Understanding the Cost of General Liability Insurance for Idaho Contractors

The Importance of General Liability Insurance for Idaho Contractors

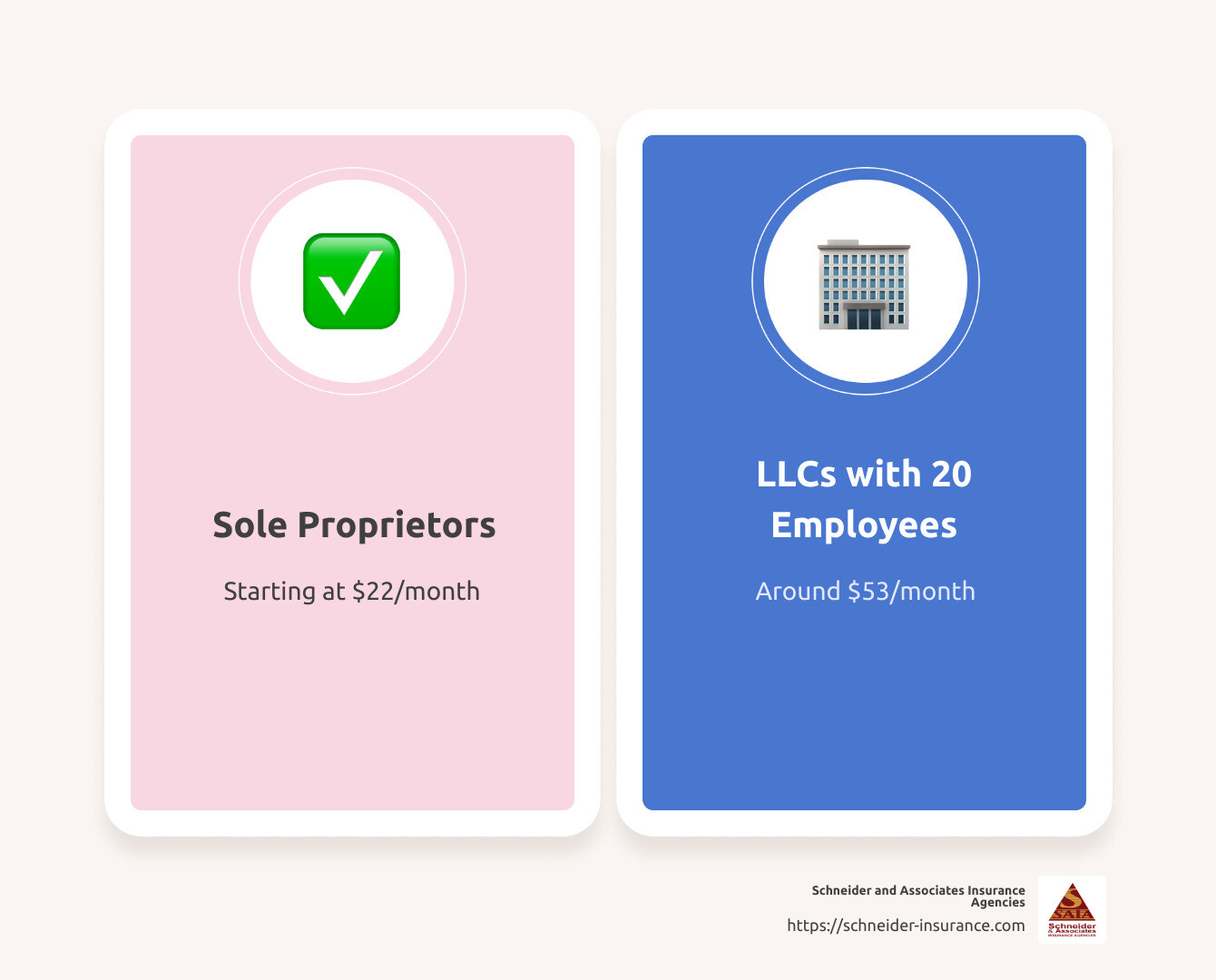

Understanding the average general liability insurance cost for contractors in Idaho is essential to safeguarding your financial future. For those seeking a quick answer, the core costs break down as follows:

Sole Proprietors: Starting at $22/monthLLCs with 20 Employees: Around $53/month

Why is this coverage crucial? Idaho contractors tackle diverse risks daily, from property damage and workplace injuries to lawsuits and natural disasters. Without adequate insurance, contractors leave their business vulnerable to potentially devastating financial losses.

Insurance provides a safety net. It ensures that even when unexpected incidents occur, your financial stability remains intact, enabling you to continue operations without significant setbacks. Whether you’re dealing with third-party injury claims, property damage, or worker injuries, having the right insurance allows you to handle these situations confidently.

My name is Paul Schneider, and with years of expertise in insurance solutions for small businesses, I understand the nuances of protecting Idaho contractors with general liability insurance. I’ve seen first-hand how essential it is to get the right coverage tailored to your unique needs.

Key Factors Influencing General Liability Insurance Costs

When it comes to understanding the average general liability insurance cost for contractors in Idaho, several key factors come into play. Let’s break down the most important ones:

Type of Work

The nature of your work significantly impacts your insurance premiums. High-risk trades like roofing, electrical, plumbing, and demolition typically face higher premiums due to their inherent dangers. For instance, a roofing contractor will likely pay more than a finish carpenter because of the elevated risk of falls and injuries.

Years in Business

Experience matters. New contractors usually face higher premiums as they lack an established track record. However, contractors who have been in business for many years often benefit from lower rates. This is because they are perceived as less risky due to their extensive experience.

Claims History

Your past claims activity directly influences your insurance costs. Contractors with frequent or severe liability claims will see significant premium increases. According to industry data, maintaining a clean claims history is one of the best ways to keep premiums low.

Coverage Limits

Choosing higher liability coverage limits increases your protection but also raises your premiums. For example, a contractor opting for a $2 million policy will pay more than one with a $1 million policy. Balancing adequate protection with affordable premiums is key.

Number of Employees

The size of your workforce also affects your premiums. More employees mean a higher risk of accidents and claims. For instance, a contractor with 20 employees will have higher premiums compared to a sole proprietor.

Safety Record

A strong safety record can help lower your premiums. Implementing safety programs and training can reduce the likelihood of accidents, leading to fewer claims and lower insurance costs.

Business Size

Larger businesses with higher revenue generally face higher premiums. This is because more revenue equals greater risk exposure. Insurance companies use revenue as a proxy for business size and risk level.

Insurance Provider

The choice of your insurance provider can also impact your premiums. Providers known for affordability and customer satisfaction offer competitive rates. For example, a provider might offer coverage for sole proprietors at about $22 per month and for LLCs with 20 employees at around $53 per month.

Understanding these factors can help you make informed decisions about your general liability insurance. Next, we’ll look at the average general liability insurance cost for contractors in Idaho, breaking it down by contractor size.

Average General Liability Insurance Cost for Contractors in Idaho

Understanding the average general liability insurance cost for contractors in Idaho can help you budget and plan for your business needs. Let’s break down typical premiums for small, medium, and large contractors, including key factors like revenue, employees, and policy limits.

Small Contractors

Small contractors in Idaho typically have:

Revenue: Around $150,000Employees: 1General Liability: YesWorkers’ Comp: YesCommercial Auto: YesInland Marine: YesUmbrella: No

Typical premiums for small contractors vary by trade. For example:

Electricians: $700 – $1,800 per yearPlumbers: $4,300 – $8,900 per yearPainters: $1,100 – $3,000 per yearLandscapers: $816 – $1,993 per year

Small contractors pay more due to higher risk concentration and lower revenue. However, working with a reputable insurance provider and maintaining a good safety record can help keep costs down.

Medium Contractors

Medium contractors often have:

Revenue: Around $500,000Employees: 3General Liability: YesWorkers’ Comp: YesCommercial Auto: YesInland Marine: YesUmbrella: No

Here are typical premiums for medium contractors:

Electricians: $1,700 – $5,200 per yearPlumbers: $13,900 – $51,400 per yearPainters: $2,500 – $5,300 per yearLandscapers: $2,331 – $4,423 per year

Medium contractors benefit from economies of scale, spreading risk over more employees and projects. They can often negotiate better rates by partnering with strong insurance carriers and implementing robust safety programs.

Large Contractors

Large contractors generally have:

Revenue: Around $1,000,000Employees: 5General Liability: YesWorkers’ Comp: YesCommercial Auto: YesInland Marine: YesUmbrella: Yes

Typical premiums for large contractors include:

Electricians: $3,800 – $9,500 per yearPlumbers: $21,000 – $39,400 per yearPainters: $3,800 – $11,200 per yearLandscapers: $4,232 – $9,369 per year

Large contractors can often secure lower rates due to their larger revenue base and ability to spread risk. Having an umbrella policy provides additional coverage, offering peace of mind against larger claims.

XL Contractors

For even larger contractors with:

Revenue: Around $2,500,000Employees: 10General Liability: YesWorkers’ Comp: YesCommercial Auto: YesInland Marine: YesUmbrella: Yes

Premiums can be higher, but the extensive coverage protects against significant risks. For instance:

General Contractors: $17,700 – $40,000 per year

Policy limits for general liability insurance are commonly $1 million per occurrence and $2 million aggregate. This level of coverage is crucial for protecting against third-party claims and potential financial losses.

Understanding these benchmarks helps Idaho contractors compare their insurance costs to industry standards. By working closely with an insurance advisor, you can tailor your coverage to fit your business needs and potentially secure more favorable rates.

Additional Insurance Coverages for Idaho Contractors

While general liability insurance is essential, Idaho contractors should consider additional coverages to fully protect their businesses. Here are some key policies:

Commercial Auto Insurance

Commercial auto insurance is vital for contractors using vehicles for business purposes. It covers injuries, property damage, theft, vandalism, and weather damage.

Typical premiums: Average $43 per month in Idaho.Coverage limits: Idaho requires a minimum of $25,000 per person for bodily injury, $50,000 per accident, and $15,000 for property damage.

Inland Marine Insurance

Inland marine insurance covers tools and equipment, whether they’re on-site, in transit, or stored off-site. This is crucial for protecting valuable assets that are frequently moved.

Typical premiums: Vary widely based on equipment value, but small contractors might pay $300 – $1,000 annually.Coverage: Includes theft, loss, and damage from various risks.

Surety Bonds

Surety bonds ensure contractors fulfill their contractual obligations. They come in three main types:

Commercial Property Insurance

Commercial property insurance protects a contractor’s physical assets, including buildings, equipment, and inventory, against risks like fire, theft, and natural disasters.

Typical premiums: Average $500 – $2,000 annually, depending on property value and location.Coverage limits: Tailored to the value of the property and contents.

Cyber Liability Insurance

Cyber liability insurance covers data breaches, hacking incidents, and electronic theft. It’s increasingly important as contractors handle more digital information.

Typical premiums: Range from $1,000 – $5,000+ annually based on revenue and coverage limits.Coverage: Includes customer notification, IT remediation, and legal expenses.

Umbrella Liability Insurance

Umbrella liability insurance provides additional coverage above primary policies like general liability and auto insurance.

Typical premiums: About $1,000 – $2,000 per million in extra coverage.Coverage limits: Often $1 million to $5 million, providing extensive protection against large claims.

Investing in these additional coverages can help Idaho contractors safeguard their businesses from various risks. Understanding the costs and benefits of each policy ensures comprehensive protection tailored to your specific needs.

Strategies to Lower General Liability Insurance Costs

Reducing your general liability insurance costs is crucial for maintaining a healthy bottom line. Here are some effective strategies to help Idaho contractors lower their premiums:

Risk Management

Proactively managing risks can significantly decrease your insurance costs. Implementing a comprehensive risk management plan helps identify potential hazards and take steps to mitigate them. This can include:

Regularly inspecting job sites for safety issues.Providing ongoing safety training for employees.Maintaining equipment to prevent accidents.

By lowering the likelihood of claims, insurers often reward businesses with lower premiums.

Safety Programs

Investing in safety programs can also reduce your insurance costs. A strong safety record demonstrates to insurers that you prioritize preventing accidents and injuries. This can lead to lower premiums. Effective safety programs might include:

Conducting routine safety drills.Providing proper protective gear.Enforcing strict safety protocols.

A clean safety record can result in substantial savings on your general liability insurance.

Deductible Choices

Choosing a higher deductible can lower your insurance premiums. A deductible is the amount you pay out-of-pocket before your insurance kicks in. While higher deductibles mean more initial costs during a claim, they often lead to lower monthly or annual premiums. Assess your financial ability to handle higher deductibles to find the best balance for your business.

Policy Bundling

Bundling multiple policies with the same insurer can result in significant discounts. For example, combining your general liability insurance with commercial property insurance or workers’ compensation can lower your overall premiums. This approach not only saves money but also simplifies managing your insurance policies.

Annual Premium Payment

Paying your insurance premium annually instead of monthly can lead to cost savings. Many insurers offer discounts for annual payments. While it requires a larger upfront payment, it can reduce your overall insurance costs in the long run.

By implementing these strategies, Idaho contractors can effectively reduce their general liability insurance costs while maintaining comprehensive coverage. This proactive approach ensures financial protection and supports the long-term success of your business.

Frequently Asked Questions about General Liability Insurance for Idaho Contractors

How much is a $1 million dollar insurance policy for a business?

The average general liability insurance cost for contractors in Idaho varies based on several factors, but a $1 million policy is a common choice for many small businesses. For small contractors, the average cost is around $42 per month, or approximately $500 annually. However, 29% of small businesses pay less than $30 per month, and 41% pay between $30 and $60 per month.

These premiums can be influenced by the type of work you do, your claims history, and your business size. For instance, high-risk trades like roofing or electrical work may see higher premiums due to the increased likelihood of costly claims.

What is standard general liability insurance?

Standard general liability insurance provides essential coverage for common third-party risks that businesses face. This includes:

Bodily Injuries: If someone is injured on your business premises or as a result of your business operations, this coverage can help pay for medical expenses and legal fees.Property Damage: Covers the cost of repairing or replacing property that your business damages.

It’s important to note that general liability insurance does not cover professional errors or omissions (for that, you’d need Errors & Omissions Insurance), nor does it cover employee injuries (which is covered by Workers’ Compensation Insurance).

How much does a $2 million business insurance policy cost?

For those needing more extensive coverage, a $2 million general liability insurance policy will naturally cost more than a $1 million policy. On average, contractors who opt for higher coverage limits can expect to pay between $1,000 and $2,000 annually per million dollars of extra coverage.

For small businesses, this means the monthly premiums for a $2 million policy could range from $83 to $167, depending on the specific risks associated with your business and other factors like your claims history and the type of work you perform.

By understanding these costs and coverage details, Idaho contractors can make informed decisions about the level of protection they need to safeguard their businesses. For tailored quotes and expert advice, consider partnering with a specialized insurance provider like Schneider and Associates Insurance Agencies.

Conclusion

In contracting, having the right insurance is not just a smart move—it’s essential. Tailored coverage ensures that your business is protected against the unique risks you face. From property damage to workplace injuries, and even lawsuits, having the correct insurance policies in place can save you from significant financial losses.

At Schneider and Associates Insurance Agencies, we specialize in providing customized insurance solutions for contractors in Idaho. We understand the specific challenges and risks associated with your industry. Our team is dedicated to helping you find the best coverage to protect your assets and secure your future.

Whether you are a small contractor just starting out or a large company with many employees, we can help you navigate the complexities of insurance. Our goal is to provide you with peace of mind, knowing that your business is well-protected.

Don’t leave your business exposed to unnecessary risks. Partner with us to ensure you have the right coverage in place.

Get a tailored quote today and take the first step towards securing your business’s future.

By understanding the average general liability insurance cost for contractors in Idaho and the factors that influence these costs, you can make informed decisions about your insurance needs. Protect your business, your employees, and your future with the right insurance coverage.