Understanding the Factors that Impact Home Insurance Cost

There are plenty of great reasons why it pays to take out home insurance to protect your personal property. However, although a homeowners insurance policy may be an essential part of modern living, the amount you must pay is never set in stone. Home insurance costs can differ wildly due to multiple factors, and understanding these is key to getting a good deal.

Contents

● 7 Factors that Impact Home Insurance Cost

– Location

– Age of Property

– Size of Home

– Claims History

– Credit History

– Security and Maintenance

– Renovations

● Conclusion

7 Factors that Impact Home Insurance Cost

A variety of factors can impact home insurance costs, and different insurers may have their own rules, depending on their particular niche. Below, we’ll cover the major aspects that both home buyers and renters should be aware of before agreeing on a premium.

Location

The size of your house, coupled with its location, can directly affect the cost of insurance aswell. If you happen to live close to a lake, river, or ocean, you may be more prone to flood damage, and so be charged a higher premium. Likewise, if the area you live in has a high crime rate, there’s a bigger likelihood that your home will be affected and, thus, a greater chance that your insurance agent will need to pay out.

It’s worth being aware that rural locations can affect your home insurance cost as well. A property that’s off a main road and harder to reach could face delays when it comes to fire damage or needing a new roof, and such risks can affect the price you pay.

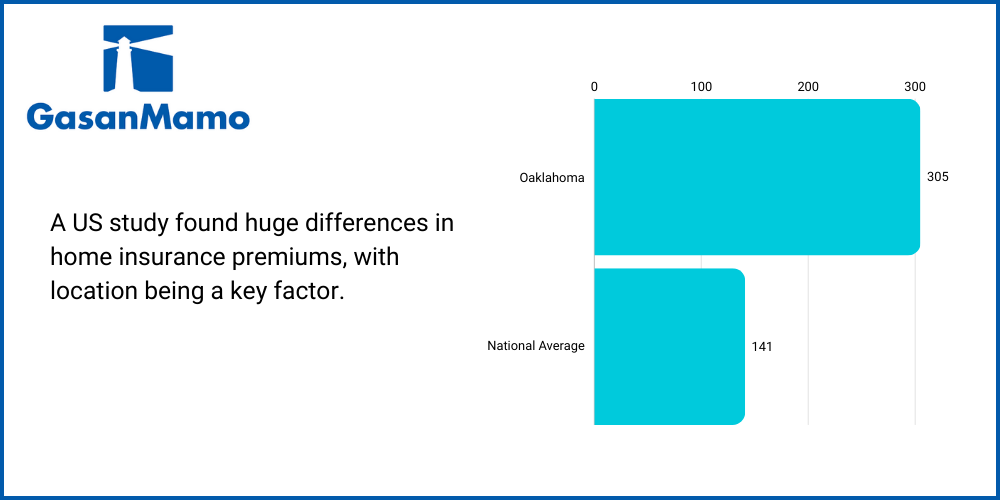

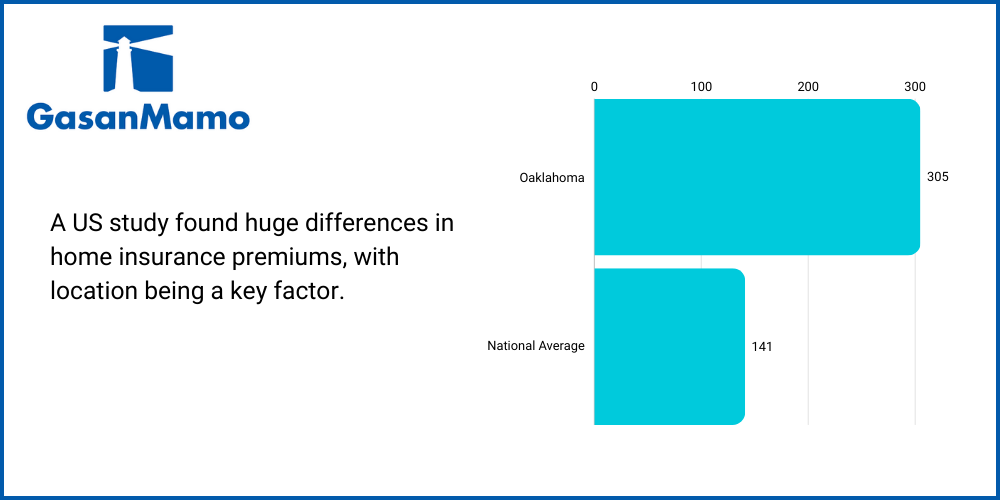

A US study found huge differences in home insurance premiums, with location being a key factor. Those living in Oklahoma pay an average of $305 per month, compared to the national average of $141. A high risk of natural disasters, high winds, and flooding potential have pushed premiums well beyond the norm.

Age of Property

The older a property, the more chance things can go wrong with it. Older houses may also have been built with materials that are more difficult to source or require expertise that’s hard to find. Thatched cottages with walls held up by wattle and daub may be exquisite to the eye but can be expensive in one’s pocket.

Size of Home

The size of your home naturally affects the amount it takes to insure it. This is simply because a larger property is more expensive to rebuild, along with a bigger space having more room for personal belongings.

Claims History

Just like car insurance, your claims history will be considered when calculating a premium to protect your home. Someone who has claimed replacement carpets more than once can quickly earn a reputation. An insurer can interpret any claim as a sign that a claimant is high-risk. In such cases, insurance companies normally raise insurance premiums accordingly.

Credit History

Those with a good credit history are considered less risk to insure than those with poor scores, so it pays to improve your record if you can. Excessive credit card debt and multiple personal loans can result in a low credit score. This poor credit score, in turn, can lead to higher insurance premiums.

Security and Maintenance

Before delivering insurance quotes, insurance companies may ask you a few questions regarding how safe your home is. Single-glazed windows may be deemed easier to break than double-glazed, putting you at a higher risk of burglary. A lack of door/window locks, burglar alarm systems, smoke detectors and security cameras can place you in the same position.

It’s not just theft-related factors that can affect your premium. A failure to carry out essential repairs or take reasonable steps to secure your home against storm damage may lead to you paying more. It’s well worth noting that most home insurance claims are related to property damage, mostly due to natural disasters or theft. It pays to secure and maintain your personal property, as any required payouts for damage to your home can drive up future premiums.

Renovations

If you’re considering making any changes to your home, consider speaking with an insurer before carrying them out. Structural changes can easily affect home insurance cost. Installing an open-fire or log-burning stove can see premiums shoot up. It’s not just the increased fire risk, but the greater chance of carbon monoxide poisoning to your home’s inhabitants.

Similarly, renovating a cellar into a usable room can increase your home’s risk of flooding, or contents being affected by damp. And installing any kind of water feature in your garden – such as a mini-swimming pool or hot tub – can increase your risk factor and thus your premium.

It’s not so much flooding that insurers are concerned about here, but more your personal liability coverage. Should someone be injured whilst using your facilities, they may blame you, leaving you liable for both medical expenses and legal expenses. Home liability insurance tends to shoot up in average cost as a result.

For more on personal liability insurance, see our post on What are the Different Types of Home Insurance?

Conclusion

Home insurance can sometimes appear a costly beast, and it’s handy to know there are ways to reduce your premium. As a rule, it’s good to keep a clear head when surveying potential properties to rent or buy – keeping one eye on a property’s potential, and another on its potential costs. With a little consideration made from an insurer’s perspective, you’ll be able to avoid any unpleasant surprises when it comes to protecting your home.

Begin your own search for the right plan by looking through our clear and transparent benefits on our home insurance page.

GasanMamo Insurance is authorised under the Insurance Business Act and regulated by the MFSA.