US commercial property rates accelerate on reinsurance hardening: Marsh

US commercial property insurance pricing accelerated in the fourth-quarter of 2022, with the challenging and hardening reinsurance market environment a key driver, according to broker Marsh.

Property rates had been stable and even decelerating in some parts of the US commercial insurance market through much of 2022.

Although catastrophe exposed property insurance rates, particularly in exposed coastal regions like Florida and the Gulf Coast, or wildfire exposed areas such as California, have continued to harden throughout last year.

But now, the entire commercial property insurance market saw rates accelerate in the final quarter of last year, which broker Marsh puts down to the impending at the time hard reinsurance renewal.

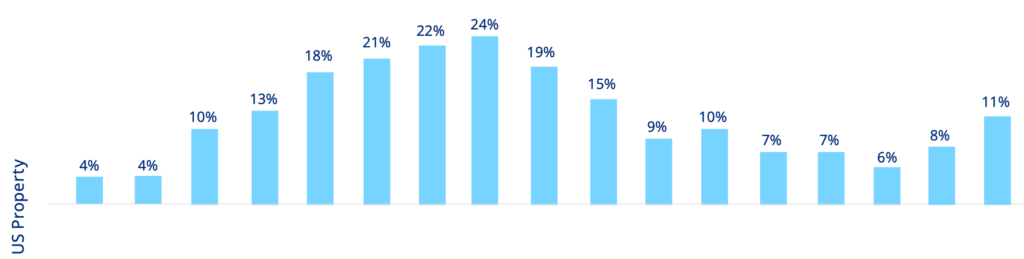

Property insurance pricing increased by 11% in the fourth-quarter of 2022, according to Marsh’s data.

That’s up from the 8% in the third-quarter, 6% from Q2, becoming the highest quarterly increase since Q4 of 2020 and the twenty-first consecutive quarter in which pricing rose.

“The pricing increases experienced by clients were largely driven by challenges in the reinsurance market leading up to the January 1 treaty renewals,” Marsh explained.

Renewal rate outcomes for commercial property insurance buyers continued to bifurcate though.

“Best-in-class risks — with limited named windstorm exposure and stable capacity from the incumbent insurer — typically experienced better results,” Marsh said.

But noted that, “Generally, clients that experienced higher increases were affected by losses and/or were predominantly located in high hazard CAT zones, such as the Gulf of Mexico and the Atlantic coast.”

Global inflationary trends meant that underwriters continued to focus on valuation in their underwriting, Marsh said and total insured values increased by 10%, on average, in Q4.

On a global basis, commercial property insurance rates increased by 7% in Q4 2022, up from 6% in the prior quarter.

The outcome was not even globally though, as the UK saw rates increase at 6% for the third consecutive quarter, but Latin America saw some rate acceleration like the US.

In Latin America, Marsh noted that property catastrophe risks are a concern and that the highest increases were seen in cat-exposed areas.

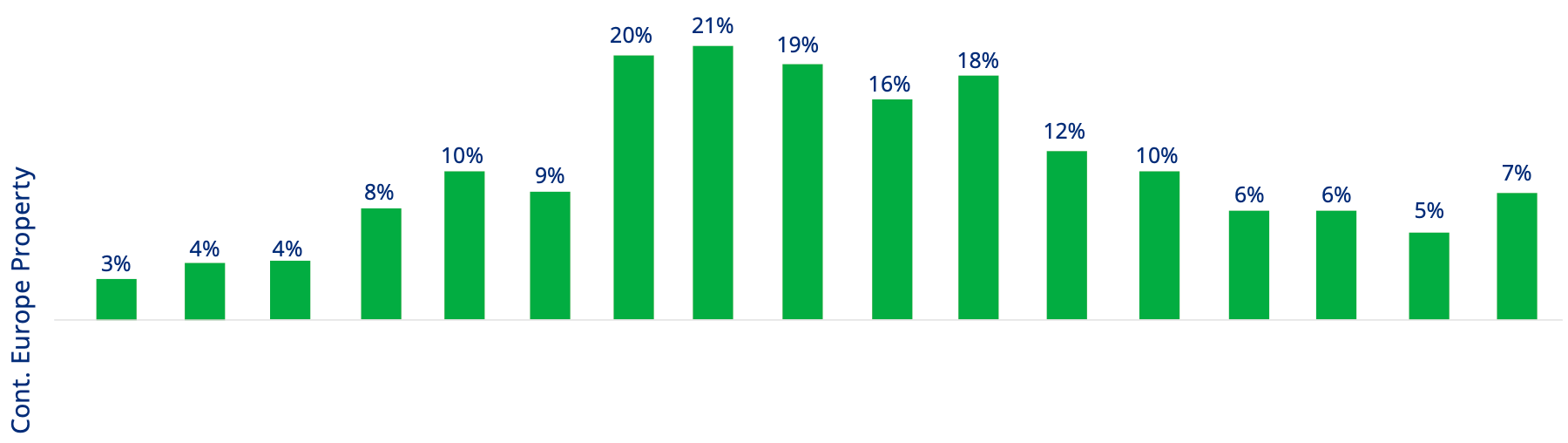

Continental European property insurance accelerated, rising 7% in Q4, up from 5% the prior quarter, with global issues around capacity (likely also with reinsurance behind this trend) as well as cat risks seen as drivers.

“Hurricane Ian and other catastrophe losses created uncertainty around capacity and put upward pressure on CAT pricing,” Marsh explained on Europe. “The inflationary environment also drove property pricing increases, especially where asset values were deemed inadequate.

“Terms and conditions and capacity continued to be bifurcated in areas including CAT- exposed and non-CAT-exposed; loss-hit and loss-free; and high hazard and low hazard.”

In the Pacific, catastrophe perils are also in focus, with Marsh saying, “loss impacted and CAT-exposed clients seeing the highest increases.”

Catastrophe and secondary cat perils are in focus in Asia, although here rate rises were far lower at 2%, the same as the prior quarter, Marsh noted.

Commenting on the commercial insurance pricing data, Lucy Clarke, President, Marsh Specialty and Global Placement, Marsh said, “After a challenging 2022, our clients will continue to face a tough operating environment in 2023. With a slowdown in the global economy, in addition to ongoing inflation and geopolitical tensions, many clients face significant headwinds.

“Pricing for property risks continues to be impacted by the high level of losses in 2022, especially resulting from Hurricane Ian. We are working with our clients to examine a wide range of options, including the increased use of captives and alternative risk financing options, to address their needs and to obtain the optimal outcome for them from the market.”