Using Customer-Directed Motives and Tech to Build Risk Resilience

Published on

April 13, 2023

Is the time right for insurers to make major moves based on new customer sentiments? Using three customer personas, below, we examine a new opportunity in insurance: customer-directed prevention and protection. Each situation gives us insight into how insurers might collaborate with policyholders to reduce risk.

Cameron pays attention to all the neighborhood news on his Nextdoor app. He notices that many of his neighbors have installed their own surveillance systems by companies like Ring and Nest. He likes the idea of video systems that are tied in with his full home network, including thermostats. He enjoys the control he has over his home systems, even when he travels. He feels more comfortable being away when he can remotely tune in to his home.

Sheila had her car stolen outside of her apartment in March. She liked her car, but what she disliked most about losing it was the inconvenience of the process. When she asked her agent what she could do to keep it from happening again, the agent suggested adding some security tech to the vehicle. Right after purchasing a new car, Sheila had a dash cam installed. She added a GPS tracking tag and a wheel lock. She is now looking for an apartment with secure garage parking.

Natalie bought herself an Apple Watch after a co-worker showed her how well it was tracking her exercise and sleep. The watch’s ECG function caught an irregular heart rhythm that allowed her to get treated before something major happened, such as a stroke. Now Natalie refers to her watch as the “lifesaver.”

What is fascinating is that in each of these cases, the customer has the motive to spend their own money on lowering their own risk. At the very same time, their insurers (that have every reason to be pleased) aren’t that interested in finding out who is and who isn’t proactively protecting themselves and their property, let alone develop new products that price differently for it. Insurers who grow more digitally adept and data savvy can create and grow a new kind of customer relationship, forged on a common desire for risk avoidance and mitigation.

It’s time to get interested.

A bridge to the future with foundations in a shared desire to lower risk

Three of Majesco’s annual reports, our Consumer Trends report, SMB Consumer Trends report, and Strategic Priorities report, are designed to help insurers grasp the ways in which they might connect their businesses with the needs, expectations, and motives of customers. As we dig into the major and minor details of customer trends, we also make suggestions about how insurers might take advantage of shifts in usage or shifts in motive. We ask questions regarding lifestyles, purchase patterns, and areas of interest. We look closely at connections and disconnections between what customers want and what insurers are providing and use this as input to our product roadmaps to help our customers stay in-sync or ahead of their customer needs and expectations.

As we look at the topic of risk resilience, we are starting to see a rapidly growing need for insurers to coalesce their thinking behind a new vision of risk — the customer’s view of risk. It’s at this point that insurers can answer their own questions about the right products, pricing, and channels that fit today’s customer needs and expectations.

For insurers focused on new products, pricing, and new channels, the focus is on growth and profitability. One way is by decreasing the circumstances of risk in a world where risk seems to be shifting and growing by leaps and bounds. Prevention and protection are becoming the marketing love language of the insured — eclipsing repair and restoration. If we look through the lens of statistics, we may conclude that there is a new dynamic in insurance — a tightening bond between the customer relationship and insurer efforts to lower risk substantially. Here’s an overview of the issue at hand based on our research:

Customers are increasingly interested in protecting themselves, their property, vehicles, and health.

Insurers are, overall, more preoccupied with internal operational areas. They are less concerned about some of the risks that their customers are concerned about.

If insurers could effectively tap into customer interest in lowering risk, they could create a win-win for themselves and their customers by building up resilience against risk. In doing so, insurers could significantly influence and positively impact costs, profitability, and customer retention.

Let’s look at each factor individually.

Customers are increasingly more interested in protecting themselves, their property, vehicles, and health.

Consumer spending on smart home devices has skyrocketed in recent years. Between 2020 and 2021, there was a 43% increase in smart home device sales. Home security spending was expected to reach $5.43 billion in 2022 and $9.14 billion by 2027.[i]

Video cameras were the fastest-growing smart home appliance in the first half of 2022 (55% growth from 2021 to 2022). Smart doorbells also had a 43% increase year over year. Video doorbells are now owned by at least 14.6% of Americans.[ii]

Growth is astounding in the wearable fitness tracking sector, with usage tripling between 2016 and 2019, then doubling from 2019-2022. Globally, over 1.1 billion people own and wear a fitness tracking device. Over 30% of US adults use a wearable healthcare device, with 82% of those who are “willing to share their health data with their care providers.”[iii]

These statistics point in the same direction. People are growing comfortable with using technology to protect themselves and to understand and control their lives and health. Can insurers take advantage of this new level of interest and usage to engage customers in a protective partnership? Can insurers and customers work more closely together to avoid risk and construct a framework for risk resilience?

Healthcare’s lesson for P&C and L&AH insurers

Without going into a history lesson on Consumer Directed Health Care (CDHC), the theory behind it is crucial. The more that people have a say in where and how money is spent on their health, the less they will spend on unnecessary procedures and the more they will take care of their health. Not every facet of consumer-directed care is working. For example, consumer-directed care was supposed to drive down the costs of health care because people would “shop around” for providers. That portion has yet to prove true.

Most consumer-directed care, however, is working. People are paying more attention to their health and their care. The incentive to stay healthy is improving health, plus it is improving interest in personal health statistics, like those measured with wearables such as an Apple Watch and Fitbit.

The same customer-directed motives can be used by insurers in the P&C and L&AH spaces. It’s the right time to partner with customers in the decisions they have to make about how, where, and when they protect themselves. Insurers should be prepared to understand their customers better and be ready to step in to assist those who are motivated to stay safe and healthy.

Insurers may be less concerned about some of the risks that customers are concerned about.

Many insurers are still prioritizing their internal issues over their customer understanding and experiences. When they do have shared concerns over risk, insurers tend to be less engaged and less worried than their customers.

Are insurers and customers aligned on their concerns?

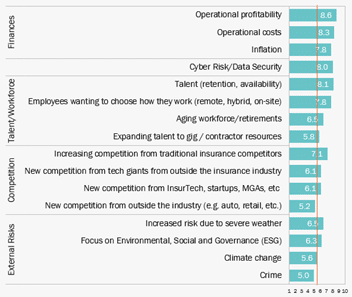

Recent Majesco research uncovered some customer/insurer disconnects that we can use as examples. In our recent thought-leadership report, Game-Changing Strategic Priorities Redefining Market Leaders, we tracked insurers’ top-of-mind issues. (See Fig. 1).

Figure 1 – The most important issues for insurers

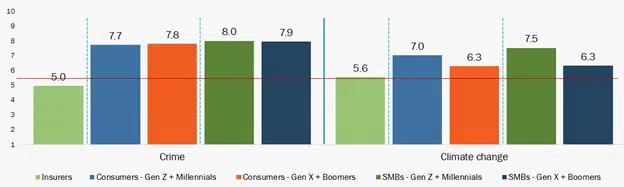

If you skim just the top six concerns, you see internal priorities that concern executives. These are certainly crucial to insurance operations. However, insurers’ lower concern about External Risks is misaligned with their customers’ views, especially on the issues of crime and climate change. (See Figure 2. Pay close attention to the Insurers’ level of interest vs. their customers.) Gaps in concerns about crime are large, ranging from 36% to 38%. Gaps in climate change concern are lower but still concerning, from 12% to 26%. Gen Z and Millennial SMB owners are also more concerned about increased risks due to severe weather (7.3 vs. 6.5) and focus on ESG factors (7.2 vs. 6.3). As customers increasingly look at who they do business with across other factors, such as ESG and climate change positions, this could shift who they do business with long-term.

Figure 2 -Disconnects between insurers and customers in concerns about crime and climate change

It’s easy to dismiss statistics like this, but why would you want to? An understanding of customers can help insurers as they prepare to engage more deeply. For example, “74% of Americans who are concerned about climate change own a smart home device.” The link between the two may not be easily understood, but it is clear. Many smart-home devices are designed to save energy. People concerned about saving energy may be concerned about the environment. Climate change is also increasingly tied to catastrophic risk events. It is the kind of statistic that shows how critical it is for insurers to grasp which of their customer types are most likely to partner with them in efforts to protect and prevent.

Insurers should be taking advantage of the fact that customers want more control over the risks of their lives. To do this, they will need to understand their customer’s motivations and their desires to self-direct their protection.

If insurers could effectively tap into customer interest in lowering risk, they could create a win-win for themselves and their customers by building up resilience against risk. In doing so, insurers could significantly influence and positively impact costs, profitability, and customer retention.

Customers want confidence and security, but insurers sell them a loss-recovery contract. While most insurers are focused on how they can better assess risk, many more are expanding to also focus on the prevention of losses and creating risk resilience for customers. The old adage of “control what you can control” is now front and center for insurers as they look at new risk management strategies as a crucial component of their underwriting and customer service strategy.

What are insurers doing today?

It is crucial to identify, assess, and create plans to minimize risk. Leading insurers are leveraging technology such as IoT devices, smart watches, loss control surveys, and value-added services to not only assess and monitor risk but to proactively respond to it with mitigation services and actions. From concierge services to monitoring water hazards and the safety of employees, to helping to live healthy lifestyles, leading insurers are shifting to risk resilience strategies that not only drive better business outcomes but also great customer loyalty and retention.

Where does Cameron’s home insurer fit into his desire for whole-home monitoring? Can his insurer step in with incentives, with better tracking software, or with expanded sensors for things like water damage to provide real-time alerts? He is likely to appreciate the cooperative efforts of his insurer to protect his home. Chubb, for example, is a proponent of leak detection technologies. Chubb shares device costs by offering premium credits to some policyholders that install leak detection devices.[iv] Where are there other opportunities for risk mitigation where insurers and policyholders can work together?

How can Sheila’s auto insurer give her better peace of mind protection and an experience that fits with her need to keep her car from theft? Can auto insurers do a better job of protecting against theft, directing auto buyers to cars that are tough to steal, or improving their ability to recover quickly? So far, insurers aren’t motivated to give steep discounts for the use of protective technologies. Are they at least able to find out which policyholders are actively working toward risk prevention?

The use of Apple Watch and Fitbit data for life insurance is well-documented, but still not in wide use outside of John Hancock’s Vitality. But where are the other life and voluntary benefit insurers who might team up with policyholders that are making great strides for their health? With health data tracking on the rise, insurers should be looking at ways in which life/property protection technologies can work across silos to benefit both insurers and policyholders.

How can insurers guide their insureds to eat healthier, exercise regularly and steer clear of known risks? How can they cultivate a new type of customer relationship that is based on improving their lives, protecting people and property, and understanding risks at all levels.

For most insurers, risk resilience begins with proper use and understanding of customer data and preferences through next-generation core, digital and data technology.

Are insurers prepared to gather and analyze the many types of data that will give them insights into customer behavior and motivators? Are they then prepared to develop products and services that fit customer-directed motives for their own protection? As risk grows globally, insurers need to prepare by switching their technologies over to cloud-based platforms where data flows easily, connectivity is simplified and secure, and insights are visual.

At a higher level, insurers need to consider their customers as partners in risk resilience — tapping into their own desire to keep themselves healthy, safe, and secure. For more information on developing a risk-resilient technology environment, be sure to watch Majesco’s webinar, Creating Customer Value, Security and Loyalty in Times of Change by Rethinking Insurance. Also check out Majesco’s market-leading solutions including P&C Core, L&AH Core, Data & Analytics, Loss Control, Underwriter360 and IQX Underwriting that are providing the foundation and capabilities of a risk-resilient technology environment. And, for a deeper dive into the strategic priorities of market leaders, be sure to read, Game-Changing Strategic Priorities Redefining Market Leaders.

Control what you can control … a next generation risk resilient technology foundation.

[i] Smart Home Report 2022 – Security, Statista, December 2022

[ii] Smart Home Market Report, p. 13, August 2022, PlumeIQ

[iii] Chandrasekeran, Ranganathan, Vipanchi Katthula, Evangelos Moustakas, Patters of Use and Key Predictors for the Use of Wearable Health Care Devices by US Adults: Insights from a National Survey, October 16, 2020, National Institutes of Health

[iv] Rabb, William, Insurers Making Waves with Wider Use of Leak, Temp Sensors, January 31, 2022, Insurance Journal.