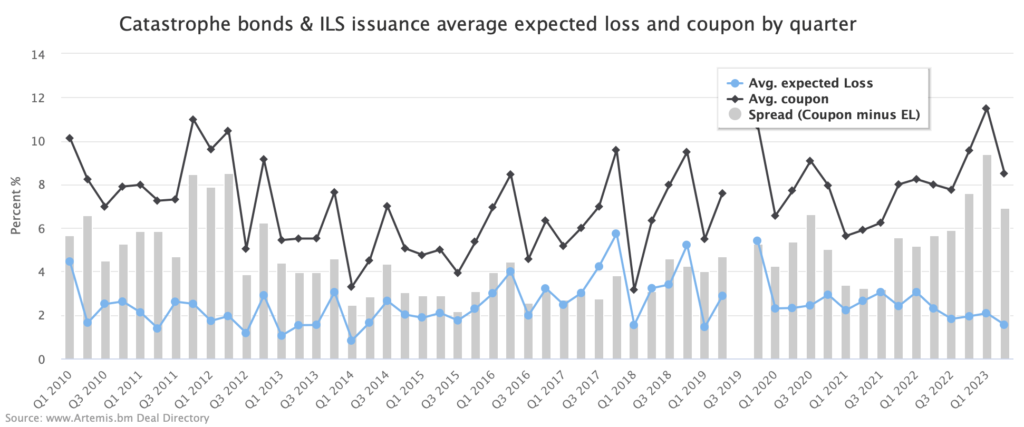

First, our chart displaying the average coupon, expected loss and spreads of cat bond & related ILS issuance by year.

Year-to-date, the average coupon remains high at 10.71%, while the average expected loss is down year-on-year at 1.94%.

Which means the average spread above expected loss now stands at 8.77%, including the latest cat bond issuances that have settled this week.

But, we now have this data by quarter as well and it is there that you can see how the second-quarter’s pricing is developing, with clear evidence of some softening in the cat bond market, or at least rates coming off the hard market peak.

As of today, which sees eight new cat bond series already incorporated into Q2 2023 data, you can clearly see the decline in spreads in the second-quarter (seen below, click the chart for an interactive version)

For Q1 2023, the average expected loss was 2.08%, the average coupon 11.49%, giving an average spread of 9.41%.

Given the average spread had been above 10% at one stage in the first-quarter, it’s clear prices were coming off their highs before the end of March.

But for Q2 2023, the fact the cat bond market has softened off its hard market high is even more evident, with eight new priced and settled cat bond issues providing evidence so far this quarter.

For Q2 2023, the average expected loss was lower at just 1.55%, but the average coupon was also a good deal lower at 8.50%, giving an average spread for the second-quarter so far of only 6.95%.

Spreads are certainly lower, but they aren’t the only way to look at catastrophe bond pricing using our data.

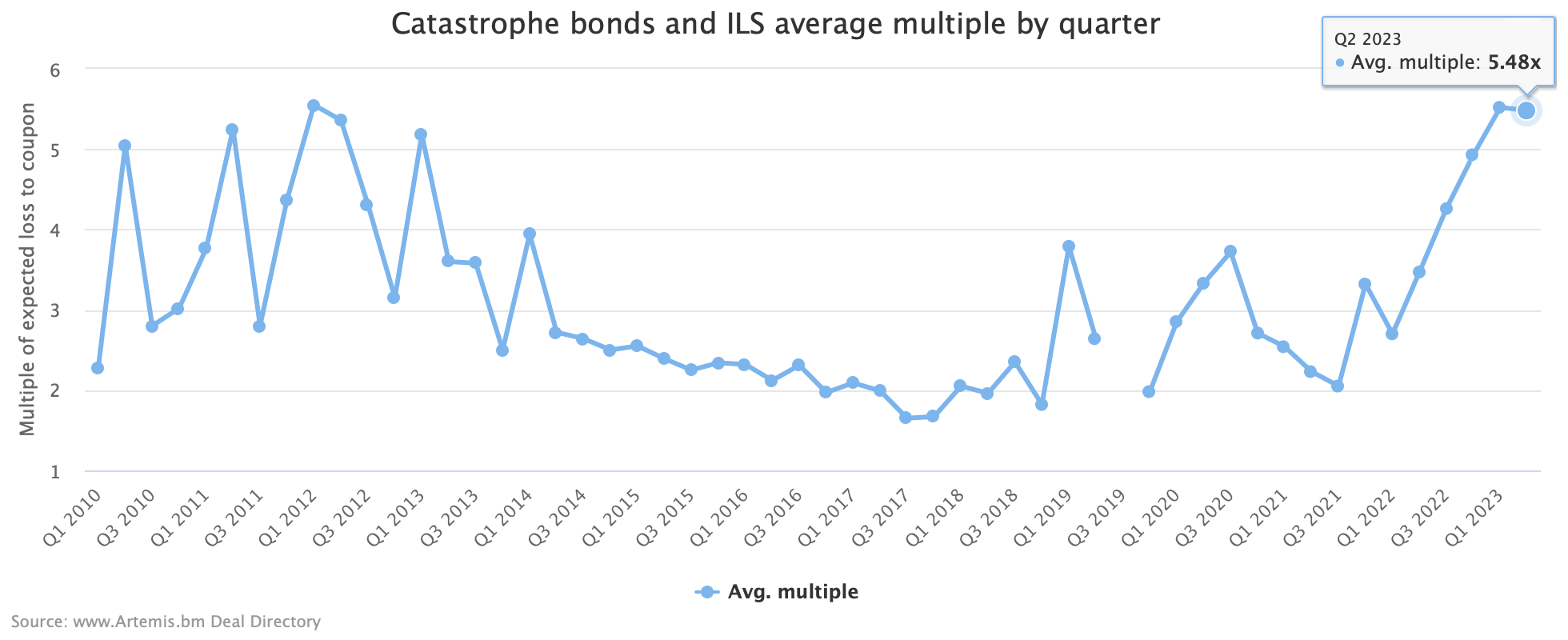

Second, our chart displaying the average multiple (expected loss to coupon) of cat bond & related ILS issuance by year shows a similar story.

Year-to-date, the average multiple-at-market of catastrophe bond issuance stands at 5.52 times the expected loss, a significant uptick on the prior year.

But, again, if you look further down that page where we track the average cat bond issuance multiple by quarter of issuance, you get a particularly clear picture of the hard cat bond market ensuing from 2021 and accelerating through 2022.

Then the multiple peaked in the first-quarter of 2023, but has now come off that peak in the second-quarter, falling to a 5.48 average multiple-at-market for cat bond issuance we’ve recorded in Q2 to-date.

Again, you can see this in the chart below and click on it for the interactive version.

So, there is very clear evidence in the data that the record high catastrophe bond spreads have softened somewhat, likely in response to inflows of new capital from investors, as well as high investor demand for cat bond investments.

But, it’s also a function of the issuance seen and while it’s still early days in Q2, the multiple-at-markets earned by investors, in terms of expected loss to coupon, appears more resilient so far.

Over the coming months, we’ll be looking at how the price trend in the market develops and where spreads and multiples are by the fourth-quarter will be interesting, as that typically busy issuance period is also often a time of further capital inflows.

Ultimately, we’re hoping to see a stabilisation at some point, as this is what investors want to see. They do not want to see a race back down to ultra-low cat bond spreads and multiples, like we’d seen in the past.

Reinsurance pricing dynamics are following-suit, to a degree it seems, with some of our sources expecting the pace of rate increases to soften somewhat at the mid-year reinsurance renewals, which could provide another valuable data-point to inform how cat bond rates develop further ahead.

Because catastrophe bonds are issued outside of the traditional reinsurance renewal cycle, the cat bond market can actually show how pricing will develop more broadly, as a key gauge of risk appetite and price requirements in the market.

One additional data source you might find helpful, is our ILW pricing data, which is a unique data set on the development of rates-on-line for industry-loss warranty (ILW) coverage over more than a decade.

Our ILW pricing data shows a similar “coming off the top” softening of rates-on-line, a further indication that the current hard market may have peaked.

With ILW pricing still at record highs, this is another valuable input to decision-making and helps in understanding the current reinsurance and ILS pricing environment.

We also track catastrophe bond and related ILS issuance data, the most prolific sponsors in the market, most active structuring and bookrunning banks and brokers, which risk modellers feature in cat bonds most frequently, plus much more.

Find all of our charts and data here, or via the Artemis Dashboard which provides a handy one-page view of cat bond market metrics.

All of these charts and visualisations are updated as soon as a new cat bond issuance is completed, or as older issuances mature.