US property cat reinsurance rates up 116% since 2017: Guy Carpenter

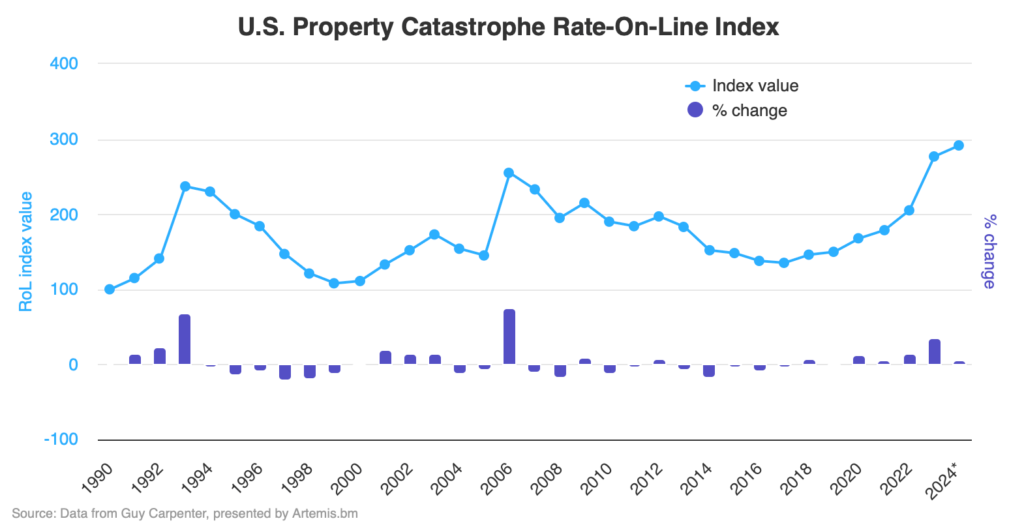

Property catastrophe reinsurance rates-on-line slowed their trajectory significant at the January 2024 renewals, but in the United States while the slow-down was a little more severe than some other regions, US property cat reinsurance rates are now a stunning 116% up since 2017, according to Guy Carpenter’s Index.

Guy Carpenter’s U.S. Property Catastrophe Rate-On-Line Index rose by almost 5.3% at the 1/1 2024 reinsurance renewal season.

Which, while still a further increase, was actually a little slower paced than some other parts of the world.

The reinsurance broker had reported recently that global property cat reinsurance rates rose by 5.4% at the 1/1 2024 renewals, while European property cat reinsurance rates rose a little faster at 7.6%.

The US property catastrophe reinsurance marketplace remains the dominant source of risk for insurance-linked securities (ILS) fund managers, so the continued upward trajectory there was encouraging, albeit slower than Europe in regional terms.

The rise of almost 5.3% at 1/1 2024 renewals means this US property catastrophe reinsurance rate Index has now risen every year since 2017.

You can view an interactive version of the Index by clicking on the image below:

At the January renewals, only a smaller component of US property catastrophe reinsurance programs renew, largely regional and nationwide, with less coastal towers placed.

So it will be interesting to see how the Guy Carpenter U.S. Property Catastrophe Rate-On-Line Index moved after mid-year as well.

The US property cat reinsurance Index now remains at an all-time high and since the lowest point of the last soft market, in 2017, this Index is now up by 116%.

With demand continuing to soak up capacity, helped by inflationary effects as well as US insurers buying more protection, there is every chance we see at least a relatively stable renewals at the mid-year of 2024, possibly more rate increases, albeit at an expected slower pace again.

Guy Carpenter reported that the renewals at January 1st 2024 were far more stable and while the US property cat reinsurance business is not the main focus of those renewals, further increases suggest rate momentum may continue through to the the mid-year renewal season, with that juncture having a more significant contribution to this Index.

Read all of our reinsurance renewal news coverage.