Understanding Unoccupied Home Insurance: Coverage and Benefits

Introduction

Empty property insurance is a special type of insurance designed to protect homes that are not actively lived in. If you own a house that’s sitting empty—whether it’s a rental property between tenants, a vacation home during off-season, or a house you’re trying to sell—this insurance provides the coverage you need. Here’s a quick breakdown:

Definition: Protects uninhabited homes from risks like theft, vandalism, and natural disasters.

Importance: Homes that are empty face higher risks because no one is there to notice issues as they arise.

Financial Protection: Covers potential financial losses from damage, giving peace of mind.

Having no one around increases the chances of things like break-ins or water leaks turning into major problems. Traditional homeowners insurance often doesn’t cover vacant homes. This means you could face huge expenses if something goes wrong.

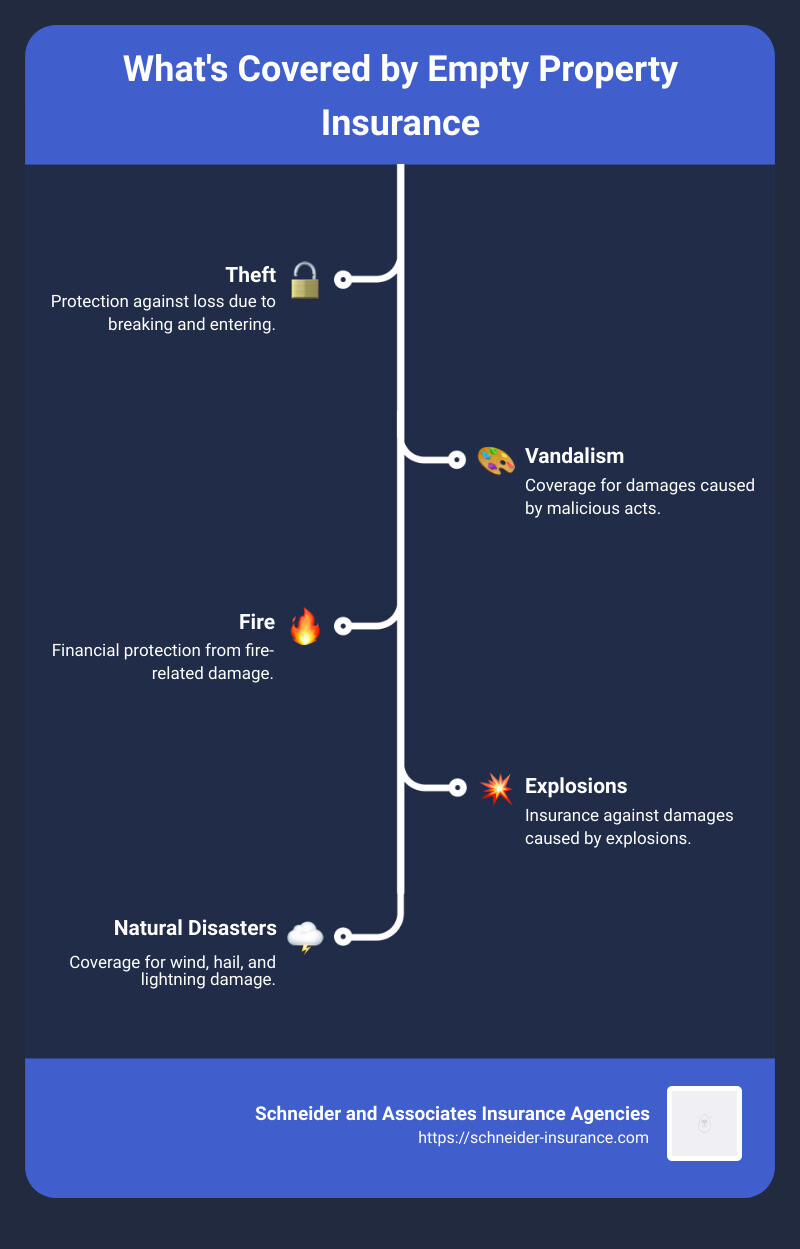

Here’s what’s typically covered by empty property insurance:

TheftVandalismFireExplosionsWindHailLightning

In short, insuring your empty property means protecting your investment and financial stability.

What is Unoccupied Home Insurance?

Unoccupied home insurance, also known as vacant home insurance, is a special type of coverage designed to protect homes that are not lived in for extended periods. Whether you’re selling a home, renovating, or have inherited a property, this insurance ensures that your property remains protected, even when it’s empty.

Vacant Home Insurance vs. Unoccupied Home Insurance

It’s important to understand the difference between vacant and unoccupied homes:

Vacant: A home is considered vacant when it’s completely empty, with no furniture or personal belongings inside. Utilities may also be turned off.Unoccupied: A home is unoccupied if it still contains furniture and personal items, and utilities are connected, but no one currently lives there.

Why Specialty Coverage is Needed

Standard homeowners insurance policies typically do not cover homes that are left empty for more than 30 to 60 days. This is because vacant or unoccupied homes are at a higher risk for issues like vandalism, theft, and unnoticed damage from things like burst pipes.

Example: Imagine you’ve moved into a new house but your old one is still on the market. If a storm causes a tree to fall on your vacant home, a standard homeowners policy might not cover the damage. But with vacant home insurance, you’re protected.

Coverage Details

Unoccupied home insurance generally covers:

Theft: Protection against stolen belongings or property damage from break-ins.Vandalism: Coverage for malicious mischief or damage to the property.Fire and Explosions: Protection against fire damage or explosions.Natural Disasters: Coverage for damage from wind, hail, and lightning.

Flexible Terms

Policies for unoccupied homes can be more flexible than standard homeowners insurance. You can often choose terms ranging from three to 12 months, depending on how long the property will be empty.

Fact: According to the National Association of Insurance Commissioners, a home may be considered vacant if left unoccupied for 60 or more days.

In summary, unoccupied home insurance offers peace of mind by protecting your property from the unique risks associated with being empty. It’s an essential safeguard for anyone who owns a home that won’t be lived in for an extended period.

Differences Between Vacant and Unoccupied Properties

Understanding the difference between vacant and unoccupied properties is crucial when considering empty property insurance. Many people use these terms interchangeably, but they have distinct meanings in the insurance world.

Vacant vs. Unoccupied

Vacant Property: A property is considered vacant when it is entirely empty. This means no furniture, no personal belongings, and often, the utilities are turned off. For example, if you inherit a home and move all the belongings out, leaving it completely bare, it’s vacant.

Unoccupied Property: An unoccupied property still has furniture and personal items, suggesting someone could return at any time. Utilities like electricity and water are usually still on. Think of a vacation home that you only visit during the summer. It’s unoccupied, not vacant.

Presence of Furniture

The presence of furniture is a key factor. A vacant home is devoid of furniture, making it more susceptible to vandalism and other risks. On the other hand, an unoccupied home still has furniture, indicating it is lived-in occasionally, which can sometimes reduce the risk profile.

Utilities Status

Utilities play a significant role in defining a property’s status. In a vacant home, utilities are often turned off to save costs. This can lead to issues like frozen pipes in winter. In contrast, unoccupied homes usually maintain basic utilities, reducing some risks but still needing special insurance considerations.

Fact: Insurers generally won’t cover a vacant home with a standard homeowners policy for longer than a month or two. This makes specialized empty property insurance essential.

By understanding these differences, you can better assess your insurance needs and ensure your property is adequately protected, whether it’s vacant or unoccupied.

Why You Need Empty Property Insurance

Empty property insurance is crucial for several reasons. Let’s break down why you need it:

Greater Risk

Empty homes are more vulnerable: Without someone living there, vacant homes are at higher risk for issues like theft, vandalism, and damage from natural events. For example, a small water leak can turn into a major flood if no one is around to catch it early.

Fact: Insurers generally won’t cover a vacant home with a standard homeowners policy for longer than a month or two. This makes specialized empty property insurance essential.

Financial Loss

Avoid unexpected costs: If your empty home gets damaged and you don’t have the right insurance, you could face significant out-of-pocket expenses. Imagine a burst pipe flooding the entire basement because no one was there to turn off the water.

Peace of mind: Knowing your property is covered can save you from financial stress. For example, if a storm damages your roof, empty property insurance can cover the repair costs.

Peace of Mind

Sleep better at night: With empty property insurance, you don’t have to worry about what’s happening to your vacant home while you’re away. Whether you’re selling a house, renovating it, or it’s a vacation property, this insurance provides peace of mind.

Personal liability coverage: If someone gets injured on your vacant property, liability coverage can pay for their injuries and protect you from lawsuits. For instance, if a worker slips on icy steps that haven’t been shoveled, your insurance can cover medical bills and legal fees.

In summary, empty property insurance is not just an added expense; it’s a smart investment to protect your financial well-being and give you peace of mind.

Coverage Provided by Empty Property Insurance

Empty property insurance offers a range of protections to keep your home safe, even when no one is living there. Here’s what you can expect:

Fire

Fire is one of the most common risks for empty homes. Without someone there to quickly put out a fire or call for help, the damage can be extensive. Empty property insurance covers fire damage, ensuring that you won’t bear the full cost of repairs or rebuilding.

Lightning

Lightning strikes can cause significant damage, from starting fires to frying electrical systems. Your insurance will cover these damages, saving you from expensive repairs.

Wind

High winds can lead to broken windows, damaged roofs, and other structural issues. With this coverage, you can be assured that repairs from wind damage won’t come out of your pocket.

Hail

Hailstorms can be surprisingly destructive, especially to roofs and windows. Insurance covers these damages, ensuring that your home remains protected without a financial burden on you.

Theft

Empty homes are prime targets for thieves. Whether it’s appliances, fixtures, or personal belongings, theft can be costly. Empty property insurance can include coverage for theft, helping you replace stolen items and repair any damage caused during the break-in.

Vandalism

Vandals can cause significant damage to an unoccupied property. Broken windows, graffiti, and other malicious acts can be covered under your policy, so you don’t have to pay for repairs out of pocket.

Liability

If someone gets injured on your property, even if it’s unoccupied, you could be held liable. Empty property insurance includes personal liability coverage. For example, if a neighbor trips and falls while checking on your home, your insurance can cover medical expenses and legal costs.

By understanding these coverages, you can see how empty property insurance provides comprehensive protection for your home, even when you’re not there.

Factors Affecting the Cost of Empty Property Insurance

Risk Profile

The cost of empty property insurance largely depends on the risk profile of the home. Insurers consider factors like the age and condition of the property. Older homes or those in poor condition may cost more to insure due to the higher likelihood of damage. For instance, a 50-year-old house with outdated wiring might be seen as a fire hazard, raising your premium.

Location

Where your property is located also plays a significant role in determining the cost. Homes in areas with high crime rates or those far from emergency services like fire stations are typically more expensive to insure. For example, a vacant house in a remote rural area might have a higher premium than one in a well-patrolled suburban neighborhood.

Policy Duration

The length of time you need the insurance also affects the cost. Policies can be as short as three months or go up to a year. Short-term policies might seem cheaper, but if your property remains empty longer than expected, you may end up paying more to extend the coverage. Conversely, a longer-term policy might offer better rates but requires a bigger upfront payment.

Coverage Limits

Finally, the amount of coverage you choose will directly impact the cost. Higher coverage limits mean higher premiums. For instance, if you opt for a policy that covers not just the structure but also theft, vandalism, and liability, you’ll pay more than for a basic policy that only covers fire and wind damage.

By understanding these factors, you can make informed decisions and find the best empty property insurance for your needs.

How to Purchase Empty Property Insurance

Determine Your Need

First, figure out if you need empty property insurance. If your home will be vacant or unoccupied for more than 30 to 60 days, you likely need this specialized coverage. Be honest with your insurance company about the status of your property to avoid any issues later.

Check with Your Current Provider

Start by asking your current insurance provider if they offer empty property insurance. Some insurers allow you to add this coverage to your existing policy, while others may require a separate policy. It’s essential to know the specifics of what your current provider offers.

Shop Around

Don’t settle on the first quote you get. Shop around and compare quotes from multiple insurers. Look beyond just the monthly cost; consider deductibles, coverage limits, and what each policy covers. For example, some policies might include coverage for vandalism and theft, while others may not.

Apply for Coverage

Once you’ve chosen a provider, gather the necessary documents to apply for coverage. You’ll likely need a government-issued ID, proof of property ownership, and details about the estimated value of the home. You may also need to provide an estimated timeframe for how long the property will be vacant.

By following these steps, you can ensure you get the best empty property insurance to protect your investment.

Tips for Keeping an Unoccupied Home Safe

Leaving a home unoccupied can pose various risks, but taking a few proactive steps can help keep your property safe and secure. Here are some tips to ensure your empty home remains in good condition.

Yard Work

Keeping up with yard work is crucial. Tall grass, overgrown shrubs, and out-of-control weeds can make a house look abandoned, attracting unwanted attention. If you can’t handle the yard work yourself, hire someone to mow the lawn and do basic landscaping. It not only keeps the property looking lived-in but also helps prevent damage from overgrown branches and clogged gutters.

Security Systems

Install a robust security system. Strong locks on all windows and doors are a must, but consider going further by installing an alarm system. According to Forbes, having security systems in place can also potentially lower your insurance premiums.

Smart-Home Devices

Smart-home devices like water leak sensors, smart smoke alarms, and doorbell cameras can be lifesavers. These devices can send alerts to your phone if something goes wrong. For example, if a pipe bursts or there’s a fire, you’ll know immediately and can take action. This is especially useful for homes that are vacant for extended periods.

Regular Checks

Have someone check on the house regularly. If you don’t live close enough to visit, ask a neighbor or friend to stop by and let you know if there are any issues. This can help catch problems early before they become major headaches. As Schneider and Associates Insurance suggests, having someone keep an eye on your property can prevent small issues from escalating.

Lighting

Set up lighting to deter intruders. Motion sensor lights on the outside of your home can help scare off potential burglars. Inside, you can use timers to turn lights on and off, making it look like someone is home. This simple step can significantly reduce the risk of break-ins.

Prevent Frozen Pipes

Winter can be particularly harsh on vacant homes. Set the thermostat to at least 55 degrees to prevent pipes from freezing. Additionally, shut off the main water supply and drain the lines. This precaution can save you from costly repairs due to burst pipes.

By following these tips, you can help ensure your unoccupied home remains safe and secure, giving you peace of mind while you’re away.

Frequently Asked Questions about Empty Property Insurance

What is the definition of vacant property for insurance?

In insurance, a vacant property typically means a home that is completely empty and not being used. This includes no furniture, no personal belongings, and no one living there. For insurance purposes, a property is often considered vacant if it has been unoccupied for 30 to 60 days. This definition is crucial because most standard homeowners insurance policies have vacancy clauses that limit or exclude coverage if the property is vacant for an extended period.

What is the difference between a vacant property and an unoccupied property?

While these terms might seem similar, they have distinct meanings in insurance:

Vacant Property: As mentioned, this is a home that is entirely empty and not in use. There are no personal belongings or furniture, and no one is residing there.

Unoccupied Property: This is a home that is not currently lived in but still contains furniture and personal items. For example, a house could be unoccupied if the owners are on an extended vacation but plan to return.

Understanding this difference is important because insurance companies view the risks differently. Vacant properties are more prone to issues like vandalism and unnoticed damage, which is why they require empty property insurance.

Why is vacant building insurance so expensive?

Empty property insurance tends to be more expensive than standard homeowners insurance for several reasons:

Higher Risk: Vacant homes are more vulnerable to theft, vandalism, and unnoticed damage (like water leaks or fire). Without someone present to report issues immediately, small problems can turn into significant damage.

Extended Coverage Needs: Insurers often need to provide broader coverage to protect against the unique risks associated with vacant properties. This includes protection from events like squatter damage and more extensive liability coverage.

Shorter-Term Policies: Since many vacant homes don’t stay empty for a full year, insurers offer flexible policy terms (e.g., three, six, or nine months). These shorter-term policies can sometimes be more costly on a per-month basis.

By understanding these factors, you can better appreciate why vacant property insurance is a necessary but pricier investment.

Conclusion

At Schneider and Associates Insurance Agencies, we understand that every home and homeowner is unique. That’s why we offer personalized solutions for your insurance needs, including empty property insurance. Whether you’re dealing with a vacant home due to a recent move, renovation, or an inherited property, we can help you find the right coverage to protect your investment.

Our local touch means we know the specific risks and requirements in your area. We work closely with you to assess your situation and develop a tailored coverage plan that fits your needs and budget. From flexible policy terms to comprehensive protection against a variety of risks, we ensure your vacant home is safeguarded.

Protect your vacant property with the expertise and personalized service you deserve.

Contact us today to learn more about our empty property insurance solutions and how we can help you.