Understanding rebuild cost

The Rebuild Cost of a property is a common stumbling block in the world of insurance. Also referred to as the Reinstatement Cost or Building Sum Insured, the three terms all apply to the same thing but understanding what a rebuild cost is and its significance within a policy is important when considering what cover you have in place.

The rebuild cost of a property refers to the amount it would cost to completely rebuild a property if it suffered a catastrophic loss and had to be rebuilt to its current state. The rebuild cost considers having to take down the whole property, removing all of the debris, planning and then rebuilding the entire property to its original state. This figure includes all the materials (steel, bricks, tiles, etc.) and the labour costs involved in such a task.

One common misconception is the difference between the rebuild cost and market value of the property. In many circumstances the rebuild cost is lower than the market value as the cost of land, for example in London, is far greater than the material and labour costs which is what underwriters consider.

It is important to ensure that the rebuild cost of a property is correct as it is one of the main rating factors when underwriters consider a risk and subsequently calculate their premium and apply terms. Ensuring that an accurate figure is applied, guarantees that the correct premium is paid and sufficient cover is in place.

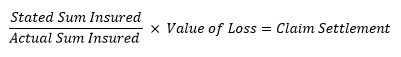

By over insuring a property, the policy holder will end up paying a higher premium than necessary. On the other hand, by declaring a lower rebuild cost or sum insured, the property will be underinsured. In the event of a claim in this situation, the insurers will apply the “Law of Average” where a proportionate level of cover will be provided. This is calculated by

While there are lots of useful online tools which can help approximate rebuild valuations of a property, the only guaranteed way to establish an accurate reinstatement figure is to have a full survey carried out at the property. These can be easily arranged with a local surveyor or if you ask your broker/insurers, they may be able to direct you to a list of surveyors with whom they may have preferential rates.

It is important to point out that a home-buyers report, often undertaken when purchasing a property, should not be used as an accurate guide to the rebuild figure and caution should be taken to ensure that the full report and its findings are understood.

Something to consider when reading a home-buyers report is the stated reinstatement figure. It is often the case that the report notes the figure stated should only be used as a guide and that professional advice should be sought to ensure an accurate figure is provided.

At Insurance Tailors we always recommend undertaking a survey every 5 years especially when properties are listed or when changes have been made to a property, e.g. building works, to ensure that your property is accurately insured.

Written by: Alex Gillespie, Portfolio Associate, agillespie@insurancetailors.com

The post Understanding rebuild cost appeared first on Insurance Tailors.